Principles of Taxation for Business and Investment Planning 2020 Edition

23rd Edition

ISBN: 9781260433210

Author: Jones, Sally

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 1QPD

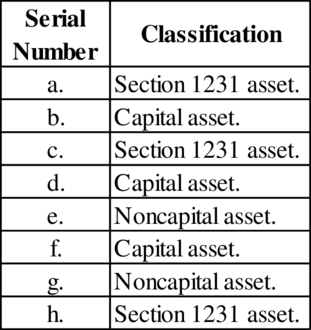

BBB Company, which manufactures industrial plastics, owns the following assets. Characterize each asset as either a capital, ordinary, or Section 1231 asset.

- a. A computer system used in BBB’s main office.

- b. A 50 percent interest in a business

partnership organized to conduct a mining operation in Utah. - c. Heavy equipment used to mold BBB’s best-selling plastic item.

- d. BBB’s customer list developed over 12 years of business.

- e. BBB’s inventory of raw materials used in the manufacturing process.

- f. An oil painting of BBB’s founder and first president that hangs in the boardroom. The painting was commissioned by the company from a local artist and paid for in cash.

- g. A patent developed by BBB’s research and development department.

- h. BBB’s company airplane.

Expert Solution & Answer

To determine

Characterize each asset as either a capital, ordinary or section 1231 asset.

Explanation of Solution

Characterize each asset as either a capital, ordinary or section 1231 asset.

Figure (1)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

French Vanilla Company commenced operations in the current year. A number of expenditures were made during the current year that were debited to one account Intangible asset.

Incorporation fees and legal costs related to organizing the incorporation for P150,000

Fire Insurance premium for three-year period for 60,000

Legal fees for filing a patent on a new product resulting from an A&B project for 50,000

Purchase of copyright for 300,000

Legal fees for successful defense of the patent developed from the project for 50,000

Entered into a 10-year franchise agreement with a franchisor for 600,000

Advertising cost for 50,000

Purchase of all the outstanding ordinary shares of an acquire. On the

date of purchase, the acquire had fair value of total assets, P6,000,000

and total liabilities of P2,200,000. for 5,000,00

What amount should be reported as intangible asset?

Below are transactions related to Duffner Company.

a. The City of Pebble Beach gives the company 5 acres of land as a plant site. The fair value of this land is determined to be $81,000.

b. 13,000 shares of common stock with a par value of $50 per share are issued in exchange for land and buildings. The property has been appraised at a fair value of $810,000, of which $180,000 has been allocated to land and $630,000 to buildings. The stock of Duffner Company is not listed on any exchange, but a block of 100 shares was sold by a stockholder 12 months ago at $65 per share, and a block of 200 shares was sold by another stockholder 18 months ago at $58 per share.

c. No entry has been made to remove from the accounts for Materials, Direct Labor, and Overhead the amounts properly chargeable to plant asset accounts for machinery constructed during the year. The following information is given relative to costs of the machinery constructed.

Materials used

$12,500

Factory…

On January 1, 20X2, Sansa Company purchases two (2) separate sets of assets and activities from thirdparties, as follows:i. A manufacturing plant of Arya Company. The set of assets acquired and liabilities assumed are as follows:Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000Sansa will continue to employ the existing employees of the manufacturing plant and will pay them thesame salaries as before. The above manufacturing plant is a cash-generating unit that generatesoutputs that are sold to outside customers. Sansa pays a cash consideration of P100 million to AryaCompany.ii. A set of assets and liabilities of Bron Company.Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000The vendor will retrench the existing employees of the factory and pay their termination benefits. The setof assets is not capable of generating independent cash flows. However,…

Chapter 8 Solutions

Principles of Taxation for Business and Investment Planning 2020 Edition

Ch. 8 - BBB Company, which manufactures industrial...Ch. 8 - Prob. 2QPDCh. 8 - Prob. 3QPDCh. 8 - Prob. 4QPDCh. 8 - Does the characterization of gain or loss as...Ch. 8 - Distinguish between a firms tax basis in an asset...Ch. 8 - Both Corporation A and Corporation Z have business...Ch. 8 - Mrs. Carly called her accountant with a question....Ch. 8 - Prob. 9QPDCh. 8 - Mr. K realized a loss on the sale of an asset to...

Ch. 8 - Prob. 11QPDCh. 8 - Prob. 12QPDCh. 8 - Prob. 13QPDCh. 8 - Prob. 14QPDCh. 8 - Prob. 1APCh. 8 - Several years ago, PTR purchased business...Ch. 8 - Prob. 3APCh. 8 - Prob. 4APCh. 8 - Prob. 5APCh. 8 - Prob. 6APCh. 8 - TPW, a calendar year taxpayer, sold land with a...Ch. 8 - Refer to the facts in the preceding problem and...Ch. 8 - Refer to the facts in problem 7. In the first year...Ch. 8 - Prob. 10APCh. 8 - Prob. 11APCh. 8 - In year 1, Aldo sold investment land with a 61,000...Ch. 8 - Prob. 13APCh. 8 - Prob. 14APCh. 8 - Silo Inc. sold investment land to PPR Inc. for...Ch. 8 - Prob. 16APCh. 8 - Prob. 17APCh. 8 - Prob. 18APCh. 8 - Shenandoah Skies is the name of an oil painting by...Ch. 8 - Koil Corporation generated 718,400 ordinary income...Ch. 8 - Prob. 21APCh. 8 - Alto Corporation sold two capital assets this...Ch. 8 - Zeno Inc. sold two capital assets in 2019. The...Ch. 8 - Prob. 24APCh. 8 - Prob. 25APCh. 8 - Firm OCS sold business equipment with a 20,000...Ch. 8 - Prob. 27APCh. 8 - Prob. 28APCh. 8 - This year, QIO Company generated 192,400 income...Ch. 8 - Prob. 30APCh. 8 - Prob. 31APCh. 8 - Since its formation, Roof Corporation has incurred...Ch. 8 - Corporation Q, a calendar year taxpayer, has...Ch. 8 - Prob. 34APCh. 8 - Firm P, a noncorporate taxpayer, purchased...Ch. 8 - Prob. 36APCh. 8 - Prob. 37APCh. 8 - Prob. 38APCh. 8 - A taxpayer owned 1,000 shares of common stock in...Ch. 8 - Prob. 40APCh. 8 - Prob. 41APCh. 8 - Prob. 42APCh. 8 - Prob. 43APCh. 8 - A fire recently destroyed a warehouse owned by...Ch. 8 - Prob. 45APCh. 8 - Bali Inc. reported 605,800 net income before tax...Ch. 8 - Prob. 47APCh. 8 - Prob. 48APCh. 8 - Prob. 49APCh. 8 - Prob. 1IRPCh. 8 - Prob. 2IRPCh. 8 - Prob. 3IRPCh. 8 - Prob. 4IRPCh. 8 - Prob. 5IRPCh. 8 - Prob. 6IRPCh. 8 - Firm WD sold depreciable realty for 225,000. The...Ch. 8 - Prob. 8IRPCh. 8 - Prob. 9IRPCh. 8 - Prob. 10IRPCh. 8 - Prob. 11IRPCh. 8 - For the past 12 years, George Link has operated...Ch. 8 - Prob. 2RPCh. 8 - Prob. 3RPCh. 8 - Prob. 4RPCh. 8 - Firm Z, a corporation with a 21 percent tax rate,...Ch. 8 - Mr. RH purchased 30 acres of undeveloped ranch...Ch. 8 - Prob. 3TPCCh. 8 - Prob. 4TPCCh. 8 - Prob. 5TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 20X2, Sansa Company purchases two (2) separate sets of assets and activities from thirdparties, as follows:i. A manufacturing plant of Arya Company. The set of assets acquired and liabilities assumed are as follows:Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000Sansa will continue to employ the existing employees of the manufacturing plant and will pay them thesame salaries as before. The above manufacturing plant is a cash-generating unit that generatesoutputs that are sold to outside customers. Sansa pays a cash consideration of P100 million to AryaCompany.ii. A set of assets and liabilities of Bron Company.Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000The vendor will retrench the existing employees of the factory and pay their termination benefits. The setof assets is not capable of generating independent cash flows. However,…arrow_forwardOn December 1, B Company purchased a 4,000,000 tract of land for a factory site. The entity razed an old building on the property and sold the materials salvaged from the demolition. The entity incurred additional costs and realized a salvage proceeds during December as follows: Demolition of old building 200,000 Legal fees for the purchased contract and recording of ownership 150,000 Title guarantee insurance 50,000 Proceeds from sale of salvaged materials 20,000 In the December 31 statement of financial position, what is the carrying amount of the land?arrow_forwardABC Co. and DEF Co. are joint venturers of XYZ Co., a producer of high tech machinery. ABC and DEF, each have a 50% interest in the net assets of XYZ Co. During the year, ABC Co. earns revenue of $1,000,000 from its own operations while DEF Co. reports revenue of $400,000. How much total revenue shall be reported in ABC Co.'s statement of profit or loss for the year? 1,000,000 1,200,000 1,400,000 either a orbarrow_forward

- On January 1, 20X2, Sansa Company purchases two (2) separate sets of assets and activities from third-parties, as follows:i. A manufacturing plant of Arya Company. The set of assets acquired and liabilities assumed are as follows:Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000Sansa will continue to employ the existing employees of the manufacturing plant and will pay them the same salaries as before. The above manufacturing plant is a cash-generating unit that generates outputs that are sold to outside customers. Sansa pays a cash consideration of P100 million to Arya Company.ii. A set of assets and liabilities of Bron Company.Plant premise P100,000,000Machinery 60,000,000Equipment 30,000,000A mortgage loan secured on the plant premise 120,0000The vendor will retrench the existing employees of the factory and pay their termination benefits. The set of assets is not capable of generating independent cash flows.…arrow_forwardDalmatian Corp. follows IFRS and had the following transactions during its year ended December 31: Spent $135,000 developing its brand. Incurred development costs of $254,000 for a new product that met all the intangible asset recognition criteria on September 30 of that same year. Of the $254,000 spent, $160,000 was incurred after September 30. Purchased a customer list for $89,000 from a competitor that was closing its business. What is the total cost of intangible assets that were capitalized during 2020?arrow_forwardDuring the current year, Black Corporation incurred the following expenditures which should berecorded either as operating expenses or as intangible assets:a. Expenditures were made for the training of new employees. The average employee remainswith the company for five years, but is trained for a new position every two years.b. Black purchased a controlling interest in a vinyl flooring company. The expenditure resultedin the recording of a significant amount of goodwill. Black expects to earn above-averagereturns on this investment indefinitely.c. Black incurred large amounts of research and development costs in developing a dirt-resistantcarpet fiber. The company expects that the fiber will be patented and that sales of the resultingproducts will contribute to revenue for at least 25 years. The legal life of the patent, however,will be only 20 years.d. Black made an expenditure to acquire the patent on a popular carpet cleaner. The patent had aremaining legal life of 14 years, but…arrow_forward

- Below are transactions related to Pronghorn Company. (a) The City of Pebble Beach gives the company 5 acres of land as a plant site. The fair value of this land is determined to be $74,980. (b) 13,000 shares of common stock with a par value of $52 per share are issued in exchange for land and buildings. The property has been appraised at a fair value of $749,800, of which $179,660 has been allocated to land and $570,140 to buildings. The stock of Pronghorn Company is not listed on any exchange, but a block of 100 shares was sold by a stockholder 12 months ago at $67 per share, and a block of 200 shares was sold by another stockholder 18 months ago at $60 per share. (c) No entry has been made to remove from the accounts for Materials, Direct Labor, and Overhead the amounts properly chargeable to plant asset accounts for machinery constructed during the year. The following information is given relative to costs of the machinery constructed. Materials used $11,400…arrow_forwardOn January 1, 20x2, Gold Company purchased a computer with an expected economic life of five years. On January 1, 20x4, Gold sold the computer to TLK Corporation and recorded the following entry: Cash 39,000 Accumulated Depreciation 16,000 Computer Equipment 40,000 Gain on sale of equipment 15,000 TLK Corporation holds 60 percent of Gold’s voting shares. Gold reported net income of P45,000, and TLK reported income from its own operations of P85,000 for 20x4. There is no change in the estimated life of the equipment as a result of the inter-corporate transfer. In the preparation of the 20x4 consolidated income statement, depreciation expense will be: A. Debited for 5,000 in eliminating entriesB. Credited for 5,000 in eliminating entriesC. Debited for 13,000 in eliminating entriesD. Credited for 13,000 in eliminating entriesarrow_forwardThis year, Sigma, Incorporated generated $612,000 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months: Marketable securities This year, Sigma, Incorporated generated $612,000 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months: Initial Basis Accumulated Depreciation* Sale Price Marketable securities $144,000 $0 $64,000 Production equipment 93,000 76,000 30,000 Business realty: Land 165,000 0 180,000 Building 200,000 58,300 210,000 *Through date of sale. Required: Compute Sigma’s taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 losses. Recompute taxable income assuming that Sigma sold the securities for $150,000 rather than…arrow_forward

- Thomas Gilbert and Susan Bradley formed a professional corporation called “Financial Services Inc.—A Professional Corporation,” each taking 50 percent of the authorized common stock. Gilbert is a CPA and a member of the AICPA. Bradley is a CPCU (Chartered Property Casualty Underwriter). The corporation performs auditing and tax services under Gilbert’s direction and insurance services under Bradley’s supervision. One of the corporation’s first audit clients was Grandtime Company. Grandtime had total assets of $600,000 and total liabilities of $270,000. In the course of his examination, Gilbert found that Grandtime’s building, with a carrying value of $240,000, was pledged as collateral for a 10-year term note in the amount of $200,000. The client’s financial statements did not mention that the building was pledged as collateral for the 10-year term note. However, as the failure to disclose the lien did not affect either the value of the assets or the amount of the liabilities, and his…arrow_forwardDuring the year, Leak Construction Corp. distributed a crane used in its business to Q, who owns 100 percent of the stock. The crane was worth $10,000 and had a basis of $19,000. The corporation also distributed land worth $70,000, with a basis of $40,000. Leak will reportarrow_forwardDuring the current year, Omega Products Corporation incurred the following expenditures whichshould be recorded either as operating expenses or as intangible assets:a. Expenditures were made for the training of new employees. The average employee remainswith the company for five years, but is trained for a new position every two years.b. Omega purchased a controlling interest in a wallpaper company. The expenditure resulted inrecording a significant amount of goodwill. Omega expects to earn above-average returns onthis investment indefinitely.c. Omega incurred large amounts of research and development costs in developing a superiorproduct. The company expects that it will be patented and that sales of the resulting productswill contribute to revenue for at least 40 years. The legal life of the patent, however, will be only20 years.d. Omega made an expenditure to acquire the patent on a whatsa. The patent had a remaining legallife of 10 years, but Omega expects to produce and sell the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License