EBK CORPORATE FINANCE

4th Edition

ISBN: 8220103145947

Author: DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 4P

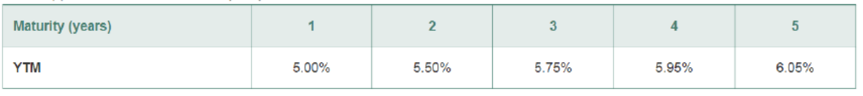

Suppose the current zero-coupon yield curve for risk-free bonds is as follows:

- a. What is the price per $100 face value of a two-year, zero-coupon, risk-free bond?

- b. What is the price per $100 face value of a four-year, zero-coupon, risk-free bond?

- c. What is the risk-free interest rate for a five-year maturity?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The current zero-coupon yield curve for risk-free bonds is as follows What is the price per $100 face value of a four-year, zero-coupon, risk-free bond?

The price per $100 face value of the four-year, zero-coupon, risk-free bond is $_______(Round to the nearest cent.)

The rate of return that you would earn if you bought a bond and held It to its maturity date is called the bond's yield to maturity (YTM). If Interest rates in the economy rise after a bond has been issued, what will happen to the bond's price and to Its YTM? Does the length of time to maturity affect the extent to which a given change in interest rates will affect the bond's price? Briefly explain with necessary numerical data.

The current zero-coupon yield curve for risk-free bonds is as follows: What is the risk-free interest rate for a five-year maturity?

The risk-free interest rate for a five-year maturity is _____%. (Round to two decimal places.)

Chapter 6 Solutions

EBK CORPORATE FINANCE

Ch. 6.1 - What is the relationship between a bonds price and...Ch. 6.1 - The risk-free interest rate for a maturity of...Ch. 6.2 - If a bonds yield to maturity does not change, how...Ch. 6.2 - Prob. 2CCCh. 6.2 - How does a bonds coupon rate affect its...Ch. 6.3 - How do you calculate the price of a coupon bond...Ch. 6.3 - How do you calculate the price of a coupon bond...Ch. 6.3 - Explain why two coupon bonds with the same...Ch. 6.4 - There are two reasons the yield of a defaultable...Ch. 6.4 - What is a bond rating?

Ch. 6.5 - Why do sovereign debt yields differ across...Ch. 6.5 - What options does a country have if it decides it...Ch. 6 - A 30-year bond with a face value of 1000 has a...Ch. 6 - Assume that a bond will make payments every six...Ch. 6 - The following table summarizes prices of various...Ch. 6 - Suppose the current zero-coupon yield curve for...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Suppose a five-year, 1000 bond with annual coupons...Ch. 6 - Prob. 8PCh. 6 - Explain why the yield of a bond that trades at a...Ch. 6 - Prob. 10PCh. 6 - Prob. 11PCh. 6 - Consider the following bonds: Bond Coupon Rate...Ch. 6 - Prob. 14PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Suppose you are given the following information...Ch. 6 - Prob. 26PCh. 6 - Grumman Corporation has issued zero-coupon...Ch. 6 - The following table summarizes the yields to...Ch. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - A BBB-rated corporate bond has a yield to maturity...Ch. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The current zero-coupon yield curve for risk-free bonds is as follows: What is the price per $100face value of a four-year, zero-coupon, risk-free bond? The price per $100 face value of the four-year, zero-coupon, risk-free bond is $. (Round to the nearest cent.)arrow_forwardThe current zero-coupon yield curve for risk-free bonds is as follows: coupon, risk-free bond? . What is the price per $100 face value of a two-year, zero- The price per $100 face value of the two-year, zero-coupon, risk-free bond is $ (Round to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Maturity (years) 1 2 3 YTM 4.95% 5.49% 5.76% 4 5.97% 5 6.09% Print Done -arrow_forwardSuppose you are given the following information about the default-free, coupon-paying yield curve: Maturity (years) Coupon rate (annual payment) YTM a. Use arbitrage to determine the yield to maturity of a two-year zero-coupon bond. b. What is the zero-coupon yield curve for years 1 through 4? Note: Assume annual compounding. a. Use arbitrage to determine the yield to maturity of a two-year zero-coupon bond. The yield to maturity of a two-year, zero-coupon bond is %. (Round to two decimal places.) b. What is the zero-coupon yield curve for years 1 through 4? The yield to maturity for the three-year and four-year zero-coupon bond is found in the same manner as the two-year zero-coupon bond. The yield to maturity on the three-year, zero-coupon bond is %. (Round to two decimal places.) %. (Round to two decimal places.) The yield to maturity on the four-year, zero-coupon bond is Which graph best depicts the yield curve of the zero-coupon bonds? (Select the best choice below.) O A. 8- 7- 6-…arrow_forward

- Suppose the current, zero-coupon, yield curve for risk-free bonds is as follows: Maturity (years) Yield to Maturity 1 4.33% 2 4.64% 3 4.92% 4 5.09% 5 5.30% a. What is the price per $100 face value of a 3-year, zero-coupon risk-free bond? b. What the price per $100 face value of a 4-year, zero-coupon, risk-free bond? c. What is the risk-free interest rate for a 1-year maturity? Note: Assume annual compounding. a. What is the price per $100 face value of a 3-year, zero-coupon risk-free bond? The price is $ (Round to the nearest cent.) b. What is the price per $100 face value of a 4-year, zero-coupon, risk-free bond? The price is $ (Round to the nearest cent.) c. What is the risk-free interest rate for a 1-year maturity? The risk-free rate is %. (Round to two decimal places.)arrow_forwardWhat is interest rate (or price) risk? Which bondhas more interest rate risk: an annual payment1-year bond or a 10-year bond? Why?arrow_forwardThe following table summarizes the prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat?arrow_forward

- Which of the following is correct? O If you pay a price above its face value to buy a bond, your return will be higher than its coupon rate. O When market rate is greater than coupon rate, the bond has a price below its face value. O When determining the value of a bond that payments semi-annual payments, one need to use semi-annual coupon rate to determine the coupon payments and semi-annual market rate as discount rate.arrow_forwardSuppose that the yield curve shows that the one-year bond yield is 8 percent, the two-year yield is 7 percent, and the three-year yield is 7 percent. Assume that the risk premium on the one-year bond is zero, the risk premium on the two-year bond is 1 percent, and the risk premium on the three-year bond is 2 percent. a. What are the expected one-year interest rates next year and the following year? The expected one-year interest rate next year = The expected one-year interest rate the following year b. If the risk premiums were all zero, as in the expectations hypothesis, what would the slope of the yield curve be? The slope of the yield curve would be (Click to select) % %arrow_forwardSuppose that y is the yield on a perpetual government bond that pays interest at the rate of $1 per annum. Assume that y is expressed with simply com- pounding, that interest is paid annually on the bond, and that y follows the process dy = a(y0 −y)dt + oydWt, where a, y0, and o are positive constants and dWt is a Wiener process. (a) What is the process followed by the bond price? (b) What is the expected instantaneous return (including interest and capital gains) to the holder of the bond?arrow_forward

- Assume that the real risk-free rate is 2% and the average annual expected inflation rate is 4%. The DRP and LP for Bond A are each 2%, and the applicable MRP is 3%. What is Bond A's interest rate?arrow_forwardIf the interest rates on 1-, 5-, 20-, and 30-year bonds are (respectively)4%, 5%, 6%, and 7%, then how would you describe the yield curve?How would you describe it if the rates were reversed?arrow_forwardSuppose 2-year Treasury bonds yield 4.1%,while 1-year bonds yield 3.2%. r* is 1%, and the maturity risk premium is zero.a. Using the expectations theory, what is the yield on a 1-year bond, 1 year from now?Calculate the yield using a geometric average.b. What is the expected inflation rate in Year 1? Year 2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License