“We really need to get this new material-handling equipment in operation just after the new year begins. I hope we can finance it largely with cash and marketable securities, but if necessary we can get a short term loan down at MetroBank.” This statement by Beth Davies-Lowry, president of Intercoastal Electronics Company, concluded a meeting she had called with the firm’s top management. Intercoastal is a small, rapidly growing wholesaler of consumer electronic products. The firm’s main product lines are small kitchen appliances and power tools. Marcia Wilcox, Intercoastal’s General Manager of Marketing, has recently completed a sales

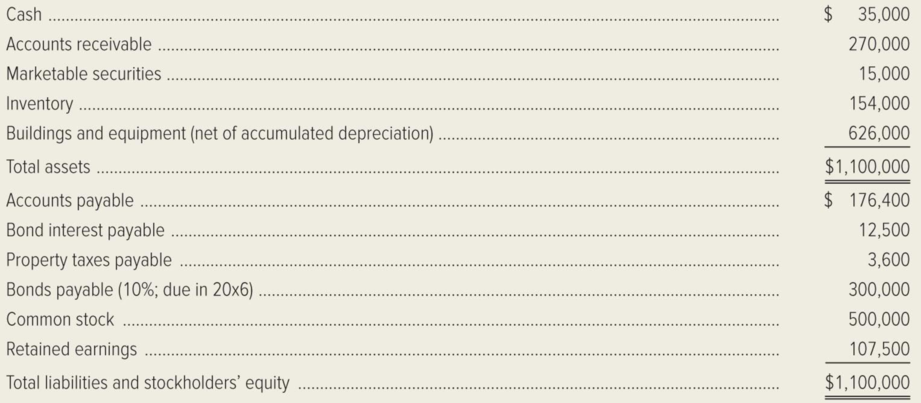

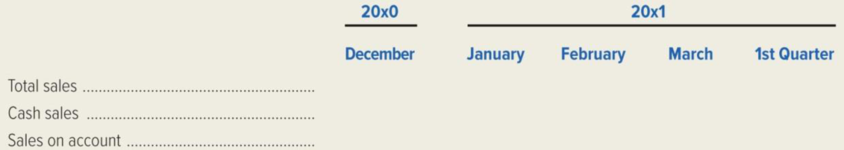

Jack Hanson, the assistant controller, is now preparing a monthly budget for the first quarter of 20x1. In the process, the following information has been accumulated:

- 1. Projected sales for December of 20x0 are $400,000. Credit sales typically are 75 percent of total sales. Intercoastal’s credit experience indicates that 10 percent of the credit sales are collected during the month of sale, and the remainder are collected during the following month.

- 2. Intercoastal’s cost of goods sold generally runs at 70 percent of sales. Inventory is purchased on account, and 40 percent of each month’s purchases are paid during the month of purchase. The remainder is paid during the following month. In order to have adequate stocks of inventory on hand, the firm attempts to have inventory at the end of each month equal to half of the next month’s projected cost of goods sold.

- 3. Hanson has estimated that Intercoastal’s other monthly expenses will be as follows:

In addition, sales commissions run at the rate of 1 percent of sales.

In addition, sales commissions run at the rate of 1 percent of sales. - 4. Intercoastal’s president, Davies-Lowry, has indicated that the firm should invest $125,000 in an automated inventory-handling system to control the movement of inventory in the firm’s warehouse just after the new year begins. These equipment purchases will be financed primarily from the firm’s cash and marketable securities. However, Davies-Lowry believes that Intercoastal needs to keep a minimum cash balance of $25,000. If necessary, the remainder of the equipment purchases will be financed using short term credit from a local bank. The minimum period for such a loan is three months. Hanson believes short-term interest rates will be 10 percent per year at the time of the equipment purchases. If a loan is necessary, Davies-Lowry has decided it should be paid off by the end of the first quarter if possible.

- 5. Intercoastal’s board of directors has indicated an intention to declare and pay dividends of $50,000on the last day of each quarter.

- 6. The interest on any short-term borrowing will be paid when the loan is repaid. Interest on Intercoastal’s bonds is paid semiannually on January 31 and July 31 for the preceding six-month period.

- 7. Property taxes are paid semiannually on February 28 and August 31 for the preceding six-month period.

Required: Prepare Intercoastal Electronics Company’s

- 1. Sales budget:

- 2. Cash receipts budget:

- 3. Purchases budget:

- 4. Cash disbursements budget:

- 5. Complete the first three lines of the summary

cash budget . Then do the analysis of short-term financing needs in requirement (6). Then finish requirement (5). Summary cash budget:

- 6. Analysis of short-term financing needs:

- 7. Prepare Intercoastal Electronics’

budgeted income statement for the first quarter of 20x1. (Ignore income taxes.) - 8. Prepare Intercoastal Electronics’ budgeted statement of

retained earnings for the first quarter of 20x1. - 9. Prepare Intercoastal Electronics’ budgeted balance sheet as of March 31, 20x1. (Hint: On March31, 20x1, Bond Interest Payable is $5,000 and Property Taxes Payable is $900.)

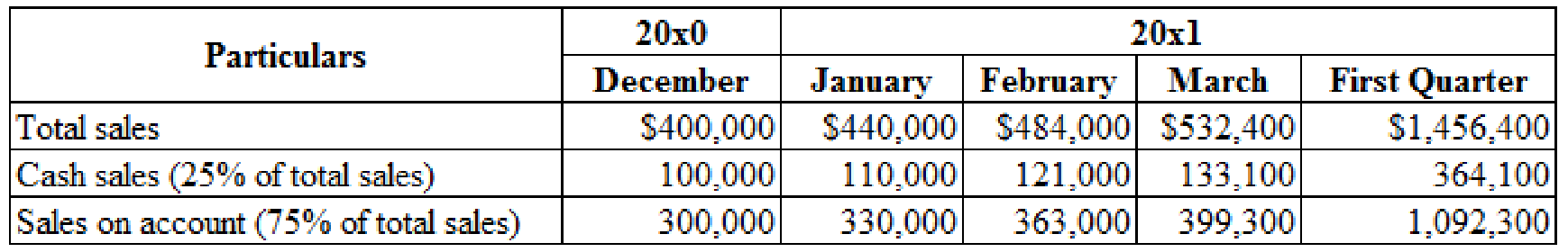

1.

Prepare a sales budget.

Explanation of Solution

Sales budget: This budget is prepared by the organization for the yearly or monthly basis as per need. It includes all the estimated revenues from the entire operating source.

Sales budget is prepared to estimate or project the sales in dollars and units for a particular period of time.

Prepare a sales budget:

Table (1)

2.

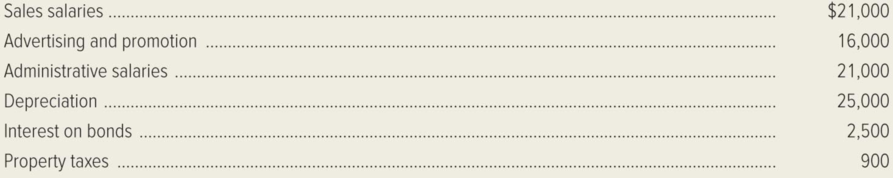

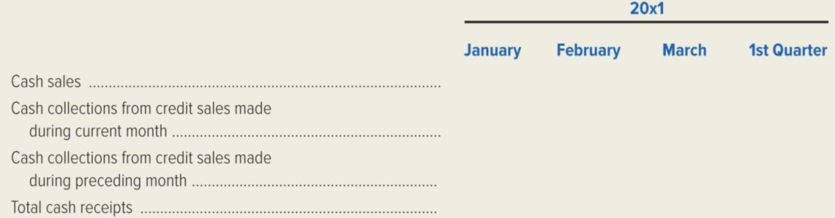

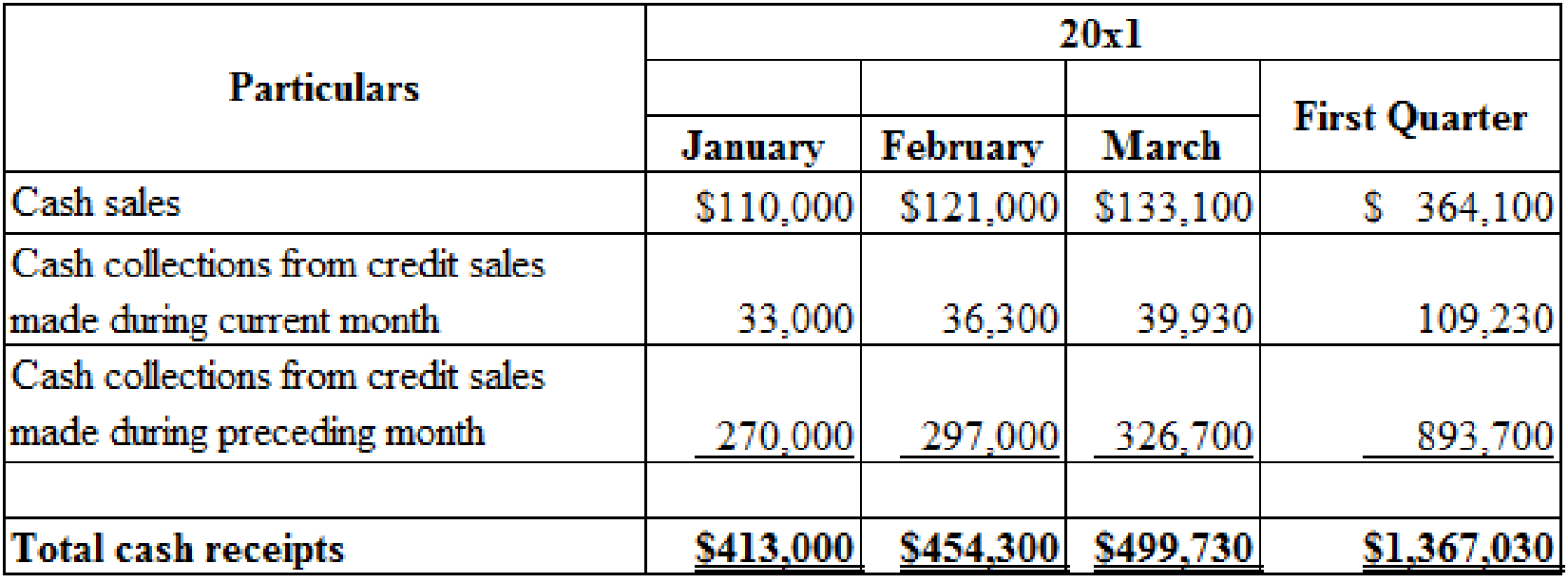

Prepare a cash receipts budget.

Explanation of Solution

Cash receipts Budget: The cash budget is a part of the financial statements which is a plan for the cash receipts for a particular accounting period. This budget gives an estimation of all the cash inflows of a business for the given financial period.

Prepare a cash receipts budget:

Table (2)

Working note 1:

20x1:

Calculate the cash collection from credit sales made during current month:

January:

February:

March:

Working note 2:

20x1:

Calculate the cash collection from credit sales made during previous sales:

January:

February:

March:

3.

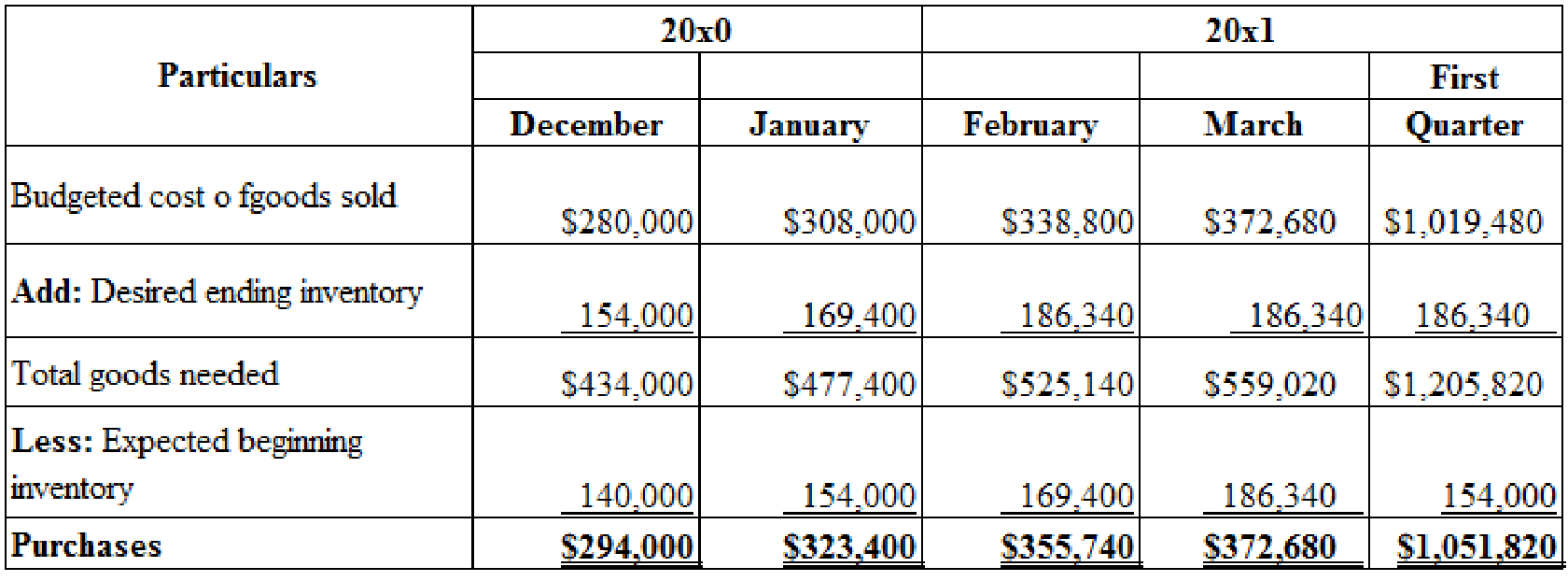

Prepare a purchases budget.

Explanation of Solution

Prepare a purchases budget:

Table (3)

Working note 1:

Calculate the expected beginning inventory for December:

4.

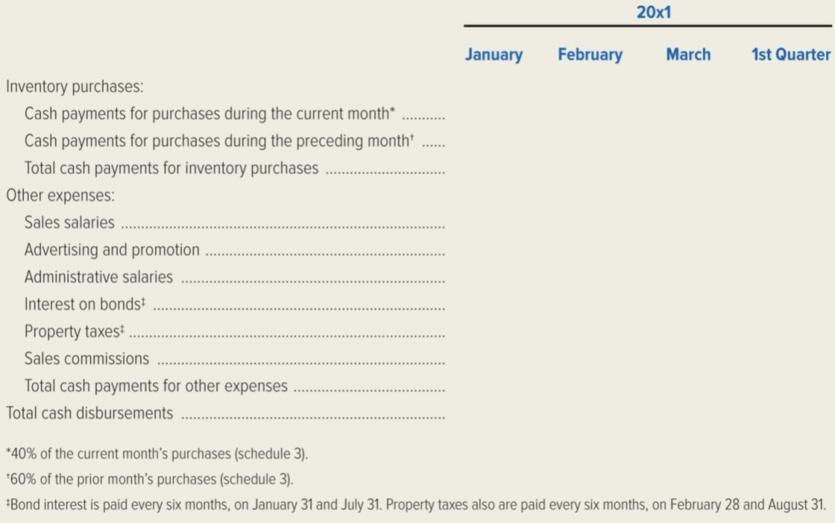

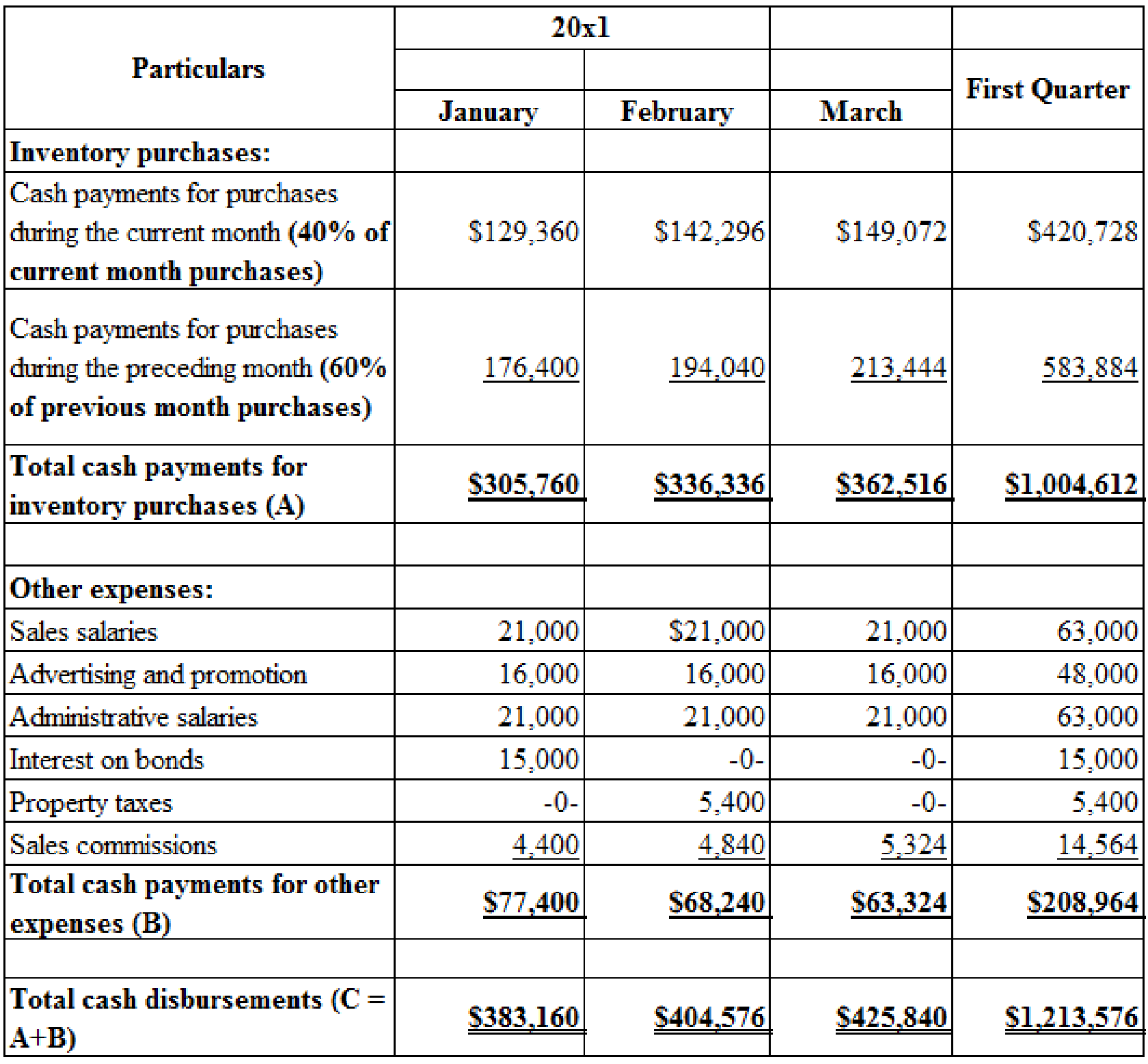

Prepare a cash disbursement budget.

Explanation of Solution

Cash payments for purchases: This Schedule is prepared for the estimation of the cash payment for purchase for the period. This includes all probable cash payment.

Budgeted cash disbursement: Budgeted cash disbursements are the cash outflows expected for a budgeted period.

Prepare a cash disbursement budget:

Table (4)

Working note 1:

Calculate the amount of interest on bonds:

5.

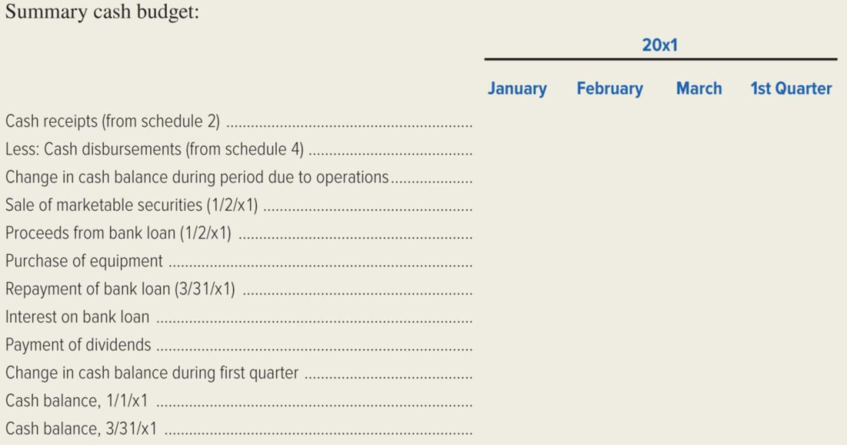

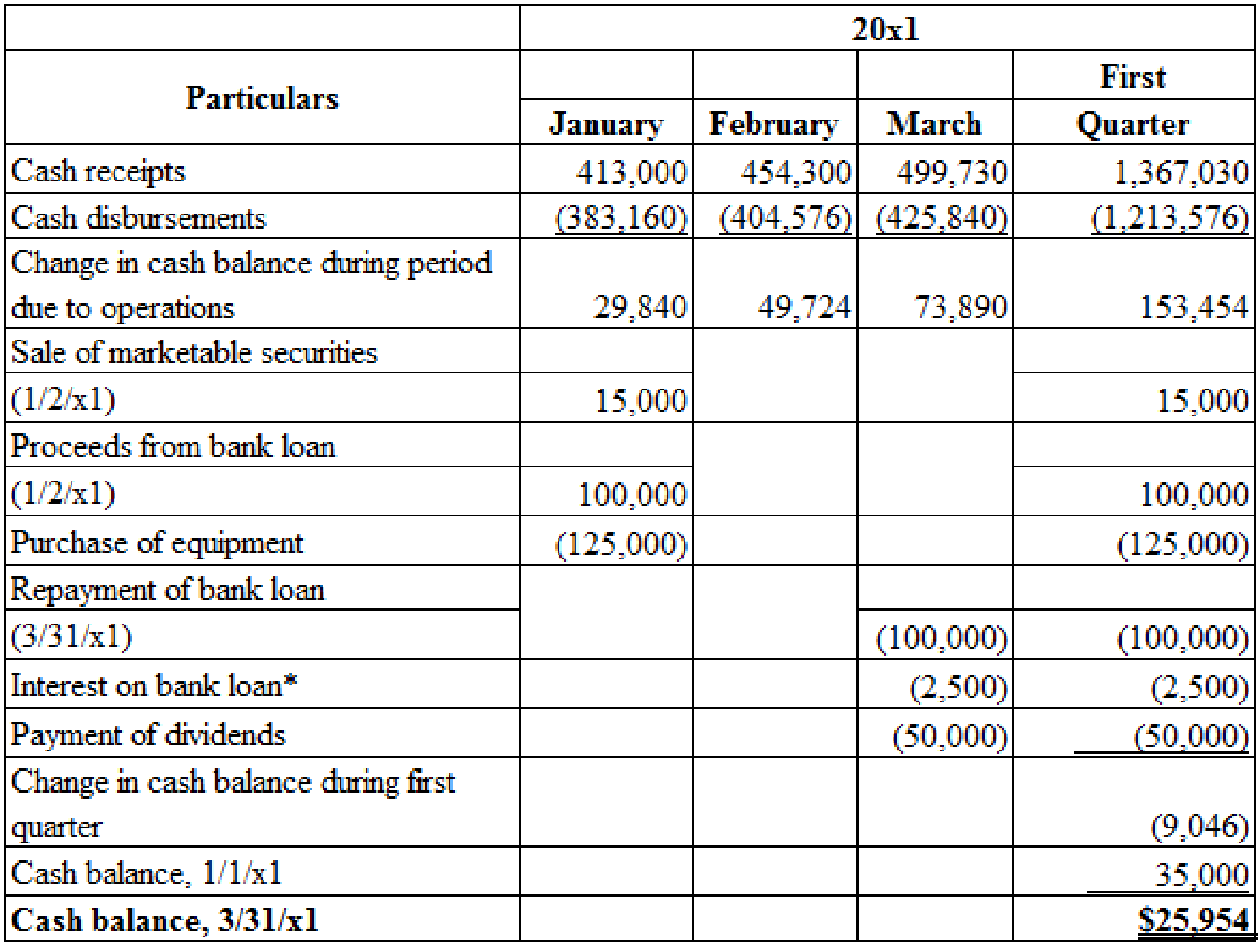

Prepare a cash budget.

Explanation of Solution

Cash Budget: Cash budget shows the expected cash inflows and cash outflows for a budgeted period.

Prepare a cash budget:

Table (5)

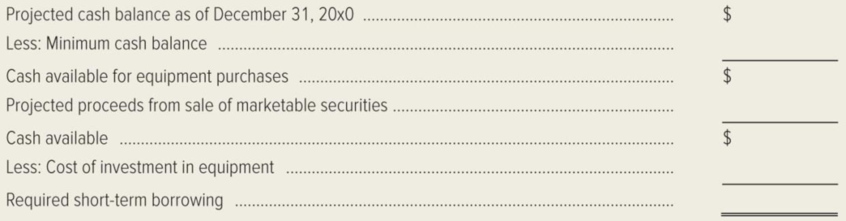

6.

Analyze the short-term financing needs.

Explanation of Solution

Analyze the short-term financing needs:

| Particulars | Amount ($) |

| Projected cash balance as of December 31, 20x0 | 35,000 |

| Less: Minimum cash balance | 25,000 |

| Cash available for equipment purchases | 10,000 |

| Projected proceeds from sale of marketable securities | 15,000 |

| Cash available | 25,000 |

| Less: Cost of investment in equipment | 125,000 |

| Required short-term borrowing | $(100,000) |

Table (6)

7.

Prepare I Electronics budgeted income statement for the first quarter of 20x1.

Explanation of Solution

Budgeted Income Statement: The statement that indicates the expected profitability of operations for the budget period is known as the budgeted income statement. It also provides the basis for evaluating the performance of a company, and act as a call to action.

Prepare I Electronics budgeted income statement for the first quarter of 20x1:

| I Electronics | ||

| Budgeted Income Statement | ||

| For the First Quarter of, 20x1 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales revenue | 1,456,400 | |

| Less: Cost of goods sold | 1,019,480 | |

| Gross margin | 436,920 | |

| Selling and administrative expenses: | ||

| Sales salaries | 63,000 | |

| Sales commissions | 14,564 | |

| Advertising and promotion | 48,000 | |

| Administrative salaries | 63,000 | |

| Depreciation | 75,000 | |

| Interest on bonds | 7,500 | |

| Interest on short-term bank loan | 2,500 | |

| Property taxes | 2,700 | |

| Total selling and administrative expenses | 276,264 | |

| Net income | $160,656 | |

Table (7)

8.

Prepare I Electronics budgeted statement of retained earnings for 20x1.

Explanation of Solution

Retained earnings: Retained earnings are that portion of profits which are earned by a company but not distributed to stockholders in the form of dividends. These earnings are retained for various purposes like expansion activities, or funding any future plans.

Prepare I Electronics budgeted statement of retained earnings for 20x1:

| I Electronics | ||

| Budgeted Statement of Retained Earnings | ||

| For the First Quarter of, 20x1 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, 12/31/x0 | $107,500 | |

| Add: Net income | 160,656 | |

| Subtotal | 268,156 | |

| Less: Dividends | 50,000 | |

| Retained earnings, 12/31/x1 | $218,156 | |

Table (8)

9.

Prepare I Electronics budgeted balance sheet as of March 31,20x1.

Explanation of Solution

Budgeted Balance Sheet: Budgeted Balance Sheet is one of the budgeted financial statements which summarize the budgeted assets, the liabilities, and the Shareholder’s equity of a company at a given date.

Prepare I Electronics budgeted balance sheet as of March 31,20x1:

| I Electronics | |

| Budgeted Balance Sheet | |

| March 31, 20x1 | |

| Assets | Amount ($) |

| Cash | 25,954 |

| Accounts receivable | 359,370 |

| Inventory | 186,340 |

| Building and equipment (net of accumulated depreciation | 676,000 |

| Total assets | $1,247,664 |

| Accounts payable | 223,608 |

| Bond interest payable | 5,000 |

| Property taxes payable | 900 |

| Bonds payable | 300,000 |

| Common stock | 500,000 |

| Retained earnings | 218,156 |

| Total liabilities and stockholders' equity | $1,247,664 |

Table (9)

Working note 1:

Calculate the amount of accounts receivable:

Working note 2:

Calculate the amount of buildings and equipment:

Working note 3:

Calculate the amount of accounts payable:

Want to see more full solutions like this?

Chapter 9 Solutions

MANAGERIAL ACCOUNTING-CONNECT ACCESS

- “We really need to get this new material – handling equipment in operation just after the new year begins. I hope we can finance it largely with cash and marketable securities, but if necessary we can get a short term loan down at Metro bank”. This Statement by Beth Davies –Lowry president of Global Electronics Company, concluded a meeting she had called with the firm ‘s top management. Global is a small, rapidly growing wholesaler of consumer electronic products. The firm’s main product lines are small kitchen appliances and power tools. Maria Wilcox, Global Electronics general manager of marketing has recently completed a sales forecast. She believes the company’s sales during the first quarter of 2021 will increase by 10% each month over the previous month s’ sales. Than Wilcox expects sales to remain constant for several months. Global ‘s projected balance sheet as of Dec 31 2020 is as follow: Cash 70,000 A/c receivable 540,000 Marketable securities 30,000 Inventory…arrow_forwardFred Jackson, president and owner of Bailey Company, is concerned about the company's ability to obtain a loan from a major bank. The loan is a key factor in the firm's plan to expand its operations. Demand for the firm's product is high—too high for the current production capacity to handle. Fred is convinced that a new plant is needed. Building the new plant, however, will require an infusion of new capital. Fred calls a meeting with Karla Jones, financial vice president. Fred: Karla, what is the status of our loan application? Do you think that the bank will approve? Karla: Perhaps, but at this point, there is a real risk. The loan officer has requested a complete set of financials for this year and the past 2 years. He has indicated that he is particularly interested in the statement of cash flows. As you know, our income statement looks great for all 3 years, but the statement of cash flows will show a significant increase in receivables, especially for this year. It will also…arrow_forward“We really need to get this new material – handling equipment in operation just after the new year begins. I hope we can finance it largely with cash and marketable securities, but if necessary we can get a short term loan down at Metro bank”. Maria Wilcox, Global Electronics general manager of marketing has recently completed a sales forecast. She believes the company’s sales during the first quarter of 2021 will increase by 10% each month over the previous month s’ sales. Than Wilcox expects sales to remain constant for several months. Global ‘s projected balance sheet as of Dec 31 2020 is as follow: Cash 70,000 A/c receivable 540,000 Marketable securities 30,000 Inventory…arrow_forward

- Carson Company is a large manufacturing firm in California that was created 20 years ago by the Carson family. It was initially financed with an equity investment by the Carson family and ten other individuals. Over time, Carson Company has obtained substantial loans from finance companies and commercial banks. The interest rates on those loans are tied to market interest rates and are adjusted every six months. Thus, Carson’s cost of obtaining funds is sensitive to interest rate movements. The company has a credit line with a bank in case it suddenly needs to obtain funds for a temporary period. It has purchased Treasury securities that it could sell if it experiences any liquidity problems. Carson Company has assets valued at approximately $50 million and generates sales of nearly $100 million per year. Some of its growth is attributed to its acquisitions of other firms. Because it expects the economy to be strong in the future, Carson plans to grow by expanding its business and…arrow_forwardYou recently went to work for Allied Components Company, a sup-plier of auto repair parts used in the after-market with products from Daimler AG, Ford, Toyota, and other automakers. Your boss, the chief financial officer (CFO), has just handed you the estimated cash flows for two proposed projects. Project L involves adding a new item to the firm’s ignition system line; it would take some time to build up the market for this product, so the cash inflows would increase over time. Project S involves an add-on to an existing line, and its cash flows would decrease over time. Both projects have 3-year lives because Allied is planning to introduce entirely new models after 3 years. Here are the projects’ after-tax cash flows (in thousands of dollars): 02 1 Project L Project S ⫺$100 ⫺$100 $10 $70 $60 $50 3 $80 $20 Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. The CFO also made subjective risk assessments of…arrow_forwardTUV Hardware Stores is a major retailer of lumber and building products. They are privately owned but professionally managed. Recently, they took out a bank loan to build a new robotic warehouse. Debt to equity is now .2:1, and the bank has asked for financial statements. They have approached your audit firm to provide some assurance based on your excellent reputation. Each retail store is franchised and there are no corporate-owned stores. In 2020, franchise fees are expected to be $176 million while wholesale sales to stores are expected to be $2,416 million and wholesale sales direct to major builders are expected to be $203 million. Gross profit on wholesale sales is around 5%. The franchise fee goes to such things as store support (training, point of sale inventory, pricing systems) and advertising, and a 20% profit. TUV has operations across Canada with major warehouses in Vancouver, Winnipeg, Brampton, and St. John, New Brunswick. The new warehouse will be built in Kitchener.…arrow_forward

- What if a loyal accountant was asked to fudge some figures on behalf of their company, all while straining under a new mortgage? Imagine that you are the Chief Financial Officer of a medium to large company. It is April and the Chief Executive Officer has just returned from a meeting with the company’s bankers. She calls you to her office to discuss the results of the negotiations. As things stand, the company requires a fairly significant injection of capital which will be used to modernise plant and equipment. The company has been promised new orders if it can produce goods to an international standard. Existing machinery is incapable of manufacturing the required level of quality. Whilst the bank is sympathetic, current lending policies require borrowers to demonstrate an adequate current and projected cash flow, as well as a level of profitability sufficient to indicate a capacity to make repayments from an early date. The problem is that, largely because of some industrial…arrow_forwardThe GFA Company, originally established 16 years ago to make footballs, is now a leading producer of tennis balls, baseballs, footballs, and golf balls. Nine years ago, the company introduced “High Flite,” its first line of high-performance golf balls. GFA management has sought opportunities in whatever businesses seem to have some potential for cash flow. Recently Mr Dawadawa, vice president of the GFA Company, identified another segment of the sports ball market that looked promising and that he felt was not adequately served by larger manufacturers. As a result, the GFA Company investigated the marketing potential of brightly coloured bowling balls. GFA sent a questionnaire to consumers in three markets: Accra, Kumasi, and Koforidua. The results of the three questionnaires were much better than expected and supported the conclusion that the brightly coloured bowling balls could achieve a 10 to 15 percent share of the market. Of course, some people at GFA complained about the cost of…arrow_forwardThe GFA Company, originally established 16 years ago to make footballs, is now a leading producer of tennis balls, baseballs, footballs, and golf balls. Nine years ago, the company introduced “High Flite,” its first line of high-performance golf balls. GFA management has sought opportunities in whatever businesses seem to have some potential for cash flow. Recently Mr Dawadawa, vice president of the GFA Company, identified another segment of the sports ball market that looked promising and that he felt was not adequately served by larger manufacturers. As a result, the GFA Company investigated the marketing potential of brightly coloured bowling balls. GFA sent a questionnaire to consumers in three markets: Accra, Kumasi, and Koforidua. The results of the three questionnaires were much better than expected and supported the conclusion that the brightly coloured bowling balls could achieve a 10 to 15 percent share of the market. Of course, some people at GFA complained about the cost of…arrow_forward

- Too little working capital had been a constant problem at Industrial Robotics (IR), a designer of automated manufacturing equipment. But, in 2010, with 47 employees and seven offices across North America, IR faced a cash shortage that threatened to hit $1 million. Founder Jack Miller wasn’t concerned. But his banker, Mario Sarducci, thought that amount was too much for a company barely doing $5 million in sales. Sarducci had worked on the IR file for the previous decade and wanted Miller to reduce his travelling expenses, shrink overhead, maximize profits, and give the bank good financial information. “You’re not running a profitable operation,” Sarducci lectured, “and your balance sheet doesn’t support your credit. My bank has gone as far as it will go.” Indeed, the bank had gone even further. At the end of 2010, IR had overdrawn its $800,000 line of credit by $300,000. If Sarducci had refused to honour those cheques, he would have forced the company to close. But Miller wasn’t…arrow_forwardYou are considering entering the shoe business. You believe that you have a narrow window for entering this market. Because of Christmas demand, the time is right today, and you believe that exactly a year from now would also be a good opportunity. Other than these two windows, you do not think another opportunity will exist to break into this business. It will cost you $35 million to enter the market. Because other shoe manufacturers exist and are public companies, you can construct a perfectly comparable company. Hence, you want to use the Black-Scholes formula to decide when and if you should enter the shoe business. Your analysis implies that the current value of your shoe company would be $40 million, and that the volatility is 25% per year. Of the $40 million current value, $6 million is coming from the free cash flows expected in the first year. The risk-free rate is 4%. What is the value of the investment opportunity if you choose to wait? (Hint: think of the investment as a…arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub