FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

6th Edition

ISBN: 9781260529326

Author: Kapoor

Publisher: McGraw-Hill Publishing Co.

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 8, Problem 1P

Summary Introduction

To determine: The claim amount that would not be covered by insurance.

Expert Solution & Answer

Explanation of Solution

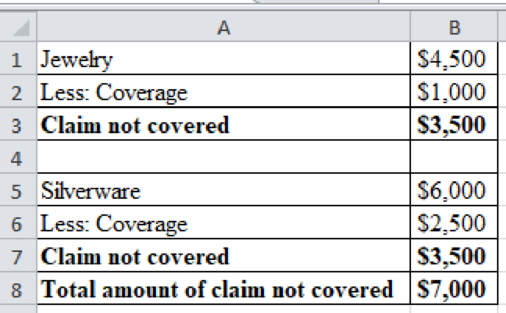

Compute the uncovered claim amount by insurance:

Excel spread sheet:

Hence claim amount that would not be covered by insurance is $7,000.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Most home insurance policies cover jewelry for 1,000 and silverware for 2,500 unless items are covered with additional insurance. If 4,500 worth of jewelry and 6,000 worth of silverware were stolen from a family, what amount of the claim would not be covered by insurance?

Most home insurance policies cover jewelry for $2,000 and silverware for $5,000 unless items are covered with additional insurance. If $9,000 worth of jewelry and $12,000 worth of silverware were stolen from a family without additional insurance, what amount of the claim would not be covered by insurance?

Home insurance policies may cover jewelry for $1,000 and silverware for $2,500 unless these items are covered with additional insurance. If $3,300 worth of jewelry and $2,100 worth of silverware were stolen from a family, and the policy has a deductible of $1,000, what amount of the claim would not be covered by insurance?

Chapter 8 Solutions

FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Rosa Valencia has a personal automobile policy (PAP) with coverage of $25,000/$50,000 for bodily injury liability, $10,000 for property damage liability that includes coverage for her vehicle, $5,000 for medical payments, and a $500 deductible for collision insurance. How much will her insurance cover in each of the following situations? Will she have any out-of-pocket costs? Rosa loses control when she swerves to miss a dog on the street, running into a parked car and causing $5,300 damage to the unoccupied vehicle and $3,750 damage to her own car. Rosa pulls out in front of another car and causes a serious auto accident, badly injuring three people. The injured parties win lawsuits against her for $35,000 for one individual, and the other two passengers claimed $5,000 each ($10,000 total). Rosa’s 16-year-old daughter borrows her car. She runs off the road when texting while driving and causes $450 damage to the car.arrow_forwardZachary Lee has a personal automobile policy (PAP) with coverage of $25,000/$50,000 for bodily injury liability, $25,000 for property damageliability, $5,000 for medical payments, and a $500 deductible for collision insurance. How much will his insurance cover in each of the following situations? Will he have any out-of-pocket costs?a. Zachary loses control and skids on ice, running into a parked car and causing $3,785 damage to the unoccupied vehicle and $2,350 damage to his own car.b. Zachary runs a stop sign and causes a serious auto accident, badly injuring two people. The injured parties win lawsuits against him for $30,000 each.c. Zachary’s 18-year-old son borrows his car. He backs into a telephone pole and causes $450 damage to the car.arrow_forwardWhile driving Mohamed's car Sarah accidentally crashed and hit a house, the loss costs a total of 2,033. If in this case Mohamed's insurance policy acted as the primary with a limit of 743, while Sarah's policy acts as the excess and has a limit of 3,663. In this case how much will Sarah's insurance policy pay?arrow_forward

- Mary owns a home with a with a replacement value of $331,195. She purchased home insurance in the amount of $200,000, and therefore does not meet the 80% rule. If Mary's deductible is $3,000 and a BBQ fire caused $75,000 worth of damage, how much will Mary have to pay herself?arrow_forwardIvy Gordon's home in Charleston was recently gutted in a fire. Her living and dining rooms were destroyed completely, and the damaged personal property had a replacement price of $36,000. The average age of the damaged personal property was 5 years, and its useful life was estimated to be 13 years. What is the maximum amount the insurance company would pay Ivy, assuming that it reimburses losses on an actual cash-value basis and has a $500 deductible? Assume that the total coverage requirement is met. Do not round intermediate calculations. Round the answer to the nearest cent.arrow_forwardCarolina's house burned and she lost household items worth a total of $50,000. House insured for $160,000, homeowner's policy coverage personal belongings up to 55% of insured value of the house.Calculate how much insursance coverage policy provides personal belongings and will she recieve payment for belongings?arrow_forward

- Virginia has business property that is stolen and partially destroyed by the time it was recovered. She receives an insurance reimbursement of $6,000 on property that had a $14,000 basis and a decrease in market value of $10,000 due to damage caused by the theft. What is the amount of Virginia's casualty loss? $14,000 $8,000 $10,000 $4,000 None of the abovearrow_forwardWhich of the following items would be included in the gross income of the recipient? Insurance payments for medical care of a dependent child Insurance payments for loss of the taxpayer's sight Season tickets worth $2,000 given to a son by his father Payments to a student for working at the student union food court Lodging provided to a worker on a remote oil rigarrow_forwardVirginia has business property that is stolen and partially destroyed by the time it was recovered. She receives an insurance reimbursement of $5,000 on property that had a $14,000 basis and a decrease in market value of $10,000 due to damage caused by the theft. What is the amount of Virginia's casualty loss? a.$4,000 b.$5,000 c.$14,000 d.$10,000 e.None of these choices are correct.arrow_forward

- Eva Stone's home in Chicago was recently gutted in a fire. Her living and dining rooms were destroyed completely, and the damaged personal property had a replacement price of $19,000. The average age of the damaged personal property was 8 years, and its useful life was estimated to be 18 years. What is the maximum amount the insurance company would pay Eva, assuming that it reimburses losses on an actual cash-value basis? Round the answer to the nearest cent.arrow_forwardYou damage your car in an accident that is covered by your collision insurance, which has a $200 deductible. If the damage to your car costs $1,200, the insurance company would pay ___.arrow_forwardLokalalo knows that not all their customers will pay so they take out insurance for that purpose. The insurance does not cover them for their full loss unfortunately. Lokalalo pays for the insurance in advance, which gives them 12 months of cover. Lokalalo paid $15,000 on 1 August 2020 for cover for the next 12 months. Paulo Jr. asks you the following questions (You do not need to provide the definition of any assets, liabilities, income or expenses. If you believe there is no effect on one financial statement, please state “no effect” instead of leaving a blank): What happens in the balance sheet at 31 August 2020 and in the income statement and the statement of cash flows for the month of August 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning