EBK CORPORATE FINANCE

4th Edition

ISBN: 9780134202785

Author: DeMarzo

Publisher: VST

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 15P

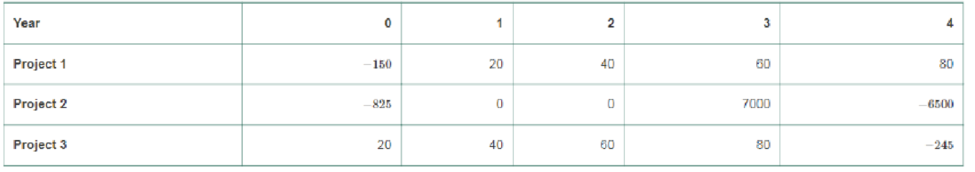

You have 3 projects with the following cash flows:

- a. For which of these projects is the IRR rule reliable?

- b. Estimate the IRR for each project (to the nearest 1%).

- c. What is the

NPV of each project if the cost of capital is 5%? 20%? 50%?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a). When ε= 15% and MARR = 20% per year, determine whether the project (whose total cash flow diagram is shown below) is acceptable using ERR

b). What is the IRR of the project ?

You are considering the following two projects and can take only one. Your cost of capital is 10.6%. The cash flows for the two projects a

as follows ($ million):

a. What is the IRR of each project?

b. What is the NPV of each project at your cost of capital?

c. At what cost of capital are you indifferent between the two projects?

d. What should you do?

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Project

Year 0

Year 1

Year 2

A

- $100

$24

$30

B

- $100

$48

$41

Year 3

$41

$30

Year 4

$48

$18

—

X

You are considering the following two projects and can take only one. Your cost of capital is 11.2%. The cash flows for the

two projects are as follows ($ million):

Project Year 0 Year 1 Year 2 Year 3 Year 4

A -100 26 28 42 48

B-100 48 42 28 19

a. What is the IRR of each project?

b. What is the NPV of each project at your cost of capital?

c. At what cost of capital are you indifferent between the two projects?

d. What should you do?

Chapter 7 Solutions

EBK CORPORATE FINANCE

Ch. 7.1 - Explain the NPV rule for stand-alone projects.Ch. 7.1 - What does the difference between the cost of...Ch. 7.2 - Prob. 1CCCh. 7.2 - If the IRR rule and the NPV rule lead to different...Ch. 7.3 - Can the payback rule reject projects that have...Ch. 7.3 - Prob. 2CCCh. 7.4 - For mutually exclusive projects, explain why...Ch. 7.4 - What is the incremental RR and what are its...Ch. 7.5 - Prob. 1CCCh. 7.5 - Prob. 2CC

Ch. 7 - Your brother wants to borrow 10,000 from you. He...Ch. 7 - You are considering investing in a start-up...Ch. 7 - You are considering opening a new plant. The plant...Ch. 7 - Your firm is considering the launch of a new...Ch. 7 - Bill Clinton reportedly was paid 15 million to...Ch. 7 - FastTrack Bikes, Inc. is thinking of developing a...Ch. 7 - OpenSeas, Inc. is evaluating the purchase of a new...Ch. 7 - You are CEO of Rivet Networks, maker of ultra-high...Ch. 7 - You are considering an investment in a clothes...Ch. 7 - You have been offered a very long term investment...Ch. 7 - You are considering opening a new plant. The plant...Ch. 7 - Bill Clinton reportedly was paid 15 million to...Ch. 7 - Prob. 13PCh. 7 - Innovation Company is thinking about marketing a...Ch. 7 - You have 3 projects with the following cash flows:...Ch. 7 - You own a coal mining company and are considering...Ch. 7 - Prob. 17PCh. 7 - Prob. 18PCh. 7 - Prob. 19PCh. 7 - Prob. 20PCh. 7 - You are a real estate agent thinking of placing a...Ch. 7 - Prob. 22PCh. 7 - You are deciding between two mutually exclusive...Ch. 7 - You have just started your summer Internship, and...Ch. 7 - Prob. 25PCh. 7 - Prob. 26PCh. 7 - Prob. 27PCh. 7 - Prob. 28PCh. 7 - Prob. 29PCh. 7 - Prob. 30PCh. 7 - Prob. 31PCh. 7 - Prob. 32PCh. 7 - Prob. 33PCh. 7 - Orchid Biotech Company is evaluating several...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering the following two projects and can take only one. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million): a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) a. What is the IRR of each project? Year 0 Year 1 Year 2 Year 3 Project A The IRR for project A is %. (Round to one decimal place.) $24 $31 $38 - $102 - $102 B $49 $38 $31 The IRR for project B is%. (Round to one decimal place.) b. What is the NPV of each project at your cost of capital? The NPV for project A is $ million. (Round to two decimal places.) Done The NPV for project B is $ million. (Round to two decimal places.) c. At what cost of capital are you indifferent between the two projects? You will be indifferent if the cost of capital is%.…arrow_forwardConsider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardConsider the investment project with the following net cash flows: What would be the value of X if the project's IRR is 25%?arrow_forward

- Consider the following cash flow profile and assume MARR is 10%/yr. Solve, a. What does Descartes’ rule of signs tell us about the IRR(s) of this project? b. What does Norstrom’s criterion tell us about the IRR(s) of this project? c. Determine the IRR(s) for this project. d. Is this project economically attractive?arrow_forwardYou've estimated the following cash flows (in $) for a project: A B 1 Year Cash flow 2 0 -3,000 3 1 900 4 2 1,300 5 3 1,606 The required return is 8.5%. 1. What is the IRR for the project? 2. What is the NPV of the project? 3. What should you do? Check all that apply: Accept the project based on its IRR Accept the project based on its NPV Reject the project based on its IRR Reject the project based on its NPVarrow_forwardYour company has a project available with the following cash flows : If the required return is 14 percent should the project be accepted based on IRR?arrow_forward

- If the cash flows for Project M are C0 = -1,000; C1 = +800; C2 = +700 and C3= -200. Calculate the IRR for the project. For what range of discount rates does the project have a positive NPV?arrow_forwardYou are considering the following two projects and can take only one. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million) a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? d. What should you do? a. What is the IRR of each project? The IRR for project A is %. (Round to one decimal place.) Data table D (Click on the following icon in order to copy its contents into a spreadsheet) Project A Year 0 -$100 B -$100 Year 1 $22 $49 Year 2 $31 $39 Print Done Year 3 Year 4 $39 $49 $31 $21 -arrow_forwardConsider an investment project with the cash flows given in the table below. Compute the IRR for this investment. Is the project acceptable at MARR = 10%? The IRR for this project is %. (Round to one decimal place.) n 0 1 2 3 Cash Flow -$35,000 15,000 14,520 13,990arrow_forward

- Project Y has following cash flows: C0 = -800, C1 = +6,000, and C2 = -6,000. Calculate the IRRs for the project: For what range of discount rates does the project have positive NPV (Plot a graph with NPV on the vertical axis and discount rate on the horizontal axis).arrow_forwardYou are considering the following two projects and can take only one. Your cost of capital is 10.6%. The cash flows for the two projects are as follows ($ million): a. What is the NPV of each project at your cost of capital? b. What is the IRR of each project? c. At what cost of capital are you indifferent between the two projects? d. What should you do? a. What is the NPV of each project at your cost of capital? The NPV for project A is $ Data table million. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) Year 1 Project A $22 B $48 Year 0 - $100 - $100 Year 2 $28 $42 Year 3 $42 $28 Year 4 $48 $20 - Xarrow_forwardWhich of the following comes closest to the net present value (NPV) of a project whose initial investment is $5 and which produces two cash flows: the first at the end of year 2 of $3 and the second at the end of year 4 of $7? The required rate of return is 13%? Select one: a. $1.84 b. $0 c. $1.64 d. $2.05 e. $2.26arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License