For Year 1:

a.

Identify whether the given transactions are asset source, asset use, asset exchange, or claims exchange.

For Year 1:

a.

Explanation of Solution

Identify the type of each transaction for Year 1:

| Event Number (Year 1) | Type of Transaction |

| 1. Issued common stock for cash. | Asset Source |

| 2. Service revenue earned on account. | Asset Source |

| 3. Collection of | Asset Exchange |

| 4. Adjusted the accounts to recognize uncollectible accounts expense. | Asset Use |

Table (1)

Asset source transactions are the transactions that results in an increase of both the asset and claims on assets.

Asset use transactions are the transactions that results in a decrease of both the asset and claims on assets.

Asset exchange transactions are the transactions that results in increase in one asset and decrease in the other asset.

Claim exchange transactions are the transactions that decreases one claim and increases other claims; the total claims remains unchanged.

For Year 1:

b.

Show the effect of each transaction on the elements of the financial statements for Year 1 using horizontal statement model.

For Year 1:

b.

Explanation of Solution

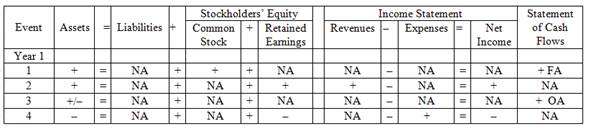

Effect of each transaction on the elements using horizontal statement model for Year 1:

Table (2)

For Year 1:

c.

Record the transactions in general journal and post them to T-accounts for Year 1.

For Year 1:

c.

Explanation of Solution

Percentage of revenue allowance method: Credit sales are recorded by debiting (increasing) accounts receivable account. The

It is a method of estimating the bad debts (expected loss on extending credit), by multiplying the expected percentage of uncollectible with the total amount of net credit sale (or total sales) for a specific period. Under percentage of sales method, estimated bad debts would be treated as an uncollectible account expense of the particular period.

Record the transactions in general journal:

| Date | Event No. | Account title and explanation |

Debit ($) |

Credit ($) |

| Year 1 | 1 | Cash | 5,000 | |

| Common stock | 5,000 | |||

| (To record the issue of common stock) | ||||

| Year 1 | 2 | Accounts receivable | 70,000 | |

| Service revenue | 70,000 | |||

| (To record the service revenue earned on account) | ||||

| Year 1 | 3 | Cash | 62,000 | |

| Accounts receivable | 62,000 | |||

| (To record the cash collected from accounts receivable) | ||||

| Year 1 | 4 | Uncollectible accounts expense (1) | 1,400 | |

| Allowance for doubtful accounts | 1,400 | |||

| (To record the uncollectible accounts expense) |

Table (3)

Working note:

Calculate the amount for uncollectible accounts expense:

T-account:

T-account is the form of the ledger account, where the

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

| Cash | |||

| 1. | $5,000 | ||

| 3. | $62,000 | ||

| Ending balance | $67,000 | ||

| Accounts receivable | |||

| 2. | $70,000 | 3. | $62,000 |

| Ending balance | $8,000 | ||

| Common stock | |||

| 1. | $5,000 | ||

| Ending balance | $5,000 | ||

| Service revenue | |||

| 2. | $70,000 | ||

| Ending balance | $70,000 | ||

| Allowance for doubtful accounts | |||

| 4. | $1,400 | ||

| Ending balance | $1,400 | ||

| Uncollectible accounts expense | |||

| 4. | $1,400 | ||

| Ending balance | $1,400 | ||

For Year 1:

d.

Prepare the income statement, statement of changes in

For Year 1:

d.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement.

| Company SC | ||

| Income statement | ||

| For the year ended, Year 1 | ||

| Particulars | Amount($) | Amount ($) |

| Revenue | ||

| Service revenue | 70,000 | |

| Total revenues | 70,000 | |

| Less: Expenses | ||

| Uncollectible accounts expense | 1,400 | |

| Total expenses | 1,400 | |

| Net income | 68,600 | |

Table (4)

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Prepare the statement of changes in stockholders’ equity.

| Company SC | ||

| Statement of changes in stockholders’ equity | ||

| For the year, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning common stock | 0 | |

| Add: Common stocks issued | 5,000 | |

| Ending common stock | 5,000 | |

| Beginning | 0 | |

| Add: Net income | 68,600 | |

| Less: Dividends | 0 | |

| Ending retained earnings | 68,600 | |

| Total stockholders’ equity | 73,600 | |

Table (5)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet.

| Company SC | ||

| Balance sheet | ||

| As of 31st December, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | 67,000 | |

| Accounts receivable | 8,000 | |

| Less: Allowance for doubtful accounts | 1,400 | 6,600 |

| Total assets | $73,600 | |

| Liabilities | 0 | |

| Stockholders’ equity | ||

| Common stock | 5,000 | |

| Retained earnings | 68,600 | |

| Total stockholders' equity | 73,600 | |

| Total liabilities and stockholders' equity | 73,600 | |

Table (6)

Statement of cash flows: This statement reports all the cash transactions involves for inflow and outflow of cash, and the result of these transactions is reported as an ending balance of cash at the end of reported period.

Prepare the statement of cash flows.

| Company SC | ||

| Statement of cash flow | ||

| For the year ended 31st December, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities: | ||

| Inflow from customers | 62,000 | |

| Net cash flow from operating activities | 62,000 | |

| Cash flow from investing activities | 0 | |

| Cash flow from financing activities | ||

| Inflow from issue of common stock | 5,000 | |

| Net cash flow from financing activities | 5,000 | |

| Net change in cash | 67,000 | |

| Add: Beginning cash balance | 0 | |

| Ending cash balance | 67,000 | |

Table (7)

For Year 1:

e.

Prepare the closing entries, post them to closing entries and prepare the post-closing

For Year 1:

e.

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the Retained Earnings account. Closing entries produce a zero balance in each temporary account.

Prepare the closing entries.

| Date | Account title and explanation | Post ref |

Debit ($) |

Credit ($) | |

| Year 1 | 1 | Service revenue | 70,000 | ||

| Retained earnings | 70,000 | ||||

| (To record the closing entries for service revenue) | |||||

| Year 1 | 2 | Retained earnings | 1,400 | ||

| Uncollectible accounts expense | 1,400 | ||||

| (To record the closing entry for expenses) | |||||

Table (8)

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Post the transactions to T-account.

| Service revenue | |||

| 1. | $70,000 | Balance | $70,000 |

| Ending balance | $0 | ||

| Retained earnings | ||||

| 2. | $1,400 | 1. | $70,000 | |

| Ending balance | $68,600 | |||

|

Uncollectible accounts expense | ||||

| Balance | $1,400 | 2. | $1,400 | |

| Ending balance | $0 | |||

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare the post-closing trial balance.

| Company SC | ||

| Post-Closing Trial Balance | ||

| December 31, Year 1 | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | 67,000 | |

| Accounts Receivable | 8,000 | |

| Allowance for Doubtful Accounts | 1,400 | |

| Common Stock | 5,000 | |

| Retained Earnings | 68,600 | |

| Totals | 75,000 | 75,000 |

Table (9)

For Year 2:

a.

Identify whether the given transactions are asset source, asset use, asset exchange, or claims exchange.

For Year 2:

a.

Explanation of Solution

Identify the type of each transaction for Year 2:

| Event Number (Year 2) | Type of Transaction |

| 1. Recognized service revenue on account. | Asset Source |

| 2. Collection of accounts receivable. | Asset Exchange |

| 3. Accounts receivable were uncollectible and written off. | Asset Exchange |

| 4. a. Allowance made for doubtful accounts. | Asset Exchange |

| 4.b. Cash collected for accounts receivable | Asset exchange |

| 5. Payment made for operating expenses. | Asset use |

| 6. Adjusted the accounts to recognize uncollectible accounts expense. | Asset use |

Table (10)

Asset source transactions are the transactions that results in an increase of both the asset and claims on assets.

Asset use transactions are the transactions that results in a decrease of both the asset and claims on assets.

Asset exchange transactions are the transactions that results in increase in one asset and decrease in the other asset.

Claim exchange transactions are the transactions that decreases one claim and increases other claims; the total claims remains unchanged.

For Year 2:

b.

Show the effect of each transaction on the elements of the financial statements for Year 2 using horizontal statement model.

For Year 2:

b.

Explanation of Solution

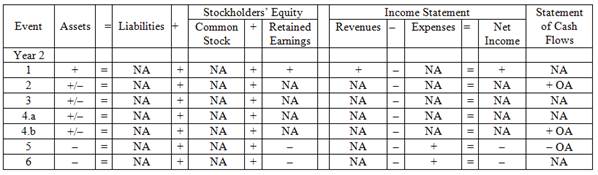

Effect of each transaction on the elements using horizontal statement model for Year 2:

Table (11)

For Year 2:

c.

Record the transactions in general journal and post them to T-accounts for Year 2.

For Year 2:

c.

Explanation of Solution

Percentage of revenue allowance method: Credit sales are recorded by debiting (increasing) accounts receivable account. The bad debts is a loss incurred out of credit sales, hence uncollectible accounts can be estimated as a percentage of credit sales or total sales.

It is a method of estimating the bad debts (expected loss on extending credit), by multiplying the expected percentage of uncollectible with the total amount of net credit sale (or total sales) for a specific period. Under percentage of sales method, estimated bad debts would be treated as an uncollectible account expense of the particular period.

Record the transactions in general journal.

| Date | Event No. | Account title and explanation |

Debit ($) |

Credit ($) |

| Year 2 | 1 | Accounts receivable | 84,000 | |

| Service revenue | 84,000 | |||

| (To record the service revenue on account) | ||||

| Year 2 | 2 | Cash | 70,000 | |

| Accounts receivable | 70,000 | |||

| (To record the collection made from accounts receivable) | ||||

| Year 2 | 3 | Allowance for doubtful accounts | 1,100 | |

| Accounts receivable | 1,100 | |||

| (To record the write off allowance for doubtful accounts) | ||||

| Year 2 | 4.a | Accounts receivable | 200 | |

| Allowance for doubtful accounts | 200 | |||

| (To reinstate the written off accounts ) | ||||

| Year 2 | 4.b | Cash | 200 | |

| Accounts receivable | 200 | |||

| (To record the recovered portion of uncollectible) | ||||

| Year 2 | 5 | Operating expenses | 51,200 | |

| Cash | 51,200 | |||

| (To record the entry for payment of operating expenses) | ||||

| Year 2 | 6 | Uncollectible accounts expense (2) | 840 | |

| Allowance for doubtful accounts | 840 | |||

| (To record the uncollectible accounts expense) |

Table (12)

Working note:

Calculate the amount for uncollectible accounts expense:

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Post the transactions to T-account.

| Cash | |||

| Balance | $67,000 | 5. | $51,200 |

| 2. | $70,000 | ||

| 4b. | $800 | ||

| Ending balance | $86,000 | ||

| Accounts receivable | |||

| Balance | $8,000 | 2. | $70,000 |

| 1. | $84,000 | 3. | $1,100 |

| 4a. | $200 | 4b. | $200 |

| Ending balance | $20,900 | ||

| Common stock | |||

| Balance | $5,000 | ||

| Ending balance | $5,000 | ||

| Service revenue | |||

| 1. | $84,000 | ||

| Ending balance | $84,000 | ||

| Uncollectible accounts expense | |||

| 6. | $840 | ||

| Ending balance | $840 | ||

| Operating expense | |||

| 5. | $51,200 | ||

| Ending balance | $51,200 | ||

| Allowance for doubtful debts | |||

| 3. | $1,100 | Balance | $1,400 |

| 4a. | $200 | ||

| 6. | $840 | ||

| Ending balance | $1,340 | ||

For Year 2:

d.

Prepare the income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for the Year 2.

For Year 2:

d.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement.

| Company SC | ||

| Income statement | ||

| For the year ended, Year 2 | ||

| Particulars | Amount($) | Amount ($) |

| Revenue | ||

| Service revenue | 84,000 | |

| Total revenues | 84,000 | |

| Less: Expenses | ||

| Operating expense | 51,200 | |

| Uncollectible accounts expense | 840 | |

| Total expenses | 52,040 | |

| Net income | 31,960 | |

Table (13)

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Prepare the statement of changes in stockholders’ equity.

| Company SC | ||

| Statement of changes in stockholders’ equity | ||

| For the year, Year 2 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning common stock | 5,000 | |

| Add: Common stocks issued | 0 | |

| Ending common stock | 5,000 | |

| Beginning retained earnings | 68,600 | |

| Add: Net income | 31,960 | |

| Less: Dividends | 0 | |

| Ending retained earnings | 100,560 | |

| Total stockholders’ equity | 105,560 | |

Table (14)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet.

| Company SC | ||

| Balance sheet | ||

| As of 31st December, Year 2 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Cash | 86,000 | |

| Accounts receivable | 20,900 | |

| Less: Allowance for doubtful accounts | 1,340 | 19,560 |

| Total assets | $105,560 | |

| Liabilities | 0 | |

| Stockholders’ equity | ||

| Common stock | 5,000 | |

| Retained earnings | 100,560 | |

| Total stockholders' equity | 105,560 | |

| Total liabilities and stockholders' equity | 105,560 | |

Table (15)

Statement of cash flows: This statement reports all the cash transactions involves for inflow and outflow of cash, and the result of these transactions is reported as an ending balance of cash at the end of reported period.

Prepare the statement of cash flows.

| Company SC | ||

| Statement of cash flow | ||

| For the year ended 31st December, Year 2 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities: | ||

| Inflow from customers | 70,200 | |

| Outflow from customers | (51,200) | |

| Net cash flow from operating activities | 19,000 | |

| Cash flow from investing activities | 0 | |

| Cash flow from financing activities | 0 | |

| Net change in cash | 19,000 | |

| Add: Beginning cash balance | 67,000 | |

| Ending cash balance | 86,000 | |

Table (16)

For Year 2:

e.

Prepare the closing entries, post them to T-account and prepare the post-closing trial balance.

For Year 2:

e.

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the Retained Earnings account. Closing entries produce a zero balance in each temporary account.

Prepare the closing entries.

| Date | Account title and explanation | Post ref |

Debit ($) |

Credit ($) | |

| Year 2 | 1 | Service revenue | 84,000 | ||

| Retained earnings | 84,000 | ||||

| (To record the closing entries for service revenue) | |||||

| Year 2 | 2 | Retained earnings | 52,040 | ||

| Operating expenses | 51,200 | ||||

| Uncollectible accounts expense | 840 | ||||

| (To record the closing entry for expenses) | |||||

Table (17)

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Post the transactions to T-account.

| Service revenue | |||

| 1. | $84,000 | Balance | $84,000 |

| Ending balance | $0 | ||

| Retained earnings | |||

| 2. | $52,040 | Balance | $68,600 |

| 1. | $84,000 | ||

| Ending balance | $100,560 | ||

|

Operating expenses | |||

| Balance | $51,200 | 2. | $51,200 |

| Ending balance | $0 | ||

| Uncollectible accounts expense | |||

| Balance | $840 | 2. | $840 |

| Ending balance | $0 | ||

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare the post-closing trial balance.

| Company J | ||

| Post-Closing Trial Balance | ||

| December 31, Year 2 | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | 86,000 | |

| Accounts Receivable | 20,900 | |

| Allowance for Doubtful Accounts | 1,340 | |

| Common Stock | 5,000 | |

| Retained Earnings | 100,560 | |

| Totals | 106,900 | 106,900 |

Table (18)

Want to see more full solutions like this?

Chapter 7 Solutions

Connect Access Card for Fundamental Financial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education