1.

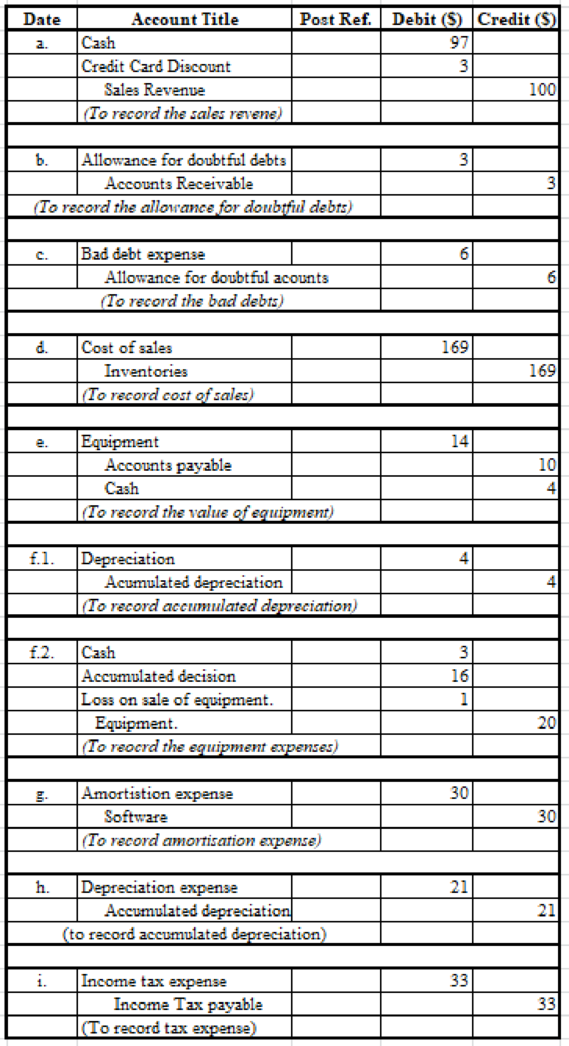

Pass necessary journal entries to record the transactions.

1.

Explanation of Solution

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accounting rules for Journal entries:

- To record increase balance of account: Debit assets, expenses, losses and credit liabilities, capital, revenue and gains.

- To record decrease balance of account: Credit assets, expenses, losses and debit liabilities, capital, revenue and gains.

Pass necessary journal entries to record the transactions.

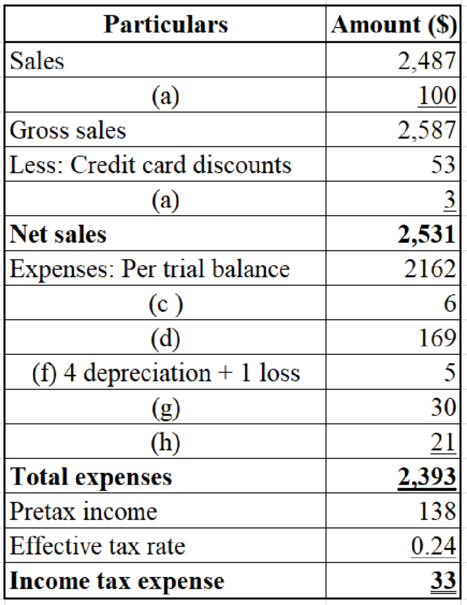

Table (2)

Table (2)

2.

Prepare T accounts using the

2.

Explanation of Solution

Prepare T accounts using the trial balance information and an adjusted trial balance.

| Cash | ||

| Beginning balance 570 | ||

| ||

| f.2 3 | e. 4 | |

| Ending balance 666 | ||

Table (3)

| Beginning balance 373 |

| |

| Ending balance 370 | ||

Table (3)

| Allowance for doubtful accounts | ||

| Balance 570 | ||

| b 3 | c 6 | |

| Balance 21 | ||

Table (3)

| Inventories | ||

| Beginning balance 539 |

| |

| Ending balance 370 | ||

Table (4)

| Prepaid Expenses | ||

| Beginning balance 59 | ||

| Ending balance 59 | ||

Table (5)

| Land | ||

| Beginning balance 22 | ||

| Ending balance 22 | ||

Table (6)

| Building | ||

| Beginning balance 189 | ||

| Ending balance 189 | ||

Table (7)

| Equipment | ||

|

Beginning balance 360

| f.2. 20 | |

| Ending balance 354 | ||

Table (8)

| Accumulated | ||

| Balance 222 | ||

| f.1. 4 | ||

| f.2 16 | h. 21 | |

| Balance 231 | ||

Table (9)

| Software | ||

| Beginning balance 90 |

| |

| Ending balance 60 | ||

Table (10)

| Patents | ||

| Beginning balance 1 | ||

| Ending balance 1 | ||

Table (11)

| Beginning balance 161 | ||

| Ending balance 161 | ||

Table (12)

| Accounts Payable | ||

| Balance 252 | ||

| e. 10 | ||

| Balance 262 | ||

Table (13)

| Accrued Liabilities | ||

| Balance 182 | ||

| Balance 182 | ||

Table (14)

| Income Tax Payable | ||

| Balance 16 | ||

| i. 33 | ||

| Balance 49 | ||

Table (15)

| Long term Debt | ||

| Balance 49 | ||

| Balance 49 | ||

Table (16)

| Common Stock | ||

| Balance 3 | ||

| Balance 3 | ||

Table (17)

| Additional paid in capital | ||

| Balance 243 | ||

| Balance 243 | ||

Table (18)

| Balance 1,107 | ||

| Balance 1,107 | ||

Table (19)

| Sales Revenue | ||

|

Balance 2,847 a. 100 | ||

| Balance 2,587 | ||

Table (20)

| Credit Card Discounts | ||

|

Beginning balance 53

| ||

| Ending balance 56 | ||

Table (21)

| Cost of sales | ||

|

Beginning balance 1,306 d. 169 | ||

| Ending balance 1,475 | ||

Table (22)

| Advertising Expense | ||

| Beginning balance 145 | ||

| Ending balance 145 | ||

Table (23)

| Utilities Expense | ||

| Beginning balance 85 | ||

| Ending balance 85 | ||

Table (24)

| Wages Expense | ||

| Beginning balance 625 | ||

| Ending balance 625 | ||

Table (25)

| Depreciation Expense | ||

|

Beginning balance 0 f.1. 4 h. 21 | ||

| Ending balance 25 | ||

Table (26)

| Amortisation Expense | ||

|

Beginning balance 0 g. 30 | ||

| Ending balance 30 | ||

Table (27)

| Interest Expense | ||

| Beginning balance 1 | ||

| Ending balance 1 | ||

Table (28)

|

Beginning balance 0 C 6 | ||

| Ending balance 6 | ||

Table (28)

| Loss of sale of equipment | ||

|

Beginning balance 0 f.2. 1 | ||

| Ending balance 1 | ||

Table (29)

| Income Tax Expense | ||

|

Beginning balance 0 f.2. 33 | ||

| Ending balance 33 | ||

Table (30)

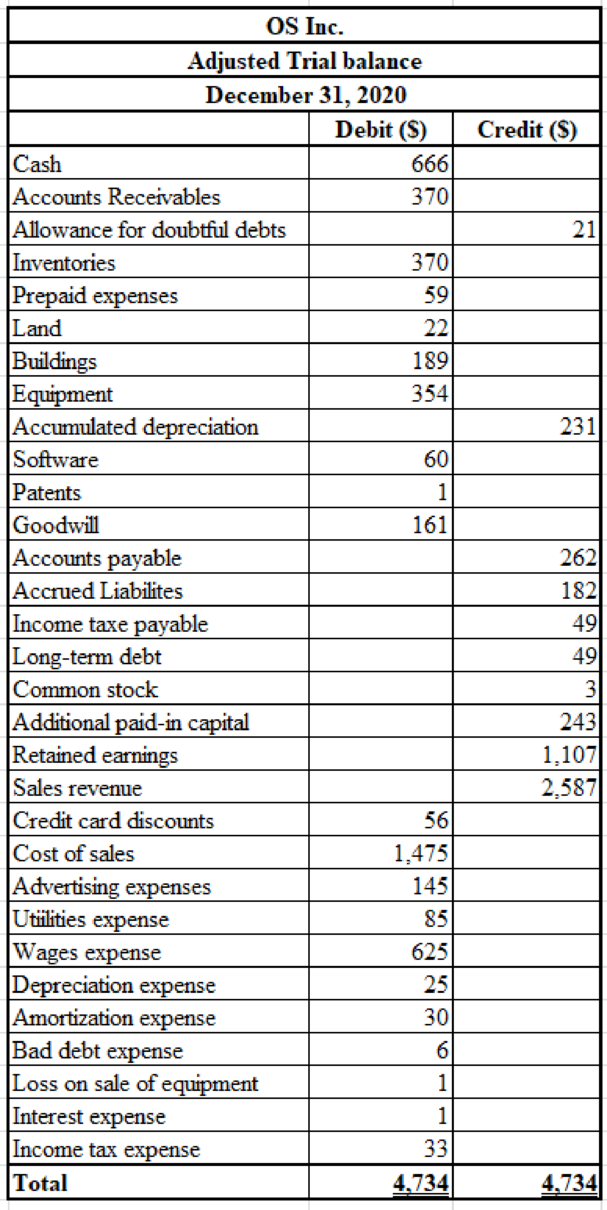

Table (31)

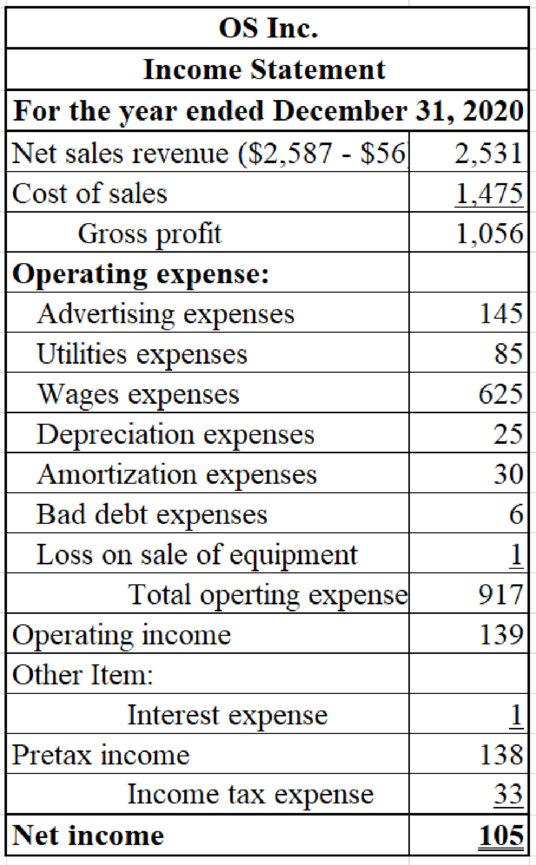

3.

Prepare an income statement, statement of

3.

Explanation of Solution

Prepare an income statement for OS Inc.

Table (32)

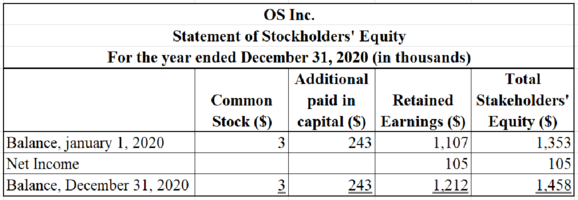

Prepare a statement of stockholders’ equity for OS Inc.

Table (33)

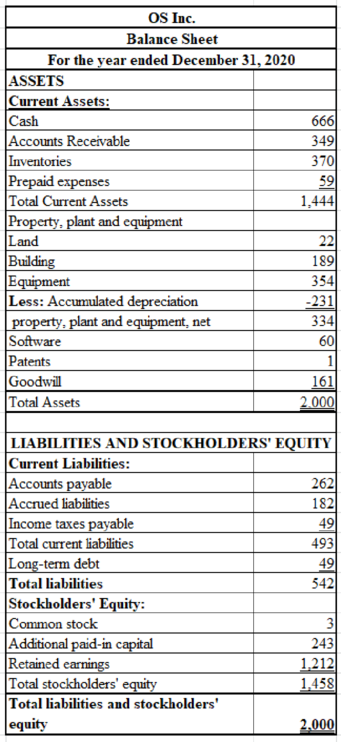

Prepare a balance sheet for OS Inc.

Table (34)

Want to see more full solutions like this?

Chapter 8 Solutions

FINANCIAL ACCOUNTING LOOSELEAF PKG

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education