Concept explainers

Jack and Jill Smith have just retired and want to build a small, basic cabin in the Blue Mountains of Vermont.

They have hired Daryl Hannah as the general contractor for the project. She has assembled a team of three

workers to complete the project: Tom. Dick, and Harry. Daryl has negotiated a cost-plus contract with the

Smiths whereby she will receive 15 percent beyond the cost of labor and materials.

Before they sign the contract the Smiths want an estimate of how much the project is likely to cost and how long it will take.

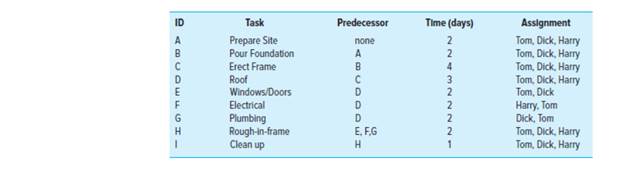

Darryl has estimated that the cost for materials, permits, etc., will total $40000. She wants to determine labor costs as well as how long the project will take. This is one of several projects Daryl is managing, and other than occasionally helping out, her role is strictly limited to supervising. She has devised the following master plan and assignments.

Note that D2ck is the only skilled plumber in the group while Harry is the only skilled electrician. Tom is a general carpenter and can assist them with their work. Dick and Harry each get paid $300 a day while Tom gets paid $200 per day.

Darryl has negotiated a 10 percent management reserve to deal with unexpected problems. Unused funds will be returned to the Smiths.

Prepare a short proposal for the Smiths that includes a Gantt chart with resources assigned, and cost estimates if the project starts on 8/1/16. Did resource limitations affect the final schedule? If so, how? What financial risks does this project face? What can the Smiths do to protect themselves against those risks?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Project Management: The Managerial Process (Mcgraw-hill Series Operations and Decision Sciences)

- Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 361,504 −$ 16,050 1 28,700 5,368 2 51,000 8,456 3 53,000 14,000 4 423,000 9,699 Whichever project you choose, if any, you require a 6 percent return on your investment. a. What is the payback period for Project A? b. What is the payback period for Project B? c. What is the discounted payback period for Project A? d. What is the discounted payback period for Project B? e. What is the NPV for Project A? f. What is the NPV for Project B ? g. What is the IRR for Project A? h. What is the IRR for Project B? i. What is the profitability index for Project A? j. What is the profitability index for Project B?arrow_forwardBefore projects can proceed, a contract must be drawn up between the customer and contractor.Define what is a typical project contract then using practical examples, discuss two (2) types ofproject contracts that may be entered into between the customer and contractor.arrow_forwardThe project manager of a task force planning the construction of a domed stadium had hopedto be able to complete construction prior to the start of the next college football season. Afterreviewing construction time estimates, it now appears that a certain amount of crashing will beneeded to ensure project completion before the season opener. Given the following time and costestimates, determine a minimum-cost crashing schedule that will shave five weeks off the projectlength. Note: No activity can be crashed more than two weeks.CRASHING COSTS ($000)Activity Immediate Predecessor Normal Time (weeks) First Week Second WeekA — 12 $15 $20B A 14 10 10C — 10 5 5D C 17 20 21E C 18 16 18F C 12 12 15G D 15 24 24H E 8 — —I F 7 30 —J I 12 25 25K B 9 10 10M G 3 — —N H 11 40 —P H, J 8 20 20End K, M, N, Parrow_forward

- Industrial Designs has been awarded a contract to design a label for a new wine produced by Lake View Winery. The company estimates that 150 hours will be required to complete the project. Three of the firm's graphics designers are available for assignment to this project: Lisa, a senior designer and team leader; David, a senior designer; and Sarah, a junior designer. Because Lisa has worked on several projects for Lake View Winery, management has specified that Lisa must be assigned at least 40% of the total number of hours that are assigned to the two senior designers. To provide label designing experience for Sarah, Sarah must be assigned at least 15% of the total project time. However, the number of hours assigned to Sarah must not exceed 25% of the total number of hours that are assigned to the two senior designers. Due to other project commitments, Lisa has a maximum of 50 hours available to work on this project. Hourly wage rates are $30 for Lisa, $25 for David, and $18 for…arrow_forwardThe project manager is tasked with the responsibility of balancing project constraints to increase the probability of project success, and ensure that the project meets its objectives. Identify and explain at least five (5) project constraints, and explain the working of the triple constraint model of project management.arrow_forwardThe project aims to investigate the feasibility of constructing a hydroelectric dam from a technical, economic, and social point of view. The project charter created by the project manager on behalf of the project sponsor is now approved. Advise on which processes should be performed next.arrow_forward

- You are to be the Contract Administrator on a project for a new facility of a five story Girne American University dormitory that houses 850 students. The engineer suggests that in the case of cost-plus contract 18, 10, 3 and 10 percent should be added to the actual labor, Renewing the roof coverings, materials, and Internal alterations costs respectively. In the case of the cost plus fixed fee contract, the fixed fee should be £40,000. In the case of the cost-plus sliding fee contract, the fee should be 14%, 12%, 10% for resulting total cost in the ranges of £300,000 to £350,000; £350,000 to £375,000 and £375,000 to £425,000 respectively. For the cost plus guaranteed ceiling price contract, the fee should be £50,000 less 35% of any actual cost above the target cost £350,000. The expected cost for superstructure and the installation of new equipment is £192,000. a) Calculate the expected total cost of the project. b) Which of the above negotiated contract to you recommend…arrow_forwardContract requirements state that a project must be completed within 180 working days, or it will incur penalties for late completion. Analysis of the activity network reveals an estimated project time of 145 working days with a project variance of 400. What is the probability that the project will be completed before the late-payment deadline?arrow_forwardIndustrial Designs has been awarded a contract to design a label for a new wine produced by Lake View Winery. The company estimates that 150 hours will be required to complete the project. The firm's three graphics designers available for assignment to this project are Lisa, a senior designer and team leader; David, a senior designer; and Sarah, a junior designer. Because Lisa has worked on several projects for Lake View Winery, management speci fied that Lisa must be assigned at least 40% of the total number of hours assigned to the two senior designers. To provide label-designing experience for Sarah, Sarah must be assigned at least 15% of the total project time. However, the number of hours assigned to Sarah must not exceed 25% of the total number of hours assigned to the two senior designers. Due to other project commitments, Lisa has a maximum of 50 hours available to work on this project.Hourly wage rates are $30 for Lisa, $25 for David, and $18 for Sarah.a. Formulate a linear…arrow_forward

- CASE: Ventura Baseball Stadium The G&E Company is preparing a bid to build the new 47,000-seat Shoreline baseball stadium. The construction must start on June 10, 2019, and be completed in time for the start of the 2022 season. A penalty clause of $500,000 per day of delay beyond April 3rd is written into the contract. Percival Young, the president of the company, expressed optimism at obtaining the contract and revealed that the company could net as much as $5 million on the project. He also said that if they were successful, the prospects of future projects would be bright, since there is a projected renaissance in building classic ball parks with modern luxury boxes. ASSIGNMENT Given the information provided in Table 6.3, construct a network schedule for the stadium project and answer the following questions: Can the project be completed by the April 3rd deadline? How long will it take? What is the critical path for the project? Based on the schedule, would you recommend…arrow_forwardCASE: Ventura Baseball Stadium The G&E Company is preparing a bid to build the new 47,000-seat Shoreline baseball stadium. The construction must start on June 10, 2019, and be completed in time for the start of the 2022 season. A penalty clause of $500,000 per day of delay beyond April 3rd is written into the contract. Percival Young, the president of the company, expressed optimism at obtaining the contract and revealed that the company could net as much as $5 million on the project. He also said that if they were successful, the prospects of future projects would be bright, since there is a projected renaissance in building classic ball parks with modern luxury boxes. ASSIGNMENT Given the information provided in Table 6.3, construct a network schedule for the stadium project and answer the following questions: Whether the Shoreline Stadium project will be completed on time. What the critical path for this project is. Whether you would recommend G&E pursue this contract?arrow_forwardIndustrial Designs has been awarded a contract to design a label for a new wine produced by Lake View Winery. The company estimates that 150 hours will be required to complete the project. The firm’s three graphic designers available for assignment to this project are Lisa, a senior designer and team leader; David, a senior designer; and Sarah, a junior designer. Because Lisa has worked on several projects for Lake View Winery, management specified that Lisa must be assigned at least 40% of the total number of hours assigned to the two senior designers. To provide label designing experience for Sarah, the junior designer must be assigned at least 15% of the total project time. However, the number of hours assigned to Sarah must not exceed 25% of the total number of hours assigned to the two senior designers. Due to other project commitments, Lisa has a maximum of 50 hours available to work on this project. Hourly wage rates are $30 for Lisa, $16 for David, and $18 for Sarah. (a)…arrow_forward

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON