a.

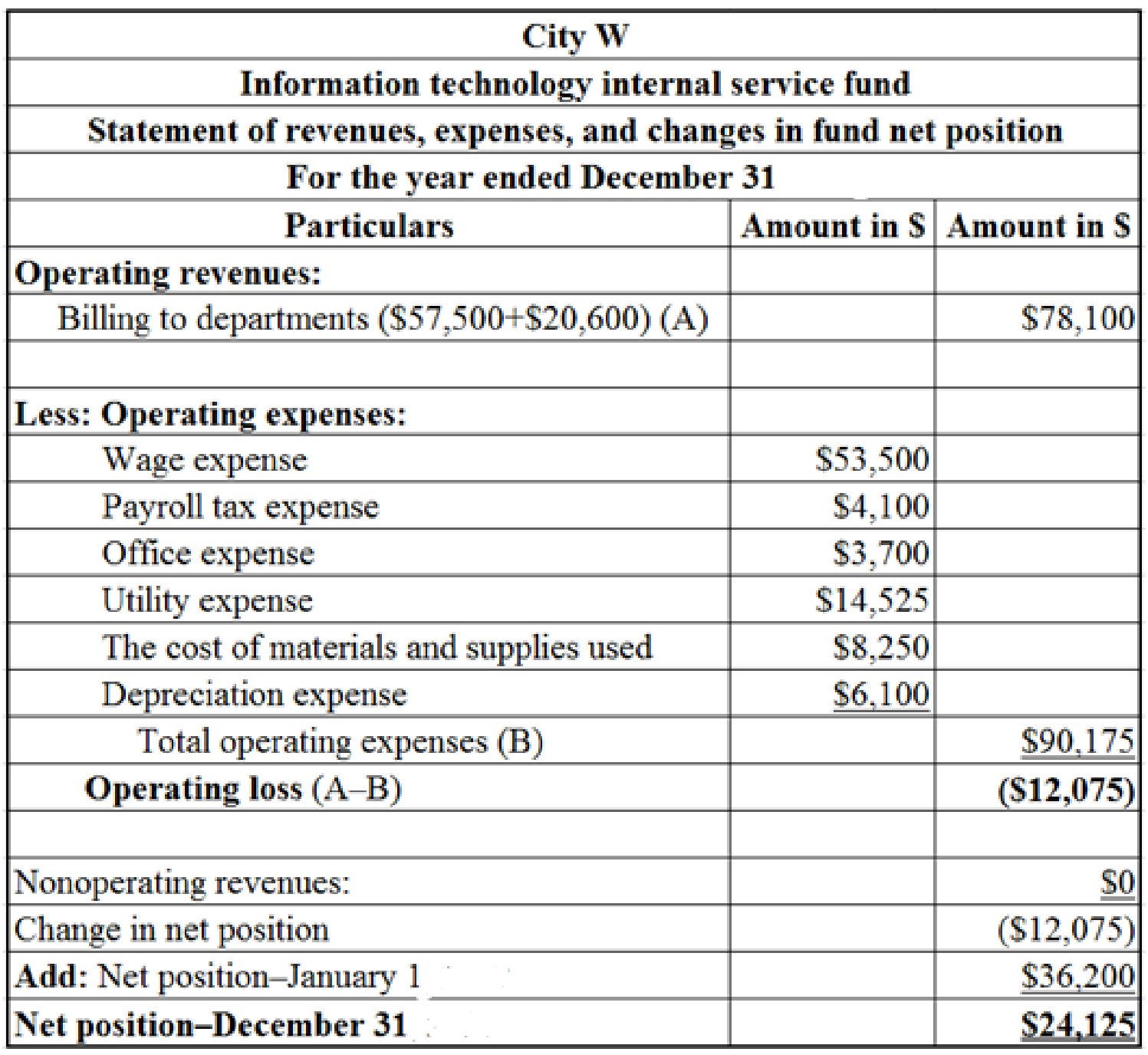

Prepare a “statement of revenues, expenses, and changes in fund net position” for information technology internal service fund of City W.

a.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for information technology internal service fund of City W.

Table (1)

Working notes:

- Determine the wage expense.

- Determine the net position on January 1.

The net position of net investment is capital assets are $23,500 and the unrestricted net position is $12,700 on January 1. Hence, the total net position on January 1 is $36,200

(b)

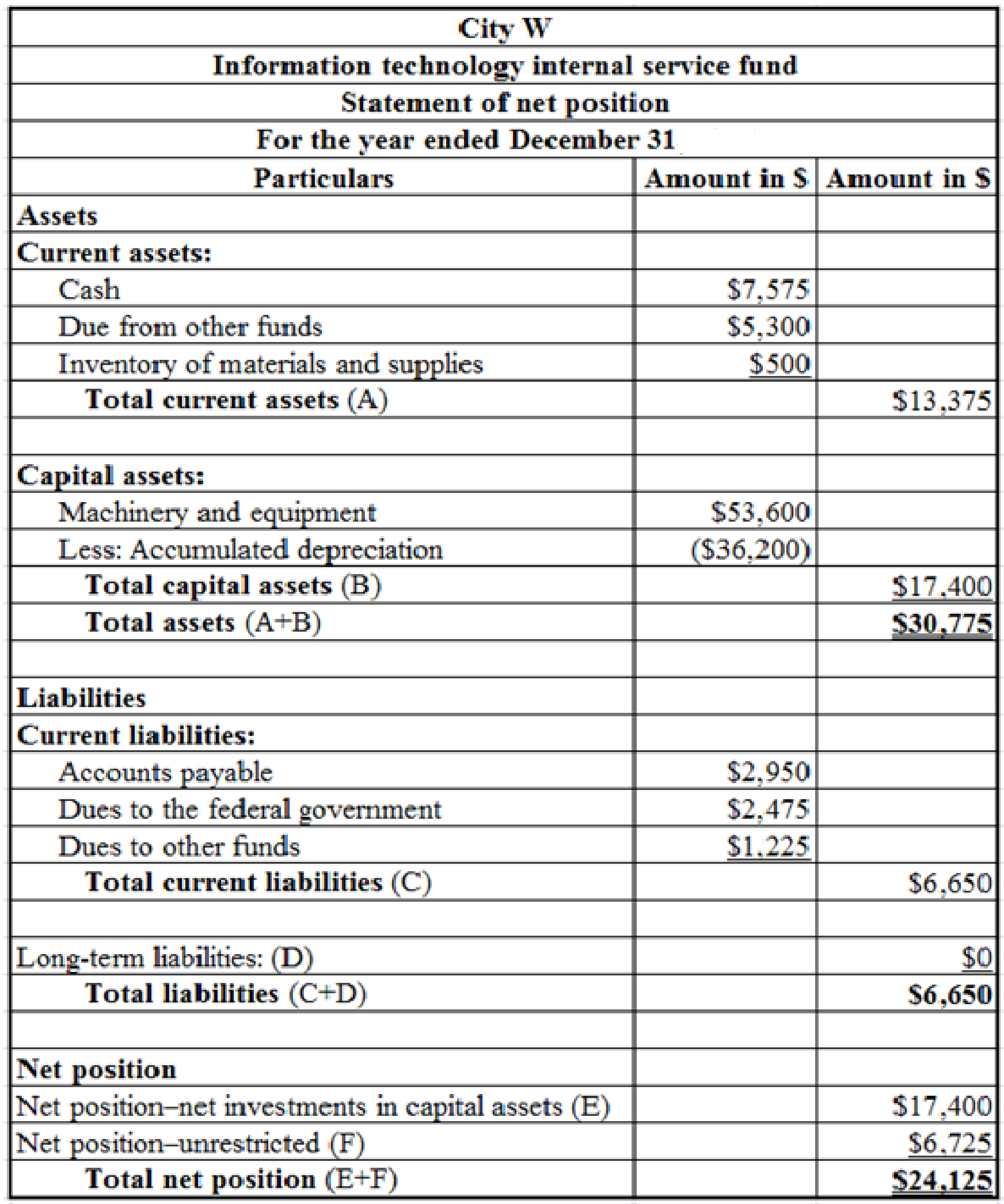

Prepare a “statement of net position” for information technology internal service fund of City W as of December 31.

(b)

Explanation of Solution

Statement of net position:

Prepare a “statement of net position” for information technology internal service fund of City W as of December 31.

Table (2)

Working notes:

- Determine the closing balance of cash on December 31.

Step 1: Determine the amount of cash paid as wages.

Step 2: Determine the amount of cash receipts from other funds.

Step 3: Determine the amount cash paid to accounts payable.

Step 4: Determine the closing balance of cash on December 31.

- Determine the closing balance of dues from other funds.

- Determine the closing balance of inventory.

- Determine the accumulated depreciation for the year ended December 31.

- Determine the closing balance of dues to federal government.

| Due to federal government | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| Cash payment towards federal taxes | 23,000 | Payroll taxes payable, January 1 | 2,650 | |||

| Closing balance, December 31 | 2,475 | Payroll taxes for the year | 4,100 | |||

| Federal income and social security taxes withheld for the year | 18,725 | |||||

| Total | 25,475 | Total | 25,475 | |||

Table (3)

Hence, the closing balance of dues to the federal government is $2,475.

- Determine the closing balance of dues to other funds.

| Due to other funds | ||||||

| Date | Details |

Debit ($) | Date | Details |

Credit ($) | |

| Cash payment towards utility expenses | 14,500 | Opening balance, January 1 | 1,200 | |||

| Closing balance, December 31 | 1,225 | Utility expenses | 14,525 | |||

| Total | 15,725 | Total | 15,725 | |||

Table (4)

Hence, the closing balance of dues to other funds is $1,225.

- Determine the net position of “net investments in capital assets” as on December 31.

- Determine the net position of unrestricted assets as on December 31.

Step 1: Calculate decrease in net investment in capital assets.

Step 2: Calculate the net position of unrestricted assets.

(c)

Prepare “a statement of

(c)

Explanation of Solution

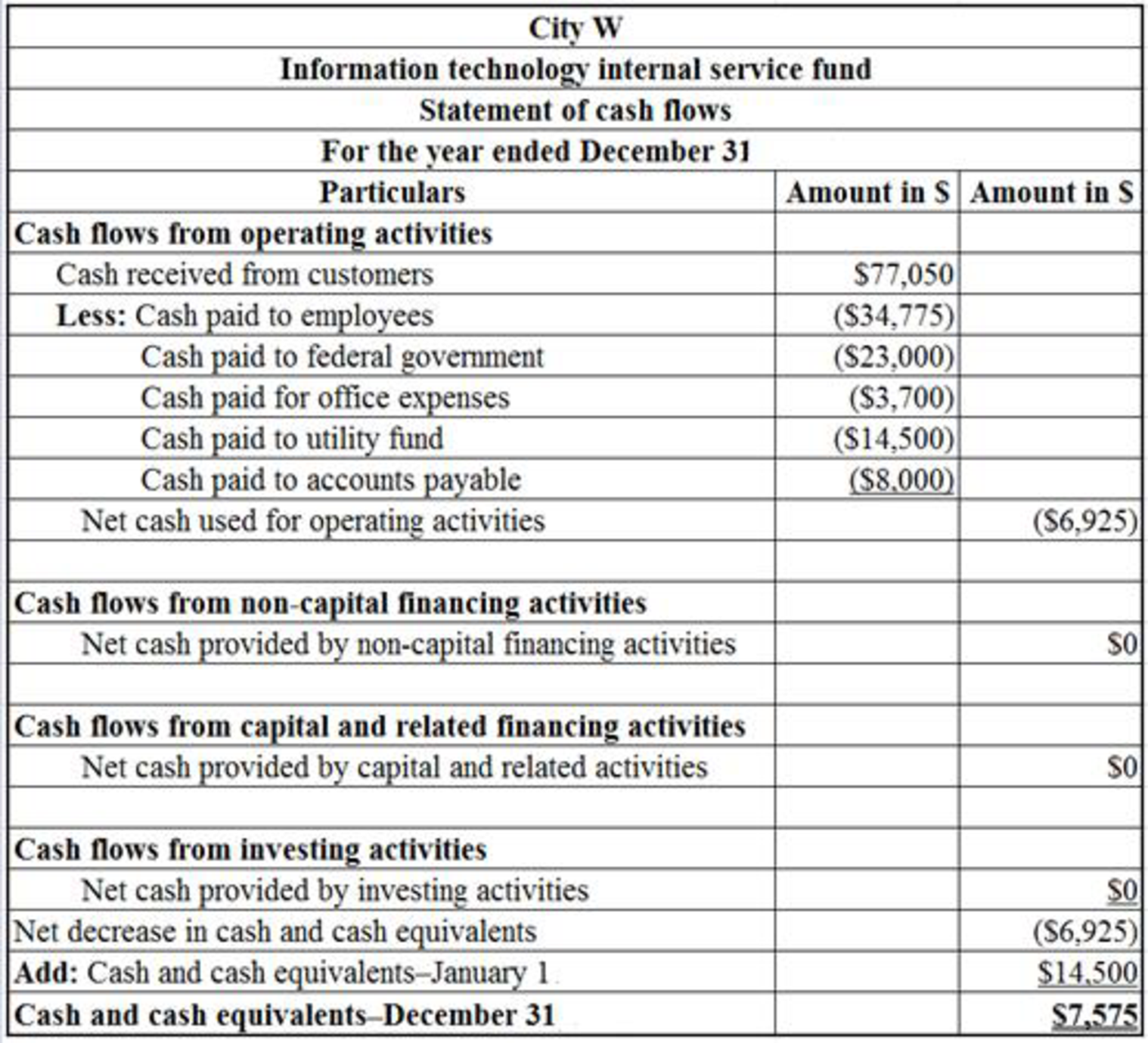

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare “a statement of cash flows” for information technology internal service fund of City W for the year ended December 31.

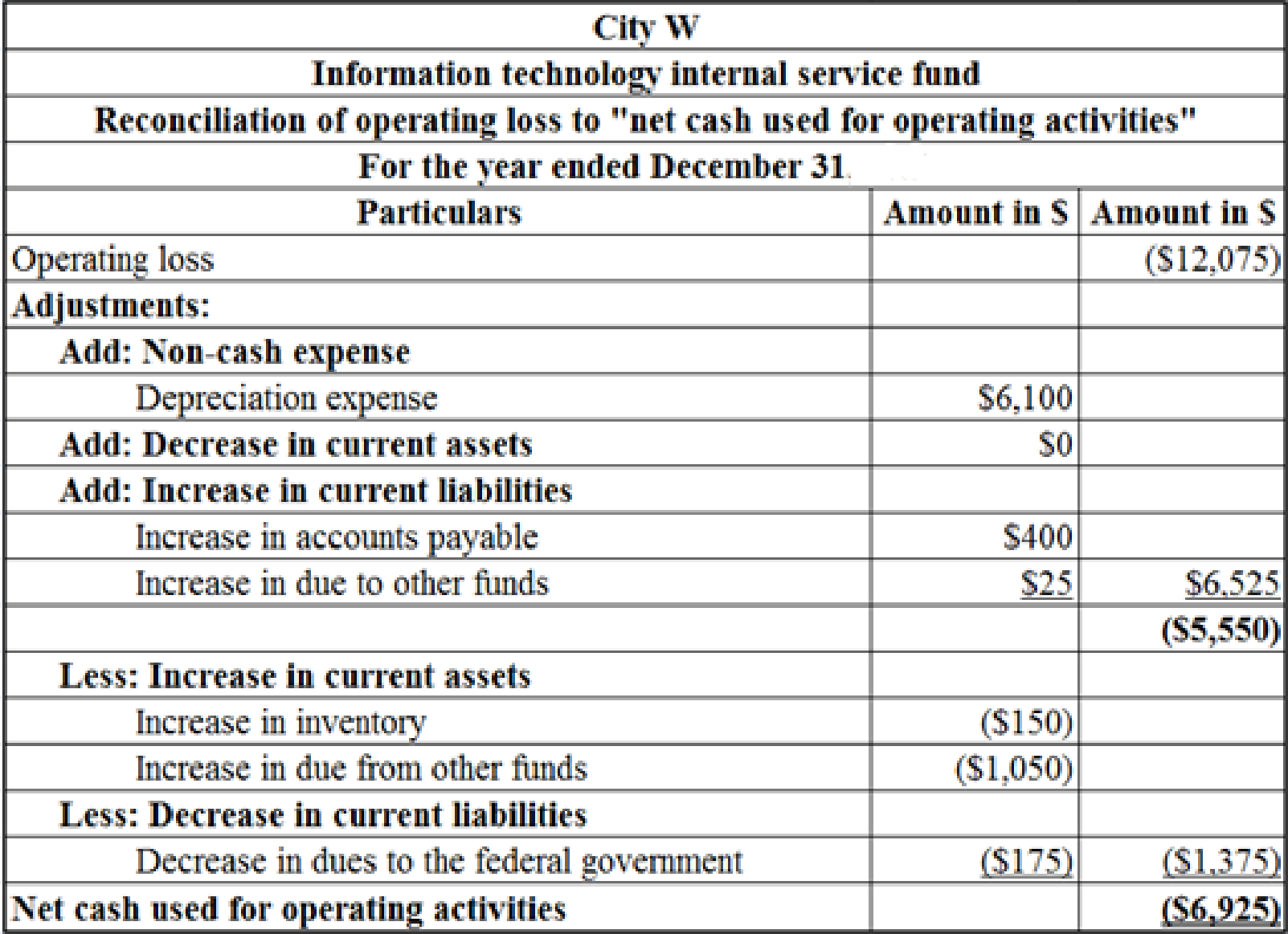

Step 1: Prepare the

Table (5)

Working notes:

- Determine the increase in accounts payable.

The opening balance of accounts payable is $2,550 and the closing balance of accounts payable is $2,950. Hence, the accounts payable increased by$400

- Determine the increase in “due to other funds”.

The opening balance of “dues to other funds” is $1,200 and the closing balance of “due to other funds” is $1,225. Hence, the “due to other funds” increased by$25

- Determine the increase in inventory.

The opening balance of inventory is $350 and the closing balance of inventory is $500. Hence, the inventory increased by $150

- Determine the increase in “due from other funds”.

The opening balance of “due from other funds” is $4,250 and the closing balance of “due from other funds” is $5,300. Hence, the “due from other funds” increased by$1,050

- Determine the decrease in “due to the federal government”.

The opening balance of “due to the federal government” is $2,650 and the closing balance of “due to the federal government” is $2,475. Hence, the “due to the federal government” increased by $175

Step 2: Prepare “a statement of cash flows”.

Table (6)

(d)

Evaluate the manager’s performance.

(d)

Explanation of Solution

The “statement of revenues, expenses, and changes in fund net position” shows an operating loss of $12,075. The charges collected by the information technology fund are not sufficient to meet its operating expenses.

The manager has not addressed the “user charges policy” of the department. Hence, the fund is incurring a loss. Hence, the manager should estimate the costs of the fund and fix a reasonable user charge to cover the fund’s expenses.

Want to see more full solutions like this?

Chapter 7 Solutions

ACCOUNTING F/ GOVERNMENTAL EBOOK CARD

- Using the information below, what amount should be accounted for in a special revenue fund or funds? Warehouse equipment used to store supplies for delivery to all city departments and agencies on a cost-reimbursement basis $ 300,000 Equipment used for supplying electric power to residents $ 1,750,000 Receivables for completed sidewalks to be paid for in installments by affected property owners. Construction was financed by special assessment bonds for which the town has no liability $ 1,500,000 Cash received from federal government, dedicated to highway maintenance, that must be accounted for in a separate fund $ 1,800,000 Multiple Choice A. $1,800,000. B. $2,100,000. C. $5,350,000. D. $3,300,000.arrow_forwardThe City of Nomanchester has a defined benefit pension plan for a number of its employees. A pension trust fund has been set up that currently has a net position of $32.7 million because quite a number of investments are being held. An actuary estimates that city employees will eventually receive $99.7 million as a result of this pension. However, only $72.4 million of that amount is for work already provided. The present value of the $72.4 million in payments is $49.8 million. On its government-wide financial statements, what amount of net pension liability should be reported? a. $-0- b. $17.1 million c. $39.7 million d. $67.0 million mber of its employees.arrow_forwardA government buys equipment for its police department at a cost of $54,000. Which of the following is not true?a. Equipment will increase by $54,000 in the government-wide financial statements.b. Depreciation in connection with this equipment will be reported in the fund financial statements.c. The equipment will not appear within the reported assets in the fund financial statements.d. An expenditure for $54,000 will be reported in the fund financial statements.arrow_forward

- Indicate (i) how each of the following transactions impacts the fund balance of the general fund, and its classifications, for fund financial statements and (ii) what impact each transaction has on the net position balance of the Government Activities on the government-wide financial statements.a. Issue a five-year bond for $6 million to finance general operations.b. Pay cash of $149,000 for a truck to be used by the police department.c. The fire department pays $17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles. d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.f. Businesses make sales of $20 million during the current year. The…arrow_forwardA city orders a new computer for its general fund at an anticipated cost of $88,000. Its actual cost when received is $89,400. Payment is subsequently made. Prepare all required journal entries for both fund and government-wide financial statements. What information do the government-wide financial statements present? What information do the fund financial statements present?arrow_forwardThe City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Choose the correct.a. Fund balance—unassigned goes down and fund balance—restricted goes up.b. Fund balance—assigned goes down and fund balance—committed goes up.c. Fund balance—unassigned goes down and fund balance—assigned goes up.d. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forward

- The County of Maxnell decides to create a waste management department and offer its services to the public for a fee. As a result, county officials plan to account for this activity as an enterprise fund. Assume the information is gathered so that the county can prepare fund financial statements. Only entries for the waste management department are required here: January 1 Receive unrestricted funds of $248,000 from the general fund as permanent financing. Febrauary 1 Borrow an additional $224,000 from a local bank at a 12 percent annual interest rate. March 1 Order a truck at an expected cost of $140,000. April 1 Receive the truck and make full payment. The actual cost including transportation was $143,000. The truck has a 10-year life and no residual value. The county uses straight-line depreciation. May 1 Receive a $23,600 cash grant from the state to help supplement the pay of the department workers. According to the grant, the money must be used for that…arrow_forwardLilly County, faced with the prospect of declining revenues, decides it can save money by doingall printing in-house. The county creates the Lilly Printing Fund (an Internal Service Fund),directs departments to fulfill their bulk printing needs through that Fund, and directs departmentsto pay the Fund promptly to minimize its operating cash flow needs.The Fund had the following transactions and events during 2021:1. Received a $12,000 loan on January 2 from the county’s General Fund to be repaid in fourequal annual installments of $3,000, starting December 31, 2021, with interest at the rateof 1 percent per annum on the outstanding balance. The specified purpose of the loan is toallow the Lilly Printing Fund to purchase equipment for $9,600 and to use the balance of $2,400to meet operating cash flow needs.2. Purchased reproduction equipment for $9,600 on January 2, using cash provided.The equipment has an estimated useful life of 4 years.3. Purchased paper and supplies for $9,000 on…arrow_forwardA city orders a new computer for its police department that is recorded within its general fund. The computer has an anticipated cost of $89,600. Its actual cost when received is $91,880. Payment is subsequently made. a. Prepare all required journal entries for both fund and government-wide financial statements. (Select the appropriate fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- Lincoln County's General Fund had two interfund transactions: 1. The general fund paid $225,000 to the housinhg and urban development fund , a special revenue fund that is supported by grantsfrom the federal government on a cost reimbersment basis. The amount is to be reoaid to the general fund as grant proceeds are received from the federal government. 2. The general fund paid $162,000 to the tourism fund, a special revenue fund that is supported by hotel and restaurant taxes. The amount is intended to supplement the taxes raised, and there is no expectation that it will be repaid to the general fund. Required: Prepare the journal entriess in the general fund and affected special revenue funds for the interfund transactions above. Describe the effect of these transactions on the fund balance of the general fund and special revenue funds.arrow_forwardThe City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Fund balance—unassigned goes down and fund balance—restricted goes up. Fund balance—assigned goes down and fund balance—committed goes up. Fund balance—unassigned goes down and fund balance—assigned goes up. Fund balance—assigned goes down and fund balance—restricted goes up.arrow_forwardA government buys equipment for its police department at a cost of $54,000. Which of the following is Equipment will increase by $54,000 in the government-wide financial statements. Depreciation in connection with this equipment will be reported in the fund financial statements. The equipment will not appear within the reported assets in the fund financial statements. An expenditure for $54,000 will be reported in the fund financial statements.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education