To determine: The percentage change in

Introduction:

A bond refers to the debt securities issued by the governments or corporations for raising capital. The borrower does not return the face value until maturity. However, the investor gets the coupons every year until the date of maturity.

Bond price or bond value refers to the present value of the future

Answer to Problem 16QP

The percentage change in bond price is as follows:

| Yield to maturity | Bond S |

Bond D |

| 9% | −5.15% | −18.40% |

| 5% | 5.50% | 25.10% |

The interest rate risk is high for a bond with longer maturity, and the interest rate risk is low for a bond with shorter maturity period. The maturity period of Bond S is 3 years, and the maturity period of Bond D is 20 years. Hence, the Bond D’s bond price fluctuates higher than the bond price of Bond S due to longer maturity.

Explanation of Solution

Given information:

There are two bonds namely Bond S and Bond D. The coupon rate of both the bonds is 7 percent. The bonds pay the coupons semiannually. The bond price is equal to its par value. Assume that the par value of both the bonds is $1,000. Bond S will mature in 3 years, and Bond D will mature in 20 years.

Formulae:

The formula to calculate the bond value:

Where,

“C” refers to the coupon paid per period

“F” refers to the face value paid at maturity

“r” refers to the yield to maturity

“t” refers to the periods to maturity

The formula to calculate the percentage change in price:

Determine the current price of Bond S:

Bond S is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to its yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond S will be $1,000.

Hence, the current price of Bond S is $1,000.

Determine the current yield to maturity on Bond S:

As the bond is selling at its face value, the coupon rate will be equal to its yield to maturity of the bond. The coupon rate of Bond S is 7 percent.

Hence, the yield to maturity of Bond S is 7 percent.

Determine the current price of Bond D:

Bond D is selling at par. It means that the bond value is equal to the face value. It also indicates that the coupon rate of the bond is equal to its yield to maturity of the bond. As the par value is $1,000, the bond value or bond price of Bond D will be $1,000.

Hence, the current price of Bond D is $1,000.

Determine the current yield to maturity on Bond D:

As the bond is selling at its face value, the coupon rate will be equal to its yield to maturity of the bond. The coupon rate of Bond D is 7 percent.

Hence, the yield to maturity of Bond D is 7 percent.

Compute the new interest rate (yield to maturity) when the interest rates rise:

Notes: The percentage change in the bond value of Bond S and Bond D when the interest rates rise by 2 percent.

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 7 percent. If the interest rates rise by 2 percent, then the new interest rate or yield to maturity will be 9 percent.

Compute the bond value when the yield to maturity of Bond S rises to 9 percent:

The coupon rate of Bond S is 7 percent, and its face value is $1,000. Hence, the annual coupon payment is $70

The yield to maturity is 7 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.5 percent that is

The remaining time to maturity is 3 years. As the coupon payment is semiannual, the semiannual periods to maturity are 6 years

Hence, the bond price of Bond S will be $948.42 when the interest rises to 9 percent.

Compute the percentage change in theprice of Bond S when the interest rates rise to 9 percent:

The new price after the increase in the interest rate is $948.42,the initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond S is −5.15% when the interest rates rise to 9 percent.

Compute the bond value when the yield to maturity of Bond D rises to 9 percent:

The coupon rate of Bond D is 7 percent, and its face value is $1,000. Hence, the annual coupon payment is $70

The yield to maturity is 9 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 4.5 percent

The remaining time to maturity is 20 years. As the coupon payment is semiannual, the semiannual periods to maturity are 40 years

Hence, the bond price of Bond D will be $815.98 when the interest rises to 9 percent.

Compute the percentage change in theprice of Bond D when the interest rates rise to 9 percent:

The new price after the increase in interest rate is $815.98. The initial price of the bond was $1,000.

Hence, the percentage decrease in the price of Bond D is −18.40 % when the interest rates rise to 9 percent.

Compute the new interest rate (yield to maturity) when the interest rates decline:

Note: The percentage change in the bond value of Bond S and Bond D when the interest rates decline by 2 percent.

The interest rate refers to the yield to maturity of the bond. The initial yield to maturity of the bonds is 7 percent. If the interest rates decline by 2 percent, then the new interest rate or yield to maturity will be 5 percent

Compute the bond value when the yield to maturity of Bond S declines to 5 percent:

The coupon rate of Bond S is 7 percent, and its face value is $1,000. Hence, the annual coupon payment is $70

The yield to maturity is 5 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.5 percent that is

The remaining time to maturity is 3 years. As the coupon payment is semiannual, the semiannual periods to maturity are 6 years

Hence, the bond price of Bond S will be $1,055.08 when the interest declines to 5 percent.

Compute the percentage change in the price of Bond S when the interest rates decline to 5 percent:

The new price after the increase in the interest rate is $1,055.08. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond S is 5.50% when the interest rates decline to 5 percent.

Compute the bond value when the yield to maturity of Bond D declines to 5 percent:

The coupon rate of Bond D is 7 percent, and its face value is $1,000. Hence, the annual coupon payment is $70

The yield to maturity is 5 percent. As the calculations are semiannual, the yield to maturity should also be semiannual. Hence, the semiannual yield to maturity is 2.5percent that is

The remaining time to maturity is 20 years. As the coupon payment is semiannual, the semiannual periods to maturity are 40 years

Hence, the bond price of Bond D will be $1,251.02 when the interest declines to 5 percent.

Compute the percentage change in the price of Bond D when the interest rates decline to 5 percent:

The new price after the increase in the interest rate is $1,251.02. The initial price of the bond was $1,000.

Hence, the percentage increase in the price of Bond D is 25.10% when the interest rates decline to 5 percent.

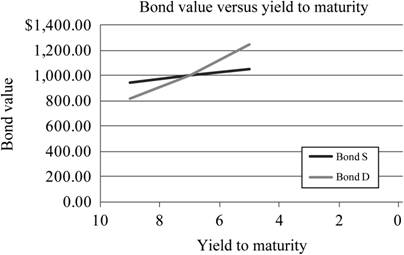

A summary of the bond prices and yield to maturity of Bond S and Bond D:

Table 1

| Yield to maturity | Bond S | Bond D |

| 5% | $1,055.08 | $1,251.02 |

| 7% | $1,000.00 | $1,000.00 |

| 9% | $948.42 | $815.98 |

A graph indicating the relationship between bond prices and yield to maturity based on Table 1:

Interpretation of the graph:

The above graph indicates that the price fluctuation is higher in a bond with higher maturity. Bond D has a maturity period of 20 years. As its maturity period is longer, its price sensitivity to the interest rates would also be higher. Bond S has a maturity period of 3 years. As its maturity period is shorter, its price sensitivity to the interest rates is lower. Hence, a bond with longer maturity is subject to higher interest rate risk.

Want to see more full solutions like this?

Chapter 7 Solutions

Student Problem Manual To Accompany Fundamentals Of Corporate Finance

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education