CONNECT ONLINE ACCESS F/MANAGERIAL ACC.

6th Edition

ISBN: 9781264445356

Author: Noreen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7C, Problem 7C.5P

Income Taxes and

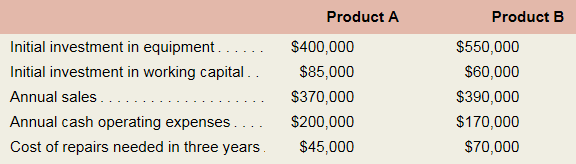

Shimano Company has an opportunity to manufacture and sell one of two new products for a five-year period. The company’s tax rate is 30% and its after-tax cost of capital is 14%. The cost and revenue estimates for each product are as follows:

Required:

- Calculate the annual income tax expense for each of Years 1 through 5 that will arise if Product A is introduced.

- Calculate the net present value of the investment opportunity pertaining to Product A.

- Calculate the annual income tax expense for each of Years 1 through 5 that will arise if Product B is introduced.

- Calculate the net present value of the investment opportunity pertaining to Product B.

- Calculate the project profitability index for Product A and Product B. Which of the two products should the company pursue? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

QUESTION 1

A new machine is to be purchased for $200,000. The company believes it will generate $75,000 annually in

revenue due to the purchase of this machine. The company will have to train an operator to run this

machine and this will result in additional labor expenses of $25,000 annually. The new machine will be

depreciated using 5 years MACRS, even though the life of the project is 7 years, and the salvage value is

estimated to be $0 at the end of year 7. The tax rate is 40% and the company's MARR is 15%.

b.

eBook

The Lesseig Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next a

years, Machine A has an after-tax Jost of $8.7 million but will provide after-tax inflows of $4.9 million per year for 4 years. If Machine A were replaced, es

after-tax cost would be $9.9 million due to inflation and its after-tax cash inflows would increase to $5.4 million due to production efficiencies Machine has

an after-tax cost of $13 million and will provide after-tax inflows of $4.2 million per year for 8 years. If the WACC is 8%, which machine should be acquired?

Explain, Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round

your answers to two decimal places.

is the better project and will increase the company's value by $

Machine A

Machine B

V

millions, rather than the s

11.14 millions created by

Question

1-

A $12,000 investment will return annual benefit for six yearswith no salvage value at the end of six years. Assumestraight line depreciation and a 46% tax rate and the inflationrate is 5%. What is the inflation free after tax rate ofreturn on the investment if the annual benefits are $2,918 intoday’s dollars?

a. 10.18%

b. 4.94%

c. 5%

d. 8.20%

Chapter 7C Solutions

CONNECT ONLINE ACCESS F/MANAGERIAL ACC.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aa.14 Allegience Insurance Company’s management is considering an advertising program that would require an initial expenditure of $177,085 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is $82,000, with associated expenses of $28,500. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience’s tax rate is 30 percent. (Hint: The $177,085 advertising cost is an expense.)Required:1. Compute the payback period for the advertising program.2. Calculate the advertising program’s net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final answer to the nearest whole dollar.)arrow_forwardRework Problem 12.11, assuming the following additional information:• For tax purposes, the entire cost of $30,000 can be depreciated according toa five-year MACRS property class.• The firm's marginal tax rate is 40%.arrow_forwardA company has wants to earn an income of $60,000 after-taxes. If the tax rate is 32%, what must be the companys pre-tax income in order to have $60,000 after-taxes? A. $88,235 B. $19,200 C. $79,200 D. $143,000arrow_forward

- Problem 03.013- Annual worth calculations What is the equivalent annual cost in years 1 through 8.00 of a contract that has a first cost of $62,000 in year 0 and annual costs of $20,000 in years 3 through 8.00? Use an interest rate of 9.00% per year. (Round the final answer to three decimal places.) The equivalent annual cost is determined to be $arrow_forward1. You have the following information Interest charges = JD 50 000 per year Tax rate = 40% Net Income= JD 90 000 Required: What is the fim's times-interest-earned (TIE) ratio?arrow_forwardQuestion: You have a customer who has a 620 fico score and their preferred product requires you to add 1/8th percent to the interest rate of 6 3/4% (30 year fixed rate). What is the P&I payment for this customer if they are putting 10% down on a sales price of $195,000? a. $1,152.91 b. $1,109.28 c. $1,138.29 d. $1,167.61 Please answer with explanation I will really upvotearrow_forward

- Purchase price $800,000 LTV 75% Term & Am 15 years Interest rate 4% Closing costs $12,000 Holding period 6 years Annual income taxes (below) Marginal tax rate 30% (aka ordinary inc tax) Taxes due on sale $200,000 Discount rate (before tax) 15% Selling expenses 3% Exit cap rate 5% Operations YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 YEAR 7 NOI $ 33,000 $ 38,000 $ 41,000 $ 47,000 $ 51,000 $ 56,000 $61,000 САРЕХ $ (5,000) $_(6,000) $ (Z,000) $(8,000) $ (9,000) $(10,000) PBTCF $ 28,000 $ 32,000 $34,000 $ 39,000 $ 42,000 $ 46,000 Income taxes on annual $ (5,000) $ (6,000) $ (7,000) $ (8,000) $ (9,000) $ (10,000) operations What is the before tax IRR for this investment? 20.05% O None of these are correct O -17.23 % O 20.23 % 19.09 %arrow_forwardAnsel Accounting Firm rents an office space for $250,000 per year which is due at the beginning of each year. If the hurdle rate of Ansel Accounting Firm is 10%, how much is the present value of five years' worth of rent? a. $1,042,466.36 b. $402,627.50 c. $155,230.33 d. $170,753.36arrow_forwardIf Yörsan Dairy Product's machine operating cost is $45,341 per year for years 1 through 3 and then it increases by 4 % per year through year 15, which one of the following is closest to the year-zero present worth of the machine operating cost at an interest rate of 12% per year? Select one: a. 356,038 b. 351,548 c. 375,935 d. 409,082 e. 316,206arrow_forward

- Suppose you sell a fixed asset for $10,000 when its book value is $2,000. If your company's marginal tax rate is 21 percent, what will be the effect on cash flows of this sale (i.e., what will be the after - tax cash flow of this sale )? Multiple Choice $3, 680 $8, 320 $420 $6,500arrow_forwardEffective Cost of Trade Credit The D.J. Masson Corporation needs to raise $600,000 for 1 year to supply working capital to a new store. Masson buys from its suppliers on terms of 2/10, net 70, and it currently pays on the 10th day and takes discounts. However, it could forgo the discounts, pay on the 70th day, and thereby obtain the needed $600,000 in the form of costly trade credit. What is the effective annual interest rate of this trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places. Cost of Bank loan Mary Jones recently obtained an equipment loan from a local bank. The loan is for $22,000 with a nominal interest rate of 14%. However, this is an installment loan, so the bank also charges add-on interest. Mary must make monthly payments on the loan, and the loan is to be repaid in 1 year. What is the effective annual rate on the loan (assuming a 365-day year)? Do not round intermediate calculations. Round your answer…arrow_forwardQ) Lucid images ltd manufactures premium high definition television. The firm's fixed costs are $4,000,000 per year. The variable cost of each TV is $2,000, and the TVs are sold for $3,000 each. The company sold 5,000 Tvs during the previous year.( In the following requirements, ignore income taxes). Required: Treat each of the requirements as independent situations: (a) Calculate the break-even point in units. (b) What will the new break-even point be if fixed costs increase by 10 percent? (c) What was the company's net profit for previous year? (d) The sals manager believes that a reduction in the sales price to $2,500 will result in orders for 1,200 more TVs each year. What will the break-even point be if the price is changed?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License