To calculate: The rate of crossover for two projects and sketch the NPV profile.

Introduction:

The

Answer to Problem 11QP

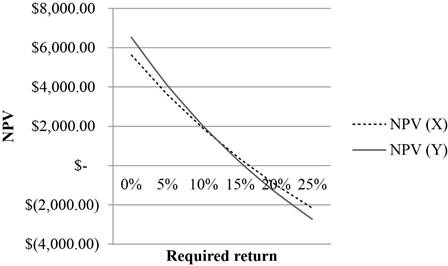

The crossover rate for the two projects is 11.95%. The NPV profiles shows that both projects have a higher NPV for the rate of discount below 11.95% and have a lower NPV for the rate above 11.95%.

Explanation of Solution

Given information:

The details of 2 projects are provided. The cash flows of Project X for year 1, year 2, and year 3, are $10,800, $8,630, and $5,210 respectively. The initial investment is -$19,000. The Project Y cash flows for 4 years are $6,840, $9,410, $9,300 respectively and the initial investment is -$19,000.

Note:

- NPV is the difference between the present values of the cash inflows and the present value of the cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equals zero. Hence, using the available information, assume that NPV is equal to zero and form an equation to compute the IRR.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

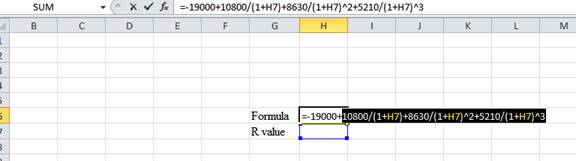

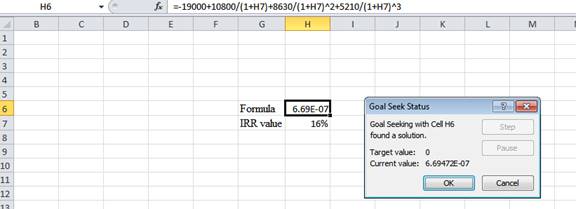

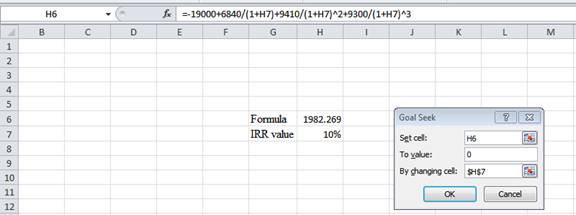

Compute IRR for Project X using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

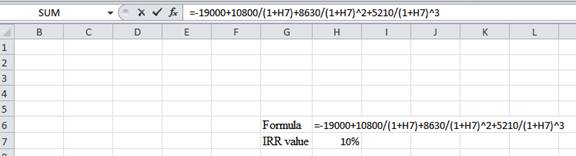

Step 2:

- Assume the IRR value as 10%.

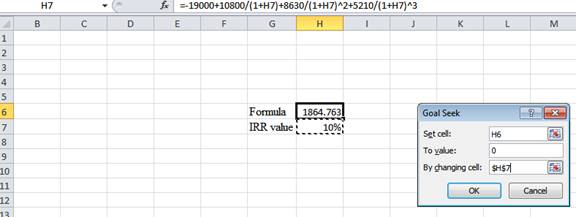

Step 3:

- In the spreadsheet, go to data and select the What-if analysis

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

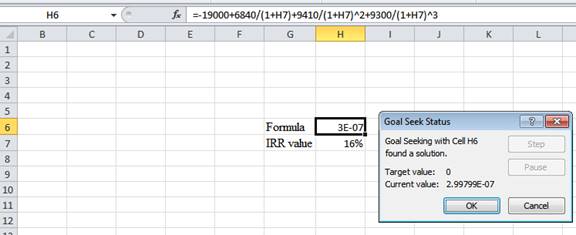

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRR value.

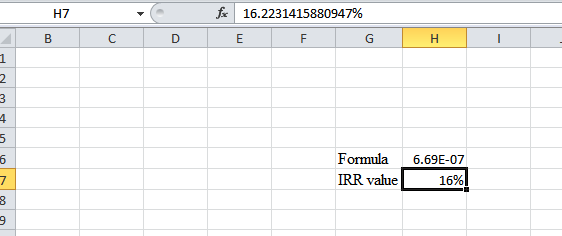

Step 5:

- The value appears to be 16.2231415880947%.

Hence, the IRR value is 16.22%.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

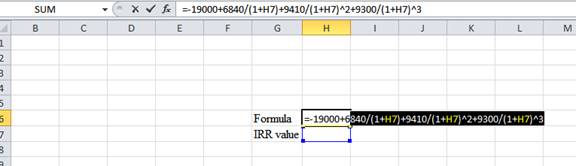

Compute IRR for Project Y using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 10%.

Step 3:

- In the spreadsheet, go to data and select the What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRR value.

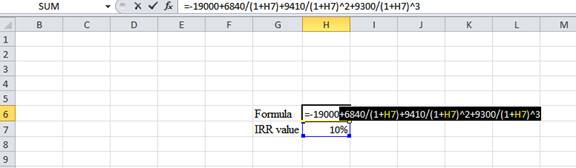

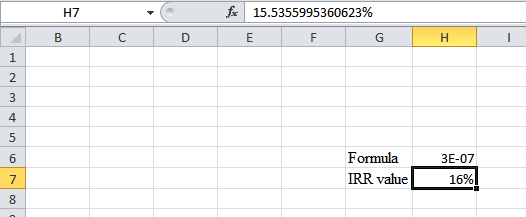

Step 5:

- The value appears to be 15.5355995360623%.

Hence, the IRR value is 15.53%.

Formula to compute the crossover rate:

Equation of crossover rate to compute R:

Where,

“R” denotes the crossover rate.

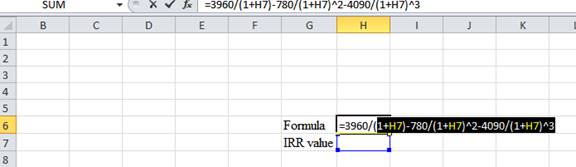

Compute R using a spreadsheet:

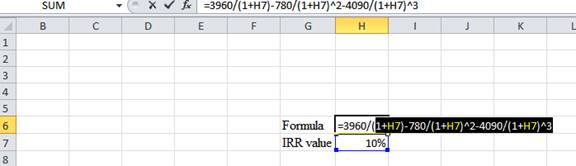

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

- Assume the IRR value as 10%.

Step 3:

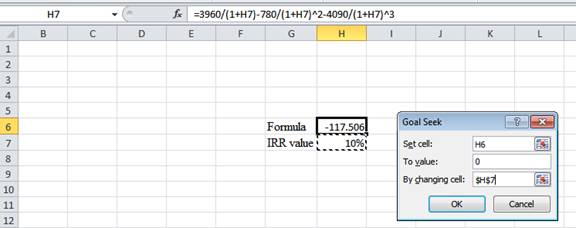

- In the spreadsheet, go to data and select the What-if analysis.

- In What-if analysis, select Goal Seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for “By changing cell”.

Step 4:

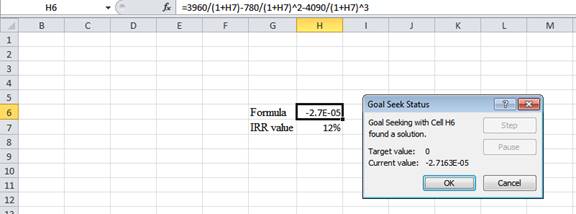

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears with the IRR value.

Step 5:

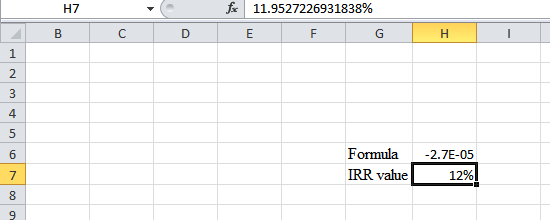

- The value appears to be 11.9527226931838%.

Hence, the R-value is 11.95%.

Formula to calculate the NPV:

Note: As the discount rate is over a range of 0% to 25%, calculate NPV for 0%, 5%, 10%, 15%, 20%, and 25%.

Compute the NPV with the discount rate of 0% for Project X:

Compute the NPV with the discount rate of 0% for Project Y:

Hence, the NPV for Project X and Y at 0% are $5,640 and $6,550 respectively.

Compute the NPV with the discount rate of 5% for Project X:

Compute the NPV with the discount rate of 5% for Project Y:

Hence, the NPV for Project X and Y at 5% are $3,613.972 and $4,083.12 respectively.

Compute the NPV with the discount rate of 10% for Project X:

Compute the NPV with the discount rate of 10% for Project Y:

Hence, the NPV for Project X and Y at 10% are $1,864.76 and $1,982.26 respectively.

Compute the NPV with the discount rate of 15% for Project X:

Compute the NPV with the discount rate of 15% for Project Y:

Hence, the NPV for Project X and Y at 15% are $342.48 and $178.03 respectively.

Compute the NPV with the discount rate of 20% for Project X:

Compute the NPV with the discount rate of 20% for Project Y:

Hence, the NPV for Project X and Y at 20% are -$991.89 and -$1,383.33 respectively.

Compute the NPV with the discount rate of 25% for Project X:

Compute the NPV with the discount rate of 25% for Project Y:

Hence, the NPV for Project X and Y at 25% are -$2,169.28 and -$2,744 respectively.

NPV profile:

Want to see more full solutions like this?

Chapter 8 Solutions

ESSENTIALS OF CORP.FIN.-W/CODE >CUSTOM<

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education