PRIN.OF CORP.FINANCE-CONNECT ACCESS

13th Edition

ISBN: 2810023360757

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 2PS

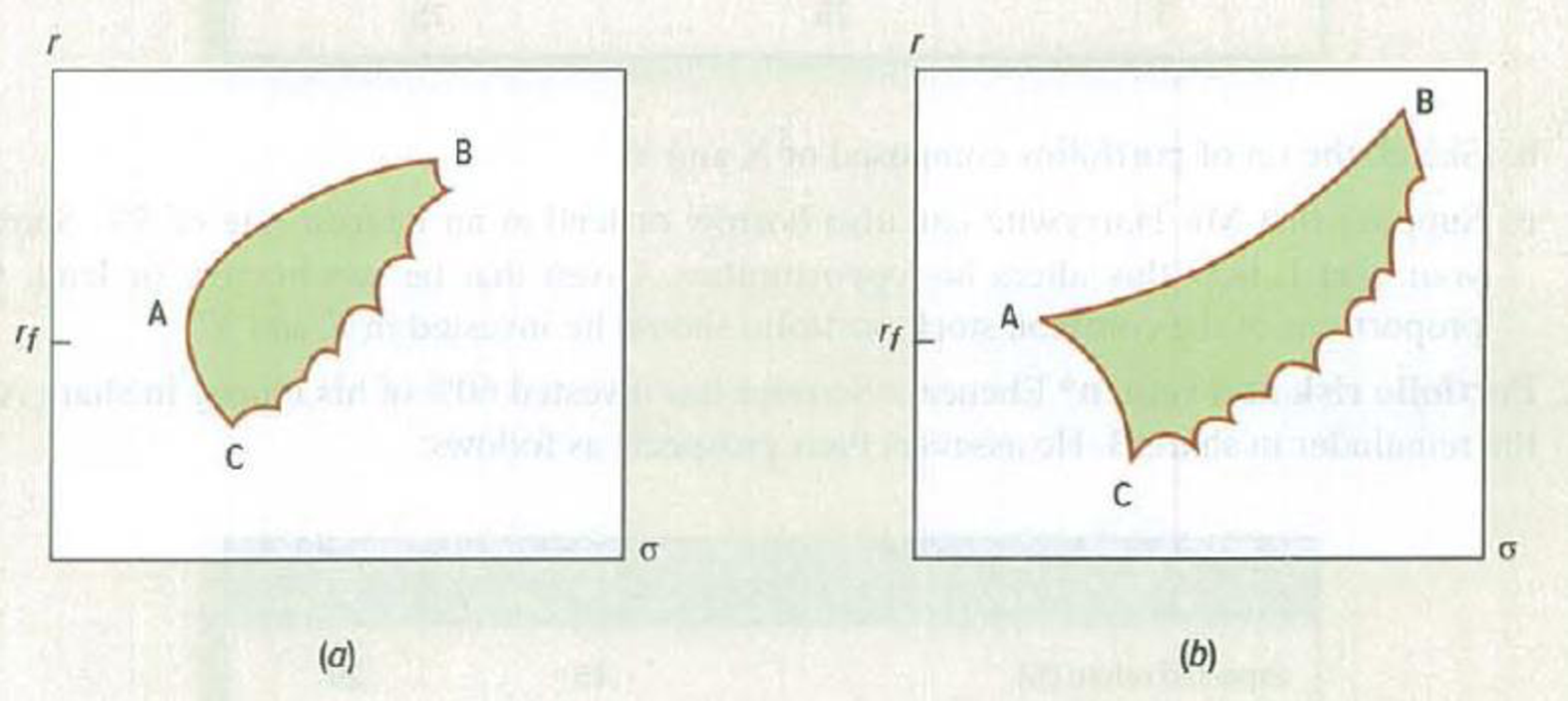

Efficient portfolios Figure 8.11 purports to show the range of attainable combinations of expected return and standard deviation.

a. Which diagram is incorrectly drawn and why?

b. Which is the efficient set of portfolios?

c. If rf is the rate of interest, mark with an X the optimal stock portfolio.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following performance data for a portfolio manager:

Benchmark

Portfolio

Index

Portfolio

Weight

Weight

Return

Return

Stocks

0.65

0.7

0.11

0.12

Bonds

0.3

0.25

0.07

0.08

Cash

0.05

0.05

0.03

0.025

a.Calculate the percentage return that can be attributed to the asset allocation decision.

b.Calculate the percentage return that can be attributed to the security selection decision.

Which of the following statements regarding the graph of the

SML is most accurate?

Select one

O A.

O B.

B-1.0

The beta of Portfolios A, B, and C are identical as they fall directly

on the line.

The expected return of Portfolio C is the difference between the

market's expected return and the risk-free rate.

O C. Portfolio A has lower systematic risk than Portfolio B.

OD. The slope of the line is the market risk premium.

The optimal proportion of the risky asset in the complete portfolio is

given by the equation below

y*=

E(Rp− Rf)

A0²

For each of the variables on the right side of the equation, discuss the

impact of the variable's effect on y* and why the nature of the relationship

makes sense intuitively.

Assume the investor is risk averse

Chapter 8 Solutions

PRIN.OF CORP.FINANCE-CONNECT ACCESS

Ch. 8 - Efficient portfolios For each of the following...Ch. 8 - Efficient portfolios Figure 8.11 purports to show...Ch. 8 - Portfolio risk and return Look back at the...Ch. 8 - Portfolio risk and return Mark Harrywitz proposes...Ch. 8 - Portfolio risk and return Ebenezer Scrooge has...Ch. 8 - Portfolio risk and return Here are returns and...Ch. 8 - Portfolio risk and return Percival Hygiene has IO...Ch. 8 - Sharpe ratio Use the long-term data on security...Ch. 8 - Portfolio beta Refer to Table 7.5. a. What is the...Ch. 8 - CAPM True or false? Explain or qualify as...

Ch. 8 - CAPM True or false? a. The CAPM implies that if...Ch. 8 - CAPM Suppose that the Treasury bill rate is 6%...Ch. 8 - CAPM The Treasury bill rate is 4%, and the...Ch. 8 - Cost of capital Epsilon Corp. is evaluating an...Ch. 8 - APT Consider a three-factor APT model. The factors...Ch. 8 - Prob. 18PSCh. 8 - APT Consider the following simplified APT model:...Ch. 8 - Prob. 20PSCh. 8 - Three-factor modelThe following table shows the...Ch. 8 - Efficient portfolios Look again at the set of the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- choose which one ? 3.Assume CAPM holds. What is the correlation between an efficient portfolio and the market portfolio?a.1b.-1c.0d.Not enough informationarrow_forwardWrite out the equation for the Capital Market Line (CML), and draw it on the graph. Interpret the plotted CML. Now add a set of indifference curves and illustrate how an investors optimal portfolio is some combination of the risky portfolio and the risk-free asset. What is the composition of the risky portfolio?arrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio X Y Z Market Risk-free Rp 11.0% ор 33.00% 10.0 28.00 8.1 10.4 5.2 18.00 23.00 Ө вр 1.45 1.20 0.75 1.00 Ө Assume that the correlation of returns on Portfolio Y to returns on the market is 0.66. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places. R-squaredarrow_forward

- You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: 8p 1.70 1.30 0.85 1.00 Portfolio X Y Z Market Risk-free Rp 11.5% 10.5 7.2 10.9 4.6 R-squared op 38.00% 33.00 23.00 28.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.76. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places.arrow_forwardThe following figures show the optimal portfolio choice for two investors with different levels of risk-aversion graphically. Which statement is correct? E[R] 0.3 0.25 0.2 0.15 0.1 0.05 0 0 0.05 0.1 0.15 Figure 1 0.2 0.25 0.3 0.35 o(R) 0.4 0.45 [H]Z 0.3 0.25 0.2 0.15 0.1 0.05 0 0 0.05 0.1 Figure (2) shows an investor that borrows in risk-free rate and invests in the risky asset. Figure (1) shows an investor with a conservative investment behavior. In the optimal point of both figures, the highest indifference curve is tangent to the efficient frontier. In Figure (1), more aggressive investment decision led to a higher Sharpe ratio. 0.15 Figure 2 0.2 0.25 o (R) 0.3 0.35 0.4 0.45arrow_forwardWhat is the correlation coefficient between returns on any efficient portfolio and returns on the market portfolio in CAPM? 0.5 -0.5 -1 1 Oarrow_forward

- An efficient portfolio is one that: Select one: a. maximises return for a given level of risk. b. maximises risk for a given level of return. c. minimises risk for a given rate of return. d. Both A and C. are efficient portfolios.arrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: Portfolio X Y Z Market Risk-free Rp 14.0% 13.0 .8.5 12.0 7.2 Ор 39.00% 34.00 24.00 29.00 0 Bp 1.50 1.15 0.90 1.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.90. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places. R-squaredarrow_forwardUse the following table to answer the questions a-c below. Standard deviation of risky | return Risky Expected return on risky portfolio Risk-free Sharpe-ratio Portfolio portfolio 1 12 3.5 4.5 2 13 3.75 4.5 3 14 4 4.5 4 15 4.25 4.5 a. Calculate the Sharpe ratio for each portfolio b. Identify the optimal portfolio from the above 4arrow_forward

- The concept of Portfolio Effect indicates that the more assets added to the portfolio, the less risk of the total portfolio Select one: O True O False Ne Jump to... CHAPTER 5-STOCK VALUAarrow_forwardWhich of the following statements regarding the graph of the SML is most accurate? A Select one OA. The beta of Portfolios A, B, and C are identical as they fall directly on the line. B. The expected return of Portfolio C is the difference between the market's expected return and the risk-free rate. C. Portfolio A has lower systematic risk than Portfolio B. D. The slope of the line is the market risk premium.arrow_forwardAs diversification increases, the firm-specific risk of a portfolio approaches A. 1. B. infinity. C. 0. D. (n – 1) × n.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio Management; Author: DevTechFinance;https://www.youtube.com/watch?v=Qmw15cG2Mv4;License: Standard YouTube License, CC-BY