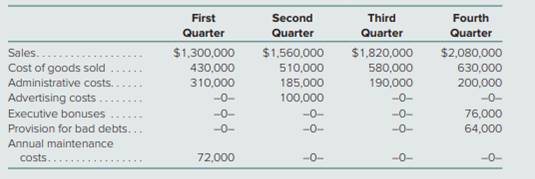

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

a.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided is $361200, $448,200, $559,200, $679,200 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 372,800 | $ 452,800 |

| Net income | $ 361,200 | $ 448,200 | $ 559,200 | $ 679,200 |

Table: (1)

Working note

Calculate insurance premium per quarter

Thus, insurance premium per quarter is $40,000

Calculate administrative expenses for the first quarter

Thus, administrative expenses for the first quarter is $190,000

Insurance premium per quarter is added to the administrative expenses estimates given.

Advertising costs estimates are equally distributed in the four quarters.

Executive bonuses are equally distributed in four quarters.

Provision for bad debts is equally distributed in four quarters.

Annual maintenance costs are equally distributed in four quarters.

b.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent is $361200, $448,200, $577,840, $701,840 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 354,160 | $ 430,160 |

| Net income | $ 361,200 | $ 448,200 | $ 577,840 | $ 701,840 |

Table: (2)

Income tax rate is 40 percent for first and second quarter and it has changed to 38 percent in the third and fourth quarter.

Want to see more full solutions like this?

Chapter 8 Solutions

ADVANCED ACCOUNTING W/CONNECT>CUSTOM<

- Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.arrow_forwardBrandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.arrow_forwardGrevilla Corporation is a manufacturing company. The corporation has accumulated earnings of $950,000, and it can establish reasonable needs for $400,000 of that amount. Calculate the amount of the accumulated earnings tax (if any) that Grevilla Corporation is subject to for this year. $_____________arrow_forward

- Borat Company gives annual bonuses after the end of the year. Borat computes the bonuses based on the companys net income after deducting the bonuses but before deducting income taxes. Borats income before bonuses and income taxes is 565,000 for the current year. The effective income tax rate is 21%, and the bonus rate is 12%. Calculate Borats bonuses and income taxes for the current year. Round your final answer to two decimal places.arrow_forwardIn the current year, Madison Corporation had 50,000 of taxable income at a tax rate of 25%. During the year, Madison began offering warranties on its products and has a Warranty liability for financial reporting purposes of 5,000 at the end of the year. Warranty expenses are not deductible until paid for income tax purposes. Prepare the journal entry to record Madisons income taxes at the end of the year.arrow_forwardThe Bookbinder Company had 500,000 cumulative operating losses prior to the beginning of last year. It had 100,000 in pre-tax earnings last year before using the past operating losses and has 300,000 in the current year before using any past operating losses. It projects 350,000 pre-tax earnings next year. a. How much taxable income was there last year? How much, if any, cumulative losses remained at the end of the last year? b. What is the taxable income in the current year? How much, if any, cumulative losses remain at the end of the current year? c. What is the projected taxable income for next year? How much, if any, cumulative losses are projected to remain at the end of next year?arrow_forward

- AirParts Corporation reported a net operating loss of $25 million for financial reporting and tax purposes. Taxable income last year and the previous year, respectively, was $20 million and $15 million. The enacted tax rate each year is 40%. Prepare the journal entry to recognize the income tax benefit of the net operating loss. AirParts elects the carryback option.arrow_forwardWolfpack Inc., a calendar year-end company, pays its employees on the last day of the month for work performed during the month. Gross salaries for the month of April are $20,000. Wolfpack withholds the following amounts from its employees’ paychecks for this pay period: federal income tax of $4,000 state income tax of $2,500 FICA tax of $1,530 Tax withholding are not remitted to the proper tax agencies until the 10th of the following month. Required: Answer the following two questions. Note: Do not include decimals or cents in your response. Question #1: The entry to record the payment of salaries on April 30 should include a debit to the "Salaries Expense" account for how much? Answer: Question #2: The entry to record the payment of salaries on April 30 should include a credit to the "Cash" account for how much? Answer:arrow_forwardWolfpack Inc., a calendar year-end company, pays its employees on the last day of the month for work performed during the month. Gross salaries for the month of April are $20,000. Wolfpack withholds the following amounts from its employees’ paychecks for this pay period: federal income tax of $4,000 state income tax of $2,500 FICA tax of $1,530 Tax withholding are not remitted to the proper tax agencies until the 10th of the following month. Required: Answer the following two questions. Note: Do not include decimals or cents in your response. Question #1: The entry to record the payment of salaries on April 30 should include a debit to the "Salaries Expense" account for how much? Answer: $Answer. Question #2: The entry to record the payment of salaries on April 30 should include a credit to the "Cash" account for how much? Answer: $Answerarrow_forward

- At the end of the year, Falabella Co. has pretax financialincome of $550,000. Included in the $550,000 is $70,000interest income on municipal bonds, $25,000 fine fordumping hazardous waste, and depreciation of $60,000.Depreciation for tax purposes is $45,000. Compute incometaxes payable, assuming the tax rate is 30% for all periods.arrow_forwardThe Foyer Company had an enacted income tax rate of 25%. The company ended Year 1 with a deferred income tax liability of $30,000, a deferred income tax asset of $40,000, and a valuation allowance of $9,000. The enacted tax rate at the beginning of Year 2 was raised to 28%. The company ended Year 2 with a deferred income tax liability of $60,000, a deferred income tax asset of $30,000, and a valuation allowance of $14,000. On the company's Year 2 income statement, what is the amount of income tax expense (deferred) that is reported?arrow_forwardExco plc’s accountants have prepared the following IFRS income statement summary for the year ended 31 December 20X1: Amounts in £ Year 20X1 Total revenue 100,000 Total expenses 70,000 * Profit before tax 30,000 * includes a non-deductible expense (see below) The following information is also available: - Exco plc’s expenses include £10,000 for a penalty charge which is not tax-deductible. - The statutory tax rate on corporate profits is 20%. The current tax (expense) reported for the year ended 31 December 20X1 is: a. £3,000 b. £6,000 c. £8,000 d. £9,000 e. £13,000arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning