Interest Rate Risk Laurel, Inc., and Hardy Corp. both have 6.5 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. The Laurel, Inc., bond has 3 years to maturity, whereas the Hardy Corp. bond has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? If interest rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of these bonds be then? Illustrate your answers by graphing

To determine:The percentage change in the price of the bonds in the given situations and the graph showing the changes.

Coupon Rate:

The coupon rate refers to the rate at which interest is earned on the face value of a bond every year. This is the rate at which yield is funded from a fixed-income security.

Yield to Maturity:

The yield to maturity is the total yield or return which is derived from a bond until the time of the maturity. For this, it is assumed that the bond will be held until the maturity and would not be called.

Interest Rate Risk:

The interest rate risk refers to the risk which is associated with a bond because of the fluctuations of the interest rate. The value of the bond differs with the change in the interest rate.

Explanation of Solution

Given,

The yield to maturity of the bonds of both companies is 6.5%.

The bonds of L Company mature after 3 years.

The bonds of H Company mature after 20 years.

Calculation of the change in the price of bonds when the interest rate is increased by 2%:

The formula to calculate the change in price is,

For L company,

Substitute $947.47(refer working note) for the new price and $1,000 for the original pricein the above formula.

The change in bonds price is (5.25%).

For H company,

Substitute $809 (refer working note) for the new price and $1,000 for the original price in the above formula.

The change in bonds price is (19.1%).

Calculation of the change in the price of bonds when the interest rate is decreased by 2%:

The formula to calculate the change in price is,

For L company,

Substitute $1.055.51 (refer working note) for the new price and $1,000 for the original price in the above formula.

The change in bonds price is 5.55%.

For H company,

Substitute $1,262.31 (refer working note) for the new price and $1,000 for the original price in the above formula.

The change in bonds price is 26.23%.

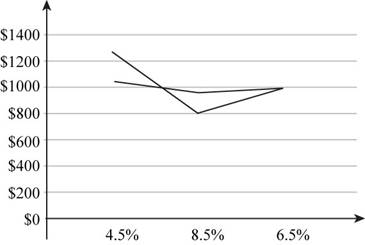

The graph showing the changes in the price is:

Fig 1

- The graph shows the change in prices of the L Company and H Company.

- The x-axisrepresents the yield to maturity.

- The y-axisrepresents the value of the bonds.

- The line in the graph shows the change in the prices of the bond with the increase and decrease in the yield to maturity.

Working note:

Calculation of thesemi-annual interest on bonds of L Company,

The semi-annual interest is $32.5.

Calculation of the semi-annual interest on bonds of H Company,

The semi-annual interest is $32.5.

Calculation of the price of bonds if yield to maturity is 8.5%:

For L Company,

The value of the bond is $947.97.

For H Company,

The value of the bond is $809.

Calculation of the price of bonds if yield to maturity is 4.5%:

For L Company,

The value of the bond is $1,055.51.

For H Company,

The value of the bond is $1,262.31.

Calculation of

Calculation of

Calculation of

Calculation of

Calculation of

Calculation of

Calculation of

Calculation of

Thus, the percentage change in price when the rate is increased by 2% for L Company is 5.25%and for H Company is19.1%. The percentage change in price when the rate is decreased by 2% for L Company is5.55% and for H Company is 26.23%.

Want to see more full solutions like this?

Chapter 8 Solutions

CORPORATE FINANCE (LL)-W/ACCESS

- Yield to Maturity and Yield to Call Arnot International’s bonds have a current market price of $1,200. The bonds have an 11% annual coupon payment, a $1,000 face value, and 10 years left until maturity. The bonds may be called in 5 years at 109% of face value (call price = $1,090). What is the yield to maturity? What is the yield to call if they are called in 5 years? Which yield might investors expect to earn on these bonds, and why? The bond’s indenture indicates that the call provision gives the firm the right to call them at the end of each year beginning in Year 5. In Year 5, they may be called at 109% of face value, but in each of the next 4 years the call percentage will decline by 1 percentage point. Thus, in Year 6 they may be called at 108% of face value, in Year 7 they may be called at 107% of face value, and so on. If the yield curve is horizontal and interest rates remain at their current level, when is the latest that investors might expect the firm to call the bonds?arrow_forwardInterest Rate Sensitivity A bond trader purchased each of the following bonds at a yield to maturity of 8%. Immediately after she purchased the bonds, interest rates fell to 7%. What is the percentage change in the price of each bond after the decline in interest rates? Assume annual coupons and annual compounding. Fill in the following table:arrow_forwardBond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. What is the price of the bonds?arrow_forward

- Current Yield for Annual Payments Heath Food Corporations bonds have 7 years remaining to maturity. The bonds have a face value of 1,000 and a yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield?arrow_forwardDeterminant of Interest Rates The real risk-free rate of interest is 4%. Inflation is expected to be 2% this year and 4% during each of the next 2 years. Assume that the maturity risk premium is zero. What is the yield on 2-year Treasury securities? What is the yield on 3-year Treasury securities?arrow_forwardBond Value as Maturity Approaches An investor has two bonds in his portfolio. Each bond matures in 4 years, has a face value of 1,000, and has a yield to maturity equal to 9.6%. One bond, Bond C, pays an annual coupon of 10%; the other bond, Bond Z, is a zero coupon bond. Assuming that the yield to maturity of each bond remains at 9.6% over the next 4 years, what will be the price of each of the bonds at the following time periods? Fill in the following table:arrow_forward

- Bond Valuation and Interest Rate Risk The Garraty Company has two bond issues outstanding. Both bonds pay 100 annual interest plus 1,000 at maturity. Bond L has a maturity of 15 years, and Bond S has a maturity of 1 year. a. What will be the value of each of these bonds when the going rate of interest is (1) 5%, (2) 8%, and (3) 12%? Assume that there is only one more interest payment to be made on Bond S. b. Why does the longer-term (15-year) bond fluctuate more when interest rates change than does the shorter-term bond (1 year)?arrow_forwardDefault Risk Premium A Treasury bond that matures in 10 years has a yield of 6%. A 10-year corporate bond has a yield of 9%. Assume that the liquidity premium on the corporate bond is 0.5%. What is the default risk premium on the corporate bond?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT