Concept explainers

Analyzing Allowance for Doubtful

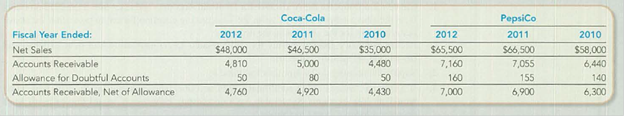

Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions).

Required:

- 1. Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2012 and 2011. (Round to one decimal place.)

- 2. Which of the companies is quicker to convert its receivables into cash?

1.

Explanation of Solution

Accounts receivable turnover:

Accounts receivable turnover is a liquidity measure of accounts receivable in times, which is calculated by dividing the net credit sales by the average amount of net accounts receivables. In simple, it indicates the number of times the average amount of net accounts receivables has been collected during a particular period.

Average collection period:

Average collection period indicates the number of days taken by a business to collect its outstanding amount of accounts receivable on an average.

Calculate accounts receivables turnover ratio and days to collect for Company Cfor 2012 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Cfor the year 2012 are 9.9 times and 36.9 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company Cfor 2011 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Cfor the year 2011 are 9.9 times and 36.9 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company Pfor 2012 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Pfor the year 2012 are 9.4 times and38.8 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company Pfor 2011 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company Pfor the year 2011 are 10.1 times and 36.1 days respectively.

2.

To identify: The company which was quicker ability to convert its receivables into cash in 2012 and 2011.

Explanation of Solution

Accounts receivables turnover ratio and the number of days to collect the receivables for Company C for the year 2012 are 9.9 times and 36.9 days respectively.

Accounts receivables turnover ratio and the number of days to collect the receivables for Company C for the year 2011 are 9.9 times and 36.9 days respectively.

Accounts receivables turnover ratio and the number of days to collect the receivables for Company P for the year 2012 are 9.4 times and 38.8 days respectively.

Accounts receivables turnover ratio and the number of days to collect the receivables for Company P for the year 2011 are 10.1 times and 36.1 days respectively.

A company which has higher receivables turnover ratio and lower days to collect the receivables is considered as the best company in converting its receivables to cash.

In 2011, Company P’s receivables turnover ratio is higher and days to collect is lower in comparison with Company C.

In 2012, Company C’s receivables turnover ratio is higher and days to collect is lower in comparison with Company P.

Want to see more full solutions like this?

Chapter 8 Solutions

FUND.OF.FIN.ACCT.-CONNECT >CUSTOM<

- Tonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit sales will be uncollectible. Allowance for Doubtful Accounts has a credit balance of 275. Prepare the adjusting entry at year-end for the estimated bad debt expense. (a) Based on an aging of its accounts receivable, Kyles Cyclery estimates that 3,200 of its year-end accounts receivable will be uncollectible. Allowance for Doubtful Accounts has a debit balance of 280 at year-end. Prepare the adjusting entry at year-end for the estimated uncollectible accounts.arrow_forwardCola Inc. and Soda Co. are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Cola Inc. Soda Co. Fiscal Year Ended: 2015 2014 2013 2015 2014 2013 Net Sales $ 31,219 $ 26,690 $ 27,944 $ 53,448 $ 39,232 $ 39,251 Accounts Receivable 4,398 3,733 3,061 6,387 4,634 3,704 Allowance for Doubtful Accounts 40 47 43 136 82 62 Accounts Receivable, Net of Allowance 4,358 3,686 3,018 6,251 4,552 3,642 Required: Calculate the receivables turnover ratios and days to collect for Cola Inc. and Soda Co. for 2015 and 2014. (Use 365 days in a year. Do not round intermediate calculations on Accounts Receivable Turnover Ratio. Round…arrow_forwardUse the data in Exercises 9-27 and 9-28 to analyze the accounts receivable turnover ratios of the Campbell Soup Company and American Eagle Outfitters, Inc.a. Compute the average accounts receivable turnover ratio for Campbell Soup and American Eagle for the years shown in Exercises 9-27 (See attachment) and 9-28 (See attachment).b. Does Campbelll Soup or American Eagle have the higher average accounts receivable turnover ratio?c. Explain why the average turnover ratios are different in (b).arrow_forward

- 1.) Beltline Co. had credit sales of $100,000 for the year, and based on experience estimates that approximately 1% of these sales will be uncollectible. Under the percent of sales method, a.the adjusting entry to record the uncollectible sales would involve a debit to Allowance for Doubtful Accounts and a credit to Bad Debt Expense. b.the estimated uncollectible sales should not be recorded until there is firm evidence that a customer will not pay. c.the estimated bad debt expense is $1,000. d.the estimated bad debt expense is $10,000. 2.) Under the percentage of receivables method theory, a.the majority of accounts receivable portion will not be collected. b.some portion of the existing accounts receivable will not be collected. c.the percentage of uncollectible accounts is calculated as Average Uncollectible Accounts divided by Average Accounts Receivable. d."some portion of the existing accounts receivable will not be collected" and "the percentage of uncollectible…arrow_forwardAccounts Receivable Analysis Xavier Stores Company and Lestrade Stores Inc. are large retail department stores. Both companies offer credit to their customers through their own credit card operations. Information from the financial statements for both companies for two recent years is as follows (in millions): Xavier Lestrade Sales $219,000 $306,600 Credit card receivables-beginning 40,352 63,501 Credit card receivables-ending 33,688 48,891 a. Determine the (1) accounts receivable turnover and (2) the number of days' sales in receivables for both companies. Round answers to one decimal place. Assume 365 days a year. Xavier Lestrade 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 days b. Xavier’s accounts receivable turnover is than Lestrade’s. The number of days' sales in receivables is for Xavier than for Lestrade. These…arrow_forwardWhich of the following would best explain an increase in receivables turnover? a. The company adopted new credit policies last year and began offering credit to customers with weak credit histories. b. Due to problems with an error in its old credit scoring system, the company had accumulated a substantial amount of uncollectible accounts and wrote off a large amount of its receivables. c. To match the terms offered by its closest competitor, the company adopted new payment terms now requiring net payment within 30 days rather than 15 days, which had been its previous requirement.arrow_forward

- Presented below is information for Sunland Company. 1. Beginning-of-the-year Accounts Receivable balance was $19,600. 2. Net sales (all on account) for the year were $103,100. Sunland does not offer cash discounts. 3. Collections on accounts receivable during the year were $88,200. Sunland is planning to factor some accounts receivable at the end of the year. Accounts totaling $11,100 will be transferred to Credit Factors, Inc. with recourse. Credit Factors will retain 5% of the balances for probable adjustments and assesses a finance charge of 4%. The fair value of the recourse obligation is $1,143. Prepare the journal entry to record the sale of the receivables.arrow_forwardSonic has the following information: Income statement method used to estimate un-collectible accounts. Company bases estimate on ALL sale. Cash sales = $1.540.123 Credit sales = $385,000 Accounts Receivable = $989,000 Existing CREDIT balance in the Allowance for Doubtful Accounts = $10.200 Bad Debts are estimated at this % of ALL sales = 3.00% Fill in the missing amount in the following adjusting journal entry: Bad Debt Expense $??? Allowance for Doubtful Accounts $??? ROUND YOUR ANSWER TO THE NEAREST WHOLE DOLLAR AND DO NOT USE $ DOLLAR SIGNS.arrow_forwardThe following are excerpts from the financial statements of 2018 and 2019 of Mandela Corporation. 2019 2018 Sales $187,600 $195,000 Accounts Receivable (net): Beginning of Year 68,100 66,500 End of Year 60,200 68,100 A newly hired manager has started implementing new credit policies. Required: a. As a consultant, you are contracted to analyze Accounts Receivable Turnover and Number of Days’ Sales in Receivable and provide opinion as to whether Mandela’s credit policy changes are working b. What conclusions does your analysis suggest. Are the new credit policies working?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,