To show:

The data of company Alcoa and data of returns on S&P.

Explanation of Solution

The data for returns of Alcoa is shown below:

| Date | Returns Alcoa |

| 12/1/2013 | 0 |

| 1/1/2014 | 0 |

| 2/1/2014 | 0.019785587 |

| 3/1/2014 | 0.094520691 |

| 4/1/2014 | 0.045565745 |

| 5/1/2014 | 0.010340052 |

| 6/1/2014 | 0.09213958 |

| 7/1/2014 | 0.09598186 |

| 8/1/2014 | 0.013333413 |

| 9/1/2014 | -0.029980428 |

| 10/1/2014 | 0.040797065 |

| 11/1/2014 | 0.031133233 |

| 12/1/2014 | -0.088938172 |

| 1/1/2015 | -0.008906032 |

| 2/1/2015 | -0.056519624 |

| 3/1/2015 | -0.133367024 |

| 4/1/2015 | 0.037969704 |

| 5/1/2015 | -0.071017427 |

| 6/1/2015 | -0.112097041 |

| 7/1/2015 | -0.121939527 |

| 8/1/2015 | -0.043485446 |

| 9/1/2015 | 0.025067099 |

| 10/1/2015 | -0.078577301 |

| 11/1/2015 | 0.047029033 |

| 12/1/2015 | 0.056257819 |

| 1/1/2016 | -0.302996218 |

| 2/1/2016 | 0.202912827 |

| 3/1/2016 | 0.074574737 |

| 4/1/2016 | 0.153553957 |

| 5/1/2016 | -0.18644828 |

| 6/1/2016 | 0.002902807 |

| 7/1/2016 | 0.135955619 |

| 8/1/2016 | -0.052185714 |

| 9/1/2016 | 0.008845955 |

| 10/1/2016 | -0.12794767 |

| 11/1/2016 | 0.301002453 |

| 12/1/2016 | -0.027282474 |

| 1/1/2017 | 0.260883907 |

| 2/1/2017 | -0.052376863 |

| 3/1/2017 | -0.005508 |

| 4/1/2017 | -0.019668973 |

| 5/1/2017 | -0.023699955 |

| 6/1/2017 | -0.008842777 |

| 7/1/2017 | 0.108723913 |

| 8/1/2017 | 0.186889829 |

| 9/1/2017 | 0.060570954 |

| 10/1/2017 | 0.024577509 |

| 11/1/2017 | -0.121820059 |

| 12/1/2017 | 0.241786656 |

| 1/1/2018 | -0.034945458 |

| 2/1/2018 | -0.145632637 |

| 3/1/2018 | -0.00022244 |

| 4/1/2018 | 0.129966368 |

| 5/1/2018 | -0.06308127 |

| 6/1/2018 | -0.025067115 |

| 7/1/2018 | -0.080131612 |

| 8/1/2018 | 0.031842536 |

| 9/1/2018 | -0.100472256 |

| 10/1/2018 | -0.143767471 |

| 11/1/2018 | -0.095281689 |

| 12/1/2018 | -0.098711084 |

| 12/7/2018 | 0 |

To show:

The data of returns on S&P.

Explanation of Solution

The data for returns of S&P is shown below:

| Date | Returns S&P |

| 12/1/2013 | 0 |

| 1/1/2014 | 0 |

| 2/1/2014 | 0.042213375 |

| 3/1/2014 | 0.006908249 |

| 4/1/2014 | 0.006181643 |

| 5/1/2014 | 0.020812196 |

| 6/1/2014 | 0.018878997 |

| 7/1/2014 | -0.015194687 |

| 8/1/2014 | 0.036963644 |

| 9/1/2014 | -0.015635436 |

| 10/1/2014 | 0.022936399 |

| 11/1/2014 | 0.024237474 |

| 12/1/2014 | -0.004197385 |

| 1/1/2015 | -0.031532779 |

| 2/1/2015 | 0.053438876 |

| 3/1/2015 | -0.017549197 |

| 4/1/2015 | 0.008484722 |

| 5/1/2015 | 0.01043673 |

| 6/1/2015 | -0.021235559 |

| 7/1/2015 | 0.019549683 |

| 8/1/2015 | -0.064624731 |

| 9/1/2015 | -0.026798731 |

| 10/1/2015 | 0.079719379 |

| 11/1/2015 | 0.000504742 |

| 12/1/2015 | -0.017685659 |

| 1/1/2016 | -0.052067617 |

| 2/1/2016 | -0.004136906 |

| 3/1/2016 | 0.06390499 |

| 4/1/2016 | 0.002695762 |

| 5/1/2016 | 0.015208367 |

| 6/1/2016 | 0.000910506 |

| 7/1/2016 | 0.034990433 |

| 8/1/2016 | -0.001219987 |

| 9/1/2016 | -0.001235213 |

| 10/1/2016 | -0.019616837 |

| 11/1/2016 | 0.033603545 |

| 12/1/2016 | 0.018037111 |

| 1/1/2017 | 0.017726315 |

| 2/1/2017 | 0.036523001 |

| 3/1/2017 | -0.000389273 |

| 4/1/2017 | 0.009050132 |

| 5/1/2017 | 0.011509759 |

| 6/1/2017 | 0.004802226 |

| 7/1/2017 | 0.019164018 |

| 8/1/2017 | 0.000546284 |

| 9/1/2017 | 0.019119039 |

| 10/1/2017 | 0.02194556 |

| 11/1/2017 | 0.003713141 |

| 12/1/2017 | 0.033766015 |

| 1/1/2018 | 0.054657399 |

| 2/1/2018 | -0.039726108 |

| 3/1/2018 | -0.027252497 |

| 4/1/2018 | 0.002715086 |

| 5/1/2018 | 0.021378191 |

| 6/1/2018 | 0.004830749 |

| 7/1/2018 | 0.035387951 |

| 8/1/2018 | 0.029814315 |

| 9/1/2018 | 0.004285093 |

| 10/1/2018 | -0.071929346 |

| 11/1/2018 | 0.017701752 |

| 12/1/2018 | -0.047137951 |

| 12/7/2018 | 0 |

c

In this step we have to calculate the excess returns of the stock Alcoa and S&P separately.

c

Explanation of Solution

The excess returns can be calculated by =

Excess return = Return on stock − T bill rate

Here is the sheet in which we have calculaed the excess returns:

| Date | Returns Alcoa | Returns S&P | T-Bill rate | Excess Return on Alcoa | Excess Return on S&P |

| 12/1/2013 | 0 | 0 | 0.07 | -0.07 | -0.07 |

| 1/1/2014 | 0 | 0 | 0.07 | -0.07 | -0.07 |

| 2/1/2014 | 0.019785587 | 0.042213375 | 0.04 | -0.02 | 0.00 |

| 3/1/2014 | 0.094520691 | 0.006908249 | 0.05 | 0.04 | -0.04 |

| 4/1/2014 | 0.045565745 | 0.006181643 | 0.05 | 0.00 | -0.04 |

| 5/1/2014 | 0.010340052 | 0.020812196 | 0.03 | -0.02 | -0.01 |

| 6/1/2014 | 0.09213958 | 0.018878997 | 0.03 | 0.06 | -0.01 |

| 7/1/2014 | 0.09598186 | -0.015194687 | 0.04 | 0.06 | -0.06 |

| 8/1/2014 | 0.013333413 | 0.036963644 | 0.03 | -0.02 | 0.01 |

| 9/1/2014 | -0.029980428 | -0.015635436 | 0.03 | -0.06 | -0.05 |

| 10/1/2014 | 0.040797065 | 0.022936399 | 0.02 | 0.02 | 0.00 |

| 11/1/2014 | 0.031133233 | 0.024237474 | 0.02 | 0.01 | 0.00 |

| 12/1/2014 | -0.088938172 | -0.004197385 | 0.02 | -0.11 | -0.02 |

| 1/1/2015 | -0.008906032 | -0.031532779 | 0.03 | -0.04 | -0.06 |

| 2/1/2015 | -0.056519624 | 0.053438876 | 0.03 | -0.09 | 0.02 |

| 3/1/2015 | -0.133367024 | -0.017549197 | 0.02 | -0.15 | -0.04 |

| 4/1/2015 | 0.037969704 | 0.008484722 | 0.03 | 0.01 | -0.02 |

| 5/1/2015 | -0.071017427 | 0.01043673 | 0.02 | -0.09 | -0.01 |

| 6/1/2015 | -0.112097041 | -0.021235559 | 0.02 | -0.13 | -0.04 |

| 7/1/2015 | -0.121939527 | 0.019549683 | 0.02 | -0.14 | 0.00 |

| 8/1/2015 | -0.043485446 | -0.064624731 | 0.03 | -0.07 | -0.09 |

| 9/1/2015 | 0.025067099 | -0.026798731 | 0.07 | -0.04 | -0.10 |

| 10/1/2015 | -0.078577301 | 0.079719379 | 0.02 | -0.10 | 0.06 |

| 11/1/2015 | 0.047029033 | 0.000504742 | 0.02 | 0.03 | -0.02 |

| 12/1/2015 | 0.056257819 | -0.017685659 | 0.12 | -0.06 | -0.14 |

| 1/1/2016 | -0.302996218 | -0.052067617 | 0.23 | -0.53 | -0.28 |

| 2/1/2016 | 0.202912827 | -0.004136906 | 0.26 | -0.06 | -0.26 |

| 3/1/2016 | 0.074574737 | 0.06390499 | 0.31 | -0.24 | -0.25 |

| 4/1/2016 | 0.153553957 | 0.002695762 | 0.29 | -0.14 | -0.29 |

| 5/1/2016 | -0.18644828 | 0.015208367 | 0.23 | -0.42 | -0.21 |

| 6/1/2016 | 0.002902807 | 0.000910506 | 0.27 | -0.27 | -0.27 |

| 7/1/2016 | 0.135955619 | 0.034990433 | 0.27 | -0.13 | -0.24 |

| 8/1/2016 | -0.052185714 | -0.001219987 | 0.30 | -0.35 | -0.30 |

| 9/1/2016 | 0.008845955 | -0.001235213 | 0.30 | -0.29 | -0.30 |

| 10/1/2016 | -0.12794767 | -0.019616837 | 0.29 | -0.42 | -0.31 |

| 11/1/2016 | 0.301002453 | 0.033603545 | 0.33 | -0.03 | -0.30 |

| 12/1/2016 | -0.027282474 | 0.018037111 | 0.45 | -0.48 | -0.43 |

| 1/1/2017 | 0.260883907 | 0.017726315 | 0.51 | -0.25 | -0.49 |

| 2/1/2017 | -0.052376863 | 0.036523001 | 0.51 | -0.56 | -0.47 |

| 3/1/2017 | -0.005508 | -0.000389273 | 0.52 | -0.53 | -0.52 |

| 4/1/2017 | -0.019668973 | 0.009050132 | 0.74 | -0.76 | -0.73 |

| 5/1/2017 | -0.023699955 | 0.011509759 | 0.80 | -0.82 | -0.79 |

| 6/1/2017 | -0.008842777 | 0.004802226 | 0.89 | -0.90 | -0.89 |

| 7/1/2017 | 0.108723913 | 0.019164018 | 0.98 | -0.87 | -0.96 |

| 8/1/2017 | 0.186889829 | 0.000546284 | 1.07 | -0.88 | -1.07 |

| 9/1/2017 | 0.060570954 | 0.019119039 | 1.01 | -0.95 | -0.99 |

| 10/1/2017 | 0.024577509 | 0.02194556 | 1.03 | -1.01 | -1.01 |

| 11/1/2017 | -0.121820059 | 0.003713141 | 1.07 | -1.19 | -1.07 |

| 12/1/2017 | 0.241786656 | 0.033766015 | 1.23 | -0.99 | -1.20 |

| 1/1/2018 | -0.034945458 | 0.054657399 | 1.32 | -1.35 | -1.27 |

| 2/1/2018 | -0.145632637 | -0.039726108 | 1.41 | -1.56 | -1.45 |

| 3/1/2018 | -0.00022244 | -0.027252497 | 1.57 | -1.57 | -1.60 |

| 4/1/2018 | 0.129966368 | 0.002715086 | 1.70 | -1.57 | -1.70 |

| 5/1/2018 | -0.06308127 | 0.021378191 | 1.76 | -1.82 | -1.74 |

| 6/1/2018 | -0.025067115 | 0.004830749 | 1.86 | -1.89 | -1.86 |

| 7/1/2018 | -0.080131612 | 0.035387951 | 1.90 | -1.98 | -1.86 |

| 8/1/2018 | 0.031842536 | 0.029814315 | 1.96 | -1.93 | -1.93 |

| 9/1/2018 | -0.100472256 | 0.004285093 | 2.03 | -2.13 | -2.03 |

| 10/1/2018 | -0.143767471 | -0.071929346 | 2.13 | -2.27 | -2.20 |

| 11/1/2018 | -0.095281689 | 0.017701752 | 2.25 | -2.35 | -2.23 |

| 12/1/2018 | -0.098711084 | -0.047137951 | 2.25 | -2.35 | -2.30 |

| 12/7/2018 | 0 | 0 | 2.25 | -2.25 | -2.25 |

d

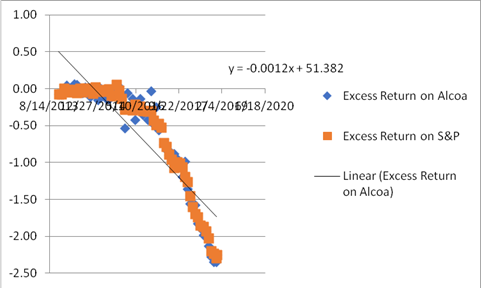

We have to plot excess Alcoa return over excess S&P return.

d

Explanation of Solution

We can use excel insert function to plot XY chart by selecting the data give above.

The plot will look like this.

Then we can also insert the trend line.

e

We have to find out the beta and alpha of Alcoa by looking at the trend line.

e

Explanation of Solution

By looking at the trend line:

| Trend line is: | y = 0.0012 x + 51.382 | |

| Beta of Alcoa from the trend line = | 0.0012 | |

| And Alpha of Alcoa is : | 51.382 | |

Want to see more full solutions like this?

Chapter 7 Solutions

Essentials of Investments (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education