MANAGERIAL ACCOUNTING F/MGRS.

5th Edition

ISBN: 9781259969485

Author: Noreen

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7C, Problem 7C.5P

Income Taxes and

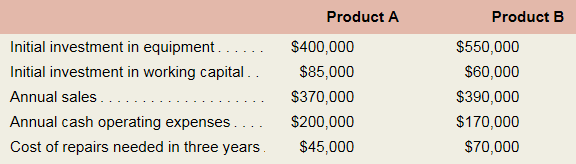

Shimano Company has an opportunity to manufacture and sell one of two new products for a five-year period. The company’s tax rate is 30% and its after-tax cost of capital is 14%. The cost and revenue estimates for each product are as follows:

Required:

- Calculate the annual income tax expense for each of Years 1 through 5 that will arise if Product A is introduced.

- Calculate the net present value of the investment opportunity pertaining to Product A.

- Calculate the annual income tax expense for each of Years 1 through 5 that will arise if Product B is introduced.

- Calculate the net present value of the investment opportunity pertaining to Product B.

- Calculate the project profitability index for Product A and Product B. Which of the two products should the company pursue? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

4a4) New equipment costs $645,000 and is expected to last for four years with no salvage value. During this time, the company will use a 30% CCA rate. The new equipment will save $155,000 annually before taxes. If the company's required rate of return is 12%, determine the PVCCATS of the purchase. Assume the half-year rule applies and a tax rate of 33%.

6. A machine could be purchased for £800,000; it would be used for 3 years and then sold for £580,000. It would qualify for capital allowances at 18% reducing balance basis with a balancing allowance or charge on disposal. The company pays tax at 20% and has a cost of capital of 10%.

What is the present value of the tax cashflow at time 1, to the nearest £100?

A £14,700

B £26,200

C £28,800

D £144,000

8. A machine could be purchased for £800,000; it would be used for 3 years and then sold for £580,000. It would qualify for capital allowances at 18% reducing balance basis with a balancing allowance or charge on disposal. The company pays tax at 20% and has a cost of capital of 10%.

What is net present value of the tax cashflows over the life of the machine, to the nearest £100?

A £6,300

B £39,400

C £52,000

D £60,200

Chapter 7C Solutions

MANAGERIAL ACCOUNTING F/MGRS.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An asset costing £20,000 is expected to last three years when it can be sold for £16,000. The tax rate is 28%, capital allowances of 20% p.a. on a reducing balance basis are available and the cost of capital is 10%. What is the tax saving in respect of the capital allowances in year 2? Question 10Select one: a. £3,000 b. £2,526 c. £896 d. £717arrow_forwardNovel Industries purchases a 41.2 million cyclo-converter. The cyclo-converter will be depreciated by 10.30 million per year over 4 years, starting this year. Suppose Nokela's tax rate is 40%. a) a. What impact will the cost of the purchase have on earnings for each of the next 4 years? b) What impact will the cost of the purchase have on the firm's cash flow for the next 4 years?arrow_forward5) Tulip plc wishes to purchase a machine costing £800,000 with an expected life of four years and a residual value of £25,000. The company can claim capital allowances on a 25 percent reducing balance basis and pays corporation tax at an annual rate of 30 percent. All tax is paid one year in arrears. If Tulip plc has a cost of capital of 10 percent, what is the present value of the capital allowance tax benefits (to the nearest £1,000)? A) £199,000 B) £181,000 C) £165,000 D) £121,000arrow_forward

- CLTV Section A company secured a contract that will result in income payments received of $280,000 today, $400,000 in 2 years and $600,000 in 5 years (these are single or lump sum payments they get). The expenses or outflows will include payments of $10,000 at the beginning of every month for 6 years and a one-time payment (expense) of $50,000 in one year from today. If the cost of money is 17% compounded annually, determine the Net Present Value (NPV) of the contract. a)What is the PV of the inflows? b) What is the PV of the outflows? c) What is the Net Present Value (NPV)?arrow_forward4 b) Your company wants to purchase a phtostat machine which costs RM15,000. It will be obsolee in 5 years. Your opttions are to borrow the money at 10 percent or to lease the machine. If you lease the payment will be RM2,500 per year, payable at the end of each of the next five yaers. If you purchase the machine it will depreciate ar a straight-line basis. The tax rate is 34 percent. Prepare a table and calculate to justify whether you should lease or buy.arrow_forwardH5 Printing World thinks it may need a new colour printing press. The press will cost $470,000 but will substantially reduce annual operating costs by $232,000 a year, before tax. The press has a 35% CCA rate and will be in its own asset pool. The first CCA deduction is made in year 0. The press will operate for 4 years and then be worthless. The cost of equity for Printing World is 11%, the cost of debt is 8%, and the company’s target debt-equity ratio is 1.00. The company’s tax rate is 35%. a. What is the NPV of buying the press? (Do not round intermediate calculations. Round your answer to the nearest dollar.) b. The equipment manufacturer is offering to lease the press for $115,000 a year, for 4 years, payable in advance. Should Printing World accept the offer?arrow_forward

- SLO 6.2. For an organization with revenue of $100 million, purchases of $60 million, and profit of $8 million before tax, a 10 percent reduction in purchase spend would result in an increase in profit of: a.10 percentb.36 percentc.57 percentd.60 percente.75 percentarrow_forwardSon.1 Mesa Media is evaluating a project to help increase sales. The project costs $650,000 and has an IRR equal to 10 percent. The project is divisible, which means any portion can be purchased. Mesa can raise up to $100,000 in new debt at a before-tax cost (rd) equal to 6 percent; additional debt will cost 8 percent before taxes. Mesa expects to retain $472,000 of its earnings this year to support the purchase of the project. Mesa's cost of retained earnings is 11 percent, and its cost of new common equity is 15 percent. Its target capital structure consists of 20 percent debt and 80 percent common equity. If Mesa's marginal tax rate is 40 percent, how much of the project should be purchased? Round your answer to the nearest dollar.arrow_forward1. A company is considering whether to purchase a new machine. Machines A and B are available for RM92,000 each. Earnings after taxation are as follows: Years Machine A (RM) Machine B (RM) 1 34,000 18,000 2 32,000 24,000 3 40,000 32,000 4 24,000 48,000 5 16,000 32,000 By using a discount rate of 10%, you are required to evaluate the two alternatives using the following: a. Payback method, and b. Net present value method. a.Payback method, and b. Net present value method.arrow_forward

- C Corp. faces a marginal tax rate of 35 percent. One project that is currently under evaluation has a cash flow in the fourth year of its life that has a present value of P10,000 (after-tax). C Corp. assumes that all cash flows occur at the end of the year and the company uses 11 percent as its discount rate. What is the pre-tax amount of the cash flow in year 4? (Round final answer to the nearest dollar.)arrow_forwardNokela Industries purchases a $42.0 million cyclo-converter. The cyclo-converter will be depreciated by $10.5 million per year over four years, starting this year. Suppose Nokela's tax rate is 25%. a. What impact will the cost of the purchase have on earnings for each of the next four years? b. What impact will the cost of the purchase have on the firm's cash flow for the next four years? a. What impact will the cost of the purchase have on earnings for each of the next four years? Earnings will ▼ by $enter your response here million each year for four years. (Select from the drop-down menu and round to one decimal place.) Part 2 b. What impact will the cost of the purchase have on the firm's cash flow for the next four years? The impact on the firm's cash flow in year 1 is $enter your response here million. (Round to one decimal place.) Part 3 The impact on the firm's cash flow in years two through four is $enter your response here million. (Round to one decimal place.)arrow_forwardThe annual FC amounted to P798,000. At present, the contribution margin ratio is 42%. Determine the amount of sales if the desired profit is P173,800 net of the ff. tax rates: For the first P100,000 25% In excess of P100,000 35%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License