To discuss: The annual average return and standard deviation.

Introduction:

In financial context, return is seen as percentage that represents the profit in an investment.

Explanation of Solution

Determine the annual average returns of MM fund:

Annual average returns can be computed by dividing sum of returns and number of years considered.

Hence, the annual average return of MM fund is 24.325%

Determine the expected return of Market index SP:

Hence, the annual average return of Market index SP is 14.925%.

Therefore, annual average return of MM fund is better than the annual average return of Market index SP over the given period of time.

Determine the money at the end of 2012 in MM fund:

It is calculated by multiplying the investment with the value attained by adding one with annual average return of MM fund.

Hence, the money at the end of 2012 in MM fund is $1,243.25.

Determine the money at the end of 2012 in Market index SP:

It is calculated by multiplying the investment with the value attained by adding one with annual average return of Market index SP.

Hence, the money at the end of 2012 in MM fund is $1,149.25.

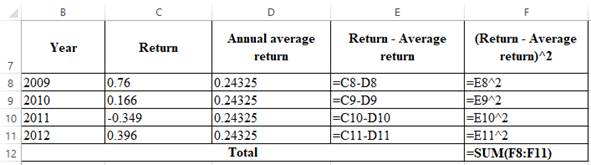

Compute standard deviation of MM fund:

| Year | Return | Average return | Return - Average return | (Return - Average return)^2 |

| 2009 | 76.00% | 24.325% | 51.68% | 0.2670 |

| 2010 | 16.60% | 24.325% | -7.73% | 0.0060 |

| 2011 | -34.90% | 24.325% | -59.23% | 0.3508 |

| 2012 | 39.60% | 24.325% | 15.28% | 0.0233 |

| Total | 0.6471 | |||

Computation of standard deviation:

The standard deviation of MM fund should be calculated as follows:

Hence, the standard deviation of MM fund is 46.44%

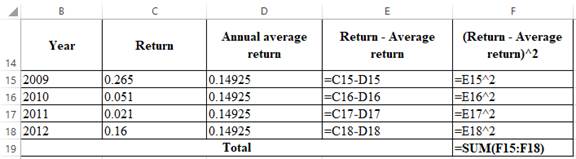

Compute standard deviation of Market index SP:

| Year | Return | Average return | Return - Average return | (Return - Average return)^2 |

| 2009 | 26.50% | 14.925% | 11.58% | 0.0134 |

| 2010 | 5.10% | 14.925% | -9.83% | 0.0097 |

| 2011 | 2.10% | 14.925% | -12.83% | 0.0164 |

| 2012 | 16.00% | 14.925% | 1.08% | 0.0001 |

| Total | 0.0396 | |||

Computation of standard deviation:

The standard deviation of Market index SP should be calculated as follows:

Hence, the standard deviation of Market index SP is 11.49%

Therefore, MM fund is more volatile than Market index SP according to the value of standard deviation.

Want to see more full solutions like this?

Chapter 8 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education