a.

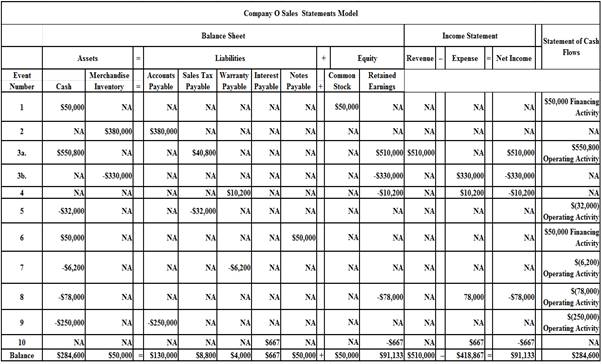

Show the effect of the given transactions using horizontal statement model.

a.

Explanation of Solution

Show the effect of the given transactions using horizontal statement model.

Table (1)

- Receiving money of $50,000 from the issue of common stock increases the value of an asset and the stockholder’s equity and affects the statement of cash flow by increasing the financing activity.

- Purchase equipment for $380,000 on account increase the value of an asset and the value of liability of the company.

- Sale of equipment for $510,000 cash increases the value of an asset and the value of the stockholder’s equity. Sale of equipment increases the net income of the company by increasing the value of the revenue in the income statement and it affects the statement of cash flow by increasing the operating activity.

- The cost of the goods sold (inventory) $330,000 decreases the value of an asset and the value of the stockholder’s equity; cost of the merchandise decreases the net income of the company by increasing the value of an expense.

- Providing six month warranty on the equipment increases the value of a liability and decreases the value of the stockholder’s equity; providing six month warranty on the equipment decreases the net income of the company by increasing the value of an expense.

- Paying sales tax to the state agency decreases the value of assets and it affects the statement of the cash flow by decreasing the value of an operating activity.

- Borrowing $50,000 note from the local bank increases the value of an asset and the liability; borrowing money from the local bank affects the statement of cash flow by increasing the value of the financing activity.

- Amount paid on warranty repairs during the year decreases the value of an asset and the liability; paying $6,200 for warranty repairs affects the statement of the cash flow by decreasing the value of an operating activity.

- Amount of $78,000 paid on operating expense decreases the value of an asset and the value of the stockholder’s equity; it decreases the value of the income by increasing the value of an expenses and amount paid on operating expense affects the statement of the cash flow by decreasing the value of an operating activity.

- Amount of $250,000 paid on accounts payable decreases the value of an asset and the liability; amount paid on accounts payable affects the statement of the cash flow by decreasing the value of an operating activity.

- Recording accrued interest of $667 on the note issued increases the value of a liability and decreases the value of a stockholder’s equity; it decreases the value of the income by increasing the value of an expenses.

Working notes:

Calculate the amount of cash collected on the sale of equipment.

Calculate the amount of interest expense.

b.

Prepare the income statement, balance sheet and the statement of cash flow for 2018.

b.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the income statement of Company O for 2018.

| Company O | ||

| Income Statement | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Sales Revenue | 510,000 | |

| Cost of Goods Sold | (330,000) | |

| Gross Margin | 180,000 | |

| Expense: | ||

| Operating expense | 78,000 | |

| Warranty expense | 10,200 | |

| Total operating expense | (88,200) | |

| Operating income | 91,800 | |

| Interest expense | (667) | |

| Net Income | 91,133 | |

Table (2)

Prepare the balance sheet of Company O for 2018.

| Company O | ||

| Balance Sheet | ||

| As of December 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Assets: | ||

| Cash | 284,600 | |

| Merchandise Inventory | 50,000 | |

| Total Assets | 334,600 | |

| Total Liabilities and | ||

| Liabilities: | ||

| Accounts Payable | 130,000 | |

| Sales Tax Payable | 8,800 | |

| Warranties Payable | 4,000 | |

| Interest Payable | 667 | |

| Notes Payable | 50,000 | |

| Total Liabilities | 193,467 | |

| Stockholders’ Equity: | ||

| Common Stock | 50,000 | |

| 91,133 | ||

| Total Stockholders’ Equity | 141,133 | |

| Total Liabilities and Stockholders’ Equity | 334,600 | |

Table (3)

Prepare the statement of cash flow of the Company O for 2018.

| Company O | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount in $ | Amount in $ |

| Cash Flows From Operating Activities: | ||

| Inflow from Customers | 510,000 | |

| Inflow from Sales Tax | 40,800 | |

| Outflow to Purchase Inventory | (250,000) | |

| Outflow for Expenses | (84,200) | |

| Outflow for Sales Tax | (32,000) | |

| Net Cash Flow from Operating Activities | 184,600 | |

| Cash Flows From Investing Activities: | 0 | |

| Cash Flows From Financing Activities: | ||

| Inflow from Stock Issue | 50,000 | |

| Inflow from Loan | 50,000 | |

| Net Cash Flow from Financing Activities | 100,000 | |

| Net Change in Cash | 284,600 | |

| Add: Beginning Cash Balance | 0 | |

| Ending Cash Balance | 284,600 | |

Table (4)

Working Note:

c.

Calculate the total amount of current liabilities at December 31, 2018.

c.

Explanation of Solution

Calculate the total amount of current liabilities at December 31, 2018.

| Particulars | Amount in $ |

| Current Liabilities: | |

| Accounts Payable | 130,000 |

| Sales Tax Payable | 8,800 |

| Warranty Payable | 4,000 |

| Interest Payable | 667 |

| Notes Payable | 50,000 |

| Total Current Liabilities | 193,467 |

Table (5)

Therefore, the total amount of current liabilities at December 31, 2018 is $193,467.

Want to see more full solutions like this?

Chapter 7 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Exercise 4-54 Operating Cycle and Current Receivables a. Dither and Sly are attorneys-at-law who specialize in federal income tax law. The): complete their typical case in 6 months or less and collect from the typical client within 1 additional month. b. Johnstons Market specializes in fresh meat and fish. All merchandise must be sold within one week of purchase. Almost all sales are for cash and any receivables are generally paid by the end of the following month. c. Mortondos is a womens clothing store specializing in high-style merchandise. Merchandise spends an average of 7 months on the rack following purchase. Most sales are on credit and the typical customer pays within 1 month of sale. d. Trees Inc. grows Christmas trees and sells them to various Christmas tree lots. Most sales are for cash. It takes 6 years to grow a tree. Required: For each of the businesses described above, indicate the length of the operating cycle.arrow_forwardAnalyze and compare J. C. Penney and Macys J. C. Penney Company, Inc. (JCP) and Macys, Inc. (M) are large department store chains in the United States. Information from recent annual reports for both companies is as follows (in millions): J. C. Penney Macys Cash (end of year) 119 1,109 Short term investments (end of year) 781 Operating expenses 4,640 8,256 Depreciation expense 616 1,061 a. Determine the days cash on hand for each company. Round to one decimal place. b. Which company has the better liquidity position?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning