a.

To prepare:

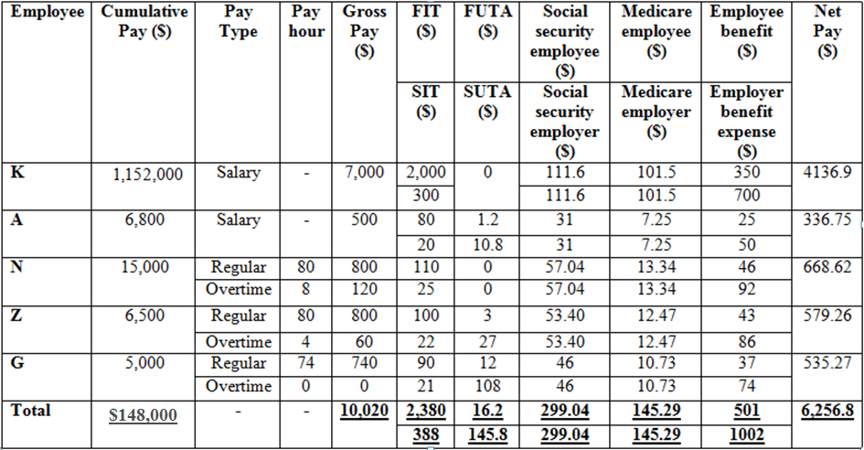

The payroll register by filling in the empty cells.

a.

Explanation of Solution

Prepare the payroll register as shown below.

Table 1

Working notes:

1. Calculation of FUTA of A.

2. Calculation of FUTA of Z.

3. Calculation of FUTA of G.

4. Calculation of SUTA of A.

5. Calculation of SUTA of Z.

6. Calculation of SUTA of G.

7. Calculation of security tax of K.

8. Calculation of security tax of A.

9. Calculation of security tax of N.

10. Calculation of security tax of Z.

11. Calculation of security tax of G.

12. Calculation of Medicare tax of K.

13. Calculation of Medicare tax of A.

14. Calculation of Medicare tax of N.

15. Calculation of Medicare tax of Z.

16. Calculation of Medicare tax of G.

17. Calculation of employee benefit of K.

18. Calculation of employee benefit of A.

19. Calculation of employee benefit of N.

20. Calculation of employee benefit of Z.

21. Calculation of employee benefit of G.

22. Calculation of net pay of K.

23. Calculation of net pay of A.

24. Calculation of net pay of N.

25. Calculation of net pay of Z.

26. Calculation of net pay of G.

b.

To prepare:

The

b.

Answer to Problem 17E

Prepare the journal entry for accrued biweekly payroll as shown below.

| Date | Particulars | L/F | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Aug 31 | Salaries expense | 10,020 | ||

| FICA - Social security taxes payable | 299.04 | |||

| FICA - Medicare taxes payable | 145.29 | |||

| Employee federal taxes payable | 2,380 | |||

| Employee state taxes payable | 388 | |||

| Employee benefits plan payable | 501 | |||

| Salaries payable | 6306.67 | |||

| (To record the payroll for August) |

Table 2

Explanation of Solution

• Salaries expense is an expense account for a company. Since the balance of this account increases, it is debited.

• FICA social security taxes payable is a liability to a company. Its balance increases, so it is credited.

• FICA Medicare taxes payable is a liability to a company. Its balance increases, so it is credited.

• Employee federal taxes payable is a liability to a company. Its balance increases, so it is credited.

• Employee state taxes payable is a liability to a company. Its balance increases, so it is credited.

• Salaries payable is a liability to a company. Its balance increases, so it is credited.

c.

To prepare:

The journal entry to record employer’s cash payment of the net payroll

c.

Answer to Problem 17E

Prepare the journal entry to record employer’s cash payment of the net payroll as shown below.

| Date | Particulars | L/F | Debit ($) | Credit ($) |

|---|---|---|---|---|

| Aug 31 | Salaries payable | 6306.67 | ||

| Cash | 6306.67 | |||

| (To record the payment for August) |

Table 3

Explanation of Solution

• Salaries payable is a liability to company. Its balance decreases, so it is debited.

• Cash is an asset account. Since the company is paying salaries, cash is reducing. Hence, cash is credited.

d.

To prepare:

The journal entry to record employer’s payroll taxes.

d.

Answer to Problem 17E

Prepare the journal entry to record employer’s payroll taxes as shown below.

| Date | Particulars | L/F | Debit ($) |

Credit ($) |

|---|---|---|---|---|

| Aug31 | Payroll taxes expense | 3212.33 | ||

| Employee benefit plan expenses | 1,002 | |||

| Employee benefit plan payable | 1,002 | |||

| FICA - Social security taxes payable | 299.04 | |||

| FICA - Medicare taxes payable | 145.29 | |||

| Employee federal taxes payable | 2,380 | |||

| Employee state taxes payable | 388 | |||

| (To record the employer’s payroll taxes) |

Table 4

Explanation of Solution

• Payroll taxes are an expense account for a company. Since the balance of this account increases, it is debited.

• Employee benefit plan is an expense account for a company. Since the balance of this account increases, it is debited.

• Employee benefit plan is a liability to a company. Its balance increases, so it is credited.

• FICA social security taxes payable is a liability to a company. Its balance increases, so it is credited.

• FICA Medicare taxes payable is a liability to a company. Its balance increases, so it is credited.

• Employee federal taxes payable is a liability to a company. Its balance increases, so it is credited.

• Employee state taxes payable is a liability to a company. Its balance increases, so it is credited.

e.

To prepare:

The journal entry to pay all liabilities.

e.

Answer to Problem 17E

Prepare the journal entry to pay all liabilities as shown below.

| Date | Particulars | L/F | Debit ($) | Credit ($) |

|---|---|---|---|---|

| Aug 31 | FICA - Social security taxes payable | 598.08 | ||

| FICA - Medicare taxes payable | 290.58 | |||

| Employee federal taxes payable | 2,380 | |||

| Employee state taxes payable | 388 | |||

| Employee benefits plan payable | 1,503 | |||

| FUTA payable | 16.2 | |||

| SUTA payable | 145.8 | |||

| Cash | 5321.66 | |||

| (To record the payment of all liabilities) |

Table 5

Explanation of Solution

• FICA Social security taxes payable is a liability to a company. Its balance decreases, so it is debited.

• FICA Medicare taxes payable is a liability to a company. Its balance decreases, so it is debited.

• Employee federal taxes payable is a liability to a company. Its balance decreases, so it is debited.

• Employee state taxes payable is a liability to a company. Its balance decreases, so it is debited.

• Employee benefit plan is a liability to a company. Its balance decreases, so it is debited.

• FUTA payable is a liability to a company. Its balance decreases, so it is debited.

• SUTA payable is a liability to company. Its balance decreases, so it is debited.

• Cash is an asset account. Since company is paying salaries, its liability decreases. Hence, cash is credited.

Want to see more full solutions like this?

Chapter 9 Solutions

FIN.+MANAG.ACCT.CH.1-24 W/CONNECT PKG

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education