FUND. OF FINANCIAL MGMT (LL)--W/ACCESS

9th Edition

ISBN: 9781337948982

Author: Brigham

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 5DQ

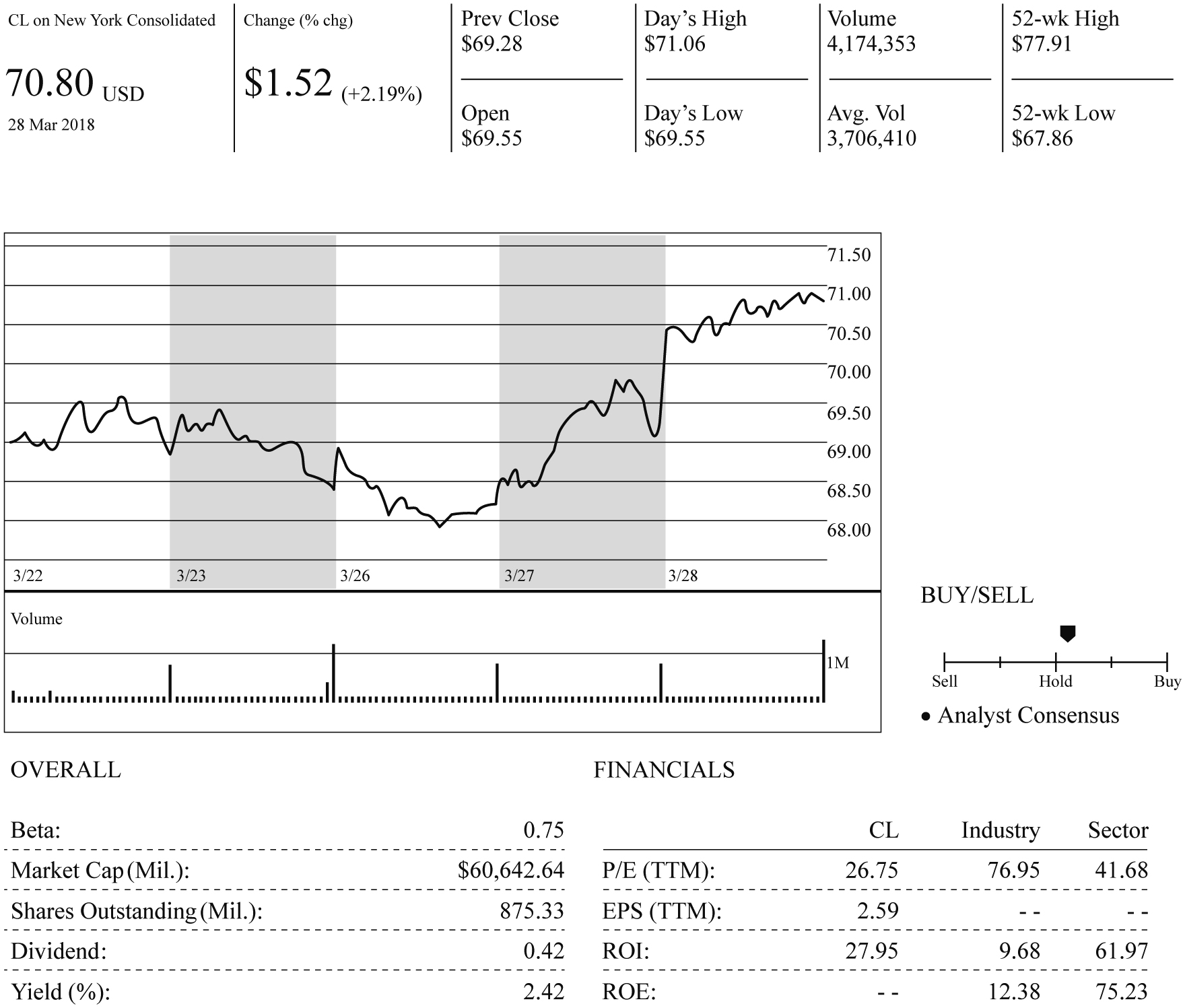

Go back to the summary page to see an estimate of the company’s beta. What is the company’s beta? What was the source of the estimated beta? Realize that if you go to another website, the beta shown could be different due to measurement differences.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Through the use of a reliable source such as YahooFinance.com or ValueLine.com, determine your company’s beta. Also, find the beta for a competitor (a firm in the same line of business). Which of these is a riskier company based on this information? Why do you think the market deems this firm as riskier?

I would like to use UnitedHealth Care Group.

Find the following values, using the equations, and then work the problems using a financial calculator to check your answers. Disregard rounding differences. (Hint: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in parts b and d, and in many other situations, to see how changes in input variables affect the output variable.) Do not round intermediate calculations. Round your answers to the nearest cent.

An initial $400 compounded for 1 year at 9.5%.

$

An initial $400 compounded for 2 years at 9.5%.

$

The present value of $400 due in 1 year at a discount rate of 9.5%.

$

The present value of $400 due in 2 years at a discount rate of 9.5%.

$

Consider a personal project or a project that you have been involved with at work. Provide the ROI that was used and how this calculation was used to determine the success or failure of the venture

Chapter 8 Solutions

FUND. OF FINANCIAL MGMT (LL)--W/ACCESS

Ch. 8 - Suppose you owned a portfolio consisting of...Ch. 8 - Prob. 2QCh. 8 - Prob. 3QCh. 8 - Is it possible to construct a portfolio of...Ch. 8 - Stock A has an expected return of 7%, a standard...Ch. 8 - A stock had a 12% return last year, a year when...Ch. 8 - If investors aversion to risk increased, would the...Ch. 8 - Prob. 8QCh. 8 - In Chapter 7, we saw that if the market interest...Ch. 8 - Prob. 1P

Ch. 8 - PORTFOLIO BETA An individual has 20,000 invested...Ch. 8 - Prob. 3PCh. 8 - Prob. 4PCh. 8 - BETA AND REQUIRED RATE OF RETURN A stock has a...Ch. 8 - EXPECTED RETURNS Stocks A and B have the following...Ch. 8 - PORTFOLIO REQUIRED RETURN Suppose you are the...Ch. 8 - Prob. 8PCh. 8 - REQUIRED RATE OF RETURN Stock R has a beta of 2.0,...Ch. 8 - Prob. 10PCh. 8 - CAPM AND REQUIRED RETURN Calculate the required...Ch. 8 - REQUIRED RATE OF RETURN Suppose rRF = 4%, rM =...Ch. 8 - CAPM, PORTFOLIO RISK, AND RETURN Consider the...Ch. 8 - PORTFOLIO BETA Suppose you held a diversified...Ch. 8 - Prob. 15PCh. 8 - CAPM AND PORTFOLIO RETURN You have been managing a...Ch. 8 - PORTFOLIO BETA A mutual fund manager has a 20...Ch. 8 - EXPECTED RETURNS Suppose you won the lottery and...Ch. 8 - EVALUATING RISK AND RETURN Stock X has a 10%...Ch. 8 - REALIZED RATES OF RETURN Stocks A and 13 have the...Ch. 8 - SECURITY MARKET LINE You plan to invest in the...Ch. 8 - Prob. 22SPCh. 8 - Prob. 23ICCh. 8 - Prob. 1DQCh. 8 - Prob. 2DQCh. 8 - Prob. 3DQCh. 8 - Select one of the four stocks listed in Question 3...Ch. 8 - Go back to the summary page to see an estimate of...Ch. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Beta pf CPB company Beta of the MSI Company is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider an organization of your choosing that might be creating a survey for a product or service. Write two example questions that you would use to interpret descriptive statistics and two example questions that you would use to interpret inferential statistics.arrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forwardOne day, the company chooses to buy their new accounting information system (AIS), and decide which activities in the systems development life cycle (SDLC) can be skipped? Justify your choice and explanation.arrow_forward

- You do not have to start from scratch, but note, these are completely independent pro formas. They must update accordingly from the data worksheets. Plan on showing your analysis and discussing the proforma changes that occur under each new scenario and how it affects profitability. Use a formatted text box (not a comment) to explain your recommendations under each new pro forma. This will be approximately a 2-3 paragraph endeavor. Scenario One: “What if” Analysis for adding flavored ice coffees. Your client is unsure if she should sell flavored ice coffees. She thinks she can sell a coffee to every second customer and it seems to be lucrative because the coffee sells for $3.75 each and costs him only $1.60 to purchase. Unfortunately your client is afraid that he would cannibalize his soft drink sales with the coffee customers (one soft drink less for every coffee sold). It will cost him $5,250 to purchase the equipment and insurance costs would rise by another…arrow_forwardHow to create a model to determine the company’s profit and to see how sensitive the profit is to the response rate from the mailing?arrow_forwardBriefly review the sensitivity analysis that is presented in the case exhibits. Under what circumstances is this project financially attractive? What bets were the company making when they went ahead with the project? DO NOT HAVE TO PERFORM YOUR OWN SENSITIVITY ANALYSIS. YOU ARE TO INTERPRET THE SENSITIVITY ANALYSIS THAT IS GIVEN.arrow_forward

- What are the steps to create a new estimate in QuickBooks Online? Projects > All Sales > New Transaction > Estimate Sales > Customers > New Customer Sales > All Sales > New Transaction > Estimate Gear icon > Estimatearrow_forwardThis topic is about CVP Analysis. Please check the photo for the problem. Thank you!arrow_forwardFind an expression for the marginal revenue function, simplify it, and record your result in the box below. Be sure to use the proper variable in your answer. (Use the preview button to check your syntax before submitting your answer.) Answer: MR(g)arrow_forward

- Provide a short narrative of your analysis of the problem. Explain what theories/ concepts apply, how, and why. Then present the solution/computation. Write a short narrative explaining the meaning of the final answer - its implication to the firm. Write a short recommendation/conclusion based on the analysis and solutions. You solved a current problem only. How can you provide for the future? What about contingencies that may arise? What proactive measures can you take?arrow_forwardThe Human Resources Manager for Optilytics LLC is evaluating applications for the position of Senior Data Scientist. The file OptilyticsLLC presents summary data of the applicants for the position. a. Use a PivotTable in Excel to create a joint probability table showing the probabilities associated with a randomly selected applicants sex and highest degree achieved. Use this joint probability table to answer the questions below. b. What are the marginal probabilities? What do they tell you about the probabilities associated with the sex of applicants and highest degree completed by applicants? c. If the applicant is female, what is the probability that the highest degree completed by the applicant is a PhD? d. If the highest degree completed by the applicant is a bachelors degree, what is the probability that the applicant is male? e. What is the probability that a randomly selected applicant will be a male whose highest completed degree is a PhD?arrow_forwardAn indirect strategY places the main idea after an explanation or reason. Which of the following is a situation that might call for an indirect strategy? Check all that apply. O You need to inform your team that the upcoming project will be a challenge. O You need to convince your coworkers to adopt a new software program that they don't understand. O You are sending a past-due notice on an account. O You need to fire your receptionist. O You want to schedule a meeting to update your boss on a client meeting. Which or the following is a situation that might call for an indirect strategy? O When preventing frustration O when trying to facilitate use of proper words Respects the feelings of the audiencearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY