Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 16SP

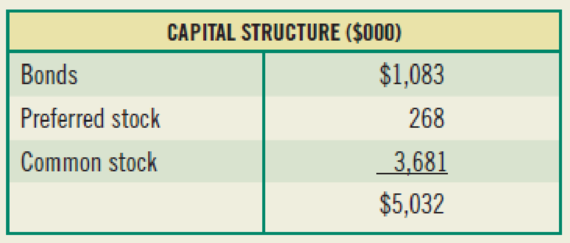

(Weighted average cost of capital) The capital structure for the Carion Corporation is provided here. The company plans to maintain its debt structure in the future. If the firm has a 5.5 percent after-tax cost of debt, a 13.5 percent cost of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure.

is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation.

Wyle Co. has $1.4 million of debt, $2.5 million of preferred stock, and $3.3 million of common equity. What would be its weight on debt?

0.28

0.32

0.19

0.46

Almond, Inc has determined the cost of each of its sources of capital and the desired weighting in the capital structure. See below. What is its weighted average cost of capital?

Source of capital Weight After‑tax cost

______________________________________________________

Long‑term debt 40% 7%

Preferred stock 10 13

Common stock equity 50 15

And if Almond Inc. pays 11.6% interest on its outstanding bonds. If its tax rate is 40%, what is its after-tax cost of debt?

The ABC Company has a cost of equity of 21.2 percent, a pre-tax cost of debt of 5.2 percent, and a tax rate of 30 percent. What is the firm's weighted average cost of capital if the proportion of debt is 65.6%?

Chapter 9 Solutions

Foundations Of Finance

Ch. 9 - Define the term cost of capital.Ch. 9 - Prob. 2RQCh. 9 - Why do firms calculate their weighted average cost...Ch. 9 - Prob. 4RQCh. 9 - Prob. 5RQCh. 9 - Prob. 6RQCh. 9 - Prob. 7RQCh. 9 - Prob. 1SPCh. 9 - Prob. 2SPCh. 9 - (Cost of equity) In the spring of 2018, the Brille...

Ch. 9 - Prob. 4SPCh. 9 - Prob. 5SPCh. 9 - Prob. 6SPCh. 9 - Prob. 7SPCh. 9 - (Cost of internal equity) Pathos Co.s common stock...Ch. 9 - (Cost of equity) The common stock for the Bestsold...Ch. 9 - Prob. 10SPCh. 9 - Prob. 11SPCh. 9 - Prob. 12SPCh. 9 - a. Rework Problem 9-12 as follows: Assume an 8...Ch. 9 - (Capital structure weights) Wingate Metal...Ch. 9 - (Weighted average cost of capital) The capital...Ch. 9 - Prob. 17SPCh. 9 - Prob. 18SPCh. 9 - Prob. 19SPCh. 9 - (Divisional costs of capital and investment...Ch. 9 - Prob. 21SPCh. 9 - Prob. 2.1MCCh. 9 - If you were to evaluate divisional costs of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- As a first step, we need to estimate what percentage of MMMs capital comes from debt, preferred stock, and common equity. This information can be found on the firms latest annual balance sheet. (As of year end 2014, MMM had no preferred stock.) Total debt includes all interest-bearing debt and is the sum of short-term debt and long-term debt. a. Recall that the weights used in the WACC are based on the companys target capital structure. If we assume that the company wants to maintain the same mix of capital that it currently has on its balance sheet, what weights should you use to estimate the WACC for MMM? b. Find MMMs market capitalization, which is the market value of its common equity. Using the sum of its short-term debt and long-term debt from the balance sheet (we assume that the market value of its debt equals its book value) and its market capitalization, recalculate the firms debt and common equity weights to be used in the WACC equation. These weights are approximations of market-value weights. Be sure not to include accruals in the debt calculation.arrow_forwardAssume Plainfield Manufacturing has debt of $6,500,000 with a cost of capital of 9.5% and equity of $4,500,000 with a cost of capital of 11.5%. What is Tylers weighted average cost of capital?arrow_forwardDefine each of the following terms: Weighted average cost of capital, WACC; after-tax cost of debt, rd(1 – T); after-tax cost of short-term debt, rstd(1 – T) Cost of preferred stock, rps; cost of common equity (or cost of common stock), rs Target capital structure Flotation cost, F; cost of new external common equity, rearrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 35% long-term debt, 20% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 21%. Debt The firm can sell for $1030 a 13-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 8.5% (annual dividend) preferred stock having a par value of $100 can be sold for $90. An additional fee of $4 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $60 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.75 ten years ago to the $5.41 dividend payment, D0, that the company just recently made. If the…arrow_forwardDillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License