INTERNATIONAL ACCOUNTING (LL)-W/CONNECT

5th Edition

ISBN: 9781260696219

Author: Doupnik

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 11EP

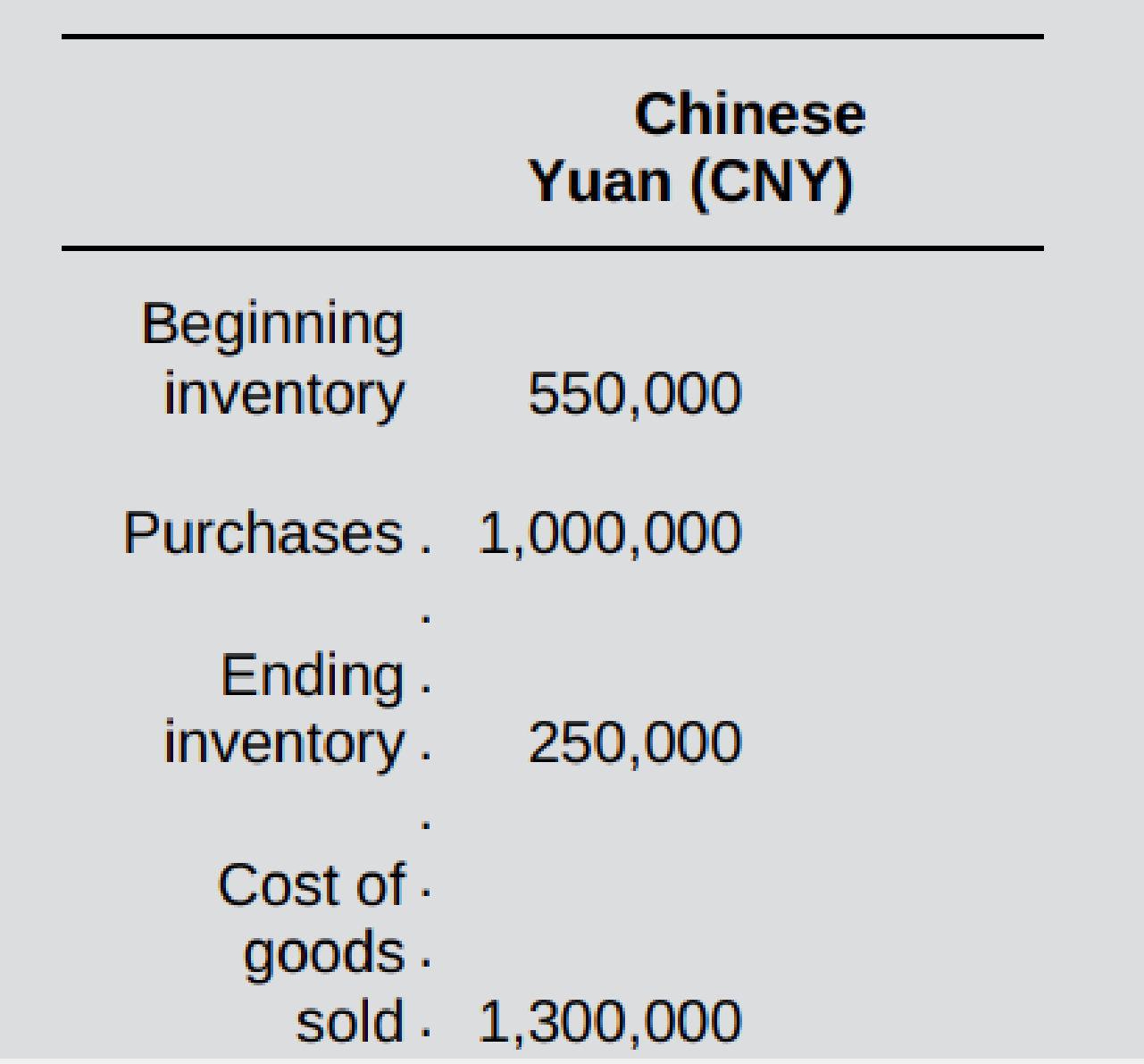

The Year 1 financial statements of the Chinese subsidiary of Singcom Limited (a Singapore-based company) revealed the following:

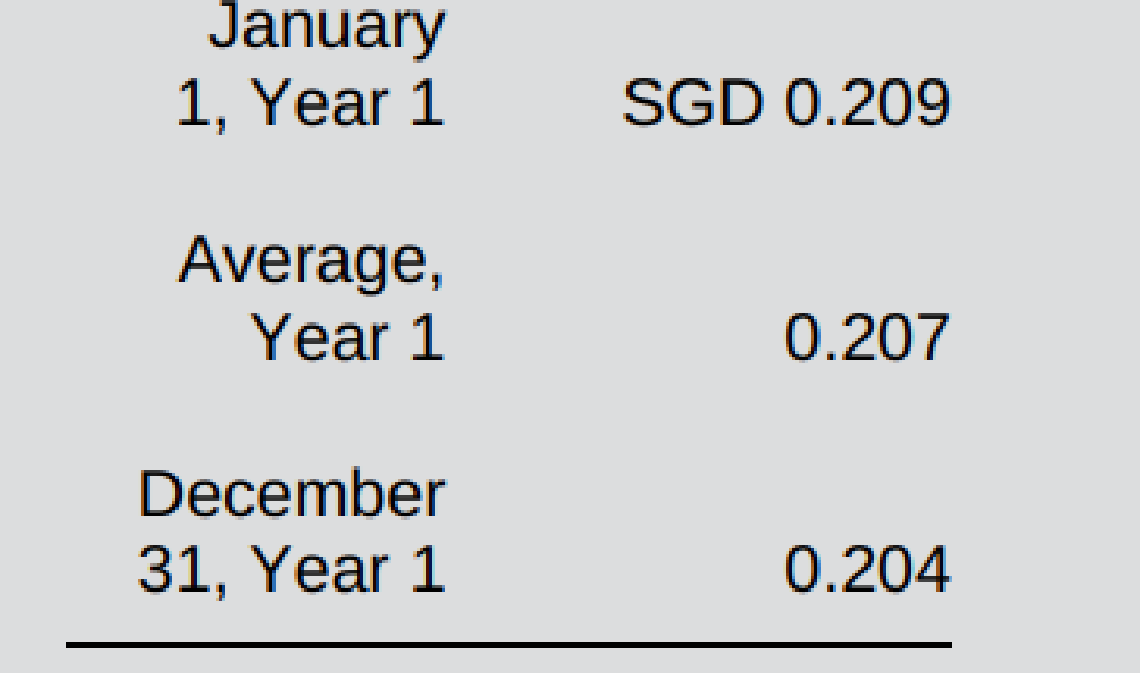

Singapore dollar (SGD) exchange rates for 1 CNY are as follows:

The beginning inventory was acquired in the last quarter of the previous year, when the exchange rate was SGD 0.210 = CNY 1; ending inventory was acquired in the last quarter of the current year, when the exchange rate was SGD 0.205 = CNY 1.

Required:

- a. Assuming that the current rate method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

- b. Assuming that the temporal method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On January 1, Narnevik Corporation formed a subsidiary in a foreign country. On April 1, the subsidiary purchased inventory on account at a cost of 250,000 local currency units (LCU). One-fifth of this inventory remained unsold on December 31, while 30 percent of the account payable had not yet been paid. The U.S.dollar–per-LCU exchange rates were as follows:

January 1

$

0.60

April 1

0.58

Average for the current year

0.56

December 31

0.54

At what amounts should the December 31 balances in inventory and accounts payable be translated into U.S. dollars using the current rate method?

On January 1, Narnevik Corporation formed a subsidiary in a foreign country. On April 1, the subsidiary purchased inventory on account at a cost of 250,000 local currency units (LCU). One-fifth of this inventory remained unsold on December 31, while 30 percent of the account payable had not yet been paid. The U.S. $ per LCU exchange rates were as follows:At what amounts should the December 31 balances in inventory and accounts payable be translated into U.S. dollars using the current rate method?

On March 1, 20x1, ABC Co. sold inventory to a foreign company for FC 1,000,000 (FC means foreign currency) when the spot exchange rate is FC 40: ₱1. The payment is due on April 1, 20x1.

ABC Co. is concerned about the possible fluctuation in exchange rates, so on this date, ABC Co. entered into a forward contract to sell FC 1,000,000 for ₱25,000 to a broker. According to the terms of the forward contract, if FC 1,000,000 is worth less than ₱25,000 on April 1, 20x1, ABC Co. shall receive from the broker the difference; if it is worth more than ₱25,000, ABC Co. shall pay the broker the difference.

If the exchange rate on April 1, 20x1 is FC35: ₱1, how much is the net cash settlement? 3,571 receipt

3,571 payment

4,231 receipt

4,231 payment

If the exchange rate on April 1, 20x1 is FC50: ₱1, how much is the net cash settlement? 5,000 payment

5,000 receipt

6,223 payment

6,223 receipt

If the exchange rate on March 31, 20x1 is FC45: ₱1, how much is the fair value of the…

Chapter 7 Solutions

INTERNATIONAL ACCOUNTING (LL)-W/CONNECT

Ch. 7 - Prob. 1QCh. 7 - Prob. 2QCh. 7 - Prob. 3QCh. 7 - Prob. 4QCh. 7 - Prob. 5QCh. 7 - 6. What are the major differences between IFRS and...Ch. 7 - Prob. 7QCh. 7 - 8. Which translation method does U.S. GAAP require...Ch. 7 - Prob. 9QCh. 7 - 10. How are gains and losses on foreign currency...

Ch. 7 - Prob. 11QCh. 7 - Prob. 12QCh. 7 - Prob. 1EPCh. 7 - Prob. 2EPCh. 7 - Prob. 3EPCh. 7 - Prob. 4EPCh. 7 - 4. Which of the following best explains how a...Ch. 7 - In the translated financial statements, which...Ch. 7 - Prob. 7EPCh. 7 - Prob. 8EPCh. 7 - Prob. 9EPCh. 7 - Prob. 10EPCh. 7 - The Year 1 financial statements of the Chinese...Ch. 7 -

10. Simga Company's Turkish subsidiary repented...Ch. 7 - Prob. 13EPCh. 7 - Prob. 14EPCh. 7 - Prob. 15EPCh. 7 - Prob. 16EPCh. 7 - Prob. 17EPCh. 7 - Prob. 18EPCh. 7 - 16. Access the most recent annual report for a...Ch. 7 - Prob. 21EPCh. 7 - Prob. 22EPCh. 7 - Prob. 1CCh. 7 - Prob. 2C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 12, 20X5, Dahl Company entered into three forward exchange contracts, each to purchase 100,000 francs in 90 days. The relevant exchange rates are as follows: Spot Rate Forward Rate for March 12, 20X6 December 12, 20X5 $ 0.88 $ 0.90 December 31, 20X5 0.98 0.93 3. Dahl entered into the first forward contract to manage the foreign currency risk from a purchase of inventory in November 20X5, payable in March 20X6. The forward contract is not designated as a hedge. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract? multiple choice $10,000 $0 $5,000 $3,000 4. Dahl entered into the second forward contract to hedge a commitment to purchase equipment being manufactured to Dahl’s specifications. At December 31, 20X5, what amount of foreign currency transaction gain should Dahl include in income from this forward contract? multiple choice $10,000 $0 $5,000…arrow_forwardCrane Pharma just received revenues of $3,164,400 in Australian dollars (A$). Management has the following exchange rates: A$2.69000/£ and $1.5906/£. What is the U.S. dollar value of the company’s revenues? (Round intermediate calculation to 4 decimal places, e.g. 15.2578 and final answer to the nearest whole dollar, e.g. 5,275.) Revenue $_____________arrow_forwardA foreign operation has the following local inflation rates: Year 1: 10% Year 2: 20% Year 3: 30% Year 4: 10% Year 5: 15% a. What is the applicable cumulative inflation rate that should be used for reporting as of end of year 5? b. What method will be used for remeasurement or translation of the foreign operation’s foreign currency financial statements? ANSWER A AND B BOTH PLEASE 2. XYZ, a US company has a subsidiary in Korea. The Korean sub sells inventory to a Japanese company with the sale denominated in US dollars. Between the date of sale and the date, the receivable is collected the Korean won strengthens 10% against the US dollar. Explain if there is a foreign exchange gain or loss or no FX impact and why? Answer 1 and 2 allarrow_forward

- In each of the following cases, calculate the price of one share of the foreign stock measured in United States dollars (US$). a. A Belgian stock priced at 103.1 euros when the exchange rate is 1.0787 US$/ (i.e., each euro is worth $1.0787). b. A Swiss stock priced at 92.5 Swiss francs (Sf) when the exchange rate is 1.0385 US$/Sf. c. A Japanese stock priced at 1,386 yen (¥) when the exchange rate is113.9988 ¥/US$. Question content area bottom Part 1 a. The Belgian stock priced in U.S. dollars is $111.14 (Round to the nearest cent b. The Swiss stock priced in U.S. dollars is $................ (Round to the nearest cent.) c. The Japanese stock priced in U.S. dollars is $.......... (Round to the nearest cent.)arrow_forwardProblems 10 and 11 are based on the following information.A Clarke Corporation subsidiary buys marketable equity securities and inventory on April 1, 2017, for 100,000 won each. It pays for both items on June 1, 2017, and they are still on hand at year-end. Inventory is carried at cost under the lower-of-cost-or-net realizable rule. Currency exchange rates for 1 won follow:Assume that the U.S. dollar is the subsidiary’s functional currency. What balances does a consolidated balance sheet report as of December 31, 2017?a. Marketable equity securities = $16,000 and Inventory = $16,000.b. Marketable equity securities = $17,000 and Inventory = $17,000.c. Marketable equity securities = $19,000 and Inventory = $16,000.d. Marketable equity securities = $19,000 and Inventory = $19,000.arrow_forwardExample 1: Kennedy Inc. is a US based MNC that conduct a part of its business in Oman. Its Omani sales are denominated in Omani Riyal. Its income statement from Oman business at the year-end is shown below: Income Statement Particulars Amount in OMR Sales 25000 Less: Cost of goods sold 8000 Gross Profit 17000 Operating expenses 11000 EBIT 6000 Interest Expenses 2000 EBT 4000 Exchange Rates: (a) The spot exchange rate = OMR 0.3850/USD (b) The average exchange rate = OMR 0.3780/USD (c) The historical exchange rate = OMR 0.3820/USD Requirement: Translate income statement into reporting currency by using the current rate method and temporal method.arrow_forward

- Tara Corporation issued a promissory note denominated in foreign currency for the purchase made from a supplierin England on December 1, for a 60-day, 12% promissory note for 100,000 pounds, at a selling rate of 1FC to P65.50. OnDecember 31, the selling spot rate is 1FC to P64.80. On January 30, the selling spot rate is 1FC to P65.45On the settlement date, how much is the foreign exchange loss?arrow_forwardA U.S. company’s foreign subsidiary had these amounts in local currency units (LCU) in 2020: Cost of goods sold LCU 5,590,000 Beginning inventory 548,000 Ending inventory 609,000 The average exchange rate during 2020 was $1.30 = LCU 1. The beginning inventory was acquired when the exchange rate was $1.10 = LCU 1. Ending inventory was acquired when the exchange rate was $1.40 = LCU 1. The exchange rate at December 31, 2020, was $1.45 = LCU 1. Assuming that the foreign country is highly inflationary, at what amount should the foreign subsidiary’s cost of goods sold be reflected in the U.S. dollar income statement?arrow_forwardOn May 1, 20X1, Aero Electric Corporation, a U.S. company, purchased goods from Neon Circuit Corporation, a British company, on account for £55,000. Aero Electric entered into a 180-day forward exchange contract to offset its exposed foreign currency liability. On the purchase date, the spot rate was $1.57 per British pound and the forward exchange rate was $1.62 per pound. Which of the following are true of the journal entry recorded for the forward contract on Aero Electric's books? (Select all that apply) Group of answer choices Debit Foreign Currency Receivable from Exchange Broker (£) for $89,100. Credit Dollars Payable to Exchange Broker ($) for $86,350. Credit Dollars Payable to Exchange Broker ($) for $89,100. Debit Foreign Currency Receivable from Exchange Broker (£) for $86,350.arrow_forward

- Given the following balance sheet of a US based MNC’s fully operational subsidiary, who operates in Japan and whose functional currency is the Japanese Yen, determine the amount of the translation exposure in dollars if the Yen depreciates by 10% from ¥110/$ to ~¥122/$ by applying the current rate method. Balance Sheet of Subsidiary in ¥ Assets Liabilities + Equity Cash ¥145,000 Accounts Payable ¥246,000 A/R ¥104,000 Short Term Debt ¥128,000 Inventory ¥275,000 Long term debt ¥329,000 PPE ¥895,000 Common Stock ¥534,000 Retained Earnings ¥182,000 Total ¥1,419,000 ¥1,419,000arrow_forwardOn November 2, 201*, Sade entered into firm commitment with Singaporean firm to acquire an equipment, delivery andpassage of title on February 28, 201* at a price of 5,000 Singapore Dollar (SGD). On the same date, to hedge againstunfavorable changes in exchange rate of SGD, Sade entered into a 120-day forward contract with Andy Bank for 5,000SGD. The relevant exchange rates were as follows:11/2/201*12/31/201* 02/28/201*Spot Rate 34 36 37Forward Rate 35 38 37How much is the recognized derivative liability as of December 31, 201* as a result of the above transactions?arrow_forwardOn December 1, Y1, AAA, a US based company, entered into a three months forward contract to purchase 1 million foreign currency FC, on March 1, Y2. The following US per FC exchange rates apply: Date Spot Rate Forward Rate December 1, Y1 $0.088 $0.084 December 31, Y1 $ 0.080 $0.074 March 1, Y2 $0.076 AAA borrowing rate is 12%. The present value factor for 2 months at an annual rate is 0.9803. How would AAA report the forward contract on its balance sheet on December 31, Y1? Justify your answer and show your calculations. 3 pts As a liability of 9,803. 1,000,000 x (0.084-0.074) = 10,000 x 0.9803 = 9803arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The Exchange Rate and the Foreign Exchange Market [AP Macroeconomics Explained]; Author: Heimler's History;https://www.youtube.com/watch?v=JsKLBpy6cEc;License: Standard Youtube License