To determine: The price of the bonds after 1 year, 3 years, 8 years, 12 years and 13 years and prepare a graph of bond prices versus time to maturity.

Yield to Maturity:

The yield to maturity is the total yield or return, which is derived from a bond until the time of the maturity. For this, it is assumed that the bond will be held until its maturity and would not be called.

Effective Annual Rate:

The effective annual rate is the rate, which is incurred or received on various investment or loans. The effective annual rate is affected by the increase in compounding years.

Current Yield:

The current yield represents the return on the bond, which is held by the owner for a year. The current yield is calculated by dividing the annual cash inflow from the current market price.

Explanation of Solution

Solution:

Given,

For M Company,

The bond is a premium bond and makes semi-annual payments.

The coupon rate is 8.5%.

The yield to maturity is 7%.

The maturity period is 13 years.

For MG Company,

The bond is a discount bond and makes semi-annual payments.

The coupon rate is 7%.

The yield to maturity is 8.5%.

The maturity period is 13 years.

Calculation of the value of the bond after 1 year:

The formula to calculate the value of the bond is,

For M Company,

Substitute $42.5 for interest value, $1,000 for the interest value, 1.9 for

The value of the bond is $1,014.25.

For MG Company,

Substitute $35 for interest value, $1,000 for the interest value, 1.88 for

The value of the bond is $985.9.

Calculation of the value of bond after 3 years:

For M Company,

Substitute $42.5 for interest value, $1,000 for the interest value, 5.329 for

The value of the bond is $1,039.98.

For MG Company,

Substitute $35 for interest value, $1,000 for the interest value, 5.2 for

The value of the bond is $961.

Calculation of the value of bond after 8 years:

For M Company,

Substitute $42.5 for interest value, $1,000 for the interest value, 12.094 for

The value of the bond is $1,089.695.

For MG Company,

Substitute $35 for interest value, $1,000 for the interest value, 11.44 for

The value of the bond is $914.1.

Calculation of the value of bond after 12 years:

For M Company,

Substitute $42.5 for interest value, $1,000 for the interest value, 16.06 for

The value of the bond is $1,120.45.

For MG Company,

Substitute $35 for interest value, $1,000 for the interest value, 14.86 for

The value of the bond is $888.3.

Calculation of the value of the bond after 13 years:

For M Company,

Substitute $42.5 for interest value, $1,000 for the interest value, 16.89 for

The value of the bond is $1,126.625.

For MG Company,

Substitute $35 for interest value, $1,000 for the interest value, 15.57 for

The value of the bond is $853.75.

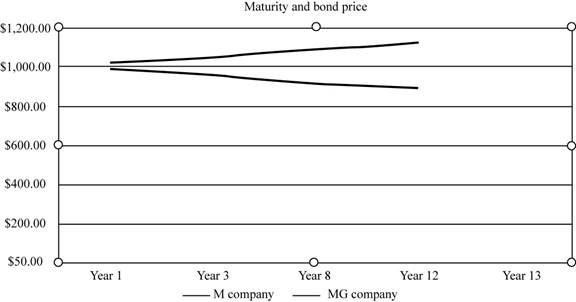

The graph showing the change in the value of bonds with the maturity period is:

Fig 1

- The graph shows the change in the price of bonds with the maturity period.

- The x-axis shows the years of maturity.

- The y-axis shows the price of the bond.

- The value of the bonds of M Company increases with time.

- The value of the bonds of MG Company decreases with time.

Working note:

Calculation of the semi-annual interest for M Company:

The semi-annual interest is $42.5.

Calculation of the semi-annual interest for MG Company:

The semi-annual interest is $35.

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Calculation of the

Thus, the value of the bonds of M Company after 1 year is $1,014.25, after 3 years is $1,039.98, after 8 years is $1,089.695, after 12 years is $1,120.45, and after 13 years is $1,126.625 and the value of the bonds of MG Company after 1 year is $985.9, after 3 years is $961, after 8 years is $914.10, after 12 years is $888.3, and after 13 years is $853.75.

Want to see more full solutions like this?

Chapter 8 Solutions

CORPORATE FIN.(LL)-W/ACCESS >CUSTOM<

- Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. What is the price of the bonds?arrow_forwardInterest Rate Sensitivity A bond trader purchased each of the following bonds at a yield to maturity of 8%. Immediately after she purchased the bonds, interest rates fell to 7%. What is the percentage change in the price of each bond after the decline in interest rates? Assume annual coupons and annual compounding. Fill in the following table:arrow_forwardCurrent Yield with Semiannual Payments A bond that matures in 7 years sells for $1,020. The bond has a face value of $1,000 and a yield to maturity of 10.5883%. The bond pays coupons semiannually. What is the bond’s current yield?arrow_forward

- Bond Valuation and Changes in Maturity and Required Returns Suppose Hillard Manufacturing sold an issue of bonds with a 10-year maturity, a 1,000 par value, a 10% coupon rate, and semiannual interest payments. a. Two years after the bonds were issued, the going rate of interest on bonds such as these fell to 6%. At what price would the bonds sell? b. Suppose that 2 years after the initial offering, the going interest rate had risen to 12%. At what price would the bonds sell? c. Suppose that 2 years after the issue date (as in Part a) interest rates fell to 6%. Suppose further that the interest rate remained at 6% for the next 8 years. What would happen to the price of the bonds over time?arrow_forwardBond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of 1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:arrow_forwardYield to Maturity and Yield to Call Arnot International’s bonds have a current market price of $1,200. The bonds have an 11% annual coupon payment, a $1,000 face value, and 10 years left until maturity. The bonds may be called in 5 years at 109% of face value (call price = $1,090). What is the yield to maturity? What is the yield to call if they are called in 5 years? Which yield might investors expect to earn on these bonds, and why? The bond’s indenture indicates that the call provision gives the firm the right to call them at the end of each year beginning in Year 5. In Year 5, they may be called at 109% of face value, but in each of the next 4 years the call percentage will decline by 1 percentage point. Thus, in Year 6 they may be called at 108% of face value, in Year 7 they may be called at 107% of face value, and so on. If the yield curve is horizontal and interest rates remain at their current level, when is the latest that investors might expect the firm to call the bonds?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning