Principles Of Managerial Finance, Student Value Edition (14th Edition)

14th Edition

ISBN: 9780133508000

Author: Lawrence J. Gitman, Chad J. Zutter

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6.7P

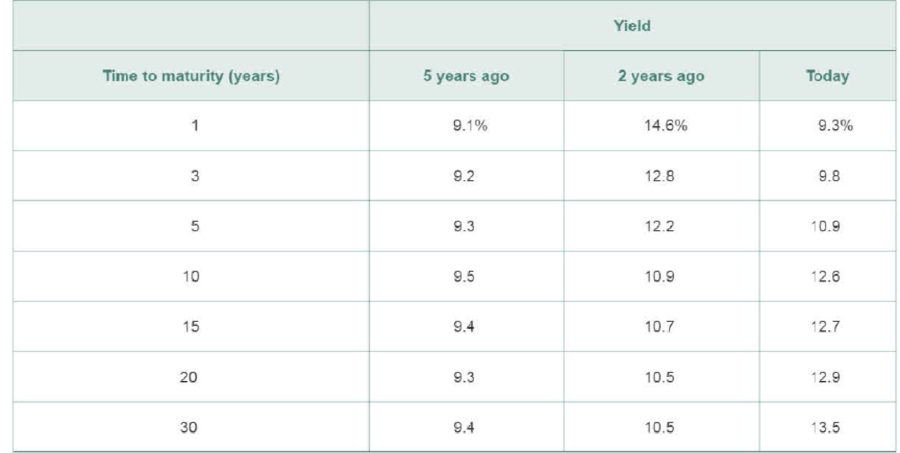

Term structure of interest rates The following yield data for a number of highest-quality corporate bonds existed at each of the three points in time noted.

a. On the same set of axes, draw the y1eld curve at each of the three given times.

b. Label each curve in part a with its general shape (downward sloping, upward sloping, flat).

c. Describe the general interest rate expectation existing at each of the three times, assuming the expectations theory holds.

d. Examine the data from 5 years ago. According to the expectations theory, what approximate return did investors expect a 5-year bond to pay as of today?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a. What is the price (expressed as a percentage of the face value) of a 1-year, zero-coupon corporate bond with a AAA rating and a face value of $1,000?

b. What is the credit spread on AAA-rated corporate bonds?

c. What is the credit spread on B-rated corporate bonds?

d. How does the credit spread change with the bond rating? Why?

Note: Assume annual compounding.

The yield to maturity reported in the financial pages for Treasury securities

A. is calculated by doubling the semiannual yield.

B. is calculated by doubling the semiannual yield and is also called the bond equivalent yield.

C. is calculated as the yield-to-call for premium bonds.

D. is also called the bond equivalent yield.

E. is calculated by compounding the semiannual yield.

Suppose the returns on long-term government bonds are normally distributed. Assume long-term government bonds have a mean return of 6.1 percent and a standard deviation of 9.8 percent.

What is the approximate probability that your return on these bonds will be less than −3.7 percent in a given year? Use the NORMDIST function in Excel® to answer this question.

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

What range of returns would you expect to see 95 percent of the time?

Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.

What range would you expect to see 99 percent of the time?

Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter…

Chapter 6 Solutions

Principles Of Managerial Finance, Student Value Edition (14th Edition)

Ch. 6.1 - Prob. 1FOPCh. 6.1 - Prob. 6.1RQCh. 6.1 - What is the term structure of interest rates, and...Ch. 6.1 - For a given class of similar-risk securities, what...Ch. 6.1 - Prob. 6.4RQCh. 6.1 - List and briefly describe the potential issuer-...Ch. 6.2 - Prob. 1FOECh. 6.2 - What are typical maturities, denominations, and...Ch. 6.2 - Differentiate between standard debt provisions and...Ch. 6.2 - How is the cost of bond financing typically...

Ch. 6.2 - Prob. 6.9RQCh. 6.2 - Prob. 6.10RQCh. 6.2 - Compare the basic characteristics of Eurobonds and...Ch. 6.3 - Why is it important for financial managers to...Ch. 6.3 - Prob. 6.13RQCh. 6.3 - Prob. 6.14RQCh. 6.3 - Prob. 6.15RQCh. 6.4 - Prob. 6.16RQCh. 6.4 - What relationship between the required return and...Ch. 6.4 - If the required return on a bond differs from its...Ch. 6.4 - As a risk-averse investor, would you prefer bonds...Ch. 6.4 - Prob. 6.20RQCh. 6 - Prob. 1ORCh. 6 - Learning Goals 5, 6 ST6- 1 Bond valuation Lahey...Ch. 6 - Prob. 6.2STPCh. 6 - Prob. 6.1WUECh. 6 - The yields for Treasuries with differing...Ch. 6 - The YTMs for Treasuries with differing maturities...Ch. 6 - Assume that the rate of inflation expected over...Ch. 6 - Calculate the risk premium for each of the...Ch. 6 - Prob. 6.6WUECh. 6 - Prob. 6.7WUECh. 6 - Assume a 5-year Treasury bond has a coupon rate of...Ch. 6 - Prob. 6.1PCh. 6 - Prob. 6.2PCh. 6 - Prob. 6.3PCh. 6 - Yield curve A firm wishing to evaluate interest...Ch. 6 - Prob. 6.5PCh. 6 - Prob. 6.6PCh. 6 - Term structure of interest rates The following...Ch. 6 - Prob. 6.8PCh. 6 - Prob. 6.9PCh. 6 - Bond interest payments before and after taxes...Ch. 6 - Prob. 6.11PCh. 6 - Prob. 6.12PCh. 6 - Prob. 6.13PCh. 6 - Prob. 6.14PCh. 6 - Prob. 6.16PCh. 6 - Prob. 6.20PCh. 6 - Prob. 6.21PCh. 6 - Prob. 6.23PCh. 6 - Bond valuation: Semiannual interest Find the value...Ch. 6 - Prob. 1SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating?b. What is the credit spread on AAA-rated corporate bonds?c. What is the credit spread on B-rated corporate bonds?d. How does the credit spread change with the bond rating? Why? Security Yield Treasury 3.120AAA corporate 3.874BBB corporate 4.521B corporate 5.328arrow_forwardThe following table summarizes the prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat?arrow_forwardWhich of the following statements is CORRECT? Group of answer choices The bond-yield-plus-risk-premium approach to estimating the cost of common equity involves adding a risk premium to the interest rate on the company’s own long-term bonds. The size of the risk premium for bonds with different ratings is published daily in The Wall Street Journal or is available online. The WACC is calculated using a before-tax cost for debt that is equal to the interest rate that must be paid on new debt, along with the after-tax costs for common stock and for preferred stock if it is used. An increase in the risk-free rate is likely to reduce the marginal costs of both debt and equity. The relevant WACC can change depending on the amount of funds a firm raises during a given year. Moreover, the WACC at each level of funds raised is a weighted average of the marginal costs of each capital component, with the weights based on the firm’s target capital structure. Beta measures market risk,…arrow_forward

- The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why?arrow_forwardAn investor gathers the following data on three newly-issued bonds: 1-year government bond, 3.0% yield 1-year ABC corporate bond, 4.2% yield 10-year government bond, 3.8% yield If investors require a 0.5% liquidity premium for corporate bonds, what are the components of the required return on a 10-year ABC bond?arrow_forwardYou are the portfolio manager of a large company that invests in many securities including corporate bonds. Youhave been assigned the task of bond portfolio management. You are provided with the following data in relationto bonds:Maturity period 7 yearsCoupon rate 12%Par value $1,000Coupons on bonds are paid annuallyYield to maturity of bonds 8%Required:i) Calculate the Macualay’s duration, modified duration and convexityii) Calculate the change in bond price when yield to maturity changes by one percent using modifieddurationiii) Calculate the change in bond price when yield to maturity changes by one percent when convexityis consideredarrow_forward

- NBP Sarmaya Izafa Fund is attempting to balance one of the bond portfolios under its management. The fund has identified three bonds which have five-year maturities and which trade at a YTM of 9 percent. The bonds differ only in that the coupons are 7 percent, 9 percent, and 11 percent. a. What does the concept of duration mean in context of security valuation? b. On what factors duration of a bond depends and what relation duration has with those factors? c. Calculate the duration of the tree bonds as described in para above. d. Plot the relation between duration and coupon ratearrow_forwardThe following table summarizes the yields to maturity on several one-year, zero-coupon securities: What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? What is the credit spread on AAA-rated corporate bonds? What is the credit spread on B-rated corporate bonds? How does the credit spread change with the bond rating? Why? (Round to three decimal places.)arrow_forwardAssume that the credit risk on a 5 year6 percent annual coupon corporate bond is represented by a 1.5 percent annual probability of default and a recovery rate of 25 percent. Assume that the government yield curve is flat at 2.5 percent. Calculate both the credit spread and credit valuation adjustment for the bond. INCLUDE DETAILED CALCULATION***arrow_forward

- A balance sheet that displays only component percentages is a a.comparative balance sheet. b.condensed balance sheet. c.common-sized balance sheet. d.trend balance sheet. If the straight-line method of amortization of bond premium or discount is used, which of the following statements is true? A. Annual interest expense will remain the same over the life of the bonds with the amortization of bond discount. B. Annual interest expense will increase over the life of the bonds with the amortization of bond discount. C. Annual interest expense will decrease over the life of the bonds with the amortization of bond discount. D. Annual interest expense will increase over the life of the bonds with the amortization of bond premium. A statement of cash flows would be least useful in answering which of the following questions? Double-click on the box below to edit your answer choices. A.Cash used to purchase equipment B.Change in total expenses C.cash provided from sale of stockarrow_forwardConsider the following newly issued bonds: Inputs Juan Rojo, Incorporated 10-Year Bond McAllister Avionics 9-Year Bond Settlement Date 01-01-2020 01-01-2020 Maturity Date 01-01-2030 01-01-2029 Coupon Rate 0.080 0.050 Redemption Value 100 100 Coupons per Year 2 1 Market Data Initial Yield 0.075 Yield Change 0.010 Required: Using any necessary data above, calculate the Price, the Macaulay Duration and the Modified Duration for each bond. Then, predict the price change given a change in the prevailing yield. Then, assume the market yield changed, as described below. In the second table, calculate the approximate price change and new price according to duration (the first-order approximation). (Use cells A5 to C13 from the given information to complete this question.) Juan Rojo, Incorporated 10-Year Bond McAllister Avionics 9-Year Bond…arrow_forwardConsider the following newly issued bonds: Inputs Juan Rojo, Incorporated 10-Year Bond McAllister Avionics 9-Year Bond Settlement Date 01-01-2020 01-01-2020 Maturity Date 01-01-2030 01-01-2029 Coupon Rate 0.080 0.050 Redemption Value 100 100 Coupons per Year 2 1 Market Data Initial Yield 0.075 Yield Change 0.010 Required: Using any necessary data above, calculate the Price, the Macaulay Duration and the Modified Duration for each bond. Then, predict the price change given a change in the prevailing yield. Then, assume the market yield changed, as described below. In the second table, calculate the approximate price change and new price according to duration (the first-order approximation). (Use cells A5 to C13 from the given information to complete this question.) Juan Rojo, Incorporated 10-Year Bond McAllister Avionics 9-Year Bond…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

What are Money Markets?; Author: The CISI;https://www.youtube.com/watch?v=ipOYM0sfW7M;License: Standard Youtube License