Depreciation is the amount of decrease in the value of an asset within a set time period due to wear and tear of that particular asset. It helps in readjusting the actual cost of the particular asset o which the depreciation is applied.

Straight Line Depreciation:

Straight line depreciation is one of the methods of depreciation in which fixed rate of depreciation is provided throughout the course of depreciation on a particular asset.

To prepare: A table and to allocate the cost.

Explanation of Solution

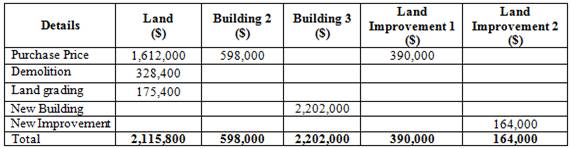

Prepare table to show allocation of cost:

Table (1)

Working Notes:

Computation of total appraised value:

Total appraised value is $2,800,000.

Land

Computation of percentage of land of the total appraised value:

Percentage of land is 62%.

Apportioned cost

Computation of apportioned cost:

Apportioned cost of land is $1,612,000.

Building

Computation of percentage of building of the total appraised value:

Percentage of building is 23%.

Apportioned cost

Apportioned cost of building is $598,000.

Land Improvements 1

Computation of percentage of land improvements 1 of the total appraised value:

Percentage of land improvement 1 is 15%.

Apportioned cost

Computation of apportioned cost:

Apportioned cost of land improvement 1 is $390,000.

2.

To Prepare:

2.

Explanation of Solution

Record the entry for purchase of assets.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| Jan1 | Land | 2,115,800 | ||

| Building 2 | 598,000 | |||

| Building 3 | 2,202,000 | |||

| Land improvements 1 | 390,000 | |||

| Land improvements 2 | 164,000 | |||

| Cash | 5,469,800 | |||

| (To record the purchase of assets) |

Table (2)

- Building is an asset account. Building account increases as the new building has been purchased; hence all the assets are debited as they increases in value.

- Land is an asset account. Land account increases as a new land is purchased and all the assets are debited as a new asset is purchased or if its value increases.

- Vehicle account is an asset account. Vehicles account increases as a new vehicle is purchased and all the assets are debited as a new asset is purchased or if its value increases.

- Land improvements are an asset account. Land improvement account increases as some improvements have been done on land to increase its useful life and all the assets are debited as their value increases.

- Cash account is an asset account. Cash account decreases as the amount paid for the purchase of all assets are made in cash and all the assets are credited as their values decreases.

3.

To Prepare:

3.

Explanation of Solution

Building 2

Record depreciation on building 2.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| Depreciation | 26,900 | |||

| | 26,900 | |||

| (To record the depreciation) |

Table (3)

- Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

- Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation that will charge to building is $26,900.

Building 3

Record entry for depreciation on building 3

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| Depreciation | 72,400 | |||

| Accumulated Depreciation | 72,400 | |||

| (To record the depreciation) |

Table (4)

- Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

- Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation that will charge to building 3 is $72,400.

Land improvement 1

To record entry for depreciation on Land improvement 1,

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| Depreciation | 32,500 | |||

| Accumulated Depreciation | 32,500 | |||

| (To record the depreciation) |

Table (5)

- Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

- Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation charged to improvement 1 $32,500.

Land improvement 2

To record entry for depreciation on Land improvement 2,

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| Depreciation | 8,200 | |||

| Accumulated Depreciation | 8,200 | |||

| (To record the depreciation) |

Table (6)

- Depreciation is an expense account. Depreciation account increases the balance of expense account and all the losses and expenses accounts are debited.

- Accumulated Depreciation account is a contra asset account. Accumulated depreciation has a credit balance and is increasing as the depreciation is transferred to this account. This is the reason it is credited.

Working Notes:

Computation of depreciation:

Depreciation that will charge to improvement 2 is $8200.

Want to see more full solutions like this?

Chapter 8 Solutions

FINANCIAL ACCOUNTING FUNDAMENTALS

- (Appendix 11.1) Auburn Company purchased an asset on January 1, Year 1, for 150,000. The asset has a MACRS life of 7 years. The residual value of the asset is 35,000. Calculate the depreciation expense for Year 1 and Year 2 using MACRS.arrow_forwardCost of Intangible Assets Advanced Technological Devices Inc. acquired a patent for $91,500. It spent an additional $31,250 successfully defending the patent in legal proceedings. Required: Determine the cost of the patent.arrow_forwardDEPLETION: CALCULATING AND JOURNALIZING Mineral Works Co. acquired a salt mine at a cost of 1,700,000, with no expected salvage value. The estimated number of units available for production from the mine is 3,400,000 tons. (a) During the first year, 200,000 tons are mined and sold. (b) During the second year, 600,000 tons are mined and sold. REQUIRED 1. Calculate the amount of depletion expense for both years. 2. Prepare general journal entries for depletion expense.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning