Concept explainers

MIRR [L06] RAK Corp. is evaluating a project with the following cash flows:

| Year | Cash Flow |

| 0 | −$41,000 |

| 1 | 15,700 |

| 2 | 19,400 |

| 3 | 24,300 |

| 4 | 18,100 |

| 5 | −9,400 |

The company uses an interest rate of 10 percent on all of its projects. Calculate the MIRR of the project using all three methods.

To calculate: The MIRR (Modified internal rate of return) for the project utilizing all three methods

Introduction:

MIRR is the Modified internal rate of return, which is a financial measure of attracting the investments. It is utilized in the capital budgeting to rank the alternative investments of same size.

Answer to Problem 19QP

The MIRR for the project using the discounted approach is 22.68%, reinvestment approach is 16.69%, and the combination approach is 15.94%.

Explanation of Solution

Given information:

Company R is assessing a project, where the cash flows are$15,700, $19,400, $24,300, $18,100, and -$9,400 for year 1, 2, 3, 4, and 5 respectively. The initial cost is $41,000.

Discounted approach:

In this approach, compute the negative cash outflows value at the year 0. On the other hand, the positive cash flows remain at its time of occurrence. Hence, discount the cash outflows to year 0.

Hence, the discounted cash flow at time 0 is -$46,836.66.

Equation of MIRR in discounted approach:

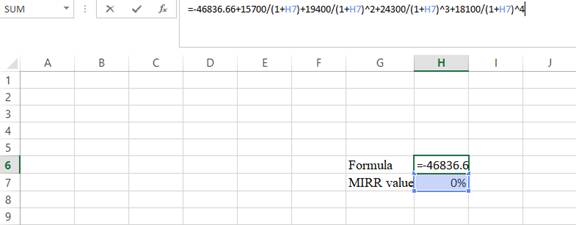

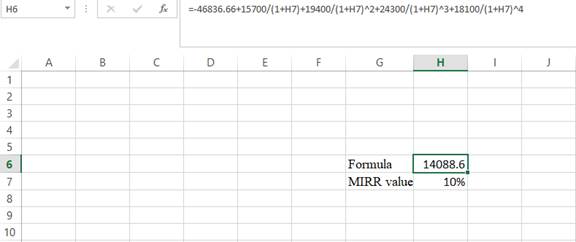

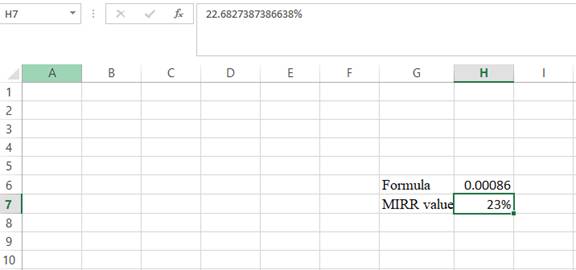

Compute MIRR using a spreadsheet:

Step 1:

- Type the equation of NPV in H6 in the spreadsheet and consider the MIRR value as H7.

Step 2:

- Assume the MIRRvalue as 10%.

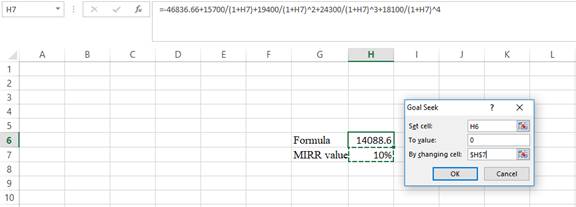

Step 3:

- In the spreadsheet, go to data and select the what-if analysis.

- In what-if analysis, select goal seek.

- In “Set cell”, select H6 (the formulae).

- The “To value” is considered as 0 (the assumption value for NPV).

- The H7 cell is selected for the “By changing cell”.

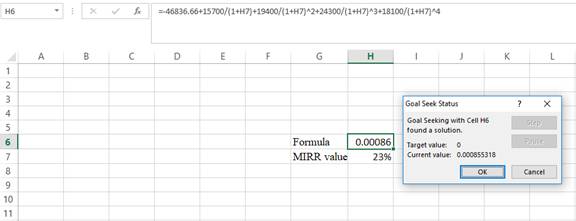

Step 4:

- Following the previous step, click OK in the goal seek. The goal seek status appears with the MIRRvalue.

Step 5:

- Thevalue appears to be 22.6827387386638%.

Hence, the MIRRvalue is 22.68%.

Reinvestment approach:

In this approach, compute the future value of all the cash flows excluding the initial cost at the closure of the project. Hence, compute the reinvesting cash flows to year 5 as:

Hence, the reinvesting cash flow at time 5 is $88,720.77.

Equation of MIRR in reinvestment approach:

Compute the MIRR:

Hence, the MIRR is $16.69%.

Combination approach:

In this approach, compute all the cash outflows at year 0 and all the cash inflows at the closure of the project. Hence, the value of the cash flows is as follows:

Hence, the total cash outflow at year 0 is -$46,836.66.

Hence, the value of total cash inflows is $98,120.77.

Equation of MIRR in combination approach:

Compute the MIRR:

Hence, the MIRR is $15.94%.

Want to see more full solutions like this?

Chapter 9 Solutions

FUND. OF CORPORATE FIN. 18MNTH ACCESS

- Project X has the following cash flows: C0 = -1,250, C1 = 750, and C2 = 900. If the IRR of the project is 20 percent and if the cost of capital is 25 percent, you would need more information accept the project reject the project be indifferentarrow_forwardMasulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.75% Year 0 1 2 3 4 Cash flows -$975 $650 $610 $570 $530 a. 1.22 years b. 2.78 years c. 1.78 years d. 2.22 years e. 1.11 years Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV, i.e., no conflict will exist. WACC: 8.75% 0 1 2 3 4 CFS -$775 $550 $390 $230 $70 CFL -$775 $115 $275 $435 $595 a. $0.00 b. $37.51 c. $34.49…arrow_forwardE7.7 (LO 3, 4), AP Shruti Shrills is considering an expansion of one of its existing buildings to add more manufacturing space for its kid-friendly noisemakers. Several possible scenarios exist for future cash flows, as follows. 1. Construction costs of $500,000; steady sales and costs each year, netting to an annual operating cash inflow of $70,000; the expansion would have no salvage value at the end of its 10-year useful life (the building would be repurposed for a different product).2. Construction costs of $500,000; rising and then falling net cash flows each year for 10 years, as follows: $50,000 for the first 2 and last 2 years, $175,000 for years 3–5, and $100,000 for years 6–8.3. Construction costs of $700,000; no cash flows in year 1, $75,000 in years 2 and 3, $150,000 in year 4, $100,000 in years 5–8, and $50,000 in the last 2 years.Required 1. Calculate the simple payback period for all three scenarios.2. Assume that Shruti will only accept investments with a payback period…arrow_forward

- Q7 - Consider the following project: Year Cash Flow 0 – $ 3,024 1 17,172 2 – 36,420 3 34,200 4 – 12,000 a) Determine the IRR (s) for this project. b) At which rates of return will the project be acceptable?arrow_forwardSuppose martin corp is considering a project that has an initial cost of $3,285,000 and the following cash inflows. The project has a required return of 9.6%. What is the NPV of the project? Years. CFs 1 $1,357,000 2 $1,568,000 3 $1,224,000 3,435,336 188,197 3,750,696 465,696 864,000arrow_forwardCarolina Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. WACC: 7.75% Year 0 1 2 3 4 CFS −$1,050 $675 $650 CFL −$1,050 $360 $360 $360 $360 If the decision is made by choosing the project with the higher IRR, how much value will be forgone?arrow_forward

- A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 01234 Project S-$1,000$869.10$260$5$10Project L-$1,000$0$250$420$831.87 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.arrow_forwardBE12.5 , AN McKnight Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $400,000, has an expected useful life of 10 years and a salvage value of zero, and is expected to increase net annual cash flows by $70,000. Project B will cost $310,000, has an expected useful life of 10 years and a salvage value of zero, and is expected to increase net annual cash flows by $55,000. A discount rate of 9% is appropriate for both projects. Compute the net present value and profitability index of each project. Which project should be accepted? Perform a post-audit.arrow_forwardBarry Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC = 11.85% Year 0 1 2 3 4 5 CFs -$52,300 8,290 16,580 24,870 33,160 41,450 A. 21.40% B. 22.76% C. 20.71% D. 28.00% E. 18.89%arrow_forward

- Here are the cash flows for a project under consideration: C0 C1 C2 −$7,510 +$5,420 +$19,200 a. Calculate the project’s net present value for discount rates of 0, 50%, and 100%. (Round your answers to the nearest whole dollar.) b. What is the IRR of the project? (Do not round intermediate calculations. Enter your answer as a whole percent.)arrow_forwardUnion pacific is considering a project that has the following cash flow and WACC data. What is the projects MIRR? Note that a projects MIRR can be less than the WACC (and negative), in which case be rejected. WACC: 9.50% Year 0 1 2 3 Cash flows -1,000, 450, 450, 450arrow_forwardAssume there is a project that will bring in $39,326.35 five years from now, and that there will be no other future cash inflow. The present value of the project is $15,650.00. What is the interest rate that was used in valuing this project? Group of answer choices A) 20.24% B) 22.59% C) 25.25% D) 21.16%arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education