Concept explainers

Problem 8-23 Recording and reporting stock transactions and cash dividends across two accounting cycles

Sun Corporation received a charter that authorized the issuance of 100,000 shares of $10 par common stock and 50,000 shares of $50 par, 5 percent cumulative

2018

Jan. 5 Sold 6,000 shares of the $10 par common stock for $15 per share.

12 Sold 1,000 shares of the 5 percent preferred stock for $55 per share.

Apr. 5 Sold 30,000 shares of the $10 par common stock for $21 per share.

Dec. 31 During the year, earned $150,000 in cash revenue and paid $88,000 for cash operating expenses.

31 Declared the cash dividend on the outstanding shares of preferred stock for 2018. The dividend will be paid on February 15 to stockholders of record on January 10, 2019.

2019

Feb. 15 Paid the cash dividend declared on December 31, 2018.

Mar. 3 Sold 15,000 shares of the $50 par preferred stock for $53 per share.

May 5 Purchased 900 shares of the common stock as

Dec. 31 During the year, earned $210,000 in cash revenues and paid $98,000 for cash operating expenses.

31 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the

common stock.

Required

- a. Organize the transaction data in accounts under an

accounting equation. - b. Prepare the stockholders’ equity section of the

balance sheet at December 31, 2018. - c. Prepare the balance sheet at December 31, 2019.

a)

Organize the transactions data in accounts under an accounting equation..

Explanation of Solution

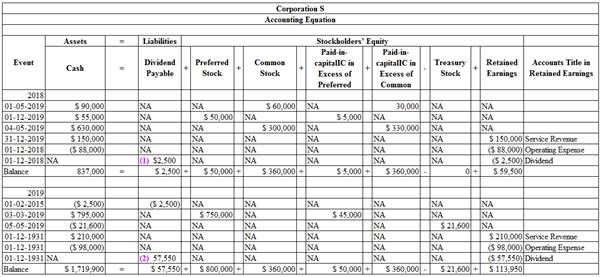

Organize the transactions data in accounts under an accounting equation:

Table (1)

Working note:

1. Calculate the preferred dividend amount of dividend declared in 2018.

1, 000, 5% preferred shares are outstanding at $50 par.

2. Calculate the amount of total dividend declared in 2019.

First calculate the amount of cash dividend declared for preferred stock in 2019:

Then calculate the amount of cash dividend declared for common stock in 2019:

Now, calculate the amount of total dividend declared in 2019:

b)

Prepare the stockholders’ equity section of the balance sheet at December 31, 2018.

Explanation of Solution

Stockholders’ equity section: It is a part of the balance sheet. It reports the stockholders’ equity balances as on the balance sheet date.

Prepare the stockholders’ equity section of the balance sheet at December 31, 2018:

| Corporation S | ||

| December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Stockholders’ Equity: | ||

| Preferred Stock, $50 par value, 5% cumulative, 50,000 shares authorized, 1,000 shares issued and outstanding | $50,000 | |

| Common Stock, $10 par value, 100,000 shares authorized, 36,000 shares issued and outstanding | 360,000 | |

| Paid-In Capital in Excess of Par-Preferred Stock | 5,000 | |

| Paid-In Capital in Excess of Par-Common Stock | 360,000 | |

| Total Paid-In Capital | 775,000 | |

| Retained Earnings | 59,500 | |

| Total Stockholders’ Equity | $834,500 | |

Table (2)

c)

Prepare the balance sheet at December 31, 2019.

Explanation of Solution

Balance sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet at December 31, 2019:

| Corporation S | ||

| Balance Sheet | ||

| As of December 31, 2019 | ||

| Assets | Amount | Amount |

| Cash | $1,719,900 | |

| Total Assets | $1,719,900 | |

| Liabilities and stockholders' equity | ||

| Liabilities: | ||

| Dividends Payable | $57,550 | |

| Total Liabilities | $57,550 | |

| Stockholders’ Equity: | ||

| Preferred Stock, $50 par value, 5% cumulative, 50,000 shares authorized, 16,000 shares issued and outstanding | $800,000 | |

| Common Stock, $10 par value, 100,000 shares authorized, 36,000 shares issued and 35,100 (3) outstanding | 360,000 | |

| Paid-In Capital in Excess of Par-Preferred Stock | 50,000 | |

| Paid-In Capital in Excess of Par-Common Stock | 360,000 | |

| Total Paid-In Capital | 1,570,000 | |

| Retained Earnings | 113,950 | |

| Less: Treasury stock | (21,600) | |

| Total Stockholders’ Equity | 1,662,350 | |

| Total Liabilities and Stockholders’ Equity | $1,719,900 | |

Table (5)

Working note:

3. Determine the number of shares has been issued and outstanding at the end of 2018 and 2019.

| Schedule of Number of Shares of Common Stock | ||

| Shares Issued | Shares Outstanding | |

| 2018 | ||

| January 5 | 6,000 | 6,000 |

| April 5 | 30,000 | 30,000 |

| Totals | 36,000 | 36,000 |

| 2019 | ||

| May 5 | (900) | |

| Totals | 36,000 | 35,100 |

Table (5)

Want to see more full solutions like this?

Chapter 8 Solutions

GEN COMBO LOOSELEAF SURVEY OF ACCOUNTING; CONNECT ACCESS CARD

- Entries for stock dividends Alpine Energy Corporation has 1,500,000 shares of 40 par common stock outstanding. On August 2, Alpine Energy declared a 4% stock dividend to be issued October 8 to stockholders of record on September 15. The market price of the stock was 70 per share on August 2. Journalize the entries required on August 2, September 15, and October 8.arrow_forwardEntries for selected corporate transactions Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises stockholders equity accounts, with balances on January 1, 20Y6, are as follows: Common Stock, 20 stated value (500,000 shares authorized, 375,000 shares issued) 7,500,000 Paid-In Capital in Excess of Stated ValueCommon Stock 825,000 Retained Earnings 33,600,000 Treasury Stock (25,000 shares, at cost 450,000 The following selected transactions occurred during the year: Jan. 22. Paid cash dividends of 0.08 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for 28,000. Apr. 10. Issued 75,000 shares of common stock for 24 per share. June 6. Sold all of the treasury stock for 26 per share. July 5. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is 25 per share. Aug. 15. Issued shares of stock for the stock dividend declared on July 5. Nov. 23. Purchased 30,000 shares of treasury stock for 19 per share. Dec. 28. Declared a 0.10-per-share dividend on common stock. 31. Closed the credit balance of the income summary account, 1,125,000. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. 3. Prepare a retained earnings statement for the year ended December 31, 20Y6. 4. Prepare the Stockholders Equity section of the December 31, 20Y6, balance sheet.arrow_forwardSTOCK DIVIDENDS Martinez Company currently has 200,000 shares of 1 par common stock outstanding. On March 15, a 5% stock dividend was declared to shareholders of record on April 2, distributable on April 14. Market value of the common stock was estimated at 13 per share. 1. Prepare journal entries for the declaration and distribution of the 5% common stock dividend. 2. Assume Martinez Company declared a stock dividend of 30% rather than 5%. Prepare journal entries for the declaration and distribution of the 30% common stock dividend.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,