Concept explainers

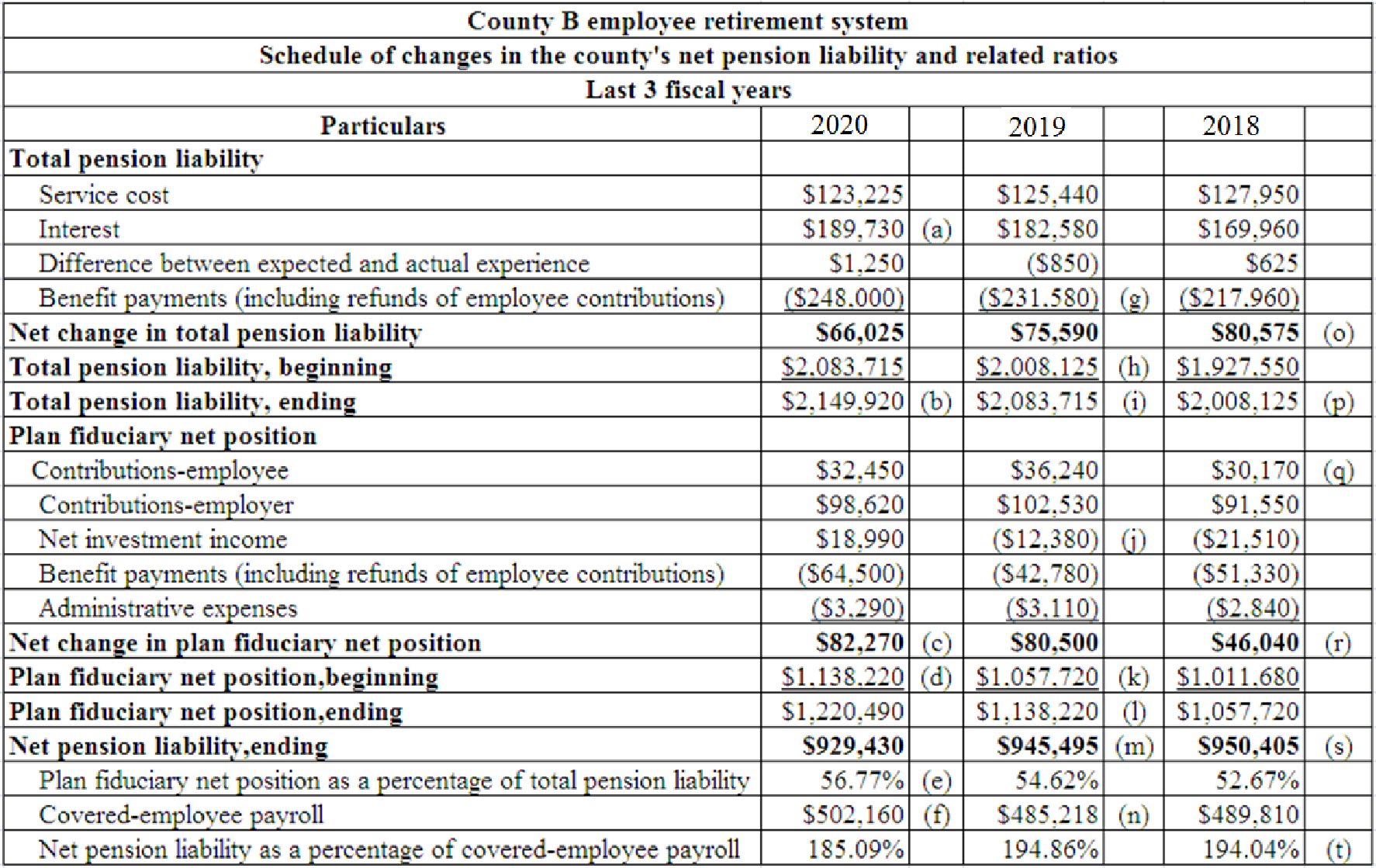

Compute the missing amount of “schedule of changes in the County’s Net pension liability and related ratios”.

Explanation of Solution

Fiduciary activities: Fiduciary activities are those activities done by persons or organizations to another parties with utmost good faith and trust. A fiduciary activity may involve managing funds, assets and other valuables of a person or a group of people.

The person or organization involved in fiduciary activities need to act ethically in the best interest of others. Government also involve in fiduciary activities by holding the assets of individuals or organization to benefit them.

Prepare the financial statement of County B:

Table (1)

Working note (a): Calculate interest during the year 2020:

Interest amount is calculated by deducting all other pension liabilities from net change in total pension liability. Total pension liabilities except interest includes service costs, difference between expected and experience, and benefit payments. The amount of service cost is $123,225, difference between expected and experience is $1,250, and benefit payment is -$248,000. The net change in total pension liability is $66,205.

Calculation of interest is as follows:

Hence, the interest amount is $189,730.

Working note (b): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position at the end of the year and plan fiduciary net position at the beginning of the year. Plan fiduciary net position at the ending is $1,057,720. Plan fiduciary net position at the beginning is $1,011,680.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $46,040.

Working note (c): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employee $32,450, contribution from employers $98,620, and net investment income $18,990. Plan fiduciary net position expenses include benefit payments of $64,500 and administrative expenses of $3,290.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $82,270.

Working note (d): Calculate plan fiduciary net position at the beginning of the year 2020:

Plan fiduciary net position at the beginning is computed as the difference between plan fiduciary net position at the end of the year and net change in plan fiduciary net position. Plan fiduciary net position at the end of the year is $1,220,490.

Calculation of plan fiduciary net position at the beginning is as given below:

Hence, the plan fiduciary net position at the beginning of the year 2020 is $1,138,220.

Working note (e): Calculate plan fiduciary net position as the percentage of total pension liability:

Plan fiduciary net position as a percentage of total pension liability is calculated by dividing plan fiduciary net position at the end of the year by total pension liability at the end of the year. Plan fiduciary net position at the end of the year is given as $1,220,490 and total pension liability at the end of the year is calculated as $2,149,920.

Calculate plan fiduciary net position as the percentage of total pension liability:

Hence, the plan fiduciary net position as percentage of total pension liability is 56.77%.

Working note (f): Calculate covered-employee payroll:

The calculation of covered-employee payroll is by dividing net pension liability at the ending by net pension liability as a percentage of covered-employee payrolls. Net pension liability at the ending is given as $929,430 and net pension liability as a percentage of covered-employee payrolls is 185.09%.

Calculate covered-employee payroll:

Hence, the covered-employee payroll is $502,150.

Working note (g): Calculate benefit payment for the year 2019:

Benefit payment is calculated by deducting all other pension liabilities from net change in total pension liability. Total pension liabilities except benefit payment includes service costs, interest, and difference between expected and experience. The amount of service cost is $125,440, interest amount is $182,580, and difference between expected and experience is -$850, and benefit payment is -$248,000. The net change in total pension liability is $75,590.

Calculate benefit payment for the year 2019:

Hence, the benefit payment for the year 2019 is ($231,580).

Working note (h): Calculate total pension liability at the beginning of the year 2019:

Total pension liability at the beginning of the year is computed as the difference between total pension liability at the end of the year and net change in total pension liability. The total pension liability at the ending is $2,083,715. The calculation is as follows:

Calculate total pension liability at the beginning of the year 2019:

Hence, the total pension liability at the beginning of the year is $2,008,125.

Working note (i): Calculate total pension liability at the end of the year 2019:

The total pension liability at the end of the year 2019 will be the same as the total pension liability at the beginning of the year 2020. The total pension liability at the beginning of the year 2020 is $2,083,715. Hence, the total pension liability at the end of the year 2019 is also $2,083,175.

Working note (j): Calculate net investment income for 2019:

Net investment income is the difference between net change in plan fiduciary net position and the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employee $36,240, contribution from employers $102,530. Plan fiduciary net position expenses include benefit payments of -$42,780 and administrative expenses of -$3,110. The net change in plan fiduciary net position is given as $80,500.

Calculate net investment income for 2019:

Hence, the net investment income for 2019 is ($12,380).

Working note (k): Calculate plan fiduciary net position at the beginning of 2019:

The plan fiduciary net position at the beginning of the year 2019 will be the same as the plan fiduciary net position at the end of the year 2018. The plan fiduciary net position at the end of the year 2018 is $1,057,720. Hence, the plan fiduciary net position at the beginning of the year 2019 is also $1,057,720.

Working note (l): Calculate plan fiduciary net position at the end of the year 2019:

Plan fiduciary net position at the ending is computed as the sum of plan fiduciary net position at the beginning of the year and net change in plan fiduciary net position. Plan fiduciary net position at the beginning of the year is $1,057,720.

Calculation of plan fiduciary net position at the beginning is as given below:

Hence, the plan fiduciary net position at the end of the year 2019 is $1,138,220.

Working note (m): Calculate net pension liability at the end of the year 2019:

Net pension liability at the end of the year 2019 is calculated as the difference between total pension liability at the ending of 2019 and plan fiduciary net position at the ending. Total pension liability at the ending of 2019 is calculated as $2,083,715 and plan fiduciary net position at the ending of 2019 is $1,138,220.

Calculate net pension liability at the end of the year 2019:

Hence, the net pension liability at the end of the year 2019 is $945,495.

Working note (n): Calculate covered-employee payroll:

The calculation of covered-employee payroll is by dividing net pension liability at the ending by net pension liability as a percentage of covered-employee payrolls. Net pension liability at the ending is given as $945,495 and net pension liability as a percentage of covered-employee payrolls is 194.86%.

Calculate covered-employee payroll:

Hence, the covered-employee payroll is $485,218.

Working note (o): Calculate net change in total pension liability for the year 2018:

Net change in total pension liability is calculated by deducting benefit payment from all other pension liabilities. Total pension liabilities except benefit payment includes service costs, interest, and difference between expected and experience. The amount of service cost is $127,950, interest amount is $169,960, and difference between expected and experience is $625. The benefit payment is given as -$217,960.

Calculate net change in total pension liability for the year 2018:

Hence, the net change in total pension liability for the year 2018 is $80,575.

Working note (p): Calculate total pension liability at the end of the year 2018:

The total pension liability at the end of the year 2018 will be the same as the total pension liability at the beginning of the year 2019. The total pension liability at the beginning of the year 2019 is $2,008,125. Hence, the total pension liability at the end of the year 2018 is also $2,008,125.

Working note (q): Calculate contribution from employees for 2018:

Contribution from employees is calculated as the difference between net change in plan fiduciary net position and the difference between plan fiduciary net position incomes and plan fiduciary net position expenses. Plan fiduciary net position income includes contribution from employers $91,550 and net investment income is -$21,510. Plan fiduciary net position expenses include benefit payments of -$51,330 and administrative expenses of -$2,840. The net change in plan fiduciary net position is calculated as $46,040.

Calculate contribution from employees for 2018:

Hence, the contribution from employee for 2018 is $30,170.

Working note (r): Calculate net change in plan fiduciary net position:

Net change in plan fiduciary net position is the difference between plan fiduciary net position at the end of the year and plan fiduciary net position at the beginning of the year. Plan fiduciary net position at the ending is $1,057,720. Plan fiduciary net position at the beginning is $1,011,680.

Calculation of net change in plan fiduciary net position is as follows:

Hence, the net change in plan fiduciary net position is $46,040.

Working note (s): Calculate net pension liability at the end of the year 2018:

Net pension liability at the end of the year 2018 is calculated as the difference between total pension liability at the ending of 2018 and plan fiduciary net position at the ending. Total pension liability at the ending of 2018 is calculated as $2,008,125 and plan fiduciary net position at the ending of 2018 is $1,057,720.

Calculation of net pension liability at the end of the year 2018 is as given below:

Hence, the net pension liability at the end of the year 2018 is $950,405.

Working note (t): Calculate net pension liability as a percentage of covered-employee payrolls:

The calculation of net pension liability as a percentage of covered-employee payroll is by dividing net pension liability at the ending by covered-employee payroll. Net pension liability at the ending is given as $950,405 and covered-employee payroll is $489,810. The calculation of covered-employee payroll is as follows:

Hence, the net pension liability as a percentage of covered-employee payrolls is 194.04%.

Want to see more full solutions like this?

Chapter 8 Solutions

ACCOUNTING FOR GOVERNMENTAL & NONPROFIT

- Warrick Boards calculated pension expense for its underfunded pension plan as follows: ($ in millions) Service cost $ 224 Interest cost 150 Expected return on the plan assets ($100 actual, less $10 gain) (90 ) Amortization of prior service cost 8 Amortization of net loss 2 Pension expense $ 294 Required: Which elements of Warrick’s balance sheet are affected by the components of pension expense? What are the specific changes in these accounts?arrow_forwardRecorded pension expenditures are not always influenced by actuarial computations. Hayward City maintains a defined benefit pension plan for its employees. In a recent year, the city contributed $5 million to its pension fund. However, its annual pension cost as calculated by its actuary was $7 million. The city accounts for the pension contributions in a governmental fund. Record the pension expenditure in the appropriate fund. Suppose in the following year the city contributed $6 million to its pension fund, but its annual pension cost per its actuary was only $5 million. Prepare the appropriate journal entries. Briefly justify why you did, or did not, take into account the pension cost as calculated by the actuary.arrow_forwardDuring the fiscal year ended December 31, 2013, Glen City’s general fund contributed $60 million to a defined benefit pension plan for city employees. The actuarially determined contribution requirement for 2013 is $65 million. The amount of pension expenditure recognized by the general fund for 2013 should be: A.) $ 0 B.) $ 60 million C.) $ 63 million D.) $ 65 millionarrow_forward

- Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2018. The provisions of the planwere not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assetsto earn a 10% rate of return. A consulting firm, engaged as actuary, recommends 6% as the appropriate discountrate. The service cost is $150,000 for 2018 and $200,000 for 2019. Year-end funding is $160,000 for 2018 and$170,000 for 2019. No assumptions or estimates were revised during 2018.Required:Calculate each of the following amounts as of both December 31, 2018, and December 31, 2019:1. Projected benefit obligation2. Plan assets3. Pension expense4. Net pension asset or net pension liabilityarrow_forwardIf answered within 30mins,it would be helpful.surely will upvote The Village of Bensonville has a pension trust fund for its public safety employees. For the year ended December 31, 2021, an actuarial consulting firm determined that the Village’s annual general fund contribution to the pension trust fund should be $3,250,000. However, due to a downturn in the local economy, the Village appropriated only $2,750,000 for its 2021 pension contribution to the public safety pension trust fund. From January through November, 2021, the Village contributed $2,460,000 to its public safety pension trust fund. The Village will make its December, 2021, contribution of $200,000 to the pension trust fund during the first week in January, 2022. Based on the information provided, what amount should be reported for expenditures on the statement of revenues, expenditures, and changes in fund balance for the general fund for the year ended December 31, 2021, and what amount should be reported under…arrow_forwardThe following incomplete (columns have missing amounts) pension spreadsheet is for Old Tucson Corporation (OTC). A) Net pension asset of $323.50 million B) Net pension liability of $519.00 million C) Net pension liability of $323.50 million D) Net pension asset of $519.00 millionarrow_forward

- Pension data for Barry Financial Services Inc., include the following: ($ in thousands)Discount rate, 7%Expected return on plan assets, 10%Actual return on plan assets, 9%Service cost, 2021 $ 310January 1, 2021:Projected benefit obligation 2,300Accumulated benefit obligation 2,000Plan assets (fair value) 2,400Prior service cost—AOCI (2021 amortization, $25) 325Net gain—AOCI (2021 amortization, $6) 330There were no changes in actuarial assumptions.December 31, 2021:Cash contributions to pension fund, December 31, 2021 245Benefit payments to retirees, December 31, 2021…arrow_forwardTh e relationship between the periodic pension cost and the plan’s funded status is bestexpressed in which of the following?A . Periodic pension cost of –£483 = Ending funded status of –£4,774 – Employer contributions of £693 – Beginning funded status of –£4,984.B . Periodic pension cost of £1,322 = Benefi ts paid of £1,322.C . Periodic pension cost of £210 = Ending funded status of –£4,774 – Beginning fundedstatus of –£4,984arrow_forwardPalto County elects not to purchase commercial insurance. Instead, it sets aside resources for potential claims in an internal service ‘‘self-insurance’’ fund. During the year, the fund recognized $4 million for claims filed during the year. Of this amount, it paid $2.3 million. Based on the calculations of an independent actuary, the insurance fund billed and collected $5.0 million in premiums from the other county departments insured by the fund. Of this amount, $3.2 million was billed to the funds accounted for in the general fund and $1.8 million to the county utility fund. The total charge for premiums was based on historical experience and included a reasonable provision for future catastrophe losses.1. Prepare the journal entries in the internal service fund to record the claims recognized and paid and the premiums billed and collected. 2. Prepare the journal entries in the other funds affected by the above. 3. If the county accounted for its self-insurance within its general…arrow_forward

- Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2021. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. A consulting firm, engaged as actuary, recommends 6% as the appropriate discount rate. The service cost is $150,000 for 2021 and $200,000 for 2022. Year-end funding is $160,000 for 2021 and $170,000 for 2022. No assumptions or estimates were revised during 2021. What is the net pension asset or net pension liability for December 31, 2021 and December 31, 2022?arrow_forwardStanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2021. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. A consulting firm, engaged as actuary, recommends 6% as the appropriate discount rate. The service cost is $150,000 for 2021 and $200,000 for 2022. Year-end funding is $160,000 for 2021 and $170,000 for 2022. No assumptions or estimates were revised during 2021.Required:Calculate each of the following amounts as of both December 31, 2021, and December 31, 2022:1. Projected benefit obligation.2. Plan assets.3. Pension expense.4. Net pension asset or net pension liability.arrow_forwardThe following information is available for Oriole Corporation’s pension plan for the year 2020: Plan assets, January 1, 2020 $410,000 Actual return on plan assets 17,000 Benefits paid to retirees 40,300 Contributions (funding) 94,100 Discount rate 11% Defined benefit obligation, January 1, 2020, accounting basis valuation 506,000 Service cost 66,300 Calculate pension expense for the year 2020, assuming that Oriole follows ASPE, and its accounting policy is to use an accounting basis valuation for its defined benefit obligation. Pension expense $ Provide the entries to recognize the pension expense and funding for the year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31, 2020 (To record pension expense.)…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education