a)

Determine the

a)

Explanation of Solution

Compute the standard cost per wheel:

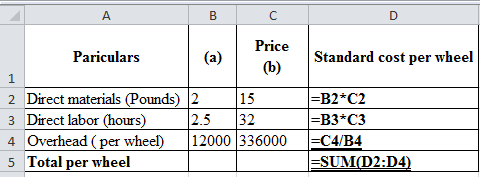

Excel workings:

Table (1)

Excel spread sheet:

Table (2)

b)

Determine the total standard cost per wheel

b)

Explanation of Solution

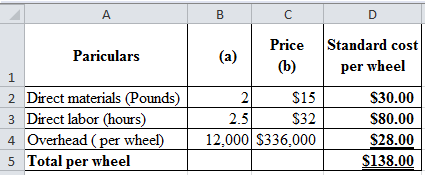

Compute the standard cost per wheel:

Table (3)

Hence, the total standard per wheel is $138.

c)

Determine the actual cost per wheel for direct materials, direct labor, and overhead.

c)

Explanation of Solution

Determine the actual cost per wheel for direct materials, direct labor, and overhead:

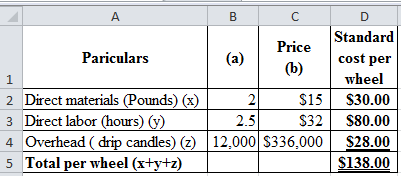

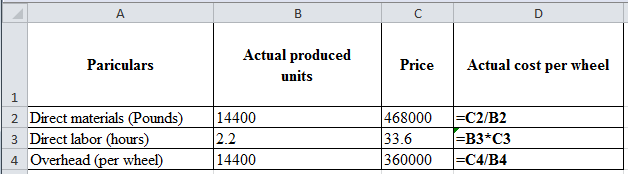

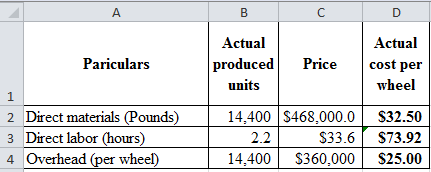

Excel workings:

Table (4)

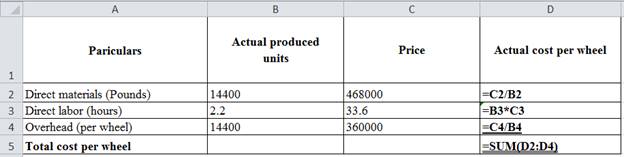

Excel workings:

Table (5)

d)

Determine the total actual cost per wheel

d)

Explanation of Solution

Compute the total actual cost per wheel:

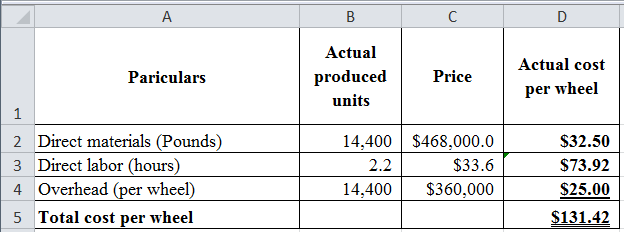

Excel workings:

Table (6)

Excel spread sheet:

Table (7)

Hence, the total standard per wheel is $131.42.

e)

Determine the usage and price variances for direct materials and direct labor and the variance Company S has to investigate and discuss the labor usage variance.

e)

Explanation of Solution

Compute the price and usage variance for direct material:

Hence, the material price variance is $18,000 which is an unfavorable variance.

Hence, the material usage variance is $18,000 which is a unfavorable variance.

Compute the price and usage variance for direct labor:

Hence, the labor price variance is $50,688 which is a favorable variance.

Hence, the labor usage variance is $138,240 which is a favorable variance.

The variance Company G has to investigate and discuss the labor usage variance:

All the variance is need to be taken for investigation. Investigation must be based on the criteria’s like materiality, capacity to control, and frequency.

The favorable labor usage variance is the result of using more costly and experienced work force which results in the unfavorable labor price variance. Other causes are effective planning to decrease the labor waste, or superior supervision and high morale.

f)

Determine the fixed cost spending and volume variances:

f)

Explanation of Solution

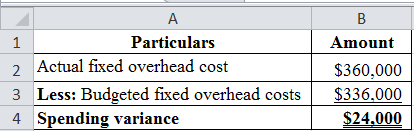

Determine the fixed cost spending variance and identify whether it is unfavorable or favorable:

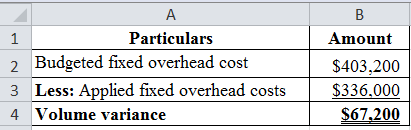

Table (8)

Hence, the spending variance is $24,000 which is unfavorable variance.

Table (9)

Hence, the volume variance is $67,200 which is favorable variance.

As more units are produced than budgeted the favorable variance occurs. The unfavorable fixed cost spending variance denotes that more was spend for fixed overheads than the planned one.

Thus, the cost per unit was less than the budgeted fixed overheads.

Profits will be more when units are produced more as the costs are fixed.

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamental Managerial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education