a)

Determine the percentage increase in sales and prepare the pro forma income statement.

a)

Explanation of Solution

The formula to calculate the percentage of increase in sales:

Compute net income:

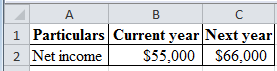

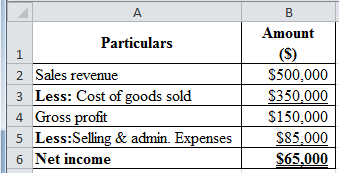

Excel spread sheet:

Table (1)

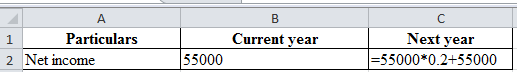

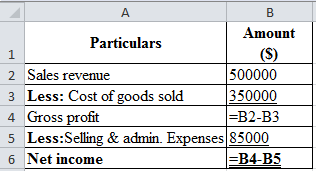

Excel workings:

Table (2)

Compute the percentage of COGS for next year:

Hence, the percentage of COGS for next year is 70%.

Compute the sales value:

Consider sales as X:

Hence, sales are $525,000.

Compute the percentage of increase in sales:

Hence, the percentage of increase in sales is 31.25%.

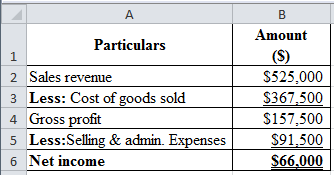

Prepare a pro forma income statement:

Table (3)

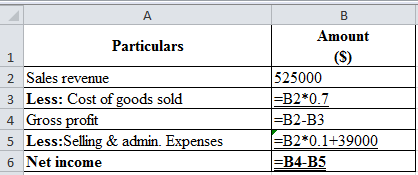

Table (4)

Hence, the net income is $66,000.

b)

Prepare the pro forma income statement and the other ideas to reach the Person C’s goal.

Given information:

Discount rate of 3% on COGS

b)

Explanation of Solution

Compute the COGS:

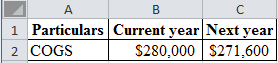

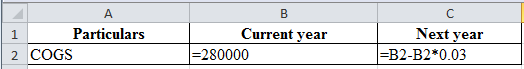

Excel spread sheet:

Table (5)

Excel workings:

Table (6)

Hence, the COGS are $271,600.

Compute the selling and administration expenses:

Consider selling and administration expenses as X:

Hence, selling and administration expenses are $62,400.

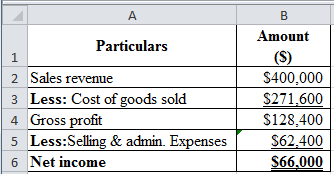

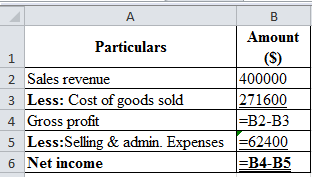

Prepare a pro forma income statement:

Excel spreadsheet:

Table (7)

Excel workings:

Table (8)

Hence, the net income is $66,000.

The management cuts the selling and administrative expenses by the amount of $2,600 to reach the goals of Person C.

c)

Whether the company can reach the goal of Person C

c)

Explanation of Solution

Compute projected sales:

Hence, the projected sales are $500,000.

Compute the projected cost of goods sold:

Hence, the projected cost of goods sold is $350,000.

Prepare a pro forma income statement:

Excel spreadsheet:

Table (9)

Excel workings:

Table (10)

Hence, the net income is $65,000.

The company cannot reach the goal as the desired profit more than the actual that is $66,000 is more than the $65,000.

Want to see more full solutions like this?

Chapter 7 Solutions

FUND.MAN.ACC.CONCEPTS W/CONNECT (LL)

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education