EP AUDITING+ASSURANCE...-MYACCT.LAB

16th Edition

ISBN: 9780134148656

Author: ARENS

Publisher: PEARSON CO

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 35DQP

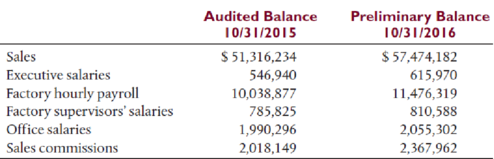

You are auditing payroll for the Morehead Technologies company for the year ended October 31, 2016. Included next are amounts from the client’s

You have obtained the following information to help you perform preliminary analytical procedures for the payroll account balances.

- 1. There has been a significant increase in the demand for Morehead’s products. The increase in sales was due to both an increase in the average selling price of four percent and an increase in units sold that resulted from the increased demand and an increased marketing effort.

- 2. Even though sales volume increased, there was no addition of executives, factory supervisors, or office personnel.

- 3. All employees including executives, but excluding commission salespeople, received a three percent salary increase starting November 1, 2015. Commission salespeople receive their increased compensation through the increase in sales.

- 4. The increased number of factory hourly employees was accomplished by recalling employees that had been laid off. They receive the same wage rate as existing employees. Morehead does not permit overtime.

- 5. Commission salespeople receive a five percent commission on all sales on which a commission is given. Approximately 75 percent of sales earn sales commission. The other 25 percent are “call-ins,” for which no commission is given. Commissions are paid in the month following the month they are earned.

Required

- a. Use the final balances for the prior year included above and the information in items 1 through 5 to develop an expected value for each account, except sales.

- b. Calculate the difference between your expectation and the client’s recorded amount as a percentage using the formula (expected value – recorded amount)/expected value.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You are auditing payroll for the Vineyard Technologies company for the year ended October 31, 2019. Included next are amounts from the client's trial balance, along with comparative audited information for the prior year.

(Click the icon to view the amounts from the trial balance.)

i (Click the icon to view the additional information.)

Read the requirements.

(Note 1: When computing the expected value of factory hourly payroll, you must take into consideration both the 6% wage increase and the 13% increase in the number of units produced and sold. Note 2: Use the increase in the 10/31/2019 preliminary sales balance over the 10/31/2018 audited sales balance to

determine the expected value for sales commissions on 10/31/2019.)

X

Executive salaries

Factory hourly payroll (see Note 1)

Factory supervisors' salaries

Office salaries

Sales commissions (see Note 2)

(1)

Preliminary

Balance

10/31/2019

630,599

11,004,992

759,699

2,713,957

2,827,321

Requirement a.

(2)

Expected Value

10/31/2019…

You are auditing payroll for the Morehead Technologies company for the year ended October 31, 2019. Included next are amounts from the client's trial balance, along with comparative audited information for the prior year.

(Click the icon to view the amounts from the trial balance.)

(Click the icon to view the additional information.)

Read the requirements.

(Note 1: When computing the expected value of factory hourly payroll, you must take into consideration both the 3% wage increase and the 8% increase in the number of units produced and sold. Note 2: Use the increase in the 10/31/2019 preliminary sales balance over the 10/31/2018 audited sales balance to

determine the expected value for sales commissions on 10/31/2019.)

Executive salaries

Factory hourly payroll (see Note 1)

Factory supervisors' salaries

Office salaries

Sales commissions (see Note 2)

Preliminary

Balance

10/31/2019

615,970

11,476,319

810,588

2,055,302

2,367,962

Requirement a.

(2)

Expected Value

10/31/2019

Requirement b.…

An auditor noted that client sales increased 10 percent for the year. At the same time, Cost of Goods Sold as a percentage of sales had decreased from 45 percent to 40 percent and year-end accounts receivable had increased by 8 percent.

Based on this information, the auditor interviewed the sales manager, who stated that the increase in sales without a corresponding increase in cost of goods sold was due to a price increase enacted by the company during the year. How would the auditor test the sales manager’s representation?a. Perform additional inquiries with sales personnel.b. Obtain copies of all price lists in use during the year and vouch the prices to sales invoices.c. Send confirmations asking customers about unit prices paid for product.d. Vouch vender invoices to payments made after year-end.

Chapter 7 Solutions

EP AUDITING+ASSURANCE...-MYACCT.LAB

Ch. 7 - Prob. 1RQCh. 7 - Prob. 2RQCh. 7 - Prob. 3RQCh. 7 - Prob. 4RQCh. 7 - Prob. 5RQCh. 7 - Prob. 6RQCh. 7 - Prob. 7RQCh. 7 - Prob. 8RQCh. 7 - Prob. 9RQCh. 7 - Prob. 10RQ

Ch. 7 - Prob. 11RQCh. 7 - Prob. 12RQCh. 7 - Describe the liquidity activity ratios and explain...Ch. 7 - Prob. 14RQCh. 7 - Prob. 15RQCh. 7 - Prob. 16RQCh. 7 - Prob. 17RQCh. 7 - Prob. 18RQCh. 7 - Define what is meant by a tick mark. What is its...Ch. 7 - Prob. 20RQCh. 7 - Prob. 21.1MCQCh. 7 - Prob. 21.2MCQCh. 7 - Prob. 21.3MCQCh. 7 - Prob. 22.1MCQCh. 7 - Prob. 22.2MCQCh. 7 - Prob. 22.3MCQCh. 7 - Prob. 23.1MCQCh. 7 - Prob. 23.2MCQCh. 7 - Prob. 23.3MCQCh. 7 - Prob. 24.1MCQCh. 7 - Prob. 24.2MCQCh. 7 - Prob. 24.3MCQCh. 7 - Prob. 25DQPCh. 7 - Prob. 26DQPCh. 7 - Prob. 27DQPCh. 7 - Prob. 28DQPCh. 7 - Prob. 29DQPCh. 7 - Prob. 30DQPCh. 7 - Following are 10 audit procedures with words...Ch. 7 - Prob. 32DQPCh. 7 - Prob. 33DQPCh. 7 - Prob. 34DQPCh. 7 - You are auditing payroll for the Morehead...Ch. 7 - Prob. 36DQPCh. 7 - Prob. 38C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firms fiscal year. The last quarter begins on April 1, 20--. Refer to the Illustrative Case on pages 6-27 to 6-33 and proceed as follows: a. Analyze and journalize the transactions described in the following narrative. Use the two-column journal paper provided on pages 6-73 to 6-77. Omit the writing of explanations in the journal entries. b. Post the journal entries to the general ledger accounts on pages 6-78 to 6-83. Narrative of Transactions: c. Answer the following questions: 1. The total amount of the liability for FICA taxes and federal income taxes withheld as of June 30 is................................................................................ ________ 2. The total amount of the liability for state income taxes withheld as of June 30 is................................................................................................................ ________ 3. The amount of FUTA taxes that must be paid to the federal government on or before August 1 (assume July 31 is a Sunday) is........................................ ________ 4. The amount of contributions that must be paid into the state unemployment compensation fund on or before August 1 is.................................................. ________ 5. The total amount due the treasurer of the union is........................................ ________ 6. The total amount of wages and salaries expense since the beginning of the fiscal year is ................................................................................................... ________ 7. The total amount of payroll taxes expense since the beginning of the fiscal year is ............................................................................................................ ________ 8. Using the partial journal below, journalize the entry to record the vacation accrual at the end of the companys fiscal year. The amount of Brookins Companys vacation accrual for the fiscal year is 15,000.arrow_forwardAlyssa Ghose is auditing payroll accruals for a manufacturingcompany. The client has accrued payroll taxes, accrued vacation pay, and accrued bonusesfor salespersons as of the end of the fiscal year. Alyssa performed the following auditprocedures.1. Compared all accrual balances in the current year to the prior year and noted nosignificant fluctuations.2. Traced the subsequent payment of payroll taxes to the cash disbursements journaland the bank statement.3. Reviewed a sample of contracts with salespersons to verify the bonus formula.4. Reviewed cancelled checks for a sample of checks disbursed after year end for unusedvacation pay.a. Are the audit procedures performed by Alyssa sufficient to test accrued payroll tax,vacation pay, and bonuses? If not, what additional procedures should she perform?b. For each additional procedure you recommend in part a., identify the related auditobjective the procedure would satisfy.arrow_forwardStingers Inc. provides audited financial statements to its creditors and management receives a bonus partially based on revenues for the year An order for $61,500 was received from one of its regular customer on December 29, for products on hand. This order was shipped f.o.b. shipping point on January 9, 2021. The company made the following entry for 2020: Accounts Receivable 61,500 Sales Revenue 61,500 INSTRUCTIONS - DETERMINE HOW REVENUE SHOULD BE RECORDED UNDER EACH ALTERNATIVE a. Assume the company follows ASPE, provide a GAAP supported-case specific analysis. b. Assume the company follows IFRS, provide a GAAP supported-case specific analysis.arrow_forward

- You are auditing payroll for the Morehead Technologiescompany for the year ended October 31, 2013. Included next are amounts from the client’strial balance, along with comparative audited information for the prior year.Audited Balance Preliminary Balance10/31/2012 10/31/2013Sales $ 51,316,234 $ 57,474,182Executive salaries 546,940 615,970Factory hourly payroll 10,038,877 11,476,319Factory supervisors’ salaries 785,825 810,588Office salaries 1,990,296 2,055,302Sales commissions 2,018,149 2,367,962You have obtained the following information to help you perform preliminary analyticalprocedures for the payroll account balances.1. There has been a significant increase in the demand for Morehead’s products. Theincrease in sales was due to both an increase in the average selling price of 4 percentand an increase in units sold that resulted from the increased demand and an increasedmarketing effort.2. Even though sales volume increased there was no addition of executives, factorysupervisors,…arrow_forward(Note 1: When computing the expected value of factory hourly payroll, you must take into consideration both the 7% wage increase and the 13% increase in the number of units produced and sold. Note 2: Use the increase in the 10/31/2023 preliminary sales balance over the 10/31/2022 audited sales balance to determine the expected value for sales commissions on 10/31/2023.) Requirement b. (1) Preliminary Requirement a. (2) [(2)-(1)]+(2) Balance 10/31/2023 Expected Value 10/31/2023 Difference as a Percentage Executive salaries 650,381 % Factory hourly payroll (see Note 1) 10,958,864 Factory supervisors' salaries 837,567 Office salaries 2,805,832 do do do % % Sales commissions (see Note 2) 3,090,829 % %arrow_forwardConsider the following details about a firm from the past year. Assume that this sample time period provides a good estimate for the firm's cycles. What is its Inventory Period? March 1 - Acquire Inventory March 20 - Pay $25,000 for Inventory April 22 - Sell Inventory on Credit May 23 - Collect $40,000 for Sale on Creditarrow_forward

- During 2018, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returnsof $720,000. Cost of goods sold totaled $6,360,000 (60% of sales). The company estimates that 8% of all saleswill be returned. Prepare the year-end adjusting journal entries to account for anticipated sales returns, assumingthat all sales are made on credit and all accounts receivable are outstanding.arrow_forwardC Ltd is a company in the chemical industry, situated near the Eden Lake. Its year end is 30th June 2022 and you were engaged as the auditor on that date. The profit before taxation shown in the draft accounts to 30th June is $23,000,000. The following matters have come to your attention: There has been a downturn in sales prices in July 2022, with the result that a portion of the inventory on hand at 30th June 2022 will be sold at below cost. Management have advised that there is an excess of cost over net realisable value amounts in total to $100,000 With reference to relevant audit standards, identify the business risk and outline any resulting potential audit risks that may require further investigation.arrow_forwardThomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forward

- The following information relates to Fanning’s Electronics on December 31, 2011. The company, which uses the calendar year as its annual reporting period, initially records prepaid and unearned items in balance sheet accounts (assets and liabilities, respectively). The company’s weekly payroll is $8,750, paid each Friday for a five-day workweek. Assume December 31, 2011, fall on a Monday, but the employees will not be paid their wages until Friday, January 4, 2012. Eighteen months earlier, on July 1, 2010, the company purchased equipment that cost $20,000. Its useful life is predicted to be five years, at which time the equipment is expected to be worthless (zero salvage value). On October 1, 2011, the company agreed to work on a new housing development. The company is paid $120,000 on October 1 in advance of future installation of similar alarm system in 24 new homes. That amount was credit to the Unearned Services Revenue account. Between October 1 and December 31, work on 20…arrow_forwardThomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forwardThomas Company had the following information related to September 2020: 1) Depreciation on the store equipment was $60,000 for the month. 2) Sales of merchandise inventory for the month of September were $1,800,000, of which $1,200,000 was paid in cash and the remaining amount sold on credit. The cost of the merchandise sold was $1,080,000. 3) The next payroll will be $144,000 and will be paid on October 12. This payroll will cover wages earned during the last week of September and the first week of October. 4) The utility bill of $72,000 for the month of September was both received and paid in early October. 5) Thomas sold a company car for a gain of $12,000 on September 22. 6) On September 3, Thomas paid $6,000 for August’s telephone bill. 7) On October 1, Thomas received the September telephone bill, which totaled $12,000. The bill will be paid in mid-October. 8) Wages paid in cash to employees during the month totaled $288,000. This amount included $60,000 paid for work done in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License