Calculating

To calculate: The size of settlements, and if Person X is a plaintiff, what will be his choice on the interest rate.

Introduction:

The series of payments that are made at equal intervals is an annuity payment. The amount of annuity payments is calculated mainly based on the particular situation.

Answer to Problem 61QP

The size of the settlement or the award is $476,773.21.

Explanation of Solution

Given information:

Person X serves on a jury. A plaintiff sues the city for the injuries that continued after the accident of a sweeper in the Street F. In the trial, the doctors stated that it will be 5 years earlier the plaintiff is able to return back to work. The decision made by the jury was in favor of the plaintiff. Person X is the foreperson of the jury, the jury proposes that the plaintiff will be provided an award that is as follows:

- a) The present value of the 2 years back pay. The annual salary of the plaintiff for the last 2 years would have been $43,000 and $46,000.

- b) The present value of the 5 years’ salary in future is assumed to be $51,000 for a year.

- c) The sum that has to be paid for the pain and suffering is $150,000.

- d) The amount of the court costs is $20,000.

It has to be assumed that the payment of the salary is made at the end of the month in equal amounts. The rate of interest is 8% at an effective annual rate.

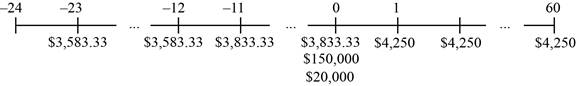

Time line of the cash flow:

Note: The cash flows here would have happened in the past and will also occur in the future. It is essential to find the present cash flows. Before computing the present value of the cash flow, it is essential to adjust the rate of interest and thus, the effective monthly interest rate can be found. Finding the annual percentage rate with compounding monthly and dividing it by twelve will provide the effective monthly rate. The annual percentage rate with the monthly compounding is calculated as follows:

Compute the annual percentage rate with the effective annual rate:

Hence, the annual percentage rate is 0.0772 or 7.72%.

To determine the today’s value of the back pay from 2 years ago, it is essential to find the future value of annuity and then the lump sums future value.

Formula to calculate the future value of an annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the future value annuity:

Hence, the future value of annuity is $44,554.76.

Formula to compute the future value:

Note: C denotes the annual cash flow or annuity payment, r represents the rate of interest, and t denotes the number of payments.

Compute the future value:

Hence, the future value is $48,119.14088.

Note: The future value of the annuity is determined by the effective monthly rate and the future value of the lump sum is determined by the effective annual rate. The other alternate way to determine the future value of the lump sum with the effective annual rate as long it is utilized for the 12 periods. The solution would be the same in either way.

Now the today’s value of the last year’s back pay is calculated as follows:

Compute the future value annuity:

Hence, the future value of the annuity is $47,663.23.

Next, it is essential to determine today’s value of the 5 year’s future salary.

Formula to calculate the present value annuity:

Note: C denotes the payments, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity for without fee:

Hence, the present value of the annuity is $210,990.8393.

The today’s value of the jury award is calculated by adding the sum of salaries, the court costs, and the compensation for the pain and sufferings. The award amount is calculated as follows:

Hence, the award amount or the size of the settlement is $476,773

To determine: As a plaintiff the choice of Person X on the interest rate.

Introduction:

The series of payments that are made at equal intervals is an annuity payment. The amount of annuity payments is calculated mainly based on the particular situation.

Explanation of Solution

As a plaintiff, Person X will choose the lesser interest rate. In this problem, both the future value and the present value is calculated. The lesser interest rate decreases the future value of the annuity and increases the present value of the annuity.

Thus, by the lesser interest rate, the value of the back pay is lowered. But, the present value of the future salary is increased. Since the salary in the future is longer and larger, it is the more significant cash flow to the plaintiff.

Want to see more full solutions like this?

Chapter 6 Solutions

FUND. OF CORPORATE FIN. 18MNTH ACCESS

- 7How much more is a perpetuity paying $5000 at the end of year worth than an annuity paying the same annual amounts at the end of each year for 30 years? Assume an interest rate of 5%. a. $10,635.08 b. $21,976.29 c. $50,000.00 d. $23,137.74 8Miller's Hardware plans on saving $40,000, $50,000, and $58,000 at the end of each year for the next three years, respectively. How much will the firm have saved at the end of the three years if it can earn 6% by reinvesting its saving? a. $155,944.00 b. $169,004.13 c. $148,000.00 d. $148,078.15 9On the day you retire you have $500,000 saved. You expect to live another 30 years during which time you expect to earn 8% on your savings while inflation averages 3.5% annually. Assume you want to spend the same amount each year in real terms and die on the day you spend your last dime. What real amount will you be able to spend each year? a. $61,931.78 b. $79,211.09 c. $79,644.58 d. $30,695.77arrow_forward1)[Deferred annuity] You consider purchasing an annuity that pays $2000/yr for 10 years. You are willing to wait until 9 years later to receive the first payment and the interest rate is 10%. How much are you willing to pay for this deferred annuity today? 2)The correct answer is 5,732.97 3)What are the steps to calculate this with a financial calculator?arrow_forwardQuestion 2B You need to save aside $320,000 for your retirement plan 10 years from now. You have a saving of $120,000 and is consider to put exactly an equal amount of money into Sustainable Investment Fund at the end of each month for 10 years to get 200 000 you still short of now. The fund is offering a rate of return 10.5 % per year, compounding monthly. Required: Calculate the monthly payment you need to contribute into Sustainable Investment Fund to get $200,000 after 10 years? If you change to contribute $1,000/month to that fund at the beginning of each month, how much money you would have in your account after 10 years? You are offered an investment that will pay $24 000 for the first year and then it will increase 4% each year. What is present value of this investment if the rate of return 13.5% applies?arrow_forward

- Suppose you just won the state lottery, and you have a choice between receiving $3,550,000 today or a 20-year annuity of $250,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes. Select the correct answer. a. 4.41% b. 1.71% c. 3.51% d. 2.61% e. 5.31%arrow_forwardH5. A person has a property that they want to sell, and they need to know the present value of the following options: (for both options consider a rate of 21.6%) a. Advance payments of $25,000 every six months for 5 years b. Payments of $9,000 quarterly for 4 years and a final payment of $20,000 nine months after the last depositarrow_forwardMay I ask for an explanation and solution to the question for a better understanding. Thank you! 1. If you invest P8,000 at 6.6% interest, compounding monthly, how much will you have in 3½ years? a. P10,072.50 b. P10,010.64 c. P29,848.00 d. P8,155.09arrow_forward

- 5. How much would you pay today for a perpetuity of $ 1,000 per year if the prevailing interest rate is 5.25%?arrow_forward5.7 An investment will pay $150 at the end of each of the next 3 years, $200 at the end of Year 4, $350 at the end of Year 5, and $550 at the end of Year 6. If other investments of equal risk earn 5% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ Future value: $arrow_forward58. Modified True or False T means Correct and F means Wrong Scenario: CHUGS are considering two equally risky annuities, each of which pays $5,000 per year for 10 years. Investment ORD is an ordinary annuity, while Investment DUE is an annuity due. The present value of DUE exceeds the present value of ORD, while the future value of DUE is less than the future value of ORD. The present value of ORD exceeds the present value of DUE, and the future value of ORD also exceeds the future value of DUE. If the going rate of interest decreases from 10% to 0%, the difference between the present value of ORD and the present value of DUE would remain constant. A rational investor would be willing to pay more for DUE than for ORD, so their market prices should differ. Group of answer choices F,F,F,T F, F, F, F T,T,F,T T,T,T,T T,T,F,F F,T,F,Tarrow_forward

- Question 2B It is given that you need to save aside $320,000 for your retirement plan 10 years from now. You have a saving of $120,000 and is consider to put exactly an equal amount of money into Sustainable Investment Fund at the end of each month for 10 years to get 200 000 you still short of now. The fund is offering a rate of return 10.5 % per year, compounding monthly. Required: Calculate the monthly payment you need to contribute into Sustainable Investment Fund to get $200,000 after 10 years? If you change to contribute $1,000/month to that fund at the beginning of each month, how much money you would have in your account after 10 years? You are offered an investment that will pay $24 000 for the first year and then it will increase 4% each year. What is present value of this investment if the rate of return 13.5% applies?arrow_forward5.3 Your parents will retire in 30 years. They currently have $230,000 saved, and they think they will need $1,650,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? Round your answer to two decimal places.arrow_forward3. You would like to have $42000 in five years to make some improvements on your house. What is the amount you need to invest today at 6% compounded monthly to reach your goal? How much of the $42000 is interest? SOLVE ON EXCELarrow_forward

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning