a.

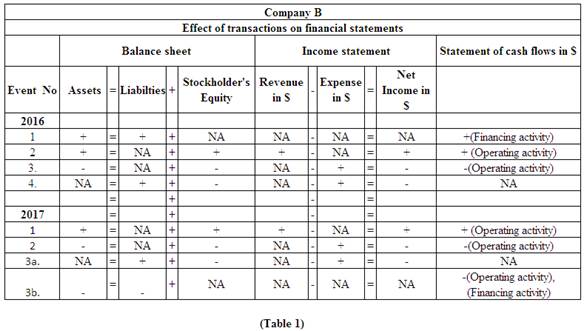

Show the effects of each of the transactions on the elements of the financial statements, using a horizontal statements model like the one shown next. Use (+) for increase, (−) for decrease, and NA for not affected.

a.

Explanation of Solution

Show the effect of each event on the financial statements using a horizontal statement model.

Note:

OA refers to operating activities.

FA refers to financing activities.

NA refers to does not affected.

b.

Record the transactions in general journal and

b.

Explanation of Solution

Prepare

| Date | Account title and Explanation | Post ref. | Amount $ | |

| Debit | Credit | |||

| 2016 | ||||

| 1. | Cash | 37,600 | ||

| Discount on Notes Payable | 2,400 | |||

| Notes payable | 40,000 | |||

| ( To record the issuance of discount note) | ||||

| 2. | Cash | 130,000 | ||

| Service Revenue | 130,000 | |||

| ( To record the services rendered for cash) | ||||

| 3. | Selling and administration expense | 98,000 | ||

| Cash | 98,000 | |||

| ( To record the payment of selling and administration expense ) | ||||

| 4. | Interest Expense (2) | 1,800 | ||

| Discount on Notes Payable | 1,800 | |||

| ( To record the amortized interest expense on discount notes) | ||||

| 5. | Service Revenue | 130,000 | ||

| 130,000 | ||||

| ( To record the closing entries for revenue account) | ||||

| 5a. | Retained Earnings | 99,800 | ||

| Selling and Administration Expenses | 98,000 | |||

| Interest Expense | 1,800 | |||

| ( To record the closing of expense account) | ||||

| 2017 | ||||

| 1. | Cash | 215,000 | ||

| Service Revenue | 215,000 | |||

| ( To record the services rendered for cash) | ||||

| 2. | Selling and administration expense | 151,000 | ||

| Cash | 151,000 | |||

| ( To record the payment of selling and administration expense ) | ||||

| 3a. | Interest Expense (3) | 600 | ||

| Discount on Notes Payable | 600 | |||

| ( To record the amortized interest expense on discount notes) | ||||

| 3b. | Notes payable | 40,000 | ||

| Cash | 40,000 | |||

| ( To record the payment of note payable) | ||||

| 4a. | Service Revenue | 215,000 | ||

| Retained Earnings | 215,000 | |||

| ( To record the closing entries for revenue account) | ||||

| 4b. | Retained Earnings | 151,600 | ||

| Selling and Administration Expenses | 151,000 | |||

| Interest Expense | 600 | |||

| ( To record the closing of expense account) | ||||

Table (2)

Working Note:

Determine the amount of discount on notes payable

Determine the amount of accrued interest expense.

The interest on note is accrued for 9 months which is from April 01, 2016 to December 31, 2016.

Determine the amount of accrued interest expense.

The interest on note is accrued for 3 months which is from January 01, 2017 to March 31, 2017.

Post the transactions to T-accounts.

| Cash | |||

| 2016 | 3. | $98,000 | |

| 1. | $37,600 | ||

| 2. | $130,000 | ||

| Balance | $69,600 | ||

| 2017 | |||

| 1. | $215,000 | 2. | $151,000 |

| 3b. | $40,000 | ||

| Balance | $93,600 | ||

| Notes Payable | |||

| 2016 | |||

| 1. | $40,000 | ||

| Balance | $40,000 | ||

| 2017 | |||

| 3b. | $40,000 | ||

| Balance | $0 | ||

| Discount on Notes Payable | |||

| 2016 | |||

| 1. | $2,400 | 4. | $1,800 |

| Balance | $600 | ||

| 2017 | |||

| 3a. | $600 | ||

| Balance | $0 | ||

| Retained Earnings | |||

| 2016 | |||

| 5a. | $99,800 | 5a. | $130,200 |

| Balance | $30,200 | ||

| 2017 | |||

| 4b. | $151,600 | 4a. | $215,000 |

| Balance | $93,600 | ||

| Service Revenue | |||

| 2016 | |||

| 5a. | $130,000 | 5a. | $130,200 |

| Balance | $0 | ||

| 2017 | |||

| 4b. | $215,000 | 4a. | $215,000 |

| Balance | $0 | ||

| Selling and administration expense | |||

| 2016 | |||

| 3. | $98,000 | 5b. | $98,000 |

| Balance | $0 | ||

| 2017 | |||

| 4b. | $151,000 | 4b. | $151,000 |

| Balance | $0 | ||

| Interest expense | |||

| 2016 | |||

| 4. | $1,800 | 5b. | $1,800 |

| Balance | $0 | ||

| 2017 | |||

| 4b. | $600 | 4b. | $600 |

| Balance | $0 | ||

c.

Prepare income statement, statement of changes in

c.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Statement of changes in the stockholders’ equity: This statement reflects whether the components of stockholders’ equity have increased or decreased during the period.

Statement of cash flows: Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Prepare the income statement for Company B for the year ended December 31, 2016 and 2017.

| Company B | ||

| Statement of income | ||

| For the year ended December 31, 2016 and 2017 | ||

| Particulars | Amount $ | |

| 2016 | 2017 | |

| Service Revenue | 130,000 | 215,000 |

| Total revenues | 130,000 | 215,000 |

| Expenses: | ||

| Selling and Administration expenses | 98,000 | 151,000 |

| Interest Expense | 1,800 | 600 |

| Total operating expense | (99,800) | (151,600) |

| Net income | 30,200 | 63,400 |

Table (3)

Hence, the net income of Company B for the year ended December 31, 2016 and 2017 is $30,200 and $63,400 respectively.

Prepare the statement of changes in stockholders’ equity of Company B for the year ended December 31, 2016 and 2017.

| Company B | ||

| Statement of changes in stockholders' equity | ||

| For the year ended December 31, 2016 and 2017 | ||

| Particulars | Amount $ | |

| 2016 | 2017 | |

| Beginning Common Stock | 0 | 0 |

| Add: Stock Issued | 0 | 0 |

| Ending Common Stock | 0 | 0 |

| Beginning Retained Earnings | 0 | 30,200 |

| Plus: Net Income | 30,200 | 63,400 |

| Ending Retained Earnings | 30,200 | 93,600 |

| Total stockholder's equity | 30,200 | 93,600 |

Table (4)

Hence, the total stockholders’ equity of Company B for the year ended December 31, 2016 and 2017 is $30,200 and $93,600 respectively.

Prepare the balance sheet of Company B as on December 31, 2016 and 2017.

| Company B | ||

| Balance sheet | ||

| As on December 31, 2016 and 2017 | ||

| Assets | Amount $ | |

| 2016 | 2017 | |

| Cash | 69,600 | 93,600 |

| Total Assets | 69,600 | 93,600 |

| Liabilities | ||

| Notes Payable | $40,000 | 0 |

| Less: Discount on Notes Payable | (600) | 0 |

| Total Liabilities | 39,400 | 0 |

| Stockholders’ Equity | ||

| Common Stock | 0 | |

| Retained Earnings | 30,200 | 93,600 |

| Total Stockholders’ Equity | 30,200 | 93,600 |

| Total liabilities and stockholders' equity | 69,600 | 93,600 |

Table (5)

Hence, the total of assets and liabilities and stockholders’ equity of Company B as on December 31, 2016 and 2017 is $69,600 and $93,600.

Prepare the statement of cash flows of Company B for the year ended December 31, 2016 and 2017.

| Company B | ||

| Statement of cash flows | ||

| For the year ended December 31, 2016 | ||

| Particulars | Amount $ | |

| 2016 | 2017 | |

| Cash flow from operating activities: | ||

| Cash Receipts from Customers | 130,000 | 215,000 |

| Cash payments for expenses | (98,000) | (151,000) |

| Cash paid for interest | (0) | (2,400) |

| Net Cash Flow from Operating Activities | 32,000 | 61,600 |

| Cash Flows From Investing Activities: | 0 | 0 |

| Net Cash Flow From Investing Activities | 0 | 0 |

| Cash Flows From Financing Activities: | ||

| Issuance of note payable | 37,600 | |

| Repayment of note payable | (37,600) | |

| Net Cash Flow From Financing Activities | 37,600 | (37,600) |

| Net Change in Cash | 69,600 | 24,000 |

| Add: Beginning Cash Balance | 0 | 69,600 |

| Ending Cash Balance | 69,600 | 93,600 |

Table (6)

Want to see more full solutions like this?

Chapter 9 Solutions

FUND.FINAN.ACCT.CONC.-WKPPRS.>CUSTOM<

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education