Concept explainers

The Number of Ending Inventory Units.

Explanation of Solution

The ending Inventory units is a difference between units of goods available for sale and units sold and has been computed as under:

| Ending Inventory Units | |

| | UNITS |

| Units Available for sale | 1800 |

| Purchase | |

| 15-Mar | 800 |

| 10-Sep | 600 |

| Ending Inventory Units | 400 |

Requirement 3-a:

First in First Out:

The first in first out method of assigning the cost to goods sold is based on the principle that the goods that are entered first in the store room shall be issued first for sale and hence the cost shall be recorded at its initial prices of goods entered in store room. The periodic Inventory system means the records are maintained only at the end of period.

The Cost assigned to ending Inventory under FIFO.

Explanation of Solution

The FIFO method of period inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of cost of oldest material lies in the store during the end of period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC FIFO METHOD | |||||||||

| | RECIEPTS | COST OF GOODS GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 600 | 45 | 27000 | 600 | 45 | 27000 | | | |

| Purchase | | | | | | | | | |

| 10-Feb | 400 | 42 | 16800 | 400 | 42 | 16800 | | | |

| 13-Mar | 200 | 27 | 5400 | 200 | 27 | 5400 | | | |

| 21-Aug | 100 | 50 | 5000 | 100 | 50 | 5000 | | | |

| 5-Sep | 500 | 46 | 23000 | 100 | 46 | 4600 | 400 | 46 | 18400 |

| TOTAL | 1800 | | 77200 | 1400 | | 58800 | 400 | | 18400 |

Therefore, Ending Inventory is 400 units of $18400.

Requirement 3-b:

Last in First Out:

The Last in first out method of assigning the cost to goods sold is based on the principle that the goods that are entered recently in the store room shall be issued first for sale and hence the cost shall be recorded at its recent prices of goods entered in store room. The periodic Inventory system means the records are maintained at the end of period.

The Cost assigned to ending Inventory under LIFO.

Explanation of Solution

The LIFO method of periodic inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of cost of newest material lies in the store at the end of period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC LIFO METHOD | |||||||||

| | RECIEPTS | COST OF GOODS GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 600 | 45 | 27000 | 200 | 45 | 9000 | 400 | 45 | 18000 |

| Purchase | | | | | | | | | |

| 10-Feb | 400 | 42 | 16800 | 400 | 42 | 16800 | | | |

| 13-Mar | 200 | 27 | 5400 | 200 | 27 | 5400 | | | |

| 21-Aug | 100 | 50 | 5000 | 100 | 50 | 5000 | | | |

| 5-Sep | 500 | 46 | 23000 | 500 | 46 | 23000 | | | |

| TOTAL | 1800 | | 77200 | 1400 | | 59200 | 400 | 45 | 18000 |

Therefore, Ending Inventory is 400 units of $18000.

Requirement 3-c:

Weighted Average:

The Weighted Average method of issuing inventory is based on principle that the goods shall be issued at an average of prices of goods which are lying in the store room at the end of period. The periodic Inventory system means the records are maintained at the end of period.

The Cost assigned to ending Inventory under Weighted average.

Explanation of Solution

The Weighted Average method of periodic inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of average cost of material lies in the store during the period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC WEIGHTED AVERAGE METHOD | |||||||||

| | RECIEPTS | COST OF GOODS GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 600 | 45 | 27000 | | | | | | |

| Purchase | | | | | | | | | |

| 10-Feb | 400 | 42 | 16800 | | | | | | |

| 13-Mar | 200 | 27 | 5400 | | | | | | |

| 21-Aug | 100 | 50 | 5000 | | | | | | |

| 5-Sep | 500 | 46 | 23000 | | | | | | |

| TOTAL | 1800 | 42.89 | 77200 | 1400 | 42.89 | 60046 | 400 | 42.89 | 17156 |

Therefore, Ending Inventory is 400 units of $17156.

Requirement 3-d:

Specific Identification:

Specific Identification method of assigning the cost to goods sold is based on the principle that the goods that have been issued for sale has been specifically identified to be issued from the particular lot of material. Therefore, the cost of that particular lot shall be assigned on the same. The periodic Inventory system means the records are maintained at the end of period.

The Cost assigned to ending Inventory under Specific Identification.

Explanation of Solution

The Specific Identification method of periodic inventory suggests that the goods issued for sale on a particular date shall be assigned cost on the basis of cost of material specifically identified as issued from the store at the end of period.

The Ending Inventory shall be computed as under:

| STATEMENT SHOWING INVENTORY RECORD UNDER PERIODIC SPECIFIC IDENTIFICATION METHOD | |||||||||

| | RECIEPTS | COST OF GOODS GOODS SOLD | BALANCE | ||||||

| DATE | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ | UNITS | RATE | AMOUNT $ |

| Balance Oct1 | 600 | 45 | 27000 | 600 | 45 | 27000 | | | |

| Purchase | | | | | | | | | |

| 10-Feb | 400 | 42 | 16800 | 300 | 42 | 12600 | 100 | 42 | 4200 |

| 13-Mar | 200 | 27 | 5400 | 200 | 27 | 5400 | | | |

| 21-Aug | 100 | 50 | 5000 | 50 | 50 | 2500 | 50 | 50 | 2500 |

| 5-Sep | 500 | 46 | 23000 | 250 | 46 | 11500 | 250 | 46 | 11500 |

| TOTAL | 1800 | | 77200 | 1400 | | 59000 | 400 | | 18200 |

Therefore, Ending Inventory is 400 units of $18200.

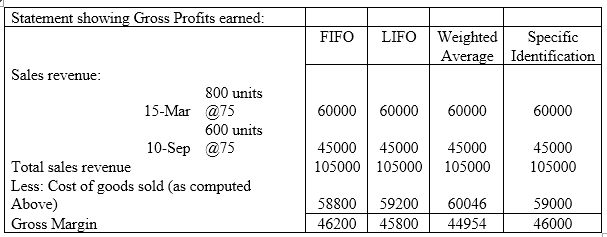

Requirement 4:

Gross Profits:

Gross Profits means excess of sales revenue over the cost of goods sold.

Gross profits earned by the company under various methods.

Explanation of Solution

The Gross profits is computed as a difference between the sales revenue and cost of goods sold as assigned under various methods and has been computed as under:

Requirement 5:

The Method to be preferred so as to generate higher bonus.

Explanation of Solution

As the bonus is based on gross profit, the method shall be preferred which will give provide lowest cost of goods sold. Therefore, as per above computations, the FIFO method shall be followed as its gives the lowest cost of goods sold and resultant higher gross profit.

The FIFO method of

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAMENTAL ACCT PRIN CONNECT ACCESS

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education