Concept explainers

Accounting for the Use and Disposal of Long-Lived Assets

Nicole’s Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $7,000. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 13,000 hours. Expected annual production was year 1, 3,100 hours; year 2, 2,500 hours; year 3, 3,400 hours; year 4, 2,200 hours; and year 5, 1,800 hours.

Required:

- 1. Complete a

depreciation schedule for each of the alternative methods.- a. Straight-line.

- b. Units-of-production.

- c. Double-declining-balance.

- 2. Assume NGS sold the hydrotherapy tub system for $2,100 at the end of year 3. Prepare the

journal entry to account for the disposal of this asset under the three different methods. - 3. The following amounts were

forecast for year 3: Sales Revenues $42,000; Cost of Goods Sold $33,000; Other Operating Expenses $4,000; and Interest Expense $800. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don’t forget to include a loss or gain on disposal for each method.)

(1) (a)

Prepare the depreciation expense schedule under straight-line method

Explanation of Solution

Straight-line method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Formula for straight-line depreciation method:

Depreciation expense: Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset.

Accumulated depreciation: The total amount of depreciation expense deducted, from the time asset acquired till date, as reported in the account as on a particular date, is referred to as accumulated depreciation.

Formula for accumulated depreciation:

Book value: The amount of acquisition cost of less accumulated depreciation as on a particular date is referred to as book value.

Formula for book value:

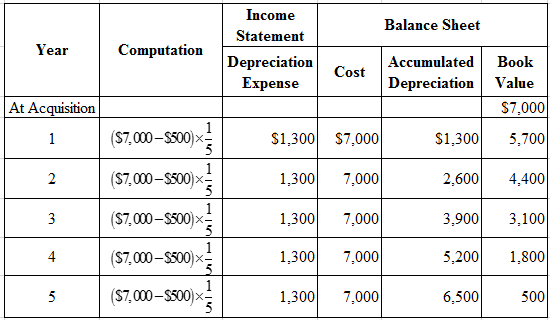

Depreciation schedule under straight-line method:

Figure (1)

(1) (b)

Prepare the depreciation expense schedule under units-of-production

Explanation of Solution

Units-of-production method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is based on the production capacity or output is referred to as units-of-production method.

Formula for units-of-production depreciation method:

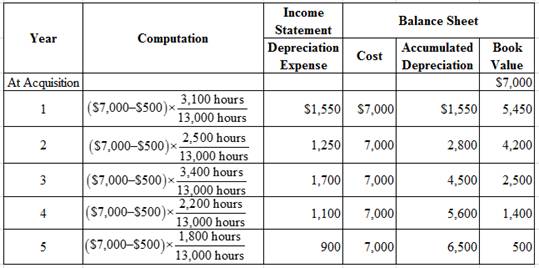

Depreciation schedule under units-of-production method:

Figure (2)

(1) (c)

Prepare the depreciation expense schedule under double-declining-balance method

Explanation of Solution

Double-declining-balance method: The depreciation method which assumes that the consumption of economic benefits of long-term asset is high in the early years but gradually declines towards the end of its useful life, is referred to as double-declining-balance method.

Formula for double-declining-balance depreciation method:

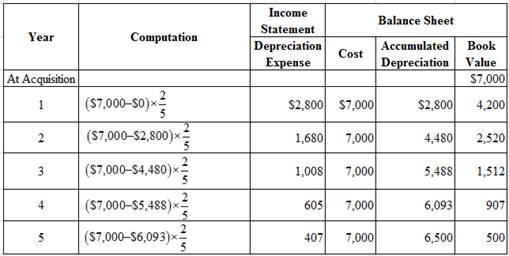

Depreciation schedule under double-declining-balance method:

Figure (3)

Note:

Compute depreciation expense in Year 5.

(2)

Prepare the journal entries for the sale of equipment under three methods

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for the sale of building, under straight-line method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 3,900 | |||||

| Loss on Disposal | 1,000 | |||||

| Equipment | 7,000 | |||||

| (To record sale of equipment) | ||||||

Table (1)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Building is a contra-asset account. Since the building is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Loss on Disposal is an expense account. Since losses and expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Building is an asset account. Since building is sold, asset account decreased, and a decrease in asset is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

Prepare journal entry for the sale of building, under units-of-production method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 4,500 | |||||

| Loss on Disposal | 400 | |||||

| Equipment | 7,000 | |||||

| (To record sale of equipment) | ||||||

Table (2)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Building is a contra-asset account. Since the building is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Loss on Disposal is an expense account. Since losses and expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Building is an asset account. Since building is sold, asset account decreased, and a decrease in asset is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

Prepare journal entry for the sale of equipment, under double-declining-balance method.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Cash | 2,100 | |||||

| Accumulated Depreciation | 5,488 | |||||

| Equipment | 7,000 | |||||

| Gain on Disposal | 588 | |||||

| (To record sale of truck) | ||||||

Table (3)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accumulated Depreciation–Equipment is a contra-asset account. Since the equipment is sold, the accumulated depreciation balance is reversed to reduce the balance in the account; hence, the account is debited.

- Equipment is an asset account. Since equipment is sold, asset account decreased, and a decrease in asset is credited.

- Gain on Disposal is a revenue account. Since gains and revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Determine the gain on sale.

Step 1: Compute book value on the date of sale.

Step 2: Compute gain (loss) on sale.

(3)

Prepare the income statement of NG Spa for the Year 3, under three depreciation methods

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement for NG Spa for the Year 3.

| NG Spa | |||

| Income Statement | |||

| For Year 3 | |||

| Particulars | Straight-Line | Units-of-Production | Double-Declining-Balance |

| Sales revenue | $42,000 | $42,000 | $42,000 |

| Cost of goods sold | 33,000 | 33,000 | 33,000 |

| Gross profit | 9,000 | 9,000 | 9,000 |

| Operating expenses: | |||

| Depreciation expense | $1,300 | $1,700 | $1,008 |

| Other operating expenses | 4,000 | 4,000 | 4,000 |

| Loss (Gain) on disposal | 1,000 | 400 | (588) |

| Total operating expenses | 6,300 | 6,100 | 4,420 |

| Income from operations | 2,700 | 2,900 | 4,580 |

| Interest expense | 800 | 800 | 800 |

| Income before income tax expense | $1,900 | $2,100 | $3,780 |

Table (4)

Want to see more full solutions like this?

Chapter 9 Solutions

FUND. OF FINANCIAL ACCT.-CONNECT ACCESS

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for 120,000 miles. Montello uses the units-of-production depreciation method and in year one it expects to use the truck for 23,000 miles. Calculate the annual depreciation expense.arrow_forwardIMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE CALCULATION OF DEPRECIATION On January 1, 20-1, Dans Demolition purchased two jackhammers for 2,500 each with a salvage value of 100 each and estimated useful lives of four years. On January 1, 20-2, a stronger blade to improve performance was installed in Jackhammer A for 800 cash and the compressor was replaced in Jackhammer B for 200 cash. The compressor is expected to extend the life of Jackhammer B one year beyond the original estimate. REQUIRED 1. Using the straight-line method, prepare general journal entries for depreciation on December 31, 20-1, for Jackhammers A and B. 2. Enter the transactions for January 20-2 in a general journal. 3. Assuming no other additions, improvements, or replacements, calculate the depreciation expense for each jackhammer for 20-2 through 20-4.arrow_forwardDuring the current year, Arkells Inc. made the following expenditures relating to plant machinery. Renovated five machines for $100,000 to improve efficiency in production of their remaining useful life of five years Low-cost repairs throughout the year totaled $70,000 Replaced a broken gear on a machine for $10,000 A. What amount should be expensed during the period? B. What amount should be capitalized during the period?arrow_forward

- Cost Issues Deskin Company purchased a new machine to be used in its operations. The new machine was delivered by the supplier, installed by Deskin, and placed into operation. It was purchased under a long-term payment plan for which the interest charges approximated the prevailing market rates. The estimated useful life of the new machine is 10 years, and its estimated residual (salvage) value is significant. Normal maintenance was performed to keep the new machine in usable condition. Deskin also added a wing to the manufacturing building that it owns. The addition is an integral part of the building. Furthermore, Deskin made significant leasehold improvements to office space used as corporate headquarters. Required: 1. What costs should Deskin capitalize for the new machine? 2. Explain how Deskin should account for the normal maintenance performed on the new machine. 3. Explain how Deskin should account for the wing added to the manufacturing building. Where should the added wing be reported on Deskins financial statements? 4. Explain how Deskin should account for the leasehold improvements made to its office space. Where should the leasehold improvements be reported on Deskins financial statements?arrow_forwardGrandorf Company replaced the engine in a truck for 8,000 and expects the new engine will extend the life of the truck two years beyond the original estimated life. Related information is provided below. Cost of truck 65,000 Salvage value 5,000 Original estimated life 6 years The truck was purchased on January 1, 20-1. The engine was replaced on January 1, 20-6. Using straight-line depreciation, compute depreciation expense for 20-6.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. Dunedin buys equipment frequently and wants to print a depreciation schedule for each assets life. Review the worksheet called DEPREC that follows these requirements. Since some assets acquired are depreciated by straight-line, others by units of production, and others by double-declining balance, DEPREC shows all three methods. You are to use this worksheet to prepare depreciation schedules for the new machine.arrow_forward

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.arrow_forwardColquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.arrow_forwardDunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.arrow_forward

- A Cost of a Fixed Asset Mist City Car Wash purchased a new brushless car-washing machine for one of its bays. The machine cost $41,700. Mist City borrowed the purchase price from its bank on a 1-year, 8% note payable. Mist City paid $975 to have the machine transported to its place of business and an additional $200 in shipping insurance. Mist City incurred the following costs as a part of the installation: During the testing process, one of the motors became defective when soap and water entered the motor because its cover had not been installed properly by Mist Citys employees. The motor was replaced at a cost of $640. Required: 1. Compute the cost of the car-washing machine. 2. CONCEPTUAL CONNECTION Explain why any costs were excluded from the cost of the machine.arrow_forwardTree Lovers Inc. purchased 2,500 acres of woodland in which it intends to harvest the complete forest, leaving the land barren and worthless. Tree Lovers paid $5,000,000 for the land. Tree Lovers will sell the lumber as it is harvested and it expects to deplete it over ten years (150 acres in year one, 300 acres in year two, 250 acres in year three, 150 acres in year four, and 100 acres in year five). Calculate the depletion expense for the next five years and create the journal entry for year one.arrow_forwardWhen depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning