(1)

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or borrower to lender or creditor. Notes receivable is an asset of a business.

To prepare:

(1)

Explanation of Solution

Journal entries of FL bank are as follows:

FL bank agreed to settle the debt in exchange for land worth $16 million.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Land | 16,000,000 | |||

| Loss on debt restructuring | 6,000,000 | |||

| Note receivable | 20,000,000 | |||

| Accrued interest receivable (1) | 2,000,000 | |||

| (To record the settlement of land for the debt) |

Table (1)

Working note:

(2) (a)

To prepare: Journal entries to record the following transaction.

(2) (a)

Explanation of Solution

Interest accrued from last year.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 1, 2016 | Loss on troubled debt restructuring | 8,584,980 | ||

| Accrued interest receivable (1) | 2,000,000 | |||

| Note receivable

|

6,584,980 | |||

| (To record accrued interest) |

Table (2)

Working note:

|

|

$ | $ |

| Previous value: | ||

| Interest Accrued 2015 (1) | 2,000,000 | |

| Principal | 20,000,000 | |

| Carrying amount of the receivables | 22,000,000 | |

| New value: | ||

| Interest

|

3,169,870 | |

| Principal

|

10,245,150 | |

| Present value of the receivable | (13,415,02) | |

| Loss | 8,584,980 |

Table (3)

- PV factor of 3.16987 (Present value of an ordinary annuity of $1: n = 4, i = 10%) is taken from the table value (Refer Table 4 in Appendix from textbook).

- PV factor of 0.68301 (Present value of $1: n = 4, i = 10%) is taken from the table value (Refer Table 2 in Appendix from textbook).

(2) (b)

To prepare: Journal entries to record the following transaction.

(2) (b)

Explanation of Solution

Reduce the interest payment to $1 Million each:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2016 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 341,502 | |||

| Interest revenue

|

1,341,502 | |||

| (To record the interest revenue ) |

Table (4)

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2017 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 375,652 | |||

| Interest revenue

|

1,375,652 | |||

| (To record the interest revenue ) |

Table (5)

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2018 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 413,217 | |||

| Interest revenue

|

1,413,217 | |||

| (To record the interest revenue ) |

Table (6)

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Cash (required by new agreement) | 1,000,000 | ||

| Note receivable (Balance) | 454,609 | |||

| Interest revenue

|

1,454,609 | |||

| (To record the interest revenue ) |

Table (7)

(2) (c)

To prepare: Journal entries to record the following transaction.

(2) (c)

Explanation of Solution

Reduce the principal to $15 Million:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2019 | Cash (required by new agreement) | 15,000,000 | ||

| Note receivable (Balance) | 15,000,000 | |||

| (To record the principal ) |

Table (8)

Note:

- $15,000,000 is rounded to amortize the note.

Working note:

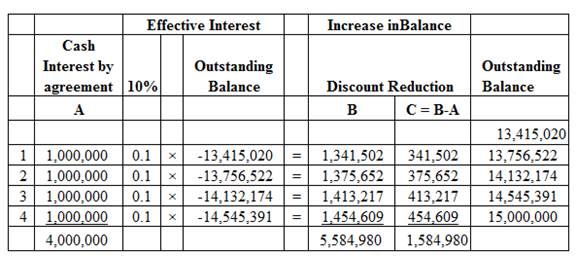

Amortization schedule:

Image (1)

(3)

To prepare: Journal entries to record the following transaction.

(3)

Explanation of Solution

To defer all payments until the maturity date:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 1, 2016 | Loss on troubled debt restructuring | 3,029,397 | ||

| Accrued interest receivable (1) | 2,000,000 | |||

| Note receivable

|

1,029,397 | |||

| (To record the loss on debt ) | ||||

| December 31, 2016 | Note receivable (Balance) | 1,897,060 | ||

| Interest revenue

|

1,897,060 | |||

| (To record the interest revenue ) | ||||

| December 31, 2017 | Note receivable (Balance) | 2,086,766 | ||

| Interest revenue

|

2,086,766 | |||

| (To record the interest revenue ) | ||||

| December 31, 2018 | Note receivable (Balance) | 2,295,443 | ||

| Interest revenue (Refer schedule) | 2,295,443 | |||

| To record the interest revenue ) | ||||

| December 31, 2019 | Note receivable (Balance) | 2,295,443 | ||

| Interest revenue (Refer schedule) | 2,295,443 | |||

| To record the interest revenue ) | ||||

| December 31, 2019 | Cash (required by new agreement) | 27,775,000 | ||

| Note receivable (Balance) | 27,775,000 | |||

| (To record the principal ) | ||||

Table (8)

Working notes:

|

|

$ |

| Previous value: | |

| Interest Accrued 2015 (1) | 2,000,000 |

| Principal | 20,000,000 |

| Carrying amount of the receivables | |

| New value: | |

| Principal

|

18,970,603 |

| Loss | 3,029,397 |

Table (9)

- PV factor of 0.68301 (Present value of $1: n = 4, i = 10%) is taken from the table value (Refer Table 2 in Appendix from textbook).

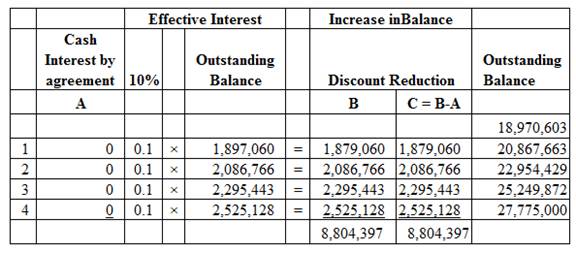

Amortization schedule:

Image (2)

Want to see more full solutions like this?

Chapter 7 Solutions

INTER. ACC W/ ACCESS+AIRFRANCE >IC< (L

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education