Concept explainers

>Continuing Problem

P7-30 Using all journals

This problem continues the Daniels Consulting situation. Daniels Consulting performs systems consulting. Daniels has also begun selling accounting software and uses the perpetual inventory system to account for software inventory. During January 2017, Daniels completed the following transactions:

Jan. 2 Completed a consulting engagement and received cash of $5,700.

2 Prepaid three months office rent, $2,400.

7 Purchased 50 units software inventory on account from Miller Co., $1,050, plus freight in, $50.

18 Sold 40 software units on account to Jason Needle, $2,625 (cost, $880).

19 Consulted with a client, Louis Frank, for a fee of $2,500 on account. (Use general journal.)

20 Paid employee salaries, $1,885, which includes accrued salaries from December of $685. Paid Miller Co. on account, $1,100. There was no discount.

21 Purchased 185 units software inventory on account from Whitestone Co., $4,810. Received bill and paid utilities, $375.

22 Sold 135 units software for cash, $5,265 (cost, $3,470).

24 Recorded the following

- Accrued salaries expense, $775

Depreciation on Equipment, $60; Depreciation on Furniture, $50- Expiration of prepaid rent, $800

- Physical count of software inventory, 50 units, $1,300

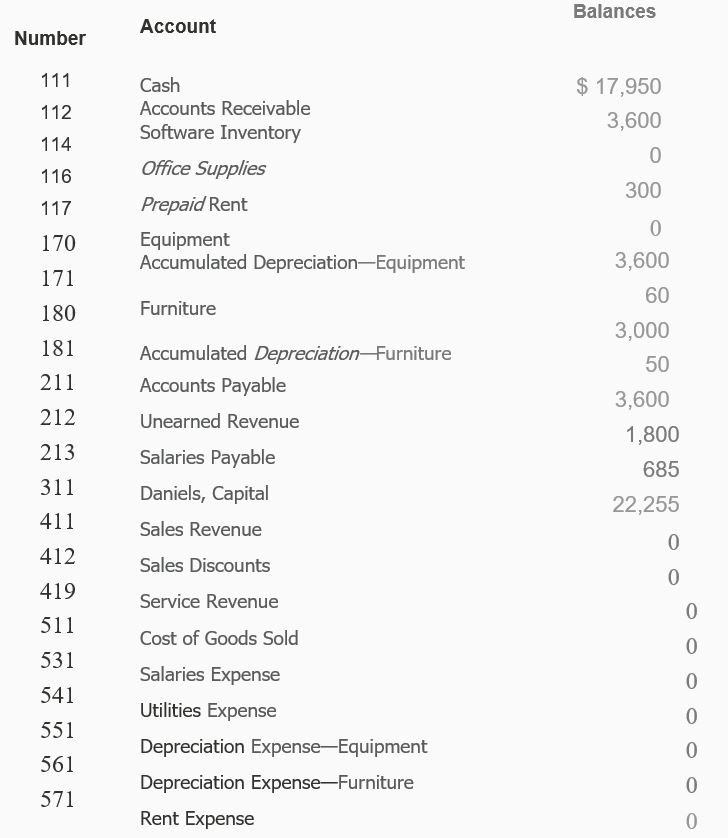

Daniels Consulting had the following

selected accounts with account numbers and normal balances:

Requirements

- Use the appropriate journal to record the preceding transactions in a sales journal (omit the Invoice No. column), a cash receipts journal, a purchases journal, a cash payments journal (omit the Check No. column), and a general journal.

- Total each column of the special journals. Show that total debits equal total credit in each special journal.

- Show how postings would be made from the journals by writing the account numbers and check marks in the appropriate places in the journals.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Accounting

- Illustration: You opened a novelty store called "The Awesome Shop" on January 1, 20x1. The following were the transactions during the year: Provided P100,000 cash as initial investment. Obtained a P50,000 loan .. Acquired furniture and fixtures for P80,000 cash. Acquired inventory on account for P60,000. (Use perpetual inventory system) Sold goods on cash basis for P200,000. The cost of sales is ?20,000. Sold goods on account for P300,000. The cost of sales is ?30,000. Paid supplies expense for P20,000 cash. Paid rent expense of P180,000. Paid utilities expense of P40,000. Collected P240,000 accounts receivable. Paid P30,000 accounts payable. Made total drawings of P25,000.arrow_forwardPLEASE SHOW SOLUTIONS IN GOOD ACCOUNTING FORM. 8. Mary Corporation has a branch in Caloocan. During 2021, the home office shipped to the branch supplies costing P156,000 at a billed price of 30% above cost. The inventories of supplies at the branch were as follows: January 1, 2021 P110,000; December 31, 2021 128,000. On December 31, 2021, the home office holds inventories of P112,800 which includes P11,500 held on consignment and which excludes P5,000 inventories out on consignment. How much is the inventories in a combined balanced sheet as of December 31, 2021?arrow_forwardJournal EntriesSelfish Gene Company is a merchandising firm. The following events occurred during themonth of May. (Note: Selfish Gene maintains a perpetual inventory system.)May 1 Received $40,000 cash as new stockholder investment.3 Purchased inventory costing $8,000 on account from Dawkins Company;terms 2/10, n/30.4 Purchased office supplies for $500 cash.4 Held an office party for the retiring accountant. Balloons, hats, andrefreshments cost $150 and were paid for with office staff contributions.5 Sold merchandise costing $7,500 on account for $14,000 to RichardCompany; terms 3/15, n/30. 8 Paid employee wages of $2,000. Gross wages were $2,450; taxes totaling$450 were withheld.9 Hired a new accountant; agreed to a first-year salary of $28,000.9 Paid $1,500 for newspaper advertising.10 Received payment from Richard Company.12 Purchased a machine for $6,400 cash.15 Declared a cash dividend totaling $25,000.18 Sold merchandise costing $13,000 for $3,000 cash and $21,000 onaccount to…arrow_forward

- II. Tan Company sells laptop computers. Inventory is maintained using the perpetual inventorysystem. All purchases of inventory are on account; accounts payable are paid in the month afterpurchase. On December 31, 2022, the inventory account had a balance of $52,500 prior toadjustment. A new accounting system was implemented in 2022 and proper accounting fortransactions around year-end was not properly controlled. Some events that occurred are asfollows.1. Laptops shipped to a customer on January 2, 2023, which cost $6,000, were included ininventory at December 31, 2022. The sale was recorded in 2023.2. Laptops costing $13,000 received December 31, 2022, were recorded as received on January2, 2023.3. Laptops received in November 2022 costing $4,200 were recorded twice in the inventoryaccount.4. Laptops shipped to a customer December 28, 2022, FOB shipping point, which cost $9,000,were not received by the customer until January 2023. The laptops were not included in theending…arrow_forward“Sharp Ltd supplies, installs and maintains burglar alarms systems for business clients. The accountant has provided a horizontal analysis and is concerned about the firm's performance.” Sharp Ltd: comparison to previous year 2017 2018 2019 Accounts receivable 1.20% 9% 8% Inventory 9% 1.7% 5% Sales -3% 1.1% 5% Non-current assets 2% 4.0% 6% Borrowings 3% 10.0% 20% 1.“Provide a brief report on the results of the analysis. Comments should include any concerns you may have.”arrow_forwardGJ started operating his new salon business (Sir George Salon) during 2017. He provides services for corporate accounts with 60-day payment term. He submits the following data in 2018: Supplies inventory, 1/1/2018 50,000 Supplies inventory, 12/31/2018 80,000 Revenues 3,000,000 Accounts receivable, Jan. 1, 2018 500,000 Accounts receivable, Dec. 31, 2018 700,000 Purchase of supplies from VAT registered entities (net) 100,000 Purchase of supplies from non-VAT registered entities 50,000 Determine the following: What is the applicable business tax for the taxpayer? How much is the correct business tax due? Assume the taxpayer is non-VAT registered, how much is the VAT payable for the year? Assume the taxpayer is VAT registered, how much is the VAT payable for the year?arrow_forward

