Loose-leaf For Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781260190083

Author: Jacqueline L. Reck James E. Rooks Distinguished Professor, Suzanne Lowensohn, Daniel Neely

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 13C

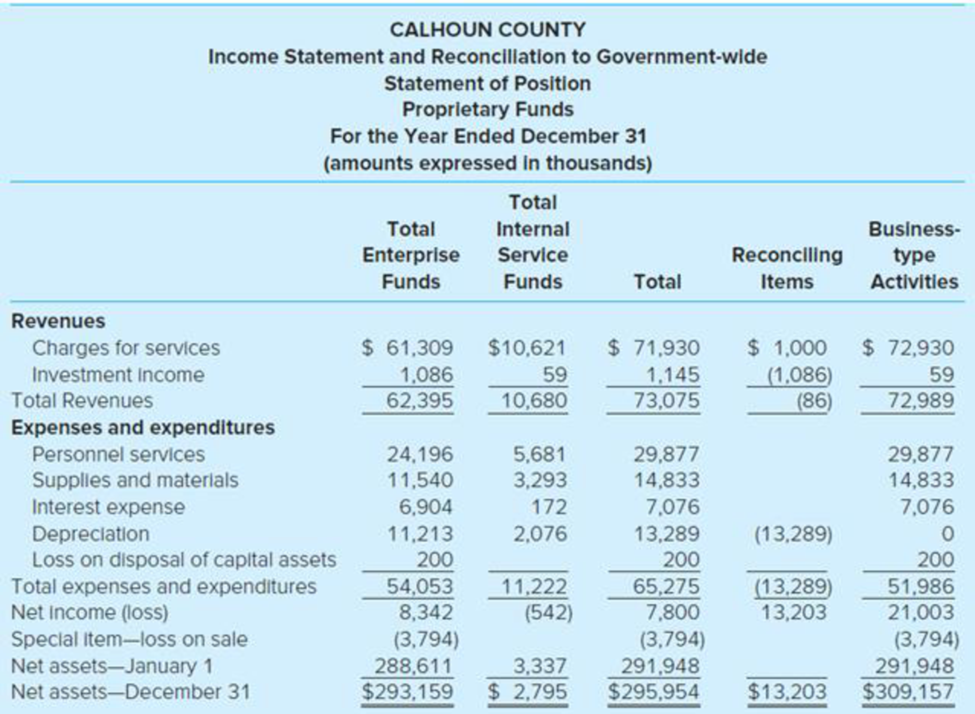

Proprietary Fund Operating Statement. (LO7-1) Calhoun County has prepared the following operating statement for its proprietary funds. The county has three enterprise funds and two internal service funds.

Required

The statement as presented is not in accordance with GASB standards. Identify the errors and explain how the errors should be corrected in order to conform with GASB standards. Along with the information in Chapter 7, Illustration A2–8 will be helpful in identifying and correcting the errors.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following are most likely to be internal service fund activities? (multiple answers allowed, incorrect answers will reduce correct answers)

Da workers compensation fund

b. IT department at Mcneese

O Gravity drainage district

Od. Fleet and equipment services fund

e. University bookstore

f.

Mallard golf course

This problem has two parts, part a and part b. Answer each part separately using the same information. Do not mix answers to a and b; they are answered separately.

Problem a: Using the list of transactions below, provide all necessary journal entries for the Fund statements. You also need to identify which funds are involved in the transaction, such as the Capital projects fund, Debt service fund Special revenue fund, or Permanent fund.

Problem b: Using the same list of transactions, provide all necessary journal entries for the Governmental Activities section in the Government-wide statements. Write “no entry” if no entry is needed.

Dunellen City, covered in this problem, issues a $10,000,000 bond at face value. The cash is to be used for the construction of a fire station.

Previously undesignated cash of $100,000 from the General Fund is set aside to begin paying the bonds issued in item (1).

A state cash grant of $300,000 is received that must be spent in the future for…

Which of the following is true regarding the use of Special Revenue Funds?

Multiple Choice

Special Revenue Funds are appropriate if the sole source of resources are assigned funds.

Once a Special Revenue Fund is established, it will continue to be a Special Revenue Fund until all resources are exhausted, even if the only source of funds is transfers from the General Fund.

Special Revenue Funds are used whenever a government wishes to segregate income for specific purposes.

Special Revenue Funds are used when a substantial portion of the resources are provided by restricted or committed revenue sources..

Chapter 7 Solutions

Loose-leaf For Accounting For Governmental & Nonprofit Entities

Ch. 7 - Prob. 1QCh. 7 - Explain the reporting requirements for internal...Ch. 7 - A member of the city commission insists that the...Ch. 7 - Prob. 4QCh. 7 - What is the purpose of the Restricted Assets...Ch. 7 - Prob. 6QCh. 7 - Prob. 7QCh. 7 - When do GASB standards require interfund...Ch. 7 - Prob. 9QCh. 7 - What is meant by segment information for...

Ch. 7 - Prob. 11QCh. 7 - Internal Service Fund Reporting. (LO7-2) Financial...Ch. 7 - Proprietary Fund Operating Statement. (LO7-1)...Ch. 7 - Enterprise Fund Golf Course Management. (LO7-1)...Ch. 7 - Prob. 17.1EPCh. 7 - Which of the following would most likely be...Ch. 7 - Under GASB standards, the City of Parkview is...Ch. 7 - Prob. 17.4EPCh. 7 - Which of the following events would generally be...Ch. 7 - Proprietary funds a. Are permitted to integrate...Ch. 7 - Prob. 17.7EPCh. 7 - Prob. 17.8EPCh. 7 - Prob. 17.9EPCh. 7 - Prob. 17.10EPCh. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - The City of Tutland issued 10 million, 6 percent,...Ch. 7 - Prob. 18EPCh. 7 - Prob. 19EPCh. 7 - Central Garage Internal Service Fund. (LO7-2) The...Ch. 7 - Internal Service Fund Statement of Cash Flows....Ch. 7 - Tribute Aquatic Center Enterprise Fund. (LO7-5)...Ch. 7 - Net Position Classifications. (LO7-5) During the...Ch. 7 - Central Station Enterprise Fund. (LO7-5) The Town...Ch. 7 - Enterprise Fund Journal Entries and Financial...Ch. 7 - Net Position Classifications. (LO7-5) The Village...Ch. 7 - Enterprise Fund Statement of Cash Flows. (LO7-5)...Ch. 7 - AppendixSolid Waste Enterprise Fund. (LO7-6) Brown...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select all that apply Which of the following statements are correct? Fund accounting segregates financial resources with constraints or limitations. General purpose governments may have more than one General Fund. Special revenue funds are used for resources to be used to acquire capital assets. Special revenue funds are not used for resources for payments on long-term debt.arrow_forwardFor each of the following, indicate whether the statement is true or false and include a brief explanation for your answer.a. A pension trust fund appears in the government-wide financial statements but not in the fund financial statements.b. Permanent funds are included as one of the governmental funds.c. A fire department placed orders of $20,000 for equipment. The equipment is received but at a cost of $20,800. In compliance with requirements for fund financial statements, an encumbrance of $20,000 was recorded when the order was placed, and an expenditure of $20,800 was recorded when the order was received.d. The government reported a landfill as an enterprise fund. At the end of Year 1, the government estimated that the landfill will cost $800,000 to clean up when it is eventually full. Currently, it is 12 percent filled. At the end of Year 2, the estimation was changed to $860,000 when it was 20 percent filled. No payments are due for several years. Fund financial statements for…arrow_forwardGovernmental accounting Explain how each of the following would affect the classification of the fund balance in the General Fund. All related resources are reported as General Fund assets. 1. Inventory of materials and supplies is $50,000 but $20,000 has not yet been paid to vendors for the recent purchases of the materials and supplies on hand. 2. The finance director has committed to using $40,000 of the carryover fund balance for employee attendance at training conferences. 3. Prepaid insurance in the General Fund is $10,000. 4. The city council adopted an ordinance setting aside $100,000 for planned improvements to police training programs. 5. Unspent receipts of a tax imposed with the stipulation that the monies raised must be used for economic development total $750,000. 6. Unrestricted tax receivables total $1,000,000, however, there are related deferred inflows of resources for unavailable taxes of $740,000. 7. A long-term receivable from which collection proceeds are assigned…arrow_forward

- When a government orders equipment which is to be used by an activity accounted within the General Fund, it should be recorded in the General Fund as a(an): Multiple Choice Encumbrance. Capital asset. Expenditure. None of the choices are correct, the General Fund does not record capital assets purchases..arrow_forwardAll proprietary fund financial information is reported in the Business-type Activities column of the government-wide financial statements. a. True O b. Falsearrow_forwardUnder the reporting model required by GASB Statement No. 34, fund statements are required for governmental, proprietary, and fiduciary funds. Government-wide statements include the statement of net position and the statement of activities.1. Explain the measurement focus and basis of accounting for governmental fund statements, proprietary fund statements, fiduciary fund statements, and government-wide statements.2. Explain some differences between fund financial statements and government-wide statements with regard to component units, fiduciary funds, and location of internal service funds.3. What should be included in the statement of net position categories invested in capital assets, net of related debt, restricted, and unrestricted?arrow_forward

- For each of the following accounts indicate in which fund type it could be found. Select your answer from the following responses: A. Governmental funds only. B. Proprietary funds only. Bond Proceeds Long Term liability for Compensated Absences Deferred Inflows/Outflows of Resources Taxes Receivable Estimated Revenues Operating Revenuesarrow_forwardWhich of the following is true about the management’s discussion and analysis (MD&A)? It is an optional addition to the comprehensive annual financial report, but the GASB encourages its inclusion. It adds a verbal explanation for the numbers and trends presented in the financial statements. It appears at the very end of a government’s comprehensive annual financial report. It replaces a portion of the fund financial statements traditionally presented by a state or local government.arrow_forwardWhich of the following is incorrect with respect to fund balances? Multiple Choice Restricted fund balance are net resources of a government fund that are subject to constraints imposed by external parties or by law. Assigned fund balances are resources that the governing body has specified for a particular use through ordinance or resolution by the government’s highest level of authority. Only unassigned fund balances may have a negative balance. Inventory and prepaid items are classified as nonspendable fund balances..arrow_forward

- Just need C and E corrected 4. The City of Grinders Creek maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. General fixed assets as of the beginning of the year, which had not been recorded, were as follows: Land $ 8,500,000 Buildings 27,600,000 Improvements Other Than Buildings 24,500,000 Equipment 11,690,000 Accumulated Depreciation, Capital Assets 25,800,000 During the year, expenditures for capital outlays amounted to $9,000,000. Of that amount, $4,800,000 was for buildings; the remainder was for improvements other than buildings. The capital outlay expenditures outlined in (2) were completed at the end of the year (and will begin to be depreciated next year). For purposes of financial statement presentation, all capital assets are depreciated using the straight-line method, with no estimated salvage value. Estimated lives are as follows:…arrow_forwardA local government transfers RO 20,000 from its general fund to an internal service fund to establish a centralized motor vehicle service center. Which one of the following represents the above transfer of funds from the general fund to internal service fund? a. Residual expenditure transfer b. Residual loan transfer c. None of the options d. Residual grant transferarrow_forwardWhich of the following funds provides goods and services only to other departments or agencies of the government on a cost-reimbursement basis? Group of answer choices a.) Internal service funds b.) Enterprise funds c.) Special revenue fundsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License