Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 7, Problem 17P

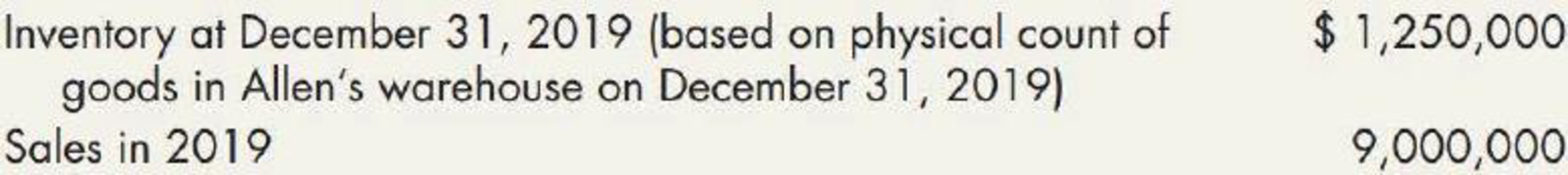

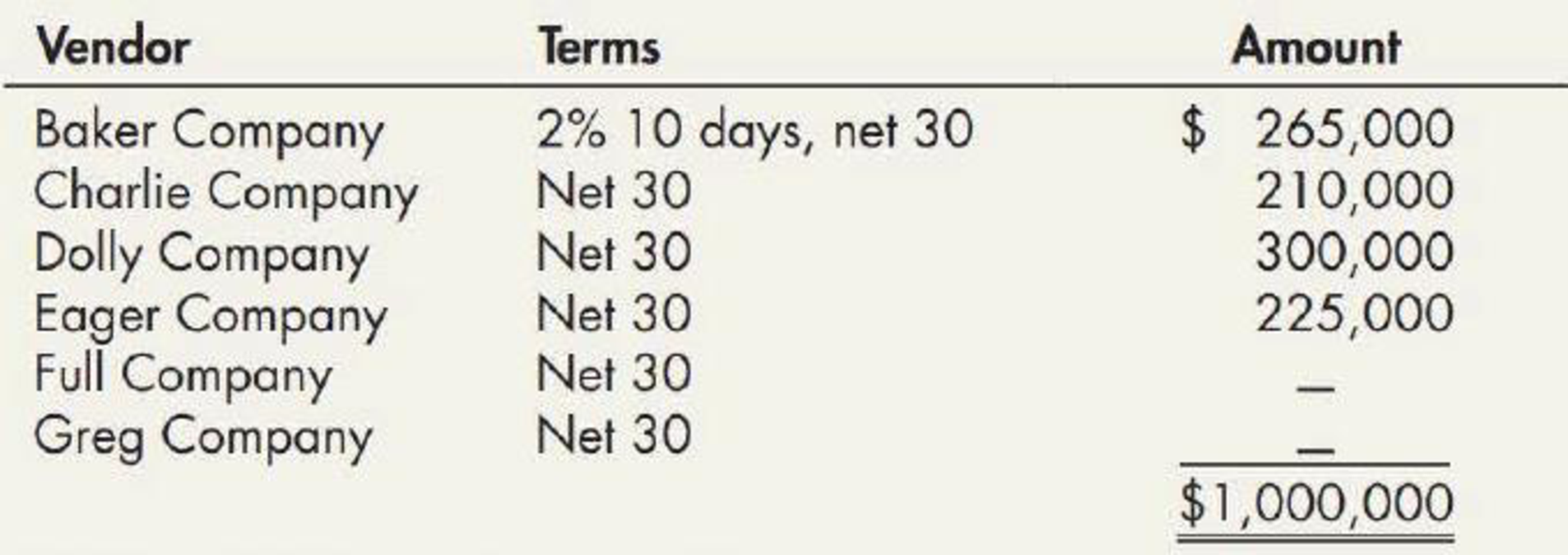

Allen Company is a wholesale distributor of automotive replacement parts. Initial amounts taken from Allen’s accounting records are as follows:

Accounts payable at December 31, 2019:

Additional information is as follows:

- 1. Parts held on consignment from Charlie to Allen, the consignee, amounting to $155,000 were included in the physical count of goods in Allen’s warehouse on December 31, 2019, and in accounts payable at December 31, 2019.

- 2. $22,000 of parts, which were purchased from Full and paid for in December 2019, were sold in the last week of 2019 and appropriately recorded as sales of $28,000. The parts were included in the physical count of goods in Allen’s warehouse on December 31, 2019, because the parts were on the loading dock waiting to be picked up by customers.

- 3. Parts in transit to customers on December 31, 2019, shipped FOB shipping point on December 28, 2019, amounted to $34,000. The customers received the parts on January 7, 2020. Sales of $40,000 to the customers for the parts were recorded by Allen on January 3, 2020.

- 4. Retailers were holding $210,000 at cost ($250,000 at retail) of goods on consignment from Allen, the consignor, at their stores on December 31, 2019.

- 5. Goods were in transit from Greg to Allen on December 31, 2019. The cost of the goods was $25,000, and they were shipped FOB shipping point on December 29, 2019.

- 6. A quarterly freight bill in the amount of $2,000 specifically relating to merchandise purchases in December 2019, all of which was still in the inventory at December 31, 2019, was received on January 4, 2020. The freight bill was not included in either the inventory or in accounts payable at December 31, 2019.

- 7. All of the purchases from Baker occurred during the last 7 days of the year. These items have been recorded in accounts payable and accounted for in the physical inventory at cost before discount. Allen’s policy is to pay invoices in time to take advantage of all cash discounts, adjust inventory accordingly, and record accounts payable, net of cash discounts.

Required:

Prepare a schedule of adjustments to the initial amounts of inventory, accounts payable, and sales. Show the effect, if any, of each of the transactions separately and indicate if the transactions would have no effect on the amount.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The balance of Ward Company’s Accounts Payable at December 31, 2019 was P1,300,000 before any year-endadjustments of the following transactions during 2019: Goods were in transit from a vendor to Ward on December 31, 2019. The invoice cost was P45,000 and thegoods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020.

Goods shipped FOB shipping point on December 20, 2019 from a vendor to Ward were lost in transit. The invoicecost was P34,000. On January 4, 2020, Ward filed a P34,000 claim against the common carrier.

On December 27, 2019, Ward wrote and recorded checks totaling P60,000 in payment of an accounts payablewhich were mailed on January 10, 2020.

a) Prepare adjusting journal entries on December 31, 2019 showing solutions in good accounting form.b) What amount should Ward report as accounts payable on its December 31, 2019 Statement of FinancialPosition?

PLEASE PROVIDE WELL EXPLAINED , COMPUTED AND FORMULATED ANSWER WITH STEPS AND WORKING

Star Inc. ships merchandise on consignment to The Party Place, a retailer on February 13, 2020. The cost of the merchandise is $26,000, and Star Inc. pays the freight cost of $1,900 to ship the goods to the retailer. On November 30, 2020 (The Party Place accounting year end), The Party Place notifies Star Inc. that 65% of the merchandise has been sold for $72,000. The Party Place retains a 10% commission as well as $3,900, which represents advertising costs it paid, and remits the balance owing to Star Inc. Please make sure your final answer(s) are accurate to 2 decimal places.

a) Complete the journal entries required by Star Inc. for the above transactions. Enter an appropriate description

b) Complete the journal entries required by The Party Place for the above transactions on their accounting year end. Enter an appropriate description when entering the transactions in the journal. Dates must be…

On June 11, 2019, Hat Trick Manufacturing sold goods worth $400,000 with terms 2/10, n/30 to Ice House sports. On June 20, 2019, hat trick manufacturing received payment for 1/2 of the amount due from ice house sports. what will be the amount reported in the financial statements for the account receivable due from ice house sports if the fiscal year ends on june 30, 2019 and the gross mwthod is used? And no plagiarism please

Chapter 7 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 7 - Distinguish among the types of inventory accounts...Ch. 7 - Prob. 2GICh. 7 - Describe the flow of costs for o merchandising...Ch. 7 - Describe the relationship between cost of goods...Ch. 7 - Prob. 5GICh. 7 - Does the use of a perpetual system eliminate the...Ch. 7 - What is the general rule used to determine if a...Ch. 7 - For goods in transit at the end of a period,...Ch. 7 - Prob. 9GICh. 7 - Prob. 10GI

Ch. 7 - Prob. 11GICh. 7 - Consider each of the following independent...Ch. 7 - Prob. 13GICh. 7 - Prob. 14GICh. 7 - Prob. 15GICh. 7 - Prob. 16GICh. 7 - Prob. 17GICh. 7 - Prob. 18GICh. 7 - Prob. 19GICh. 7 - Prob. 20GICh. 7 - Discuss the LIFO and FIFO cost flow assumptions...Ch. 7 - Prob. 22GICh. 7 - Prob. 23GICh. 7 - List the acceptable cost flow assumptions under...Ch. 7 - Prob. 25GICh. 7 - Explain the dollar-value LIFO method of inventory...Ch. 7 - Describe the double-extension and link-chain...Ch. 7 - Prob. 28GICh. 7 - Prob. 29GICh. 7 - What is the impact of LIFO inventory liquidation...Ch. 7 - Goods on consignment should be included in the...Ch. 7 - The following items were included in Venicio...Ch. 7 - During 2019, R Corp., a manufacturer of chocolate...Ch. 7 - Dixon Menswear Shop purchased shirts from Colt...Ch. 7 - The moving average inventory cost flow assumption...Ch. 7 - The cost of the inventory on January 31, 2019,...Ch. 7 - Questions M7-6 and M7-7 are based on the following...Ch. 7 - Assuming no beginning inventory, what can be said...Ch. 7 - On December 31, 2018, Kern Company adopted the...Ch. 7 - When the double-extension approach to the...Ch. 7 - On December 31, Pitts Manufacturing Company...Ch. 7 - On January 1, Pope Enterprises inventory was...Ch. 7 - Reid Company uses the periodic inventory system....Ch. 7 - Billings Company uses a periodic inventory system....Ch. 7 - Dani Corporation signed a binding commitment on...Ch. 7 - Stevens Company uses a perpetual inventory system....Ch. 7 - RE7-6 Stevens Company uses a perpetual inventory...Ch. 7 - Johnson Company uses a perpetual inventory system....Ch. 7 - RE7-8 Johnson Company uses a perpetual inventory...Ch. 7 - Jessie Stores uses the periodic system of...Ch. 7 - Jessie Stores uses the periodic system of...Ch. 7 - Carla Company uses the perpetual inventory system....Ch. 7 - Carla Company uses the perpetual inventory system....Ch. 7 - On January 1 of Year 1, Dorso Company adopted the...Ch. 7 - An evaluation of Bryces Bookstores inventory was...Ch. 7 - Inventory Accounts for a Manufacturing Company...Ch. 7 - Prob. 2ECh. 7 - Perpetual versus Periodic Inventory Systems Graham...Ch. 7 - Determining Net Purchases The following amounts...Ch. 7 - Perpetual versus Periodic Inventory Systems...Ch. 7 - Goods in Transit Gravais Company made two...Ch. 7 - Items Included in Inventory The following are...Ch. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Discounts Nelson Company bought inventory for...Ch. 7 - Alternative Inventory Methods Nevens Company uses...Ch. 7 - Alternative Inventory Methods Park Companys...Ch. 7 - Alternative Inventory Methods Frate Company was...Ch. 7 - LIFO, Perpetual and Periodic Riedel Companys...Ch. 7 - Habicht Company was formed in 2018 to produce a...Ch. 7 - Dollar-Value LIFO A company adopted the LIFO...Ch. 7 - On January 1, 2018, Sato Company adopted the...Ch. 7 - Dollar-Value LIFO Beistock Company manufactures...Ch. 7 - Acute Company manufactures a single product. On...Ch. 7 - Inventory Pools Stone Shoe Company adopted...Ch. 7 - Grimstad Company uses FIFO for internal reporting...Ch. 7 - LIFO and Interim Financial Reports Assume prices...Ch. 7 - Applying the Cost of Goods Sold Model The...Ch. 7 - Items to Be Included in Inventory As the auditor...Ch. 7 - Valuation of Inventory The inventory on hand at...Ch. 7 - Prob. 4PCh. 7 - Cost of Goods Sold As an accountant for Lee...Ch. 7 - Alternative Inventory Methods Garrett Company has...Ch. 7 - Totman Company has the following transactions...Ch. 7 - Comprehensive The following information for 2019...Ch. 7 - LIFO Liquidation Profit Hammond Company adopted...Ch. 7 - LIFO and Inventory Pools On January 1, 2016,...Ch. 7 - Olson Company adopted the dollar-value LIFO method...Ch. 7 - Dollar-Value LIFO Kwestel Company adopted the...Ch. 7 - Webster Company adopted do liar-value LIFO on...Ch. 7 - Dollar-Value LIFOComprehensive Kelly Company...Ch. 7 - On January 1, 2019, Lucas Distributors Inc....Ch. 7 - Inventory Valuation You are engaged in an audit of...Ch. 7 - Allen Company is a wholesale distributor of...Ch. 7 - FIFO and LIFO A company may compute inventory...Ch. 7 - Prob. 2CCh. 7 - In January, Broome Inc. requested and secured...Ch. 7 - Prob. 4CCh. 7 - Prob. 5CCh. 7 - Interpretation of GAAP and Ethical Issues Robin...Ch. 7 - Selection of an Inventory Method and Ethical...Ch. 7 - Analyzing Starbuckss Inventory Disclosures Obtain...Ch. 7 - Fenimore Manufacturing Company uses the average...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before any necessary year-end adjustment relating to the following: Goods were in transit from a vendor to Ashwood on December 31, 2019. The invoice cost was 85,000, and the goods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020. Goods shipped FOB shipping point on December 20, 2019, from a vendor to Ashwood were lost in transit. The invoice cost was 40,000. On January 5, 2020, Ashwood filed a 40,000 claim against the common carrier. Goods shipped FOB destination on December 22, 2019, from a vendor to Ashwood were received on January 6, 2020. The invoice cost was 20,000, What amount should Ashwood report as accounts payable on its December 31,2019, balance sheet? a. 1,260,000 b. 1,285,000 c. 1,325,000 d. 1,345,000arrow_forwardRix Company sells home appliances and provides installation and service for its customers. On April 1, 2019, a customer purchased a dishwasher that Rix normally sells for 1,000. In addition, the customer purchased the installation service and a 3-year service contract, with stand-alone selling prices of 200 and 400, respectively. Because the customer purchased all three items as a bundle, Rix charged the customer 1,400. Required: 1. How should the transaction price be allocated among the products? 2. Prepare the journal entries to recognize revenue related to each product in 2019.arrow_forwardReview the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.arrow_forward

- Mark Industries issues a note in the amount of $45,000 on August 1, 2018 in exchange for the sale of merchandise. Which of the following is the correct journal entry for this sale? A. B. C. D.arrow_forwardOn March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: Accumulated Depreciation-Building $746,350 Administrative Expenses 515,750 Building 2,419,500 Cash 168,150 Cost of Merchandise Sold 3,900,350 Interest Expense 9,750 Kathy Melman, Capital 1,585,350 Kathy Melman, Drawing 180,400 Merchandise Inventory 941,750 Notes Payable 261,150 Office Supplies 21,000 Salaries Payable 7,850 Sales 6,627,450 Selling Expenses 710,900 Store Supplies 93,650 Required: a. Prepare a multiple-step income statement for the year ended March 31, 2019. Be sure to complete the heading of the statement. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon (:) will automatically appear if it is required. In the Other expenses section only, enter amounts that represent other expenses as negative numbers…arrow_forwardOn March 15, Drexel Corp. provides goods to a retailer through consignment where Drexel Corp. retains ownership of the goods until the goods are sold to the retailer’s customer. Sale to the final customer is documented when the goods are scanned at the cash register of the retailer. Drexel Corp. receives a daily report on the number of units sold by the retailer to the end customer. Any unsold product can be returned to Drexel Corp. at any time. Drexel Corp. has the right through the contract to recall any goods shipped and to transfer the goods to another retailer as a way to increase the rate of sales to the final customer. After the sale of the products to the final customer, the retailer cannot return the items to Drexel Corp. During March, Drexel Corp. transferred 600 units to the retailer, and the retailer sold 500 units. The product cost Drexel Corp. $80 per unit and the product was sold for $115 per unit to the end customer. The retailer sent a payment to Drexel Corp. for the…arrow_forward

- The following information are extracted from the books and records of the Company and its branch. The balances are at December 31,2021, the third year of the corporation’s existence. (see image below). The branch acquires all of its merchandise from the home office. The inventories of the branch at billed prices on January 1, 2021 is P 90,000 and on December 31, 2021 is P100,800. Determine a. The percentage of profit on cost that the home office uses to bill merchandise shipped to branch and b. The balance of the Shipments to Branch account before the books are closedarrow_forwardOn december 15, 2019 Flanagan company purchased goods costing 100,000. The term were FOB shipping point. Costs incurred by the entity in connection with the purchase and delivery of the goods were as follows: Normal freight charges $3,000 Handling costs 2,000 Insurance on shipment 500 Abnormal freight charges for express 1,200 Shipping The goods were received on December 17, year 2. What is the amount that Flanagan should charge to inventory and to current period expense?arrow_forwardDELTA Company reported on December 31,2021 at P7,000,000 based on physical count of goods priced at cost and before any necessary year end adjustments relating to the following.Included in the physical count were goods billed to a customer FOB Shipping Point on December 30, 2021.These goods had a cost of 200,000 and were picked by the carrier on January 5, 2022.Goods shipped FOB Shipping point on December 28, 2021 from a venfor to Delta were received and recorded on January 4, 2022. The invoice cost was P300,000.What amount should be reported as inventory on December 31, 2021?arrow_forward

- The balance in Iwig Company’s accounts payable account at December 31, 2021 was P400,000 before any necessary year-end adjustments relating to the following: A. Goods were in transit to Iwig from a vendor on December 31, 2021. The invoice cost was P50,000. The goods were shipped FOB shipping point on December 29, 2021 and were received on January 4, 2022. B. Goods shipped FOB destination on December 21, 2021 from a vendor to Iwig were received on January 6, 2022. The invoice cost was P25,000. C. On December 27, 2021, Iwig wrote and recorded checks to creditors totaling P30,000 that were mailed on January 10, 2022. 2. In Iwig’s December 31, 2021 statement of financial position, the accounts payable should bearrow_forwardHuhu Company and Hihi Company engaged in the following transactions during the month of July 2021. On July 16, Huhu Company sold merchandise to Hihi Company for P6,000, terms 2/10, n/30. Shipping costs were P600. Hihi Company received the goods and Huhu Company’s invoice on July 17. On July 24, Hihi Company sent the payment to Huhu, which Huhu received on July 25. Additional Info: Both Huhu and Hihi use the periodic inventory system. The arrangement regarding the shipping costs are as follows: Shipping terms FOB destination, Freight Collect. Hihi paid the shipping costs on July 17 and deducted the P600 from the amount owed to Huhu Company. A copy of freight bill to Huhu Company was provided with the July 24 cash remittance. Hihi remitted P5,280 on July 24. How much is the accounts payable of Hihi before remittances?arrow_forwardOn May 1, 2021, Company A shipped merchandise costing $16,000 to Company B on consignment. Company A paid $1,400 in shipping costs to deliver the inventory. On September 30, 2021, Company B advised Company Athat all of the inventory had been sold for a total of $54,000. On October 15, 2021, Company A received payment from Company B for the proceeds, less a 12% commission. Required: Prepare all the journal entries for Company A to account for the transaction from April 2 through October 15.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License