a)

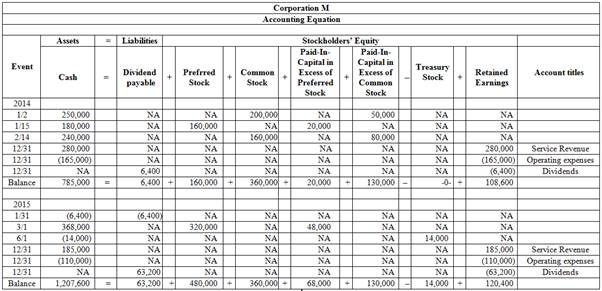

Organize the transactions data in accounts under an

a)

Explanation of Solution

Organize the transactions data in accounts under an accounting equation:

Table (1)

Working note:

1. Calculate the preferred dividend amount of dividend declared in 2014:

2,000, 4%

2. Calculate the amount of total dividend declared in 2015:

First calculate the amount of cash dividend declared for preferred stock in 2015:

Then calculate the amount of cash dividend declared for common stock in 2015:

Now, calculate the amount of total dividend declared in 2015:

b)

Prepare the

b)

Explanation of Solution

Stockholders’ equity section: It is a part of the balance sheet. It reports the stockholders’ equity balances as on the balance sheet date.

Prepare the stockholders’ equity section of the balance sheet at December 31, 2014:

| Corporation S | ||

| December 31, 2014 | ||

| Particulars | Amount ($) | Amount ($) |

| Stockholders’ Equity: | ||

| Preferred Stock, $80 par value, 4% cumulative, 50,000 shares authorized, 2,000 shares issued and outstanding | $160,000 | |

| Common Stock, $10 par value, 100,000 shares authorized, 45,000 shares issued and outstanding | 360,000 | |

| Paid-In Capital in Excess of Par-Preferred Stock | 20,000 | |

| Paid-In Capital in Excess of Par-Common Stock | 130,000 | |

| Total Paid-In Capital | 670,000 | |

| 108,600 | ||

| Total Stockholders’ Equity | $778,500 | |

Table (2)

c)

Prepare the balance sheet at December 31, 2015.

c)

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Preparethe balance sheet at December 31, 2015:

| Corporation M | ||

| Balance Sheet | ||

| As of December 31, 2015 | ||

| Assets | Amount | Amount |

| Cash | $1,207,600 | |

| Total Assets | $1,207,600 | |

| Liabilities and stockholders' equity | ||

| Liabilities: | ||

| Dividends Payable | $63,200 | |

| Total Liabilities | $63,200 | |

| Stockholders’ Equity: | ||

| Preferred Stock, $80 par value, 4% cumulative, 50,000 shares authorized, 6,000 shares issued and outstanding | $480,000 | |

| Common Stock, $10 par value, 100,000 shares authorized, 45,000 shares issued and 44,000(3) outstanding | 360,000 | |

| Paid-In Capital in Excess of Par-Preferred Stock | 68,000 | |

| Paid-In Capital in Excess of Par-Common Stock | 130,000 | |

| Total Paid-In Capital | 1,038,000 | |

| Retained Earnings | 120,400 | |

| Less: | (14,000) | |

| Total Stockholders’ Equity | 1,144,400 | |

| Total Liabilities and Stockholders’ Equity | $1,2079,600 | |

Table (3)

Working note:

3. Determine the number of shares has been issued and outstanding at the end of 2014 and 2015:

| Schedule of Number of Shares of Common Stock | ||

| Shares Issued | Shares Outstanding | |

| 2014 | ||

| January 5 | 25,000 | 25,000 |

| April 5 | 20,000 | 20,000 |

| Totals | 45,000 | 45,000 |

| 2015 | ||

| May 5 | (1,000) | |

| Totals | 45,000 | 44,000 |

Table (4)

Want to see more full solutions like this?

Chapter 8 Solutions

Loose-Leaf for Survey of Accounting

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education