Concept explainers

| Year | Cash Flow (A) | Cash Flow (B) |

| 0 | $43,500 | $43,500 |

| 1 | 21,400 | 6,400 |

| 2 | 18,500 | 14,700 |

| 3 | 13,800 | 22,800 |

| 4 | 7,600 | 25,200 |

a. What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct?

b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule?

c. Over what range of discount rates would the company choose project A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.

a)

To calculate: The IRR (Internal rate of return) for the proposed projects of Company G, the project that the company must accept and discuss whether the decision made is appropriate.

Introduction:

The IRR (Internal rate of return) is a rate of discount, which makes the predictable investment’s NPV equal to zero.

The NPV (Net present value) is a capital budgeting technique, which is used to assess the investment, and it is utilized to identify the profitability in a proposed investment.

Answer to Problem 12QP

As IRR is higher in Project A when compared to Project B, then Project A can be accepted. However, it is not the appropriate decision because the criterion of IRR has a problem in ranking of mutually exclusive projects.

Explanation of Solution

Given information:

Company G has identified two mutually exclusive projects where the cash flows of Project A are $21,400, $18,500, $13,800, and $7,600 for the years 1, 2, 3, and 4, respectively. The cash flows of Project B are $6,400, $14,700, $22,800, and $25,200 for the years 1, 2, 3, and 4, respectively. The initial costs for both the project are $43,500, respectively.

Note:

- NPV is the difference between the present values of the cash inflows from the present value of cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equal to zero. Hence, using the available information, assume that the NPV is equal to zero and form an equation to compute the IRR.

Equation of NPV to compute IRR assuming that NPV is equal to zero:

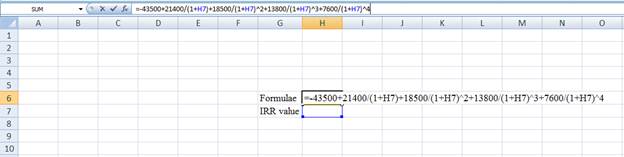

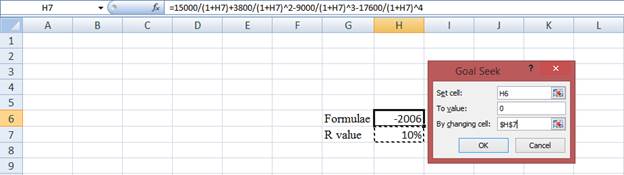

Compute IRR for Project A using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

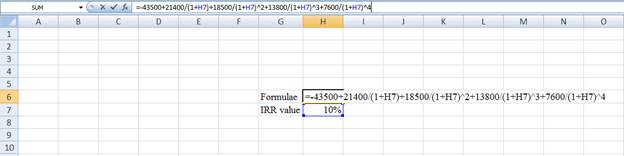

Step 2:

- Assume the IRR value as 0.10%.

Step 3:

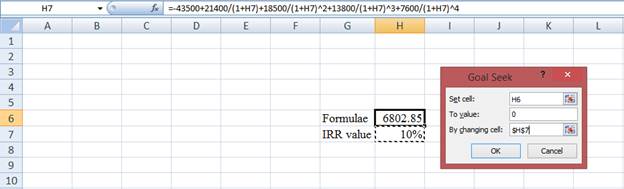

- In the spreadsheet, go to the data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

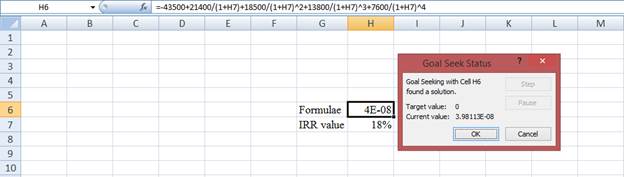

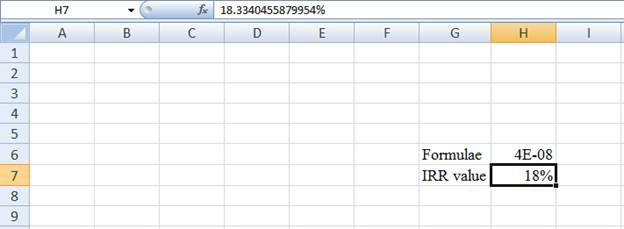

Step 4:

- Following the previous step, click OK in the goal seek. The goal seek status appears with the IRR value.

Step 5:

- The value appears to be 18.3340455879954%.

Hence, the IRR value is 18.33%.

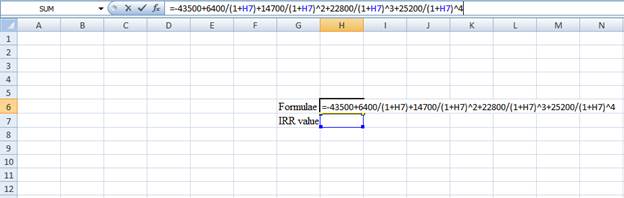

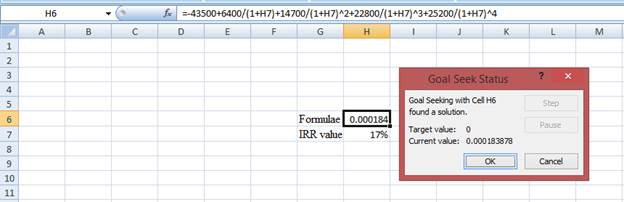

Compute IRR for Project B using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the IRR value as H7.

Step 2:

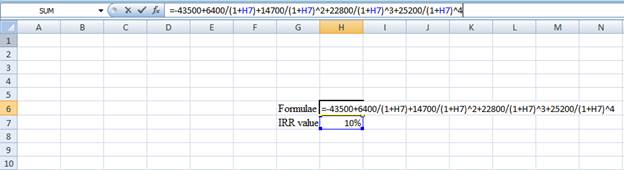

- Assume the IRR value as 0.10%.

Step 3:

- In the spreadsheet, go to the data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

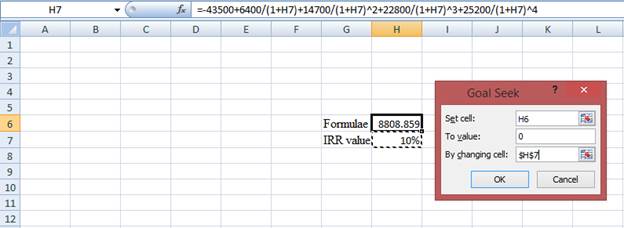

Step 4:

- Following the previous step, click OK in the goal seek. The goal seek status appears with the IRR value.

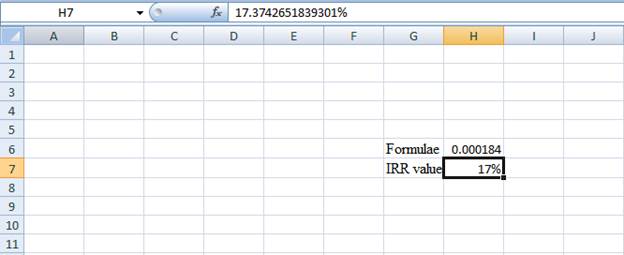

Step 5:

- The value appears to be 17.3742651839301%.

Hence, the IRR value is 17.37%.

b)

To calculate: The NPV for the projects to choose the best project for the company.

Introduction:

The IRR (Internal rate of return) is a rate of discount, which makes the predictable investment’s NPV equal to zero.

The NPV (Net present value) is a capital budgeting technique, which is used to assess the investment, and it is utilized to identify the profitability in a proposed investment.

Answer to Problem 12QP

As NPV is greater in Project B, the company must accept Project B.

Explanation of Solution

Given information:

Company G has identified two mutually exclusive projects where the cash flows of Project A are $21,400, $18,500, $13,800, and $7,600 for the years 1, 2, 3, and 4, respectively. The cash flows of Project B are $6,400, $14,700, $22,800, and $25,200 for the years 1, 2, 3, and 4, respectively. The initial costs for both the project are $43,500, respectively.

Note:

- NPV is the difference between the present values of the cash inflows from the present value of cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equal to zero. Hence, using the available information, assume that the NPV is equal to zero and form an equation to compute the IRR.

Formula to calculate the NPV:

Compute NPV for Project A:

Hence, the NPV for Project A is $5,891.09.

Compute NPV for Project B:

Note: The rate is given at 11%.

Hence, the NPV for project B is $7,467.80.

c)

To calculate: The rates of discount at which the company will select Project A and Project B, and the discount rate in which the company will be indifferent in selecting between the two projects.

Introduction:

The IRR (Internal rate of return) is a rate of discount, which makes the predictable investment’s NPV equal to zero.

The NPV (Net present value) is a capital budgeting technique, which is used to assess the investment, and it is utilized to identify the profitability in a proposed investment.

Answer to Problem 12QP

At the rate of discount above 15.19%, the company must choose Project A and for the rate below 15.19%, the company should choose Project B. Hence, it is indifferent at the discount rate of 15.19%.

Explanation of Solution

Given information: Company G has identified two mutually exclusive projects where the cash flows of Project A are $21,400, $18,500, $13,800, and $7,600 for the years 1, 2, 3, and 4, respectively. The cash flows of Project B are $6,400, $14,700, $22,800, and $25,200 for the years 1, 2, 3, and 4, respectively. The initial costs for both the project are $43,500, respectively.

Note:

- NPV is the difference between the present values of the cash inflows from the present value of cash outflows.

- The IRR is the rate of interest, which makes the project’s NPV equal to zero. Hence, using the available information, assume that the NPV is equal to zero and form an equation to compute the IRR.

Equation to calculate the crossover rates:

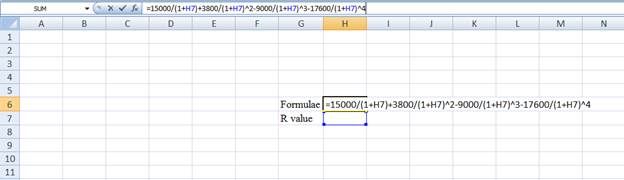

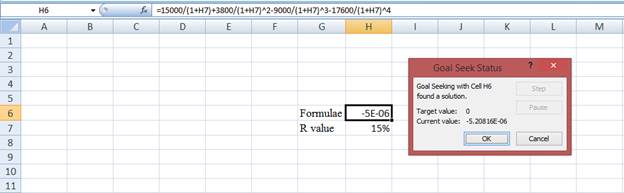

Compute the discount rate using spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the R value as H7.

Step 2:

- Assume the R value as 10%.

Step 3:

- In the spreadsheet, go to the data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formula).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

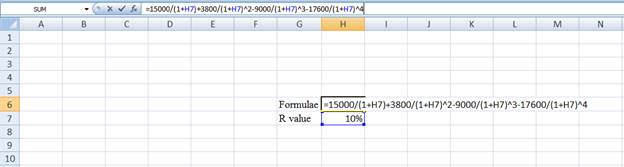

Step 4:

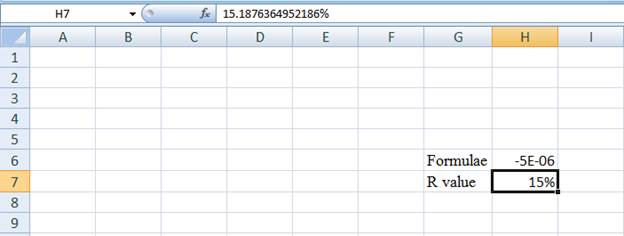

- Following the previous step, click OK in the goal seek. The goal seek status appears with the R value.

Step 5:

- The value appears to be 15.1876364952186%.

Hence, the R value is 15.19%.

Want to see more full solutions like this?

Chapter 9 Solutions

FUND.OF CORPORATE FINANCE(LL)

- Calculate NPV of projects S and L, NPVS & NPVL NPVS NPVL UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFS ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360arrow_forward5). The HC Corporation is trying to choose between the following two mutually exclusive design projects: Year Cash Flow I (in dollars) Cash Flow II (in dollars) 0 -64, 000 -18,000 1 31, 000 9,700 2 31, 000 9,700 3 31, 000 9,700 a). If the required return is 10%, and the company applies the profitability index decision rule, which project should the firm accept? Why? b). If the company applies the NPV decision rule, which project should it take? Why? c). Explain why your answers in (a) and (b) are different.arrow_forwardUF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFs ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360 Question: Find the crossover rate. (answer in excel format and show spreadsheet inputs)arrow_forward

- A Company is considering two mutually exclusive projects whose expected net cash flows are in the table below. The company's WACC is 15%. What is the NPV for Project Y? What is the NPV for Project Z? What is the IRR for Project Y? What is the IRR for Project Z? Which Project, if any, should you choose? Time Project Y Project Z 0 S (420.00) S(950.00) 1 S(572.00) $270.00 2 S(189.00) S270.00 3 S(130.00) $270.00 4 $1,300.00 $270.00 5 $720.00 $270.00 6 $980.00 $270.00 7 $(225.00) $270.00 Pleaseshow in excel I think im getting the wrong valuesarrow_forwardCalculate IRR of projects S and L, IRRS & IRRL IRRS IRRL UF Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFS ($1,050) $700 $625 CFL ($1,050) $370 $370 $360 $360arrow_forwardThe Webex Corporation is trying to choose between the following two mutually exclusive designprojects: Year Net Cash Flow Project - I($) Net Cash Flow Project - II($) 0 (53,000) (16,000) 1 27000 9100 2 27000 9100 3 27000 9100 (a) If the required return is 10% and the company applies the Profitability Index decision rule,which project should the firm accept?(b) If the company applies the Net Present Value decision rule, which project should it take?(c) Explain why your answers in (a) and (b) are different(d) Calculate the Internal Rate of Return of both projects.arrow_forward

- The Michner corporation is trying is trying to choose between the following 2 mutually exclusive design project: Cash Flow 1 Cash Flow 2 Year 0: -82000 -21700 Year 1: 37600 11200 Year 2: 37600 11200 Year 3: 37600 11200 If the required return is 10% and the company applies the profitability index decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? why are a & b are differentarrow_forwardA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $895.52 $240 $10 $10 Project L -$1,000 $5 $260 $400 $807.20 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.arrow_forwardA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 01234 Project S-$1,000$869.10$260$5$10Project L-$1,000$0$250$420$831.87 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.arrow_forward

- A company has a 11% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 0 1 2 3 4 5 6 7 Project A -$300 -$387 -$193 -$100 $600 $600 $850 -$180 Project B -$405 $131 $131 $131 $131 $131 $131 $0 What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. a. Project A: $ b. Project B: $ 3 What is each project's IRR? Round your answer to two decimal places. c. Project A:% d. Project B: % What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. e. Project A: % f. Project B: % g. From your answers to parts a-c, which project would be selected? h. If the WACC was 18%, which project would be selected? Construct NPV profiles for Projects A and B. Round your answers to the nearest cent.…arrow_forwardKosovski Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost. WACC: 10.75% 0 1 2 3 4 CFS -$775 $560 $535 CFL -$775 $315 $315 $315 $315 Please explain the process and provide calculations.arrow_forwardA company is analyzing two mutually exclusive projects, S and L, with thefollowing cash flows: The company’s WACC is 8.5%. What is the IRR of the better project? (Hint: The better projectmay or may not be the one with the higher IRR.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education