Concept explainers

INSTRUCTIONS

- 1. Open the general ledger accounts and

accounts receivable ledger accounts indicated below. - 2.

Post the entries from the general journal in Problem 7.2B to the appropriate accounts in the general ledger and in the accounts receivable ledger. - 3. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule.

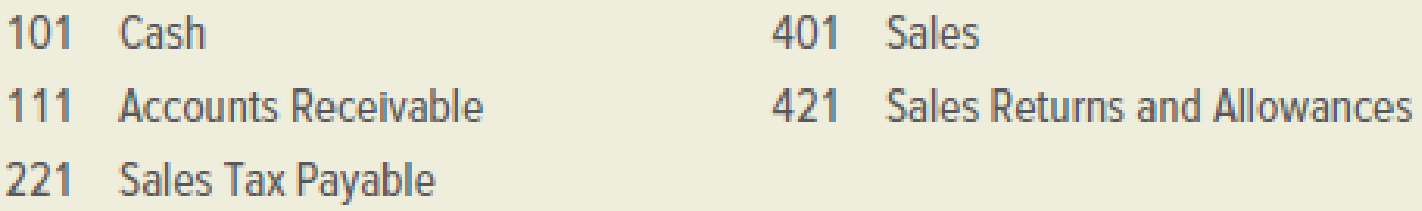

GENERAL LEDGER ACCOUNTS

ACCOUNTS RECEIVABLE LEDGER ACCOUNTS

Analyze: Damaged or defective goods decreased sales by what dollar amount? By what percentage?

Problem 7.2B

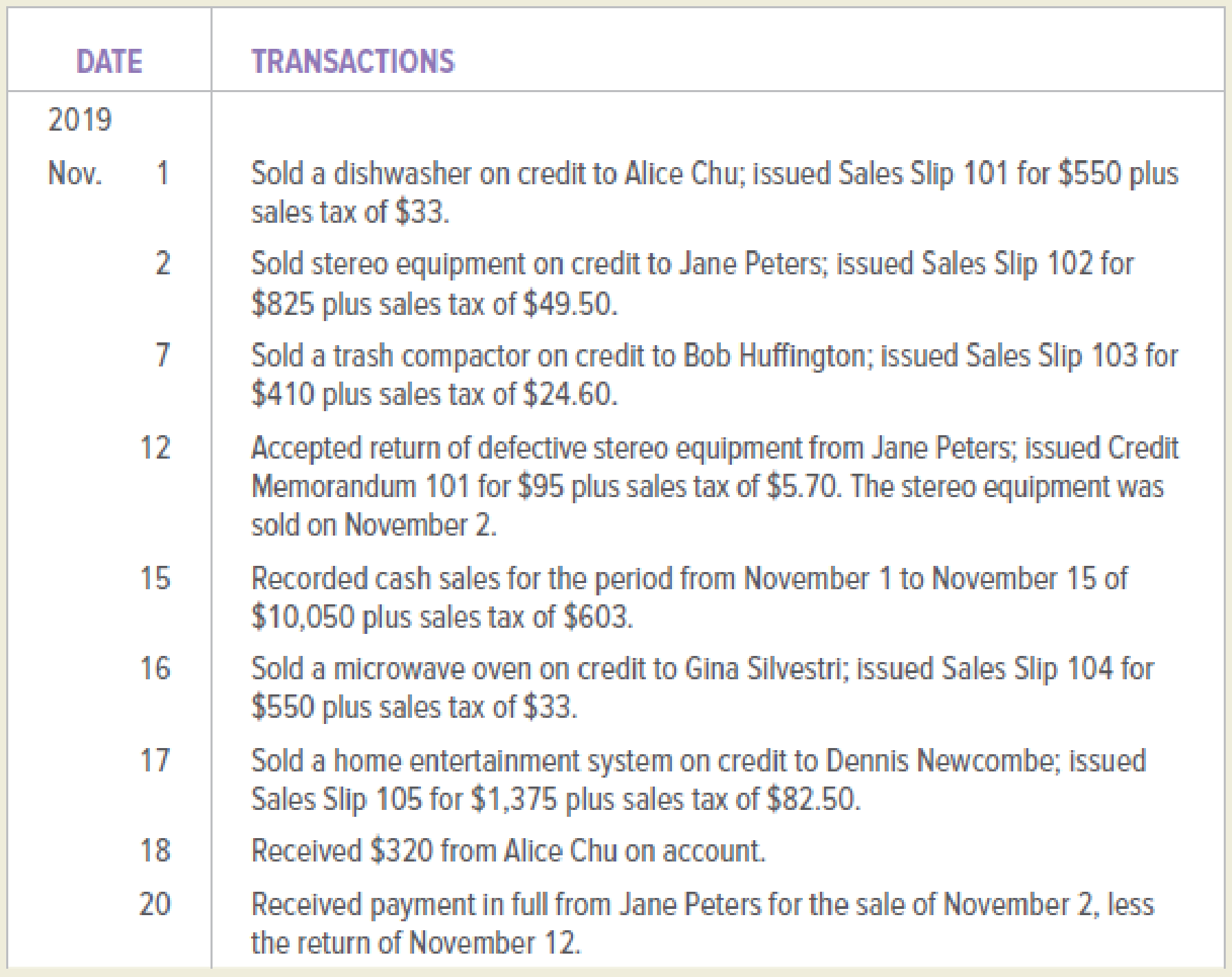

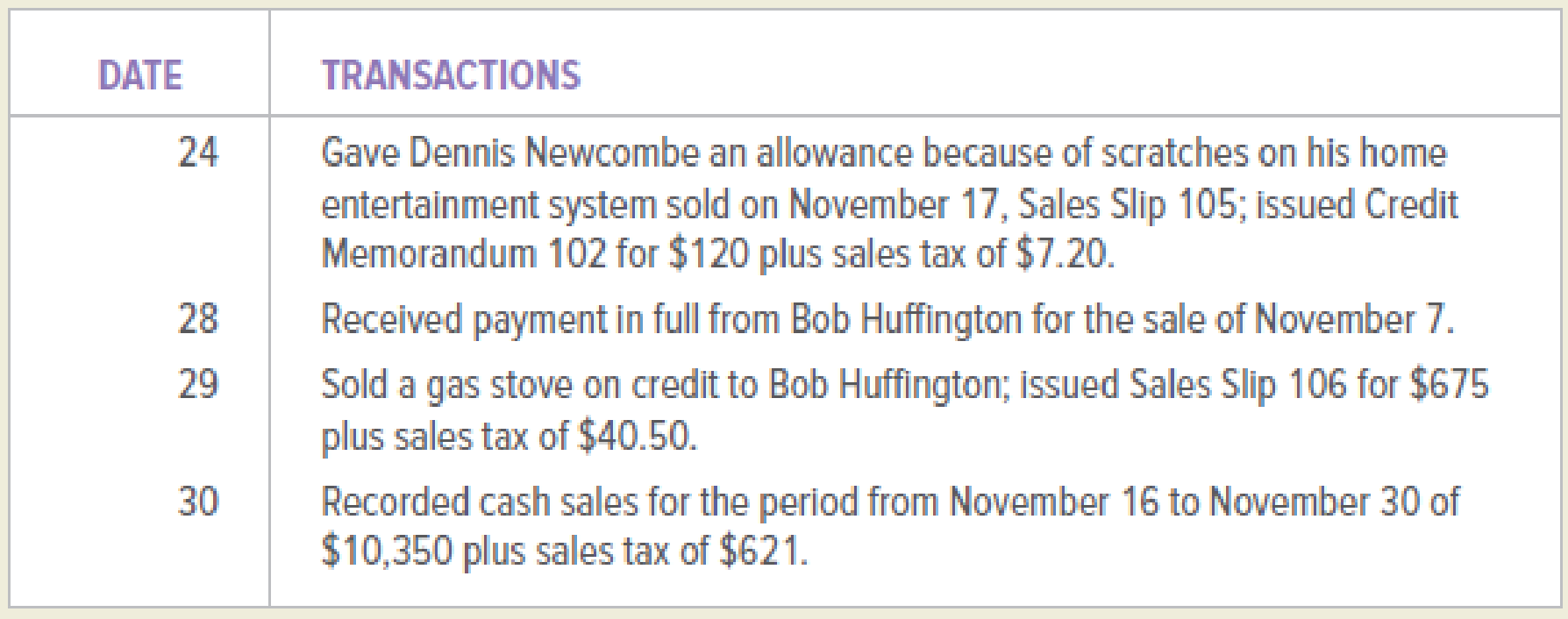

Appliances for Less began operations November 1, 2019. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. During November, Appliances for Less engaged in the following transactions:

INSTRUCTIONS

Record the transactions in a general journal. Use 1 as the journal page number.

Analyze: What is the total amount due from Bob Huffington for the November 29 sale?

1 and 2

Prepare the general ledger for Company AL.

Explanation of Solution

General ledger: General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements. In the ledger all the entries are recorded in the account order, for which the transactions actually take place.

Post the journal entries in the General Ledger:

| GENERAL LEDGER | ||||||

| ACCOUNT: Cash | Account No.: 101 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| November 15 | J2 | $ 10,653.00 | $ 10,653.00 | |||

| November 18 | J2 | $ 320.00 | $ 10,973.00 | |||

| November 20 | J3 | $ 773.80 | $ 11,746.80 | |||

| November 28 | J3 | $ 434.60 | $ 12,181.40 | |||

| November 30 | J3 | $ 10,971.00 | $ 23,152.40 | |||

| ACCOUNT: Accounts receivable | Account No.: 111 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| November 1 | J1 | $ 583.00 | $ 583.00 | |||

| November 2 | J1 | $ 874.50 | $ 1,457.50 | |||

| November 7 | J2 | $ 434.60 | $ 1,892.10 | |||

| November 12 | J2 | $ 100.70 | $ 1,791.40 | |||

| November 16 | J2 | $ 583.00 | $ 2,374.40 | |||

| November 17 | J2 | $ 1,457.50 | $ 3,831.90 | |||

| November 18 | J2 | $ 320.00 | $ 3,511.90 | |||

| November 20 | J3 | $ 773.80 | $ 2,738.10 | |||

| November 24 | J3 | $ 127.20 | $ 2,610.90 | |||

| November 28 | J3 | $ 434.60 | $ 2,176.30 | |||

| November 29 | J3 | $ 715.50 | $ 2,891.80 | |||

Table (1)

| GENERAL LEDGER | ||||||

| ACCOUNT: Sales Tax Payable | Account No.: 221 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| November 1 | J1 | $ 33.00 | $ 33.00 | |||

| November 2 | J1 | $ 49.50 | $ 82.50 | |||

| November 7 | J2 | $ 24.60 | $ 107.10 | |||

| November 12 | J2 | $ 5.70 | $ 101.40 | |||

| November 15 | J2 | $ 603.00 | $ 704.40 | |||

| November 16 | J2 | $ 33.00 | $ 737.40 | |||

| November 17 | J2 | $ 82.50 | $ 819.90 | |||

| November 24 | J3 | $ 7.20 | $ 812.70 | |||

| November 29 | J3 | $ 40.50 | $ 853.20 | |||

| November 30 | J3 | $ 621.00 | $ 1,474.20 | |||

| ACCOUNT: Sales | Account No.: 401 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| November 1 | J1 | $ 550.00 | $ 550.00 | |||

| November 2 | J1 | $ 825.00 | $ 1,375.00 | |||

| November 7 | J2 | $ 410.00 | $ 1,785.00 | |||

| November 15 | J2 | $ 10,020.00 | $ 11,805.00 | |||

| November 16 | J2 | $ 550.00 | $ 12,355.00 | |||

| November 17 | J2 | $ 1,375.00 | $ 13,730.00 | |||

| November 29 | J3 | $ 675.00 | $ 14,405.00 | |||

| November 30 | J3 | $ 10,350.00 | $ 24,755.00 | |||

| ACCOUNT: Sales Returns and Allowances | Account No.: 421 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| November 12 | J2 | $ 95.00 | $ 95.00 | |||

| November 24 | J3 | $ 120.00 | $ 215.00 | |||

Table (2)

Reference Notes:

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit: A debit is an accounting term that refers to the left side of an account. The term debit is be denoted by (Dr). The recording amount on the left side of the account is known as debiting.

Credit: A credit is an accounting term that refers to the right side of an account. The term credit is denoted as (Cr). The recording amount on the right side of the account is known as crediting.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all the increase in the assets, the expenses and the dividends, all the decrease in liabilities, revenues and the stockholders’ equities.

- Credit, all the increase in the liabilities, the revenues, and the stockholders’ equities, and all decreases in the assets, and the expenses.

Pass the journal entries for the given transactions:

| General Journal | Page - 1 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| November 1 | Accounts receivable (2) | 111 | $ 583 | |

| Sales | 401 | $ 550 | ||

| Sales Tax Payable (1) | 221 | $ 33 | ||

| (To record the sale on account to AC; Sales slip 101) | ||||

| November 2 | Accounts receivable (4) | 111 | $ 874.50 | |

| Sales | 401 | $ 825.00 | ||

| Sales Tax Payable (3) | 221 | $ 49.50 | ||

| (To record the sale on account to JP; Sales slip 102) |

Table (3)

| General Journal | Page - 2 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| November 7 | Accounts receivable (6) | 111 | $ 434.60 | |

| Sales | 401 | $ 410.00 | ||

| Sales Tax Payable (5) | 221 | $ 24.60 | ||

| (To record the sale on account to BH; Sales slip 103) | ||||

| November 12 | Sales Returns and Allowances | 421 | $ 95.00 | |

| Sales Tax Payable (7) | 221 | $ 5.70 | ||

| Accounts receivable (8) | 111 | $ 100.70 | ||

| (To record the sales returns from JP for the sales made on November 2 using sales slip 102, the credit memorandum is 101) | ||||

| November 15 | Cash (10) | 101 | $ 10,653 | |

| Sales | 401 | $ 10,050 | ||

| Sales Tax Payable (9) | 221 | $ 603 | ||

| (To record the cash sales) | ||||

| November 16 | Accounts receivable (12) | 111 | $ 583 | |

| Sales | 401 | $ 550 | ||

| Sales Tax Payable (11) | 221 | $ 33 | ||

| (To record the sale on account to GS; Sales slip 104) | ||||

| November 17 | Accounts receivable (14) | 111 | $ 1,457.50 | |

| Sales | 401 | $ 1,375.00 | ||

| Sales Tax Payable (13) | 221 | $ 82.50 | ||

| (To record the sale on account to DN; Sales slip 105) | ||||

| November 18 | Cash | 101 | $ 320 | |

| Accounts receivable | 111 | $ 320 | ||

| (To record the receipt of partial payment from AC) |

Table (4)

| General Journal | Page - 3 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| November 20 | Cash (15) | 101 | $ 773.80 | |

| Accounts receivable | 111 | $ 773.80 | ||

| (To record the receipt of payment from JP) | ||||

| November 24 | Sales Returns and Allowances | 421 | $ 120.00 | |

| Sales Tax Payable (16) | 221 | $ 7.20 | ||

| Accounts receivable (17) | 111 | $ 127.20 | ||

| (To record the sales returns from DN for the sales made on November 17 using sales slip 105, the credit memorandum is 102) | ||||

| November 28 | Cash | 101 | $ 434.60 | |

| Accounts receivable | 111 | $ 434.60 | ||

| (To record the receipt of payment from BH) | ||||

| November 29 | Accounts receivable (19) | 111 | $ 715.50 | |

| Sales | 401 | $ 675.00 | ||

| Sales Tax Payable (18) | 221 | $ 40.50 | ||

| (To record the sale on account to BH; Sales slip 103) | ||||

| November 30 | Cash (21) | 101 | $ 10,971 | |

| Sales | 401 | $ 10,350 | ||

| Sales Tax Payable (20) | 221 | $ 621 | ||

| (To record the cash sales) |

Table (5)

Working Notes (1):

Calculate the value of Sales Tax Payable on November 1.

Working Notes (2):

Calculate the value of Accounts receivable on November 1.

Working Notes (3):

Calculate the value of Sales Tax Payable on November 2.

Working Notes (4):

Calculate the value of Accounts receivable on November 4.

Working Notes (5):

Calculate the value of Sales Tax Payable on November 12.

Working Notes (6):

Calculate the value of Accounts receivable on November 12.

Working Notes (7):

Calculate the value of Sales Tax Payable on November 12.

Working Notes (8):

Calculate the value of Accounts receivable on November 12.

Working Notes (9):

Calculate the value of Sales Tax Payable on November 15.

Working Notes (10):

Calculate the value of Cash on November 15.

Working Notes (11):

Calculate the value of Sales Tax Payable on November 16.

Working Notes (12):

Calculate the value of Accounts receivable on November 16.

Working Notes (13):

Calculate the value of Sales Tax Payable on November 17.

Working Notes (14):

Calculate the value of Accounts receivable on November 17.

Working Notes (15):

Calculate the value of Cash on November 20.

Working Notes (16):

Calculate the value of Sales Tax Payable on November 24.

Working Notes (17):

Calculate the value of Accounts receivable on November 24.

Working Notes (18):

Calculate the value of Sales Tax Payable on November 29.

Working Notes (19):

Calculate the value of Accounts receivable on November 29.

Working Notes (20):

Calculate the value of Sales Tax Payable on November 30.

Working Notes (21):

Calculate the value of Cash on November 30.

3

Using the Schedule of Accounts Receivable compare the Accounts receivable balances with the total and identify the amount and percentage of sales decreased due to the defective goods.

Explanation of Solution

Schedule of accounts receivable: This is the schedule which reports all the debtors of a company during the given period and the balances to be recovered from them.

Prepare the Accounts receivable Subsidiary Ledger:

| ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER | |||||

| NAME: AC | |||||

| ADDRESS: | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| November 1 | Sales Slip 101 | J1 | $ 583.00 | $ 583.00 | |

| November 18 | J2 | $ 320.00 | $ 263.00 | ||

| NAME: BH | |||||

| ADDRESS: | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| November 7 | Sales Slip 103 | J2 | $ 434.60 | $ 434.60 | |

| November 28 | J3 | $ 434.60 | $ 0.00 | ||

| November 29 | Sales Slip 106 | J3 | $ 715.50 | $ 1,150.10 | |

| NAME: DN | |||||

| ADDRESS: | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| November 17 | Sales Slip 105 | J2 | $ 1,457.50 | $ 1,457.50 | |

| November 24 | Credit Memorandum 102 | J3 | $ 127.20 | $ 1,330.30 | |

| NAME: JP | |||||

| ADDRESS: | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| November 1 | Sales Slip 102 | J1 | $ 874.50 | $ 874.50 | |

| November 12 | Credit Memorandum 101 | J2 | $ 100.70 | $ 773.80 | |

| November 20 | J3 | $ 773.80 | $ 0.00 | ||

Table (6)

| ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER | |||||

| NAME: GS | |||||

| ADDRESS: | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| November 16 | Sales Slip 104 | J2 | $ 583.00 | $ 583.00 | |

Table (7)

Prepare the Schedule of Accounts Receivable:

| Company AL | |

| Schedule of Accounts Receivable | |

| November 30, 2019 | |

| Particulars | Amount ($) |

| AC | $ 263.00 |

| BH | $ 715.50 |

| DN | $ 1,330.30 |

| JP | $ 0.00 |

| GS | $ 583.00 |

| Total accounts receivable | $ 2,891.80 |

Table (8)

The amount of sales decreased due to the defective goods is $215 and the percentage of sales decreased due to the defective goods is 0.9%.

Working notes (22):

Calculate the percentage of sales:

Want to see more full solutions like this?

Chapter 7 Solutions

COLLEGE ACCOUNTING W/CONNECT

- A customer returns $870 worth of merchandise and receives a full refund. What accounts recognize this sales return (disregarding the merchandise condition entry) if the return occurs before the customer remits payment to the retailer? A. accounts receivable, sales returns and allowances B. accounts receivable, cash C. sales returns and allowances, merchandise inventory D. accounts receivable, cost of goods soldarrow_forwardJOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forwardA customer returns $690 worth of merchandise and receives a full refund. What accounts recognize this sales return, assuming the customer has not yet remitted payment to the retailer? A. accounts receivable, sales returns and allowances B. accounts receivable, cash C. sales returns and allowances, purchases D. sales discounts, cost of goods soldarrow_forward

- Record general journal entries to correct the errors described below. Assume that the incorrect entries were posted in the same period in which the errors occurred and were recorded using the periodic inventory system. a. A freight cost of 85 incurred on equipment purchased for use in the business was debited to Freight In. b. The issuance of a credit memo to Lang Company for 119 for merchandise returned was recorded as a debit to Purchases Returns and Allowances and a credit to Accounts Receivable, Lang Company. c. A cash sale of 68 to J. L. LaSalle was recorded as a sale on account. d. A purchase of merchandise from James Company in the amount of 750 with a 25 percent trade discount was recorded as a debit to Purchases and a credit to Accounts Payable of 750 each.arrow_forwardJOURNALIZING PURCHASES RETURNS AND ALLOWANCES AND POSTING TO GENERAL LEDGER AND ACCOUNTS PAYABLE LEDGER Using page 3 of a general journal and the following general ledger and accounts payable ledger accounts, journalize and post the following transactions: July 7Returned merchandise to Starcraft Industries, 700. 15Returned merchandise to XYZ, Inc., 450. 27Returned merchandise to Datamagic, 900.arrow_forwardJOURNALIZING PURCHASES RETURNS AND ALLOWANCES AND POSTING TO GENERAL LEDGER AND ACCOUNTS PAYABLE LEDGER Using page 3 of a general journal and the following general ledger accounts and accounts payable ledger accounts, journalize and post the following transactions: Mar. 5Returned merchandise to Tower Industries, 500. 11Returned merchandise to A D Arms, 625. 23Returned merchandise to Mighty Mansion, 275.arrow_forward

- Which of the following accounts are used when recording the sales entry of a sale on credit? A. merchandise inventory, cash B. accounts receivable, merchandise inventory C. accounts receivable, sales D. sales, cost of goods soldarrow_forwardThe company just took a physical count of inventory and found $75 worth of inventory was unaccounted for. It was either stolen or damaged. Which journal would the company use to record the correction of the error in inventory? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardKelley Company has completed the following October sales and purchases journals: a. Total and post the journals to T accounts for the general ledger and the accounts receivable and accounts payable ledgers. b. Complete a schedule of accounts receivable for October 31, 20--. c. Complete a schedule of accounts payable for October 31, 20--. d. Compare the balances of the schedules with their respective general ledger accounts. If they are not the same, find and correct the error(s).arrow_forward

- If a customer pays with a credit card and the service has been provided, which of the following accounts will be used to record the sales entry for this transaction? A. Cost of Goods Sold, Merchandise Inventory, Sales Revenue B. Sales Revenue, Credit Card Expense, Accounts Receivable C. Accounts Receivable, Merchandise Inventory, Credit Card Expense D. Cost of Goods Sold, Credit Card Expense, Sales Revenuearrow_forwardPurchases on account of merchandise for resale would be recorded in the _______________. a. Sales journal b. Purchases journal c. Cash receipts journal d. Cash payments journal e. None of the abovearrow_forwardFor each of the following accounts, identify whether the normal balance is a debit or a credit. Also specify whether the account is a contra account. a. Sales Returns and Allowances b. Merchandise Inventory c. Sales d. d Freight In e. Purchases Returns and Allowances f. Sales Tax Payable g. Purchasesarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College