BUS 225 DAYONE LL

17th Edition

ISBN: 9781264116430

Author: BLOCK

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 11P

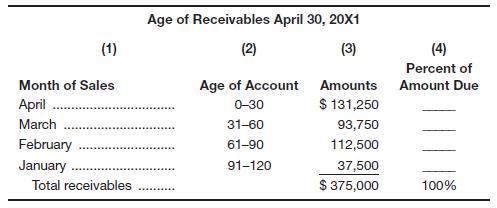

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

a. Fill in column (4) for each month.

b. If the firm had

c. If the firm likes to see its bills collected in 35 days, should it be satisfied with the average collection period?

d. Disregarding your answer to part c and considering the aging schedule for accounts receivable, should the company be satisfied?

e. What additional information does the aging schedule bring to the company that the average collection period may not show?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

Age of Receivables

April 30, 20X1

(3)

(2)

Age of

Account

0-30

31-60

61-90

91-120

(1)

Month of

Sales

April

March

February

January

Total receivables

Month of Sales

April

March

a. Calculate the percentage of amount due for each month.

February

January

Amounts

$120,540

86,100

103,320

34,440

$344,400

Total receivables

Percent of

Amount Due

%

%

%

do

(4)

Percent of

Amount Due

%

100 %

100%

The aging schedule of a firm shows that 40 percent of the receivables are collected in 18 days and the remaining 60 percent of the receivables are collected in 50 days. As a result, the firm's days sales outstanding (DSO) is _____.

ABCD Corporation has credit sales of $10,290,000 and receivables of $1,560,000. Assume there are 365 days in a year.

What is the receivables turnover? Round your answer to two decimal places.

What is the average collection period (days sales outstanding)? Round your answer to the nearest whole number.

days

If the company offers credit terms of 45 days, are its receivables past due? Round your answer to the nearest whole number. Enter zero if the receivables are not past due.

, it is days overdue.

Chapter 7 Solutions

BUS 225 DAYONE LL

Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Why would a financial manager want to slow down...Ch. 7 - Use The Wall Street Journal or some other...Ch. 7 - Why are Treasury bills a favorite place for...Ch. 7 - Explain why the bad debt percentage or any other...Ch. 7 - What are three quantitative measures that can be...Ch. 7 - Prob. 8DQCh. 7 - What does the EOQ formula tell us? What assumption...Ch. 7 - Why might a firm keep a safety stock? What effect...

Ch. 7 - If a firm uses a just-in-time inventory system,...Ch. 7 - City Farm Insurance has collection centers across...Ch. 7 - Prob. 2PCh. 7 - Orbital Communications has operating plants in...Ch. 7 - Postal Express has outlets throughout the world....Ch. 7 - Thompson Wood Products has credit sales of...Ch. 7 - Oral Roberts Dental Supplies has annual sales of...Ch. 7 - Knight Roundtable Co. has annual credit sales of...Ch. 7 - Darla’s Cosmetics has annual credit sales of...Ch. 7 - Barney’s Antique Shop has annual credit sales of...Ch. 7 - Mervyn’s Fine Fashions has an average collection...Ch. 7 - Route Canal Shipping Company has the following...Ch. 7 - Nowlin Pipe & Steel has projected sales of 72,000...Ch. 7 - Fisk Corporation is trying to improve its...Ch. 7 - Prob. 14PCh. 7 - Diagnostic Supplies has expected sales of 84,100...Ch. 7 - Wisconsin Snowmobile Corp. is considering a switch...Ch. 7 - Johnson Electronics is considering extending trade...Ch. 7 - Henderson Office Supply is considering a more...Ch. 7 - Fast Turnstiles Co. is evaluating the extension of...Ch. 7 - Slow Roll Drum Co. is evaluating the extension of...Ch. 7 - Global Services is considering a promotional...Ch. 7 - Problems 22-25 are a series and should be...Ch. 7 - Problems 22-25 are a series and should be...Ch. 7 - Problems 22-25 are a series and should be...Ch. 7 - Problems 22-25 are a series and should be...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ingraham Inc. currently has $525,000 in accounts receivable, and its days sales outstanding (DSO) is 67 days. It wants to reduce its DSO to 20 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forwardDome Metals has credit sales of $342,000 yearly with credit terms of net 45 days, which is also the average collection period. Dome does not offer a discount for early payment, so its customers take the full 45 days to pay. a. What is the average receivables balance? (Use a 360-day year.)b. What is the receivables turnover? (Use a 360-day year.)arrow_forwardABCD Corporation has credit sales of $10,960,000 and receivables of $1,260,000. Assume there are 365 days in a year. What is the receivables turnover? Round your answer to two decimal places. What is the average collection period (days sales outstanding)? Round your answer to the nearest whole number. days If the company offers credit terms of 30 days, are its receivables past due? Round your answer to the nearest whole number. Enter zero if the receivables are not past due. -Select-YesNoItem 3 , it is days overdue.arrow_forward

- Ingraham Inc. currently has $500,000 in accounts receivable, and its days sales outstanding (DSO) is 44 days. It wants to reduce its DSO to 20 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 10%. What will be the level of accounts receivable following the change? Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest centarrow_forwardMcGriff Dog Food Company normally takes 30 days to pay for average daily credit purchases of $9,730. Its average daily sales are $10,010, and it collects accounts in 32 days. a. What is its net credit position? Net credit position b-1. If the firm extends its average payment period from 30 days to 37 days (and all else remains the same), what is the firm's new net credit position? (Negative amount should be indicated by a minus sign.) Net credit position b-2. Has the firm improved its cash flow? Yes Noarrow_forwardALei Industries has credit sales of $146 million a year. ALei's management reviewed its credit policy and decided that it wants to maintain an average collection period of 35 days. a. What is the maximum level of accounts receivable that ALei can carry and have a 35-day average collection period? b. If ALei's current accounts receivable collection period is 55 days, how much would it have to reduce its level of accounts receivable in order to achieve its goal of 35 days?arrow_forward

- Helparrow_forwardThe Moncton Corporation has annual sales of $31 million. The average collection period is 27 days. What is the average investment in accounts receivable as shown on the balance sheet? Assume 365 days per year. (Enter the answer In dollars. Do not round Intermediate calculations. Round the final answer to nearest whole dollar amount. Omit "$" sign In your response.) Average receivables $arrow_forwardA firm has total annual sales (all credit) of P1,200,000 and accounts receivable of P500,000. How rapidly (in how many days) must accounts receivable be collected if management wants to reduce the accounts receivable to P300,000? choose the letter of the correct answera. 51.3 daysb. 61.3 daysc. 71.3 daysd. 81.3 dayse. 91.3 daysarrow_forward

- McGriff Dog Food Company normally takes 28 days to pay for average daily credit purchases of $9,540. Its average daily sales are $10,710, and it collects accounts in 32 days.a. What is its net credit position? b-1. If the firm extends its average payment period from 28 days to 38 days (and all else remains the same), what is the firm's new net credit position? (Negative amount should be indicated by a minus sign.)arrow_forwardBaker Industries has a 45 day accounts receivable period. The estimated quarterly sales for this year, starting with the first quarter, are $1,200, $1,400, $1,900 and $3,200, respectively. How much does the firm expect to collect in the third quarter? Assume that a year has 360 days. A)$1,300 B)$1,650 C)$1,400arrow_forwardWhich one of the following statements is correct if a firm has a receivables turnover of 10? It takes the firm an average of 36.5 days to sell its items. The firm has ten times more in accounts receivable than it does in cash. The firm collects its credit sales in an average of 36.5 days. It takes the firm 10 days to collect payment from its customers.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The management of receivables Introduction - ACCA Financial Management (FM); Author: OpenTuition;https://www.youtube.com/watch?v=tLmePnbC3ZQ;License: Standard YouTube License, CC-BY