Concept explainers

CASE 8-33

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below.

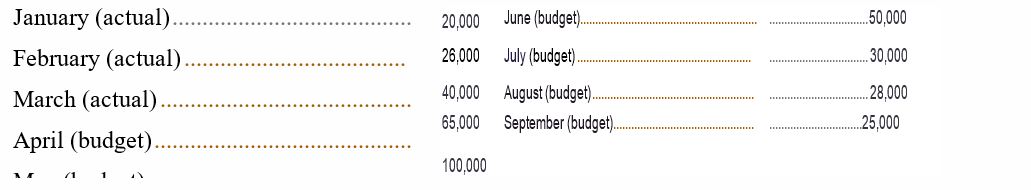

The company sells many styles of earrings, but all are sold for the same price—$10 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings):

The concentration of sales before and during May is due to Mother's Day. Sufficient inventory should be on hand at the end of each month to supply 40% of the earrings sold in the following month. Suppliers are paid $4 for a pair of earrings. One-half of a month's purchases ispaid for in the month of purchase: the other half is paid for in the following month. .All sales are on credit. Only 20% of a month's sales are collected in the month of sale. .An additional 70% is collected in the following month, and the remaining 10% is collected in the second month following sale.

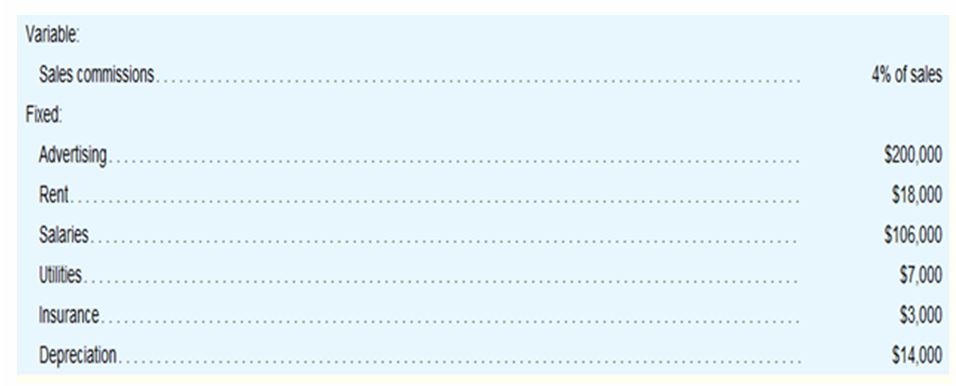

Monthly7operating expenses for the company are given below:

Insurance is paid on an annual basis, in November of each year.

The company plans to purchase $16,000 in new equipment during May and $40,000 in new equipment during June: both purchases will be for cash. The company declares dividends of $ 15,000 each quarter, payable in the first month of the following quarter.

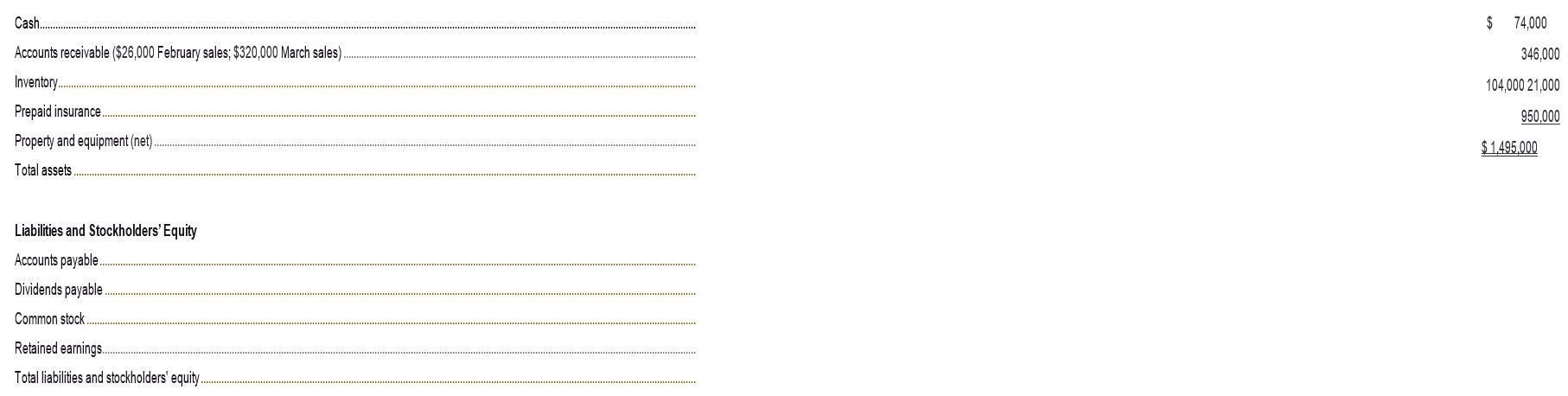

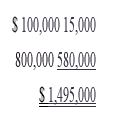

The company's

Assets

The company has an agreement with a bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans

is1% per month and for simplicity we will assume that interest is not compounded. At the end of the quarter, the company would pay the bank all of the accumulated interest on the loan and as much of the loan as possible (in increments of $1,000), while still retaining at least $50,000 in cash.

Required:

Prepare a master budget for the three-month period ending June 30. Include the following detailed schedules:

- A sales budget, by month and in total.

- A schedule of expected cash collections, by month and in total.

- A merchandise purchases budget in units and in dollars. Show' the budget by month and in total.

- A schedule of expected cash disbursements for merchandise purchases, by month and in total.

- A

cash budget . Show the budget by month and in total. Determine any borrowing that would be needed to maintain the minimum cash balance of $50,000. - A

budgeted income statement for the three-month period ending June 30. Use the contribution approach.

- A budgeted balance sheet as of June 30. 1.While popsicle manufacturing is likely to involve other raw materials, such as popsicle sticks and packaging materials, for simplicitv, we have limited our scope to high fructose sugar.

- For simplicity, we assume that

depreciation on these newly acquired assets is included in the quarterly depreciation estimates included in the Budgeting Assumptions tab.

3.For simplicity, the beginning balance sheet and the ending finished goods inventory budget both report a unit product cost of $13. For purposes of answering “what-if’ questions, this schedule would assume a FIFO inventory7 flow. In other words, the ending inventory would consist solely of units that are produced during the budget year.

4.Other adjustments might need to be made for differences between cash flows on the one hand and revenues and expenses on the other hand. For example, if property taxes are paid twice a year in installments of $8,000 each, the expense for property tax would have to be 'backed out" of the total budgeted selling and administrative expenses and the cash installment payments added to the appropriate quarters to determine the cash disbursements. Similar adjustments might also need to be made in the manufacturing overhead budget. We generally ignore these complications in this chapter.

6.The format for the statement of cash flows, which is discussed in a later chapter, may also be used for the cash budget.

7. Cost of goods sold can also be computed using equations introduced in earlier chapters. Manufacturing companies can use the equation: Cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured - Ending finished goods inventory. Merchandising companies can use the equation: Cost of goods sold = Beginning merchandise inventory - Purchases - Ending merchandise inventory.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

PACE MANAGERIAL ACC CUST LL W\ACC CARD

- budgetary control system and explain how the problems are likely to reduce the effectiveness of the system. 2. Explain how Ferguson & Son Manufacturing Company's budgetary control system could be revised to improve its effectiveness. (CMA, adapted) CASE 8-33 Master Budget with Supporting Schedules LO8-2, LO8-4, LO8-8, LO8-9, LO8-10 You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the com- pany has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below. misin ynsamos sill The company sells many styles of earrings, but all are sold for the same price-$10 per pair. Actual sales of…arrow_forwardS Problem 8-25 (Algo) Cash Budget with Supporting Schedules; Changing Assumptions [LO8-2, L08-4, LO8-8] Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: a. Budgeted monthly absorption costing Income statements for April-July are: Sales Cost of goods sold Gross margin Selling and administrative expenses: Selling expense Administrative expense* Total selling and administrative expenses Net operating income *Includes $28,000 of depreciation each month. April May June July $ 600,000 $1,100,000 $ 560,000 $ 460,000 420,000 770,000 392,000 322,000 180,000 330.000 168,000 138,000 105,000 67,000 46,000 64,800 41,600 44,000 169, 800 108,600 90,000 $ 21,000 $ 160, 200 $ 59,400 $ 48,000 111,000 48,000 159,000 b. Sales…arrow_forwardash Budgeting Dorothy Koehl recently leased space in the Southside Mall and opened a new business, Koehl's Doll Shop. Business has been good, but Koehl frequently runs out of cash. This has necessitated late payment on certain orders, which is beginning to cause a problem with suppliers. Koehl plans to borrow from the bank to have cash ready as needed, but first she needs a forecast of how much she should borrow. Accordingly, she has asked you to prepare a cash budget for the critical period around Christmas, when needs will be especially high. Sales are made on a cash basis only. Koehl's purchases must be paid for during the following month. Koehl pays herself a salary of $4,800 per month, and the rent is $3,000 per month. In addition, she must make a tax payment of $10,000 in December. The current cash on hand (on December 1) is $300, but Koehl has agreed to maintain an average bank balance of $7,000 - this is her target cash balance. (Disregard the amount in the cash register, which…arrow_forward

- Preparing a financial budget—cash budget You recently began a Job as an accounting intern a Reilly Golf Park. Your first task was to help prepare the cash budget for April and May, Unfortunately, the computer with the budget file crashed, and you did not have a backup or even a paper copy. You ran a program to salvage bits of data from the budget file. After entering the following data in the budget you may have just enough information to reconstruct the budget. Reilly Golf Park eliminates any cash deficiency by borrowing the exact amount needed from First Street Bank, where the current interest rate is 6% per year. Reilly Golf Park first pays interest on its outstanding debt at the end of each month. The company then repays all borrowed amounts at the end of the month with any excess cash above the minimum required but after paying monthly interest expenses. Reilly does not have any outstanding debt on April 1. Complete the cash budget. Round interest expense to the nearest whole…arrow_forward**Please answers questions 2-4**You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below. The company sells many styles of earrings, but all are sold for the same price - $10 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings): January (actual)..... 20,000 June (budget)..... 50,000 February (actual)..... 26,000 July (budget)..... 30,000 March (actual)..... 40,000 August (budget)..... 28,000 April (budget)..... 65,000…arrow_forwardExercise 13-39 (Algo) Prepare Budgeted Financial Statements (LO 13-6) Varmit-B-Gone is a pest control service that operates in a suburban neighborhood. The company attempts to make service calls at least once a month to all homes that subscribe to its service. It makes more frequent calls during the summer. The number of subscribers also varies with the season. The number of subscribers and the average number of calls to each subscriber for the months of interest follow: Subscribers Service calls (per subscriber) March 1,350 0.6 April 1,450 0.9 May 2,150 1.5 June 2,350 2.5 July 2,350 3.0 August 2,000 2.4 The average price charged for a service call is $80. Of the service calls, 30 percent are paid in the month the service is rendered, 60 percent in the month after the service is rendered, and 8 percent in the second month after. The remaining 2 percent is uncollectible. Varmit-B-Gone estimates that the number…arrow_forward

- The Chapter 8 Form worksheet is to be used to create your own worksheet version of the Review Problem in the text. Requirement 2: The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: a. What are the total expected cash collections for the year under this revised budget? b. What is the total required production for the year under this revised budget? c. What is the total cost of raw materials to be purchased for the year under this revised budget? d. What are the total expected cash disbursements for raw materials for the year under this revised budget? e. After seeing this revised budget, the production manager cautioned that due to the current production constraint, a complex milling machine, the plant can produce no more than 90,000 units in any one quarter. Is this a potential problem?arrow_forwardProblem 8-24 (Algo) Cash Budget with Supporting Schedules [LO8-2, LO8-4, LO8-8] Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: Budgeted monthly absorption costing income statements for April–July are: April May June July Sales $ 570,000 $ 770,000 $ 470,000 $ 370,000 Cost of goods sold 399,000 539,000 329,000 259,000 Gross margin 171,000 231,000 141,000 111,000 Selling and administrative expenses: Selling expense 77,000 97,000 58,000 37,000 Administrative expense* 43,500 58,400 36,200 35,000 Total selling and administrative expenses 120,500 155,400 94,200 72,000 Net operating income $ 50,500 $ 75,600 $ 46,800 $ 39,000…arrow_forwardr retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at certain times of the year has experienced a shortage of cash. Since you are well trained in budgeting, you have decided to prepare a master budget for the upcoming second quarter. To this end, you have worked with accounting and other areas to gather the information assembled below. The company sells many styles of earrings, but all are sold for the same price-$10 per pair. Actual sales of earrings for the last three months and budgeted sales for the next six months follow (in pairs of earrings): 1 January (actual) February (actual) March (actual) April (budget) May (budget) Variable: The concentration of sales before and during May is due to Mother's Day. Sufficient inventory should be on hand at the end of each month to supply 40% of the earrings sold in the following month. Suppliers are paid $4 for a pair of earrings. One-half of a month's…arrow_forward

- Problem 8-24 (Algo) Cash Budget with Supporting Schedules [LO8-2, LO8-4, LO8-8] Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: Budgeted monthly absorption costing income statements for April–July are: April May June July Sales $ 570,000 $ 770,000 $ 470,000 $ 370,000 Cost of goods sold 399,000 539,000 329,000 259,000 Gross margin 171,000 231,000 141,000 111,000 Selling and administrative expenses: Selling expense 77,000 97,000 58,000 37,000 Administrative expense* 43,500 58,400 36,200 35,000 Total selling and administrative expenses 120,500 155,400 94,200 72,000 Net operating income $ 50,500 $ 75,600 $ 46,800 $ 39,000…arrow_forwardBudgetary Slack with Ethical Considerations Norton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for next year. Scott Ford recently joined Norton’s accounting staff and is interested to learn as much as possible about the company’s budgeting process. During a recent lunch with Marge Atkins, sales manager, and Pete Granger, production manager, Ford initiated the following conversation: Ford: Since I’m new around here and am going to be involved with the preparation of the annual budget, I’d be interested to learn how the two of you estimate sales and production numbers. Atkins: We start out very methodically by looking at recent history, discussing what we know about current accounts, potential customers, and the general state of consumer spending. Then we add that usual dose of intuition to come up with the best forecast we can. Granger: I usually take the sales projections as the basis for my projections. Of course,…arrow_forwardKK ENTERPRISE was set up by a man and his with some few years ago. The trade in a lot of products. They don’t have enough knowledge in accounting for decision making. They need professional assistance to prepare budgets for the period October to December 2020. The following information has been provided to assist in the budgeting process: · Budgeted monthly sales revenue for 2020 is as follows: October GH¢ 40,000, November GH¢ 70,000, December GH¢ 50,000, January 2018 45,000. Sales are 20% cash and 80% credit. Credit sales are collected over a three- month period, 15% in the month of sale, 70% in the month following sale and 15% in the second month following sale. Total sales revenue in August amounts to GH¢30,000 and September’s total sales revenue amounts to GH¢36,000. Cost of sales is expected to amount to 60% of sales revenue each month. The business maintains its closing inventory levels at 75% of the following month’s cost of sales. Inventory at the beginning of October is…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education