- Supposing EQR Trading has completed the following transactions for the month of October, 2020. 1. Sale of goods to company A on credit P200,000. 2. Purchase of goods of P400,000 from company B on credit 3. Purchase of goods of P500,000from company C on credit. 4. Sales of office-use equipment of P100,000 to company D on credit. What is the total amount recorded in the Sales account for this month?arrow_forwardPSJ Electrical Trial Balance as at 31 December 2021 Sales Debit Credit 550000 Motor Van at cost 75000 Office Equipment 16800 Provision for Depreciation on Motor van 8400 Provision for Depreciation on office equipment 5400 Purchases 350380 Salaries and wages 36592 Stock: 31 January 2021 85700 Returns Inwards 13600 Carriage Inwards 6000 Bad debts 2468 Provision for bad debts 1460 General expenses 1890 Rent 5130 Insurance 4900 Motor expenses 7880 Creditors 65000 Debtors 90644 Cash at Bank 1332 Drawings: Patrick 25300 Smith 16834 Jones 12432 Current Accounts: Patrick 2780 Smith 1230 Jones 5072 Capital Accounts: Patrick 60000…arrow_forwardPSJ Electrical Trial Balance as at 31 December 2021 Sales Debit Credit 550000 Motor Van at cost 75000 Office Equipment 16800 Provision for Depreciation on Motor van 8400 Provision for Depreciation on office equipment 5400 Purchases 350380 Salaries and wages 36592 Stock: 31 January 2021 85700 Returns Inwards 13600 Carriage Inwards 6000 Bad debts 2468 Provision for bad debts 1460 General expenses 1890 Rent 5130 Insurance 4900 Motor expenses 7880 Creditors 65000 Debtors 90644 Cash at Bank 1332 Drawings: Patrick 25300 Smith 16834 Jones 12432 Current Accounts: Patrick 2780 Smith 1230 Jones 5072 Capital Accounts: Patrick 60000…arrow_forward

- E1-6 Analyzing Revenues and Expenses and Preparing an Income Statement Assume that you are the owner of Campus Connection, which specializes in items that interest students. At the end of January 2014, you find (for January only) this information: Sales, per the cash register tapes, of $150,000, plus one sale on credit (a special situation) of $2,500. With the help of a friend (who majored in accounting), you determine that all of the goods purchased during January cost $90,000 to purchase. You have $20,000 left in inventory. During the month, according to the checkbook, you paid and consumed $37,000 for salaries, rent, supplies, advertising, and other expenses; however, you have not yet paid the $900 monthly utilities for January on the store and fixtures. Required: On the basis of the data given (disregard income taxes), what was the amount of net income for January? Show computations. (Hint: A convenient form to use has the following major side captions: Revenue from Sales,…arrow_forwardE1-6 Analyzing Revenues and Expenses and Preparing an Income Statement Assume that you are the owner of Campus Connection, which specializes in items that interest students. At the end of January 2014, you find (for January only) this information: Sales, per the cash register tapes, of $150,000, plus one sale on credit (a special situation) of $2,500. With the help of a friend (who majored in accounting), you determine that all of the goods purchased during January cost $90,000 to purchase. You have $20,000 left in inventory. During the month, according to the checkbook, you paid and consumed $37,000 for salaries, rent, supplies, advertising, and other expenses; however, you have not yet paid the $900 monthly utilities for January on the store and fixtures. Required: On the basis of the data given (disregard income taxes), what was the amount of net income for January? Show computations. (Hint: A convenient form to use has the following major side captions: Revenue from Sales,…arrow_forwarde answer The following trial balance was extracted from the ledger accounts of William Enterprise, a sole proprietor as at 31 December 2019. Trial Balance as at 31 December 2019DRCR GH¢GH¢ Building, at cost650,000 Office equipment at cost135,000 Plant and Machinery263,500 Purchases248,000 Sales500,000 Inventory 1 January 201927,500 Discount allowed4,800 Returns inwards3,200 Wages and Salaries64,885 Rent5,580 Insurance6,000 Trade receivables145,000 Trade payables132,750 Bank overdraft58,956 Cash in hand5,400 Long term loan350,000 Capital 1 January 2018________517,159 1,558,8651,558,865 The following additional information as at 31 December 2019 is available:Inventory as at December 2019 was valued at GH¢24,000. Required:1.Prepare william Enterprise’s Income Statement (Profit or loss account) for the year ended 31 December 2019.2. Prepare Statement financial position as at that datearrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning