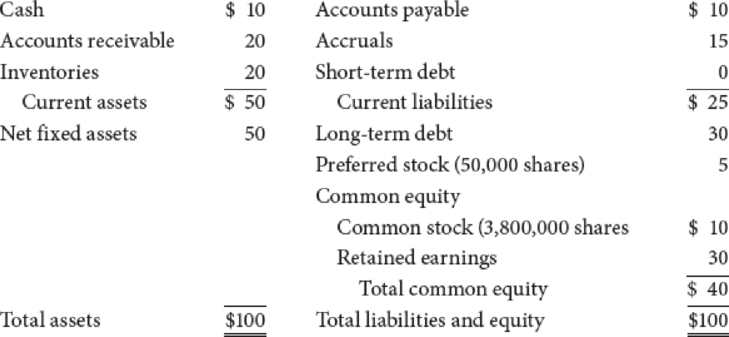

The following table gives the current balance sheet for Travellers Inn Inc. (TII), a company that was formed by merging a number of regional motel chains.

Travellers Inn (Millions of Dollars)

The following facts also apply to TII.

- (1) The long-term debt consists of 29,412 bonds, each having a 20-year maturity, semiannual payments, a coupon rate of 7.6%, and a face value of $1,000. Currently, these bonds provide investors with a yield to maturity of 11.8%. If new bonds were sold, they would have an 11.8% yield to maturity.

- (2) TII’s perpetual

preferred stock has a $100 par value, pays a quarterly dividend per share of $2, and has a yield to investors of 10%. New perpetual preferred stock would have to provide the same yield to investors, and the company would incur a 3.85% flotation cost to sell it. - (3) The company has 3.8 million shares of common stock outstanding, a price per share = P0 = $20, dividend per share = D0 = $1, and earnings per share = EPS0 = $5. The

return on equity (ROE) is expected to be 10%. - (4) The stock has a beta of 1.6%. The T-bond rate is 6%, and RPM is estimated to be 5%.

- (5) TII’s financial vice president recently polled some pension fund investment managers who hold TII’s securities regarding what minimum

rate of return on TII’s common would make them willing to buy the common rather than TII bonds, given that the bonds yielded 11.8%. The responses suggested a risk premium over TII bonds of 3 percentage points. - (6) TII is in the 25% federal-plus-state tax bracket.

Assume that you were recently hired by TII as a financial analyst and that your boss, the treasurer, has asked you to estimate the company’s WACC under the assumption that no new equity will be issued. Your cost of capital should be appropriate for use in evaluating projects that are in the same risk class as the assets TII now operates. Based on your analysis, answer the following questions.

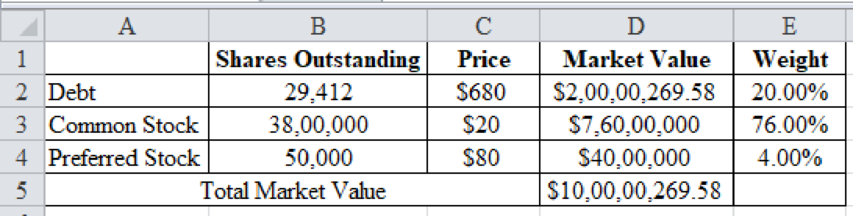

- a. What are the current market value weights for debt, preferred stock, and common stock? (Hint: Do your work in dollars, not millions of dollars. When you calculate the market values of debt and preferred stock, be sure to round the market price per bond and the market price per share of preferred to the nearest penny.)

- b. What is the after-tax cost of debt?

- c. What is the cost of preferred stock?

- d. What is the required return on common stock using

CAPM ? - e. Use the retention growth equation to estimate the expected growth rate. Then use the expected growth rate and the dividend growth model to estimate the required return on common stock.

- f. What is the required return on common stock using the own-bond-yield-plus-judgmental-risk-premium approach?

- g. Use the required return on stock from the CAPM model, and calculate the WACC.

a.

To determine: The market value weights of debt, common stock and preferred stock.

Answer to Problem 17P

The market value weights of debt are 20%, common stock is 76% and preferred stock is 4%.

Explanation of Solution

Determine the market value weights of debt, common stock and preferred stock

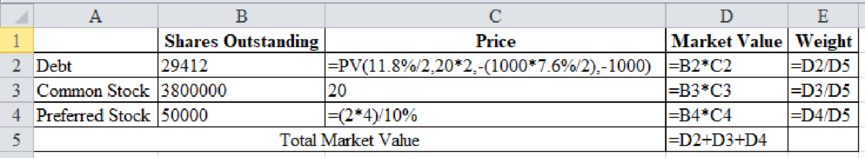

Excel Spreadsheet:

Excel Workings:

Therefore, the market value weights of debt are 20%, common stock is 76% and preferred stock is 4%.

b.

To determine: The after-tax cost of debt.

Answer to Problem 17P

The after-tax cost of debt is 8.85%.

Explanation of Solution

Determine the after-tax cost of debt

Therefore, the after-tax cost of debt is 8.85%.

c.

To determine: The cost of preferred stock.

Answer to Problem 17P

The cost of preferred stock is 10.40%.

Explanation of Solution

Determine the cost of preferred stock

Therefore, the cost of preferred stock is 10.40%.

d.

To determine: The required return on common stock using CAPM.

Answer to Problem 17P

The required return on common stock using CAPM is 14%.

Explanation of Solution

Determine the required return on common stock using CAPM

Therefore, the required return on common stock using CAPM is 14%.

e.

To determine: The required return on common stock using dividend growth model.

Answer to Problem 17P

The required return on common stock using dividend growth model is 13.40%.

Explanation of Solution

Determine the payout ratio

Therefore, the payout ratio is 20%.

Determine the growth rate

Therefore, the growth rate is 8%.

Determine the required return on common stock using dividend growth model

Therefore, the required return on common stock using dividend growth model is 13.40%.

f.

To determine: The required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach.

Answer to Problem 17P

The required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach is 14.80%.

Explanation of Solution

Determine the required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach

Therefore, the required return on common stock using own-bond-yield-plus-judgmental- risk-premium approach is 14.80%.

g.

To determine: The WACC.

Answer to Problem 17P

The WACC is 12.83%.

Explanation of Solution

Determine the WACC

Therefore, the WACC is 12.83%.

Want to see more full solutions like this?

Chapter 9 Solutions

MINDTAP 2TRM F/FINANCIAL MGMT:THEORY+PR

- Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio?arrow_forwardExecutive Cheese has issued debt with a market value of $100 million and has outstanding 15 million shares with a market price of $10 a share. It now announces that it intends to issue a further $60 million of debt and to use the proceeds to buy back common stock. Debtholders, seeing the extra risk, mark the value of the existing debt down to $85 million. Question: What is the debt ratio after the change in structure?arrow_forwardEG Capital Inc. is a large holding company that uses long-term debt extensively to fund its operations. At December 31, the company reported total assets of $100 million, total debt of $55 million, and total equity of $45 million. In January, the company issued $11 billion in long-term bonds to investors at par value. This was the largest debt issuance in the company’s history, and it significantly increased the company’s ratio of total debt to total equity. Five days after the debt issuance, CEG filed legal documents to prepare for an additional $50 billion long-term bond issue. As a result of this filing, the price of the $11 billion in bonds that the company issued earlier in the week dropped to 94 because of the increased risk associated with the company’s debt. The investors in the original $11 billion bond issuance were not informed of the company’s plans to issue additional debt so quickly after the initial bond issue. Did CEG Capital act unethically by not disclosing to initial…arrow_forward

- CEG Capital Inc. is a large holding company that uses long-term debt extensively to fund its operations. At December 31, the company reported total assets of $100 million, total debt of $55 million, and total equity of $45 million. In January, the company issued $11 billion in long-term bonds to investors at par value. This was the largest debt issuance in the company’s history, and it significantly increased the company’s ratio of total debt to total equity. Five days after the debt issuance, CEG filed legal documents to prepare for an additional $50 billion long-term bond issue. As a result of this filing, the price of the $11 billion in bonds that the company issued earlier in the week dropped to 94 because of the increased risk associated with the company’s debt. The investors in the original $11 billion bond issuance were not informed of the company’s plans to issue additional debt so quickly after the initial bond issue.Did CEG Capital act unethically by not disclosing to initial…arrow_forwardModel Engineering is a large corporation with the ability to obtain financing by selling its bonds at favorable rates. Currently, it pays 5% interest on its 10-year bond issues. In the past year, Model acquired an 80% interest in Mercer Industries. Mercer Industries has $1,000,000 of bonds outstanding that mature in six years. Interest is paid annually at a stated rate of 8%. The bonds were issued at face value.Interest rates have come down, but Mercer Industries can still expect to pay 5% to 6.5% interest on a long-term issue. Mercer Industries is a smaller company with a lower credit rating thanModel. Model would like to reduce interest costs on the Mercer Industries debt. The company has asked your advice on whether it should purchase the bonds or loan Mercer Industries the money to retire its own debt. Compare the options with a focus on the impact on consolidated statements.arrow_forwardConsider the following facts to solve problems 1 through 5. A. The capital for investment of Executive Consultants, Inc. is as follows: Sources of capital Capital Debt (corporate bonds) $4,100,000 Prefferent shares $2,200,000 Common shares $2,800,000 B. To generate the $ 4.1 million of corporate bond capital, they issued bonds at $ 965 par value, with an annual coupon of $ 100 for the next 10 years, with a flotation cost of $ 10 per bond.C. The issue of preferred shares has a cost of $ 5 per share and will pay a dividend of 10% of its par value of $ 110 per preferred share.D. The risk-free rate is 3.45% and the market return is 11.25%. The company's beta coefficient is 1.23.E. Executive Consultants, Inc. has a tax liability of 35%.Problems:You must submit the procedure and all the calculations.1. Determine the capital structure of Executive Consultants, Inc.2. Calculate the cost of debt.3. Calculate the cost of preferred equity.4. Calculate the cost of…arrow_forward

- Consider the following facts to solve problems 1 through 5. A. The capital for investment of Executive Consultants, Inc. is as follows: Sources of capital Capital Debt (corporate bonds) $4,100,000 Prefferent shares $2,200,000 Common shares $2,800,000 B. To generate the $ 4.1 million of corporate bond capital, they issued bonds at $ 965 par value, with an annual coupon of $ 100 for the next 10 years, with a flotation cost of $ 10 per bond.C. The issue of preferred shares has a cost of $ 5 per share and will pay a dividend of 10% of its par value of $ 110 per preferred share.D. The risk-free rate is 3.45% and the market return is 11.25%. The company's beta coefficient is 1.23.E. Executive Consultants, Inc. has a tax liability of 35%.Problems:You must submit the procedure and all the calculations.1. Determine the capital structure of Executive Consultants, Inc.2. Calculate the cost of debt.3. Calculate the cost of preferred equity.arrow_forwardThe UBSC ‘BirdsNest’ club has $500 worth of stock, $2,000 owed by debtors, $5,000 in cash, and it owes $3,500 to creditors payable within a year, what is its quick ratio?arrow_forwardBroom Co. has a total debt of $420,000 and shareholders’ equity of $700,000. Broom is seeking capital to fund an expansion. Broom is planning to issue an additional $300,000 in common stock, and is negotiating with a bank to borrow additional funds. The bank is requiring a debt-to-equity ratio of 0.75. what is the maximum additional amount Broom will be able to borrow?arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning