FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

6th Edition

ISBN: 9781260529326

Author: Kapoor

Publisher: McGraw-Hill Publishing Co.

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 9, Problem 1P

Summary Introduction

To determine: The amount payable by insurance company.

Expert Solution & Answer

Explanation of Solution

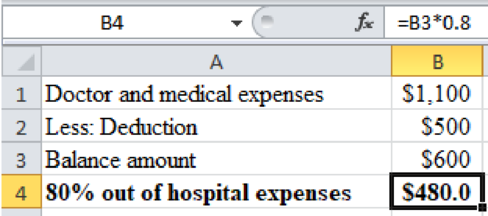

Compute the amount payable by insurance company:

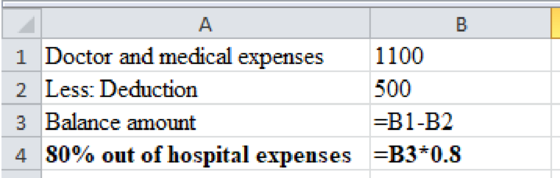

Excel workings:

Excel spread sheet:

Hence, the insurance company will pay $480.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

The Tucker family has health insurance coverage that pays 65 percent of out-of-hospital expenses after a deductible of $1,360 per person. If one family member has doctor and prescription medication expenses of $4,000, what amount would the insurance company pay?

The tucker family has health insurance coverage that pays 80 percent of out of hospital expenses after a 500 deductible per person. If one family member has doctor and prescription medication expenses of 1,100 what amount would the insurance pay?

The Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of

$ 250$250

per person. If three family members have doctor and prescription drug expenses of

$ 684$684,

$ 1 comma 496$1,496,

and

$ 188$188,

respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account established through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account?

Question content area bottom

Part 1

The Baulding family will pay

Chapter 9 Solutions

FOCUS ON PERSONAL FINANCE LL/ACCESS >BI

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Tia is married and is employed by Carrera Auto Parts. In 2019, Carrera established high-deductible health insurance for all its employees. The plan has a 2,700 deductible for married taxpayers. Carrera also contributes 5 percent of each employees salary to a Health Savings Account. Tias salary is 30,000 in 2019 and 32,000 in 2020. Tia makes the maximum allowable contribution to her HSA in 2019 and 2020. She received 600 from the HSA for her 2019 medical expenses. In 2020, she spends 1,400 on medical expenses from her HSA. The MSA earns 28 in 2019 and 46 in 2020. a. What is the effect of the HSA transactions on Tias adjusted gross income? b. How much does Tia have in her HSA account at the end of 2020?arrow_forwardValentino is a patient in a nursing home for 45 days of 2019. While in the nursing home, he incurs total costs of 13,500. Medicare pays 8,000 of the costs. Valentino receives 15,000 from his long-term care insurance policy, which pays while he is in the facility. Assume that the Federal daily excludible amount for Valentino is 370. Of the 15,000, what amount may Valentino exclude from his gross income?arrow_forwardThe Baulding family has a basic health insurance plan that pays 80 percent of out-of-hospital expenses after a deductible of $250 per person. If three family members have doctor and prescription drug expenses of $984, $1,507, and $213 respectively, how much will the Baulding family and the insurance company each pay? How could they benefit from a flexible spending account established through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account? The Baulding family will pay? The insurance company will pay? How could they benefit from a flexible spending account established through Mr. Baulding's employer? What are the advantages and disadvantages of establishing such an account?arrow_forward

- Suppose Gretchen's health insurance has a $500 annual deductible. Gretchen is responsible for 20 percent co-pay when she meets her deductible. If Gretchen has $800 in medical expenses this year, how much must she pay?arrow_forwardNancy is a widow with two teenage children. Nancy's gross income is 54200 per month, and taxes take about 22% of her income. Using the income method, Nancy calculates she will need to purchase about eight times her disposable income in life insurance to meet her needs. How much insurance should Nancy purchase?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you