Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 6P

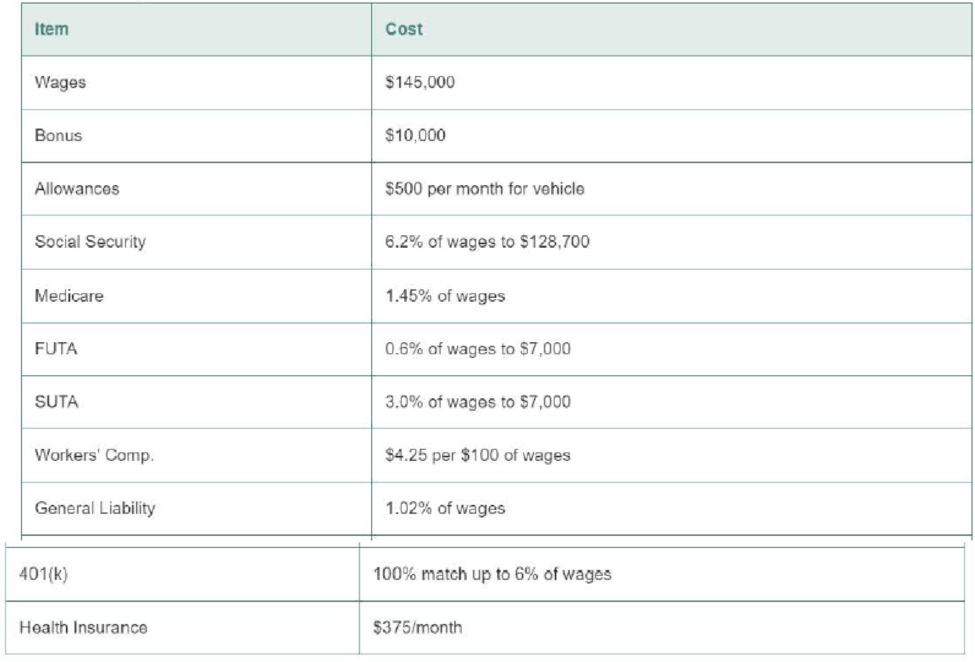

Determine the annual cost, monthly cost, and burden markup for a salaried employee given the information in Table 8-2. Assume the employee takes full advantage of the 401(k) benefit.

Table 8-2 Wage Information for Problem 6

Expert Solution & Answer

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

schedule05:53

Students have asked these similar questions

(see attached pic for the problem) 1. Compute the employee benefit expense for the current year.

The wage base for unemployment compensation taxes are:

a. all wages paid but not including those that have been set aside for the employee to draw upon at his/her discretion.

b. all wages actually paid or constructively paid.

c. all wages paid or payable for the period.

d. all wages that are considered to be constructively paid plus wages payable.

Use the combined wage bracket tables, Exhibit 9-3 and Exhibit 9-4, to solve.

Employee

MaritalStatus

WithholdingAllowances

Pay Period

GrossEarnings

CombinedWithholding

Reese, S.

M

4

Weekly

$1,211

$

Chapter 8 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 8 - What is the difference between an allowance and a...Ch. 8 - Why are the social security and Medicare taxes...Ch. 8 - How does employee turnover affect the labor burden...Ch. 8 - What can a company do to reduce its workers'...Ch. 8 - Determine the annual cost, average hourly cost,...Ch. 8 - Determine the annual cost, monthly cost, and...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Would the following companies most likely use a job order costing system or a process costing system? Paint man...

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Freeman Furnishings has summarized its data as shown. Direct labor hours will be used as the activity base to a...

Principles of Accounting Volume 2

FIFO method, spoilage, equivalent units. Refer to the information in Exercise 18-21. Suppose MacLean Manufactur...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Capitalization of Interest, Specific and General Debt, Journal Entries, IFRS. How would the solution to E11-6 c...

Intermediate Accounting (2nd Edition)

The carrying value of Bonds Payable equals a.Bonds Payable plus Discount on Bonds Payable. b.Bonds Payable minu...

Financial Accounting (12th Edition) (What's New in Accounting)

S6-2 Determining inventory costing methods

Ward Hard ware does not expect costs to change dramatically and want...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Knowledge Booster

Similar questions

- An employee and employer cost-share pension plan contributions and health insurance premium payments. If the employee covers 35% of the pension plan contribution and 25% of the health insurance premium, what would be the employees total benefits responsibility if the total pension contribution was $900, and the health insurance premium was $375? Include the journal entry representing the payroll benefits accumulation for the employer in the month of February.arrow_forwardIn EB13, you prepared the journal entries for Janet Evanovich, an employee of Marc Associates. You have now been given the following additional information: June is the first pay period for this employee. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. FICA Social Security and FICA Medicare match employee deductions. The employer is responsible for 60% of the health insurance premium. The employer matches 50% of employee pension plan contributions. Using the information from EB13 and the additional information provided: A. Record the employer payroll for the month of June, dated June 30, 2017. B. Record the payment in cash of all employer liabilities only on July 1.arrow_forwardIn EA14, you prepared the journal entries for the employee of Toren Inc. You have now been given the following additional information: May is the first pay period for this employee. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. FICA Social Security and FICA Medicare match employee deductions. The employer is responsible for 70% of the health insurance premium. Using the information from EA14 and the additional information provided: A. Record the employer payroll for the month of May, dated May 31, 2017. B. Record the payment in cash of all employer liabilities only on June 1.arrow_forward

- An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the FICA Medicare tax rate is 1.45%. What is the employees FICA taxes responsibility? A. $535.50 B. $612 C. None, only the employer pays FICA taxes D. $597.50 E. $550arrow_forward2. Calculate the EI and CPP for the following employees. Find the employer portion as well. a. Biweekly salary of 2000 b. Weekly salary of 1100arrow_forwardFind the amount of Social Security and Medicare for the current pay period for the employee. Z. McCombs has a current gross earning of $3,246.33, and a year-to-date earning of $139,564.95.arrow_forward

- An employee receives an hourly wage rate of $18, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 45; federal income tax withheld, $349; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $442 $855 $1,151 $1,207arrow_forwardAn employee earns $20 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 55 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee’s federal income tax withheld is $288. a. Determine the gross pay for the week. b. Determine the net pay for the week.arrow_forwardAn employee has gross earnings of $1,600 and withholdings of $25 for income taxes, $5 for Social Security taxes, and $3 for Medicare taxes. The employer also pays a total of $5 for Social Security and $3 for Medicare taxes, $12 for FUTA, and $2 for SUI. What is the total cost of this employee to the employer?arrow_forward

- Total Cost of Employee G. E. Spring employs Trent Pelligrini at a salary of $46,200 a year. Spring is subject to employer Social Security taxes at a rate of 6.2% and Medicare taxes at a rate of 1.45% on Pelligrini's salary. In addition, Spring must pay SUTA tax at a rate of 5.1% and FUTA tax at a rate of 0.6% on the first $7,000 of Pelligrini's salary. Compute the total cost to Spring of employing Pelligrini for the year. Round your answer to the nearest cent.arrow_forwardBecause an employee works 46 hours in a regular week of 40, with an hourly salary of $10 and receives double pay for hours worked in excess of 40, it determines: Gross Income? 7% contribution on income 6.20%Social Security Contribution 1.45% of health care contributions Net income For this same situation, it determines the employer's payroll contribution 6.20% Social Security contribution 1.45% health care contribution 4.40% state unemployment 0.60% federal unemployment 0.60% Temporary disability insurance Total employer's contributionarrow_forwardAn employer uses a career average formula to determine retirement payments to its employees. The annual retirement payout is 8 percent of the employees’ career average salary times the number of years of service. Calculate the annual benefit payment under the following scenarios. Years Worked Career Average Salary 27 $ 68,000 30 70,500 32 72,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage