Concept explainers

2.

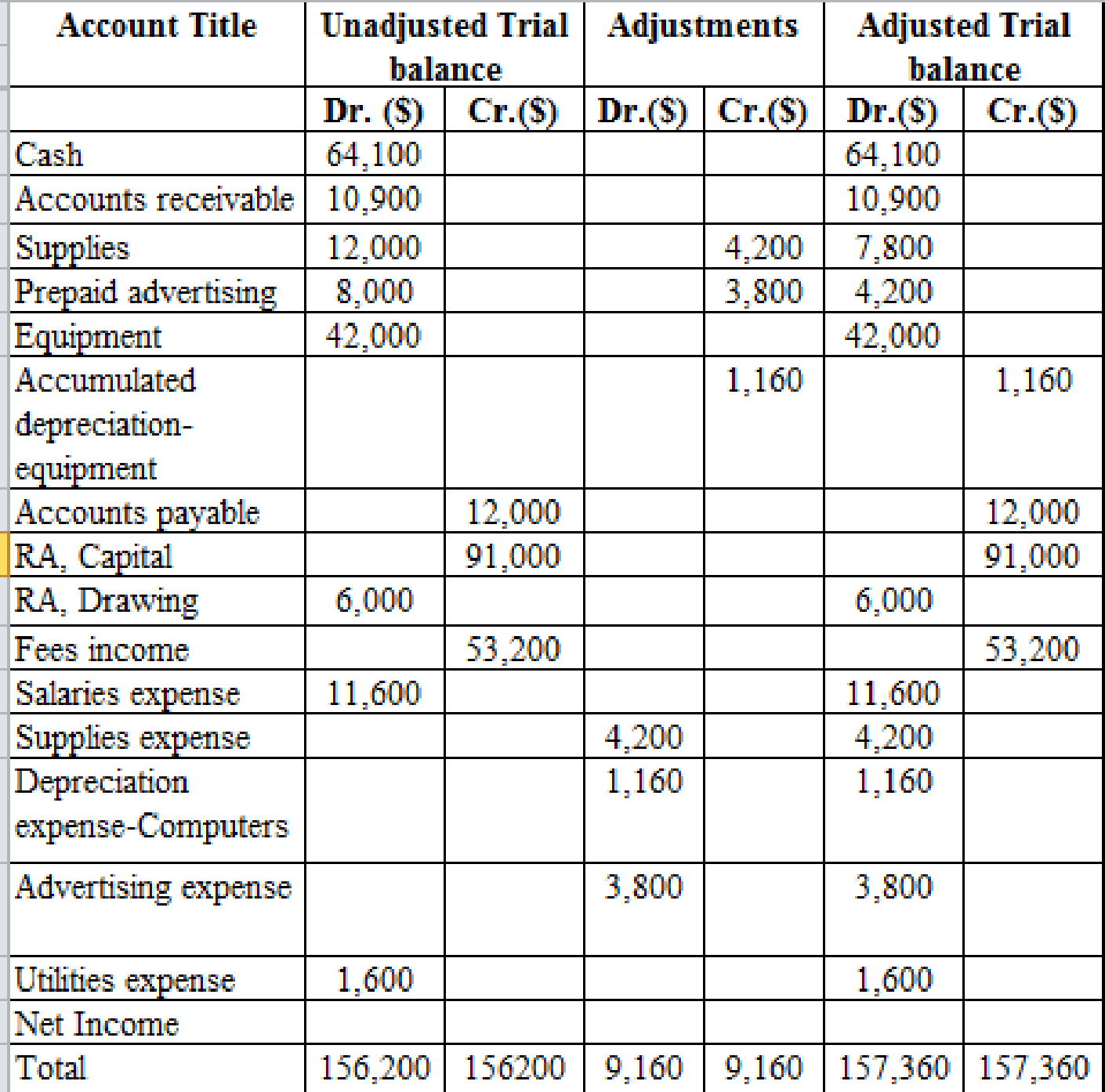

Prepare the worksheet of the Company HPGS.

2.

Explanation of Solution

Worksheet of the Company HPGS is as follows:

Table (1)

3.

Journalize the

3.

Explanation of Solution

Journalizing:

Journalizing refers to that process in which the transactions of an organization are recorded in a sequence. Based on the recorded entries, the accounts are posted to the relevant ledger accounts.

Adjusting entries of Company HPGS are as follows:

Record supplies expense:

| General Journal | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Supplies expense | 4,200 | ||

| Supplies | 4,200 | |||

| (To record supplies used) | ||||

Table (2)

- Supplies expense in an expense account and it is increased by $4,200. Therefore, debit supplies expense account with $4,200.

- Supplies are asset account and it is decreased by $4,200. Therefore, credit supplies account with $4,200.

Record advertising expense:

| General Journal | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Advertising expense | 3,800 | ||

| Prepaid Advertising | 3,800 | |||

| (To record supplies used) | ||||

Table (3)

- Advertising expense is an expense account and it is increased by $3,800. Therefore, debit Advertising expense account with $3,800.

- Prepaid Advertising is asset account and it is decreased by $3,800. Therefore, credit Prepaid Advertising account with $3,800.

Record

| General Journal | Page 3 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Depreciation expense | 1,160 | ||

| | 1,160 | |||

| (To record depreciation expense) | ||||

Table (4)

- Depreciation expense in an expense account and it is increased by $1,160. Therefore, debit depreciation expense account with $1,160.

- Accumulated depreciation-equipment is an asset account and it is decreased by $1,160. Therefore, credit accumulated depreciation-equipment with $1,160.

4.

Journalize the closing entries.

4.

Explanation of Solution

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Fees income | 53,200 | ||

| Income summary | 53,200 | |||

| (To transfer fees income amount) | ||||

Table (5)

- The account of fees income account gets closed by $53,200. Therefore, debit fees income account with $53,200.

- The amount of fees income transferred to income summary, the account of income summary increases by $53,200. Therefore, credit income summary account with $53,200.

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Income summary | 22,360 | ||

| Depreciation expense | 1,160 | |||

| Salaries expense | 11,600 | |||

| Advertising expense | 3,800 | |||

| Utilities expense | 1,600 | |||

| Supplies expense | 4,200 | |||

| (To transfer the amount of income summary) | ||||

Table (6)

- The amount of income summary is decreases by $22,360. Therefore, debit the account of income summary with $22,360.

- Depreciation expense is an expense account and it is decreased by $1,160. Therefore, credit depreciation expense with $1,160.

- Salaries expense is an expense account and it is decreased by $11,600. Therefore, credit salaries expense with $11,600.

- Advertising expense is an expense account and it is decreased by $3,800. Therefore, credit advertising expense with $3,800.

- Utilities expense is an expense account and it is decreased by $1,600. Therefore, credit utilities expense account with $1,600.

- Supplies expense is an expense account and it is decreased by $4,200. Therefore, credit the supplies expense account with $4,200.

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Income summary | 30,840 | ||

| SJ Capital | 30,840 | |||

| (To transfer the amount of income summary) | ||||

Table (7)

- The amount of income summary is decreases by $30,840. Therefore, debit the account of income summary with $30,840.

- The capital account increases by $30,840. Therefore, credit the SJ capital with $30,840.

| General Journal | Page 4 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | SJ Capital | 6,000 | ||

| SJ Drawings | 6,000 | |||

| (To transfer the amount of capital account) | ||||

Table (8)

- The amount of drawings adjusted from the capital account, the amount of capital account decreases by $6,000. Therefore, debit the account of SJ Capitalwith $6,000.

- The account of drawings increases by $6,000. Therefore, credit the account ofSJ Drawings with $6,000.

1, 3 and 4.

Prepare the ledger accounts to record the balances as of December 31, 2019 and post adjusting and closing entries.

1, 3 and 4.

Explanation of Solution

Prepare the ledger accounts to record the balances as of December 31, 2019 and post adjusting and closing entries.

Supplies account:

| Supplies Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 12,000 | 12,000 (debit) | |

| Adjusting | 4,200 | 7,800(debit) | ||

Table (9)

Prepaid Advertising Account:

| Prepaid Advertising Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 8,000 | 8,000 (debit) | |

| Adjusting | 3,800 | 4,200 (debit) | ||

Table (10)

Accumulated depreciation account:

| Accumulated Depreciation Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Adjusting | 1,160 | 1,160 (credit) | |

Table (11)

SJ Capital account:

| SJ Capital Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 91,000 (credit) | ||

| Closing | 30,840 | 121,840 (credit) | ||

| Closing | 6,000 | 115,840 (credit) | ||

Table (12)

SJ Drawings account:

| SJ Drawings Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 6,000 (debit) | ||

| Closing | 6,000 | - | ||

Table (13)

Income Summary Account:

| Income Summary Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Closing | 53,200 (credit) | ||

| Closing | 22,360 | 30,840 (credit) | ||

| Closing | 30,840 | - | ||

Table (14)

Fees Income Account:

| Fees Income Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31, 2019 | Balance | 53,200 (credit) | ||

| closing | 53,200 | - | ||

Table (15)

Salaries Expense Account:

| Salaries Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Balance | 11,600 (debit) | ||

| Closing | 11,600 | - | ||

Table (16)

Utilities Expense Account:

| Utilities Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Balance | 1,600 (debit) | ||

| Closing | 1,600 | - | ||

Table (17)

Supplies expense:

| Supplies expense | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Adjusting | 4,200 | 4,200 (debit) | |

| closing | 4,200 | - | ||

Table (18)

Depreciation Expense Account:

| Depreciation Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Adjusting | 1,160 | 1,160 (debit) | |

| Closing | 1,160 | - | ||

Table (19)

Advertising Expense Account:

| Depreciation Expense Account | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| December 31,2019 | Adjusting | 3,800 | 3,800 (debit) | |

| Closing | 3,800 | - | ||

Table (20)

5.

Prepare a post-closing

5.

Explanation of Solution

Trial balance of Company HPGS is given below:

|

Company HPGS Post- closing Trial Balance December 31, 2019 | ||

| Account Title |

Debit ($) |

Credit ($) |

| Cash | 64,100 | |

| 10,900 | ||

| Supplies | 7,800 | |

| Prepaid Advertisement | 4,200 | |

| Equipment | 42,000 | |

| Accumulated Depreciation | 1,160 | |

| Accounts Payable | 12,000 | |

| SJ, Capital | 115,480 | |

| Total | 129,000 | 129,000 |

Table (21)

Want to see more full solutions like this?

Chapter 6 Solutions

COLLEGE ACCOUNTING: CONTEMP APPROACH

- CLOSING ENTRIES From the work sheet on page 600, prepare the following: 1. Closing entries for Gimbels Gifts and Gadgets in a general journal. 2. A post-closing trial balance.arrow_forwardWORK SHEET AND ADJUSTING ENTRIES A partial work sheet for Jasmine Kahs Auto Detailing is shown below. Indicate by letters (a) through (d) the four adjustments in the Adjustments columns of the work sheet, properly matching each debit and credit. Complete the Adjustments columns. JOURNALIZING ADJUSTING ENTRIES From the Adjustments columns in Exercise 5-9B, journalize the four adjusting entries as of June 30, in proper general journal format.arrow_forwardFor each of the following items, indicatewhether that item would be considered to be a transaction at Gerbig Pet Grooming Corporation.a. A customer, Layne Gracen, gives Gerbig a check for $620 to prepay for her dog’sgrooming appointments for the upcoming year.b. Gerbig pays $310 for last month’s electric bill.c. Gerbig selects a new supplier for its shampoos and conditioners.d. The controller for Gerbig pays the bill for a catered lunch at its annual training event foremployees.e. Gerbig files its articles of incorporation with the state.f. Gerbig acquires a new stainless steel tub by signing a note payable with PetStar, a supplier of pet grooming supplies and products.g. Maggie Cramer, a customer, signs a contract for next year’s dog grooming with Gerbig.h. Gerbig pays its employees an annual bonus on December 31.arrow_forward

- Using this information and the pictures below make a journal and ledger for the worksheet included. Adjustments: Blair's Custom Shop performed a count of supplies at the end of the accounting period (June 30, 20XX) and determined that value of supplies "on hand" (not used) was $1,700.00. The value of prepaid insurance coverage "on hand" (not used) at the same time was $750.00. Calculate the adjustment amount for Supplies and Prepaid Insurance and enter those amounts on the worksheet.arrow_forwardStylist Services Co. offers its services to individuals desiring to improve their personal images. After the accounts have been adjusted at July 31, the end of the fiscal year the fiscal year ,the following balances were taken form the ledger of stylish services co. : Journalize the two entries required to close the accounts .arrow_forwardPrepare a worksheet for Brown’s Plumbing and Heating. Write the heading for the worksheet for the fiscal period ending December 31, 20xx. Record the trial balance using the accounts and their balances from the Ledger tab. Some are done for you. Calculate and record the Supplies adjustment. There is $5,600.00 in supplies on hand at the end of the fiscal year. Calculate and record the Insurance adjustment. There is $900.00 of insurance coverage left at the end of the fiscal year. Prove the Adjustments columns. Extend all balance sheet account balances. Extend all income statement account balances. Calculate and record the net income or loss. Total and rule the Income Statement and Balance Sheet columns.arrow_forward

- From each of the following December 31 adjusting journal entries, prepare the original journal entry that was recorded by supplying the blanks provided. The first one is already done for you. You may print and write the answers or encode the answers immediately. Prepaid Insurance 240 Insurance Expense 240 Supplies Expense 1,200 Supplies 1,200 Rent Revenue 6,300 Unearned Rent Revenues 6,300 Unearned Commissions Revenue 4,200 Commissions Revenue 4,200 Additional Information: Yearly insurance premium is effective and payable every March 1. Supplies are purchased every May 1 and are used evenly throughout the year. Annual rent is received every April 1. Commissions are collected every June 1 and earned evenly throughout the year. Original Journal Entries 1.(example) Debit: Insurance Expense 1,440 Credit: Cash 1,440 2. Debit: Supplies 1,800 Credit: Cash 1,800 3. Debit: __________________ Credit: __________________ 4. Debit: __________________ Credit:…arrow_forwardFrom each of the following December 31 adjusting journal entries, prepare the original journal entry that was recorded by supplying the blanks provided. The first one is already done for you. You may print and write the answers or encode the answers immediately. Prepaid Insurance 240 Insurance Expense 240 Supplies Expense 1,200 Supplies 1,200 Rent Revenue 6,300 Unearned Rent Revenues 6,300 Unearned Commissions Revenue 4,200 Commissions Revenue 4,200 Additional Information: Yearly insurance premium is effective and payable every March 1. Supplies are purchased every May 1 and are used evenly throughout the year. Annual rent is received every April 1. Commissions are collected every June 1 and earned evenly throughout the year. Original Journal Entries 1.(example) Debit: Insurance Expense 1,440 Credit:…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning